- Although American households are paying more of their bills online with each passing year, they still receive most of their recurring bills and statements via the postal service.

- Rather than completely abandoning print in favor of digital alternatives, today’s consumers are prioritizing utility and convenience while also demanding synergy between channels.

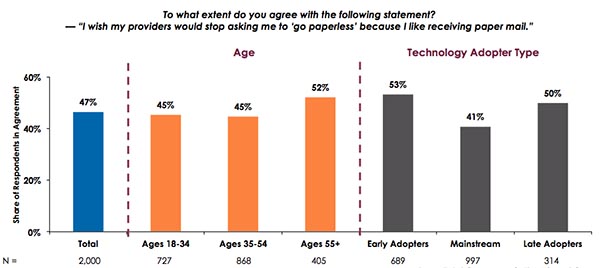

- Nearly half of consumer respondents (47%) reported that they wished their providers would stop asking them to “go paperless” because they liked receiving paper mail.

By Eve Padula

Introduction

According to the United States Postal Service (USPS), the total transactional volume sent and received by American households has declined by -10.6% since 2015. At the same time, however, transactional mail pieces still account for nearly one-fifth of total household mail volume and almost half of First-Class Mail volume. Keypoint Intelligence – InfoTrends’ most recent survey data reveals that consumers in the US and Canada receive an average of 8 transactional communications per month. About half of these transactional communications are accessed digitally.

Although there is no denying that digital communications are becoming increasingly popular, consumers’ rising affinity for digital access does not necessarily mean that printed mail will fall to the wayside. Instead, InfoTrends’ research suggests that print will remain an important component of the overall communications mix.

Digital vs. Printed Communications

In its most recent Household Diary Study, the US Postal Service reported that digital alternatives for transactional payments have significantly affected the volume of mail-based bill payment. According to the study, the share of bills that American households paid by mail declined from 54% in 2008 to only 27% in 2018. What’s more, households made 55% more payments via Internet than by mail in 2018. Despite this decline in mail-based payments, US consumers still receive most of their recurring bills and statements via the postal service.

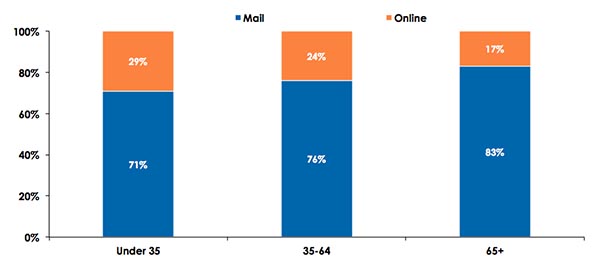

Although age did play a role in the share of bills that consumers received via mail vs. online, the differences were not substantial. Even in households were the head was under age 35, over 70% of bills were received via the mail. The share of mail-based communications received did increase with age, but not dramatically.

Share of Bills Received via Mail vs. Online

Sources: HDS Recruitment Sample and USPS Household Diary Study, 2018

Recreated by Keypoint Intelligence - InfoTrends

InfoTrends’ most recent Transactional Communications research found that most consumers expect their reception of paperless transactional communications to increase. At the same time, however, research from the USPS reports that the share of digital household bills received is only creeping up by 2% or 3% per year. Rather than completely abandoning print in favor of digital alternatives, today’s consumers are prioritizing utility and convenience while also demanding synergy between channels. They also want their transactional communications providers to maximize the utility of each channel by enhancing its unique attributes.

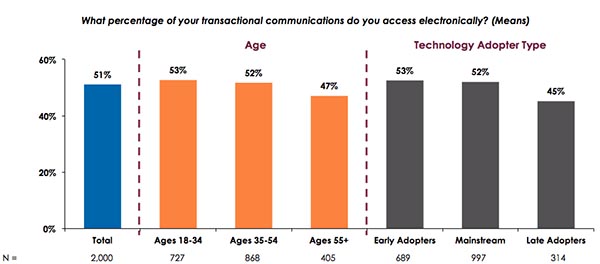

On average, the total survey respondents that participated in InfoTrends’ 2019 research reported receiving about eight different transactional communications each month, either via paper-based mail or electronically. About half of these transactional communications were accessed electronically (e.g., via a desktop or mobile device, through a mobile app, SMS, or using e-mail). Although younger, more tech-savvy respondents did access a higher share of their communications electronically, the differences by age and technology adopter type were not dramatic. InfoTrends’ annual research has drawn a compelling picture of an increasingly sophisticated and homogenized customer base that makes use of both print and digital communications across all age demographics.

Electronic Access to Transactional Communications

Sources: HDS Recruitment Sample and USPS Household Diary Study, 2018

Recreated by Keypoint Intelligence - InfoTrends

Nearly half of consumer respondents (47%) reported that they wished their providers would stop asking them to “go paperless” because they liked receiving paper mail. Perhaps more importantly, early adopters of technology were especially likely to agree with this statement. Even the most tech-savvy respondents are maintaining a preference for printed communications.

Resistance to Going Paperless

Base: Total Consumers in the US and Canada

Source: Annual State of Transactional Communications Survey; Keypoint Intelligence – InfoTrends 2019

The Bottom Line

InfoTrends’ survey results suggest that although the trend toward digital is marching on, some North American consumers are making a conscious choice to retain certain paper bills and statements. As a result, all businesses must embrace the diversity of consumer preference. Not all young, tech-savvy consumers will completely abandon paper for digital, just as not all older late adopters will be resistant to digital communications. In today’s environment, no single communication channel will deliver the experience that an entire customer base—or even an individual customer—demands.

Eve Padula is a Senior Editor/Writer for Keypoint Intelligence – InfoTrends’ Production Services with a focus on Business Development Strategies, Customer Communications, and Wide Format. She is responsible for creating and distributing many types of InfoTrends content, including forecasts, industry analysis, and research/multi-client studies. She also manages the editing cycle for many types of deliverables.