I recently downloaded a study from Iterable titled “All Things Retail: The Iterable User Engagement Report.” The study was designed to investigate the marketing strategies of 50 retailers: the top 25 retailers and their 25 fastest growing competitors during two-week period between Black Friday and Cyber Monday in 2018. The top retailers were defined as those boasting the highest CAGR over five years. The fastest growing retailers were defined as those that drove the highest web sales growth the previous year.

To gather their data, researchers created accounts for all 50 retailers, then monitored how many marketing communications they received from each retailer, the frequency and duration of those communications, and the content of those communications. They also looked at whether the communications were cross-channel. They studied four different categories: welcome emails, promotional emails, cart abandonment emails, and cross-channel messaging in the categories of apparel & accessories, electronics, home improvement, housewares, and mass merchants.

The report is comprehensive, so it was tough to pick out one aspect to talk about. Ultimately, what captivated me was the difference between the top retailers and the fastest growing retailers. You’d think that the fastest growing retailers would be growing so quickly because they are doing more of everything. More marketing = more results, right? However, this was not the case.

Welcome Messaging

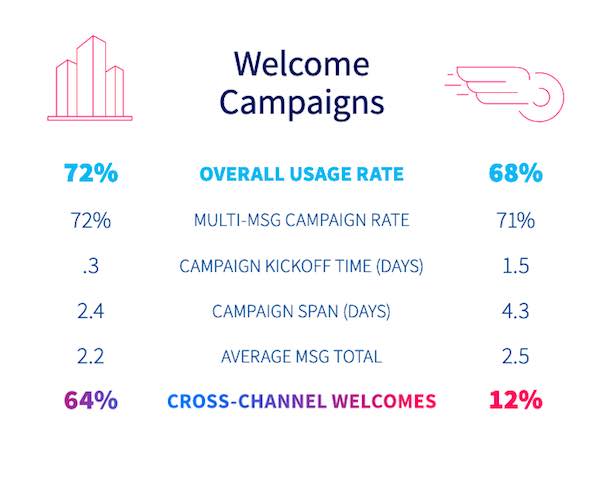

Overall, 70% of these top 50 retailers sent welcome campaigns. This means that 30% had no welcome messaging at all (an interesting customer retention technique). Of those sending welcome campaigns:

71% sent more than one message.

16% engaged cross-channel.

Average number of messages sent was 2.3.

Average welcome campaign transpired over 3.3 days.

37% welcomed new users by name.

Most of the welcome messaging shared discounts on first purchases, discussed account holder benefits, and offered tips for getting the most out of their memberships.

You might expect the fastest growing companies to be more likely to send welcome emails, but they were less likely to do so (72% of top companies had welcome email campaigns vs. 68% of the fastest growing companies). The study did not provide any additional comparisons between the two groups when it came to welcome email campaigns.

Promotional Campaigns

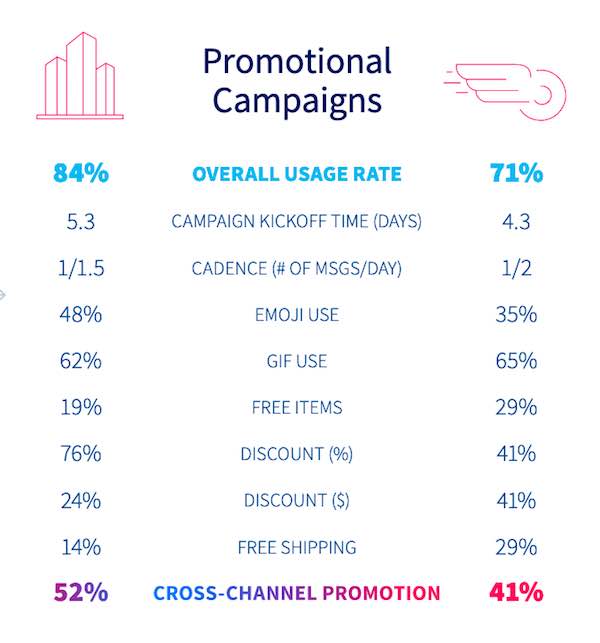

Where the top companies and the fastest growing companies differed more significantly was in their promotional emails. Overall, only 76% of retailers studied sent promotional messaging during the study period. This included 84% of the top retailers, but only 68% of the fastest growing retailers. During the study period, researchers received anywhere from a single message to more than 30 messages from each brand.

The average number of promotions sent was 9.7 over the two-week period. The top companies averaged 11.4 messages, compared to only 7.9 for the fastest growing companies. Top brands were also more likely to promote cross-channel (52%) compared to their fastest growing competitors (41%). Noted the researchers:

Looking at these numbers, it could be inferred that the fastest growing companies may be edging out the top companies when it comes to message ROI—lower volume, higher customer value versus a steady diet of catch-all promotions.

Another noteworthy difference between the top companies and the fastest growing companies was their incentives. Top companies were more likely to offer percentage off discounts (76% vs. 41%), while the fastest growing companies were more likely to offer free items (29% vs. 19%), including free shipping (29% vs. 14%). If they were going to offer a discount, the fastest growing companies were more likely to base it on real dollars rather than percentages (41% vs. 14%).

Cart Abandonment Campaigns

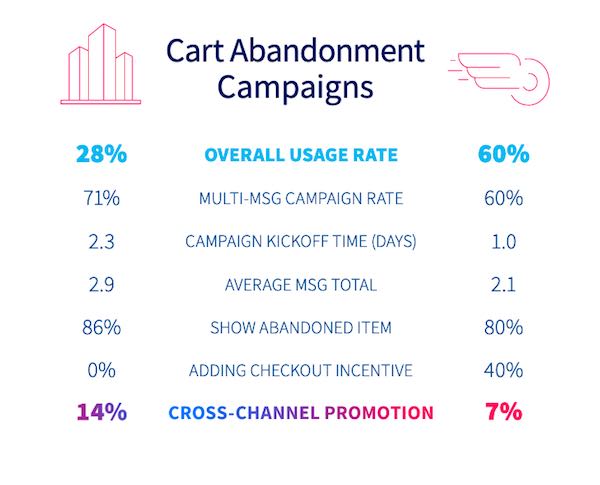

If the fastest growing companies weren’t focusing on sending promotional emails, what were they focused on? Cart abandonment. Only 28% of top retailers sent cart abandonment campaigns, while 60% of the fastest growing retailers did.

The fastest growing retailers were not only more likely to be using cart abandonment messaging, but they were also more proactive in them. They averaged 2.1 messages sent one day after abandonment, while top companies sent 2.9 messages after 2.3 days.

“Top companies sent more abandonment messages over time,” the researchers noted, “while the fastest growing companies opted for fewer messages inside a shorter time window.”

Although they were more proactive, the fastest growing retailers were once again less likely to use cross-channel messaging. Only 7% used cross-channel messaging to encourage re-engagement, while 14% of top retailers did.

Forty percent of the fastest growing retailers also offered a cart abandonment incentive, while none of the top companies did.

Takeaways

Iterable offered terrific takeaways when it came to the data at large, and I encourage everyone to download the report and read it. In terms of the differences between top companies and the fastest growing companies, researchers had this to say:

We were surprised at the disparity in campaign usage rates between the fastest growing and top companies. The fastest growing companies appeared to emphasize winning the near-sale. Their faster turnaround times inside tighter windows of relevance made for more effective messaging.

So which model should you and your customers follow? That’s an individual decision, but certainly the strategies are different. We do know that the fast growing companies are competing aggressively against their more established competitors, and clearly their strategies are different. They are nimble and laser-focused, often in ways that go against the prevailing wisdom (such as sending fewer cross-channel campaigns). Business model clearly matters in marketing mix, and growing vs. maintaining often require different approaches.

This data should spark a lot of questions, especially at the C level. Should this research inform your marketing decisions? If so, how? My suggestion? Carve out a few hours for your executive team, bring in lunch, and talk about it!