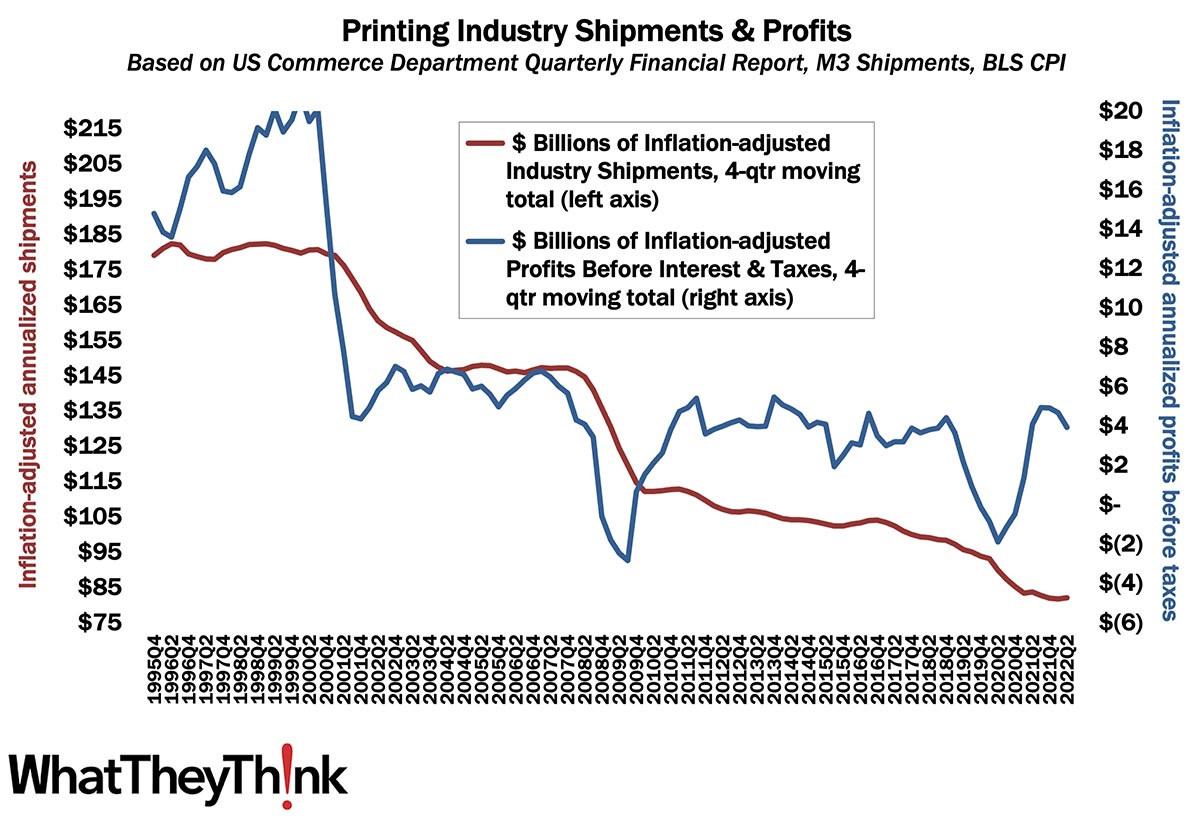

Printing industry profits plunged during the pandemic peak but rebounded strongly afterward. But after hitting a peak in Q3 of last year, we’re on a downward trend, with annualized profits for Q2 2022 coming in at $3.92 billion, down a tad from $4.68 billion in Q1 2022.

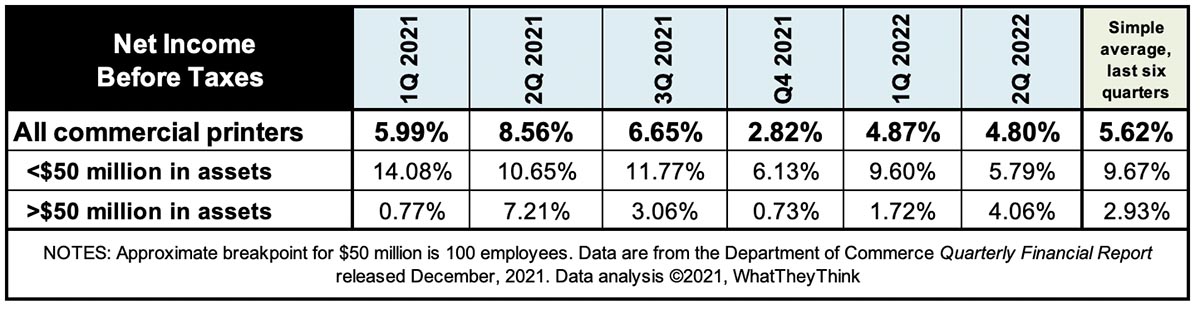

Are we returning to our pre-pandemic “Tale of Two Cities”? If we look at printing profits by asset class, large printers (more than $50 million in assets) and small printers (less than $50 million in assets):

In Q2 2022, for large printers (those with more than $50 million in assets), profits before taxes had been +4.06% of revenues, while for smaller printers (less than $50 million in assets), profits before taxes in Q1 were +5.79% of revenues. We had been referring to the disparity between “big” and “small” printers as our “Tale of Two Cities” since there had been a great profit disparity between those two asset classes, but it looks like that is not the case this time around—and maybe the Census Bureau’s adjustment to $50 million as the break point (see below) has killed that analogy for good. In Q2 2021, all printers big and small did roughly the same profitwise, which means that, for the industry on average, profits before taxes were +4.80% of revenues, down a tad from Q1’s +4.87%. For the last six quarters, profits have averaged +5.62% of revenues.

Basically, we are indeed returning to our normal, pre-pandemic trajectory.

The asset class division is based on the breakdowns in the Census Bureau’s Quarterly Services Report, whence we get our profits data. Starting with the Q4 2019 Quarterly Services Report, the Census Bureau changed their asset class breakdowns from more/less than $25 million to more/less than $50 million.