We’ve long been calling it “a tale of two cities”—large printers and small/mid-size printers and the profitability gap between them. The pandemic interrupted this ongoing narrative temporarily, but back in Q3 2020, we started to return to normal, at least in terms of industry profits trends, which continued into Q4.

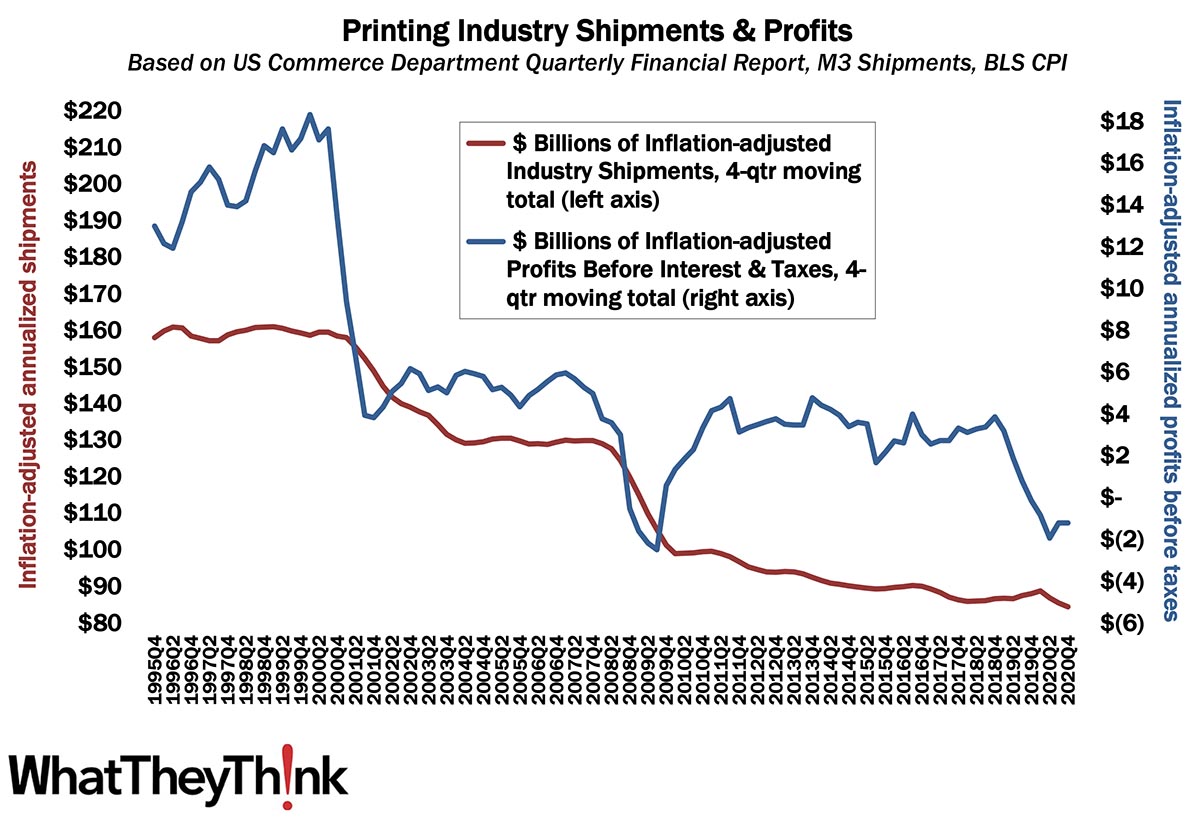

Shipments-wise, we had been having a pretty OK third and fourth quarter; things went south in November but December was remarkably strong, and (spoiler alert for the upcoming February shipments report) 2021 did not get off to a great start, so the Q1 2021 profits report may be fairly dismal, saved only if we have a strong March—but we’re getting way ahead of ourselves. Anyway, some strong Q3 and Q4 shipments reports translated into a rise in profitability. Annualized profits for Q4 2020 were unchanged from Q3 at -$1.19 billion. This isn’t all pandemic-related; Q4 2019 profits had plunged from Q3, and this was before almost anyone had ever heard the term “coronavirus.” There is some comfort (cold though it may be) in seeing that the drop from Q1 to Q2 2020 simply was the continuation of a trend that had already been going on for a few quarters.

In Q4, we continue our long-running “tale of two cities” saga. For large printers (those with more than $25 million in assets), profits before taxes had been -0.47% of revenues, an improvement from Q3, where profits had been -1.71% of revenues, and especially Q2 (-6.95% of revenues). For small printers, profits before taxes in Q4 were +7.44% of revenues, a vast decline from Q3, where profits had been +8.81% of revenues. Big printers did a little better profitwise, while small printers did a little worse—which means that, for the industry on average, profits before taxes were +2.42% of revenues, unchanged from Q3. For the last six quarters, profits have averaged -0.67% of revenues, an improvement from Q3.