WhatTheyThink’s annual printing industry outlook report is now available in our Report Store. The report contains a wealth of data, industry trends, and our forecast through 2026. It also includes the full results of our Business Outlook survey conducted in Winter 2018–2019. This article offers some of the top-level results from that survey.

A Mixed Bag

If you have been following our monthly reports on printing shipments data, 2018 was a bit of a mixed bag for the printing industry, and at the same time is perhaps the year in which things turned a corner—for the better. This was reflected in some of our survey results. We also detected a change in tenor in some of our survey results. We have been doing these surveys for the better part (and even some not so great parts) of the past 20 years, and have come to expect certain responses and prevailing attitudes. Not this time. There were some distinct differences from the past, which perhaps suggests that the new print business leadership has a different set of attitudes and concerns—and often what we feel are the “true” topics the industry should be addressing.

As we always caution, though, when you look at survey results, it’s important to interpret them through the lens of survivor bias. (We explain this in more detail in the report.)

Let’s dive in, starting with...

Business Conditions

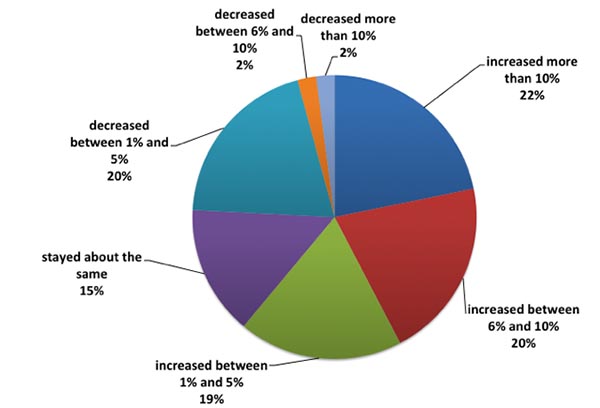

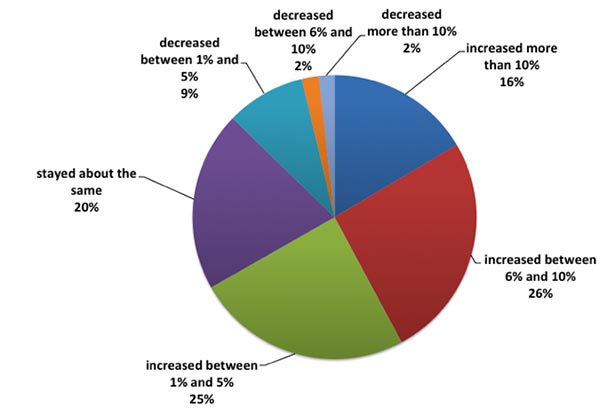

In terms of revenues, business in 2018 has been perceived by our survey respondents as pretty good; 42% said that revenues had increased by six percent or more compared to 2017 (up a few percentage points from last year’s survey), while only 4% said that they had decreased by six percent or more, substantially down from last year. Fifteen percent of respondents said that revenues for 2018 stayed roughly the same compared to 2017.

In terms of your 2018 revenues, how do they compare to 2017? All Respondents, Winter 2018–2019

Asking about anticipated business conditions is always asking for trouble. Even during economic downturns we find a lot of optimism, some of which is likely unwarranted. Not that we should complain; anyone with a completely negative perception of their business conditions is not likely going to be experiencing massive growth. Optimism is, in many cases, a sign of a healthy business. It can also be a good indicator of survivor bias, however.

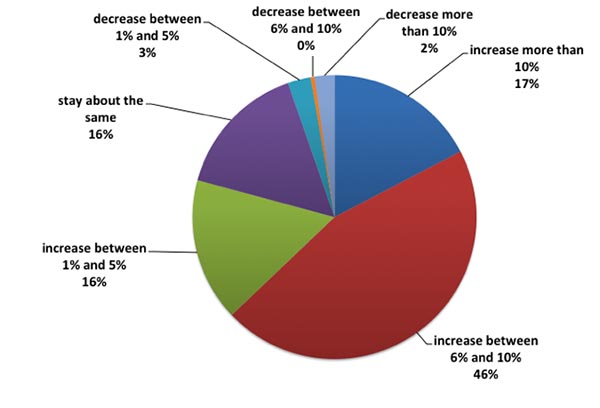

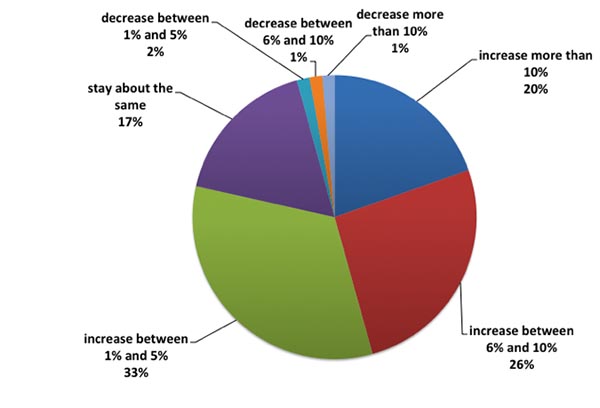

How do you expect your 2019 revenues to compare to 2018? All Respondents, Winter 2018–2019

Last year, we found that optimism had been a bit tempered for 2018, but business was better than expected (supported by printing shipments data). So the increase in optimism for 2019 is not entirely unwarranted.

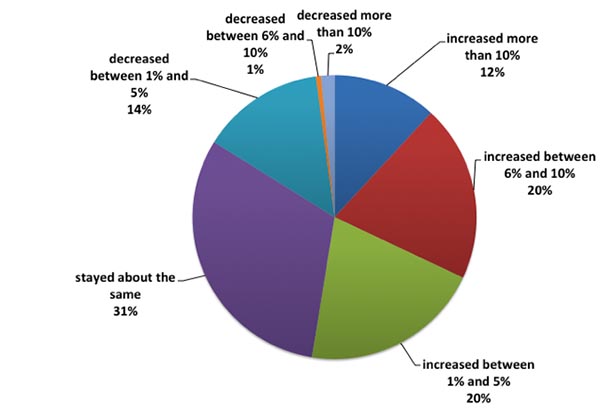

Jobs/orders in 2018 were generally up over 2017; while 32% of print businesses (down one tick from last year) reported that jobs increased six percent or more from 2017, only 3% (down from 12%) reported that jobs/orders had decreased by six percent or more over 2017. For the majority (65%), jobs/orders were generally unchanged from 2017.

In terms of your 2018 jobs/orders, how do they compare to 2017? All Respondents, Winter 2018–2019

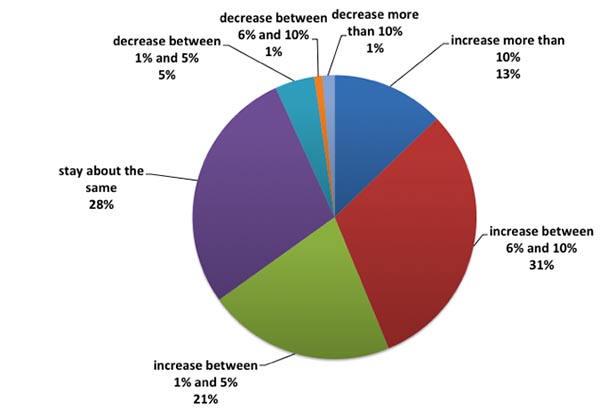

Print businesses expect jobs/orders to continue to grow, but not dramatically; 44% (unchanged from the previous year) expect jobs/orders to increase six percent or more in 2019.

How do you expect your 2019 jobs/orders to compare to 2018? All respondents, Winter 2018–2019

As for profitability, according to survey respondents, profits in 2018 were up over 2017; 42% (up from 38% the previous year) reported that profits increased six percent or more from 2017. Only four percent (down from 17%) of respondents reported that profits had decreased by six percent or more over 2016.

In terms of your 2018 profitability, how did it compare to 2017? All respondents, Winter 2018–2019

Overall, 46% (up from 38% the previous year) expect profits to increase six percent or more in 2019, while an unchanged 2% expect them to decrease by the same amount. The majority (52%) expects profits to stay about the same (17%) or increase slightly (33%).

How do you expect your 2019 profitability to compare to 2018? All respondents, Winter 2018–2019

We know from Census Bureau data that printing shipments did better in 2018 than in 2017, at least after the first quarter, so the generally rosy numbers we have seen in these business conditions data are indicative of this trend. Whether this will hold true for 2019 remains to be seen. Fingers crossed.

Challenges, Opportunities, and Investments

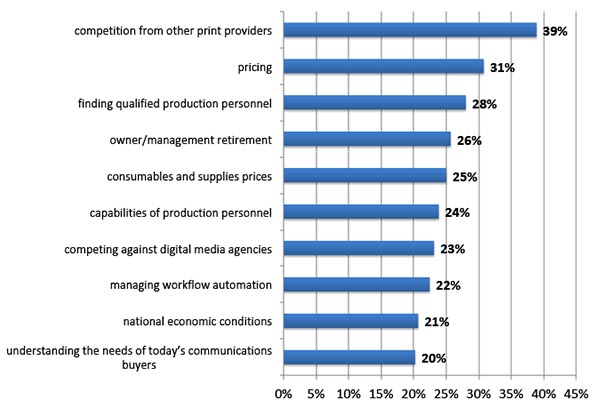

There have been some interesting developments in the top business challenges reported by print businesses. Once upon a time, “economic conditions” topped the list (even when there wasn’t a recession), but now that has taken a back seat to more important concerns.

The new number one challenge is “competition from other print providers,” selected by 39% of respondents, up from 33% the previous year. Last survey’s number one challenge, “pricing,” dropped to number two and from 44% to 31%. It’s taken a while, but print business owners are finally starting to get a handle on how to price digital and specialty printing, but challenges remain. That this challenge is still at number two more than suggests how difficult the marketplace for these items can be.

In the next 12 months, which of the following will be your biggest business challenges? All respondents, Winter 2018/2019 (multiple responses permitted)

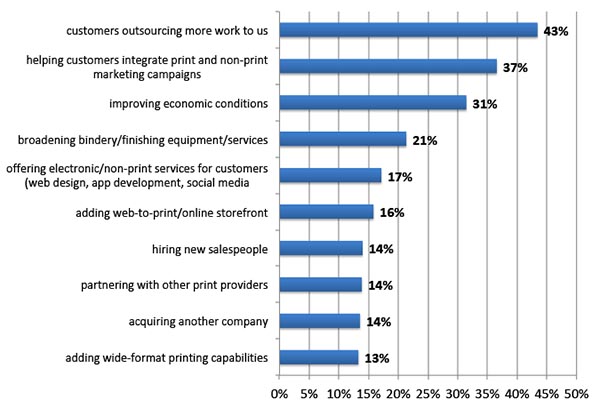

The number one business opportunity, up from 27% of respondents last survey to 43%, is “customers outsourcing more work to us.” There is always the danger that customers will be able to do a substantial amount of their own printing in-house (back in the 2000s, we saw a big migration of print work—usually of the “quick print” variety—to desktop/network printers). The idea is that customers can save time and expense in the long run by re-outsourcing this work. This is especially the case when it comes to things like wide-format and other kinds of specialty printing.

“Helping customers integrate print and non-print” is up from 28% to 37% but remains at number two. This is a very pro-active opportunity and it is a sign that the industry has at long last realized that print sits side-by-side with other kinds of media. They weren’t always cognizant of this fact—or they were in denial. Bolstering this is the opportunity that comes in at number five: “offering electronic, non-print services for customers,” holding steady at 17%.

In the next 12 months, which of the following represent your best new business opportunities? All respondents, Winter 2018–2019 (multiple responses permitted)

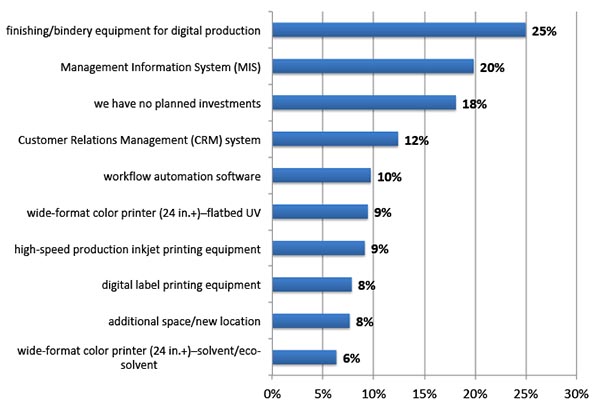

What are print businesses planning to buy in 2019? Well, not a great deal. The number one item is “finishing/bindery equipment for digital production” (25%—down one point from the previous year’s survey). The number two item is “Management Information System (MIS)” (20%—up from 11%). The number three response was number two a year ago and number one two years ago: “we have no planned investments,” selected by 18% down from 21% (and down from 25% two years ago).

Which of the following investment items have you budgeted for and plan to acquire in the next 12 months? All respondents, Winter 2018–2019(multiple responses permitted)

New Product Areas

In each survey, we try to gauge the extent that print service providers are branching out into new product and service areas, such as wide-format printing and all the various applications that fall under that increasingly broad category.

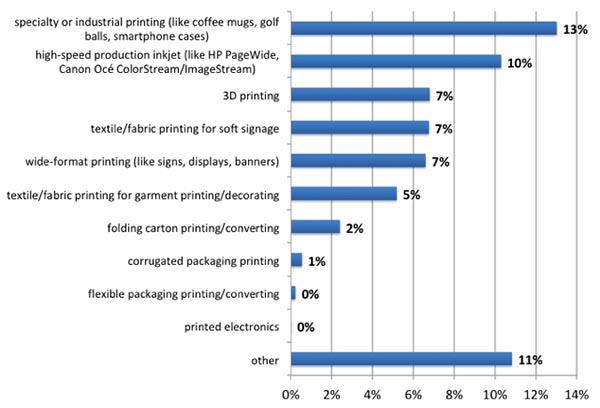

The top item selected was “specialty or industrial printing,” selected by 13% of respondents. The number two item is “high-speed production inkjet,” selected by 10%. Textile/fabric printing for soft signage, 3D printing, and wide-format printing all came in at 7%. As we usually find when we ask this question, various kinds of packaging are very far down the list.

As we saw in last year’s survey—and have heard anecdotally—the majority of businesses, if they were ever going to, have already branched into things like wide-format printing. As I remarked in my wide-format-specific look at these survey data, it seems like shops already invested in basic wide-format capabilities and are now adding thins like UV flatbeds to broaden their application offerings.

Do you plan to add any of the following capabilities in the next 12 months? All respondents, Winter 2018–2019 (multiple responses permitted)

Hiring

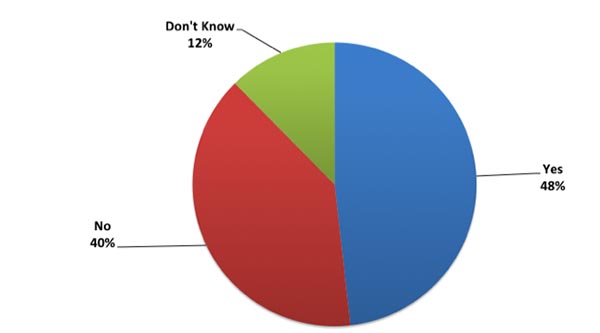

Are print businesses planning to hire any employees in the next 12 months? Yes, but not as many as last year: just under one-half (47%) do plan to hire staff—although this is down from 65% in the previous year’s survey. Four out of 10 do not—and 12% don’t know, which suggests that they are not lacking in qualified staff but may need to fill whatever vacancies crop up over the course of the year.

Are you considering hiring/adding staff in the next 12 months? All respondents, Winter 2018–2019

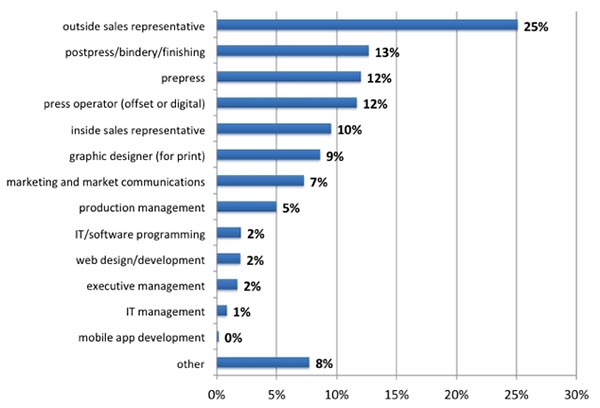

Despite all the talk about production personnel, the top position selected by survey respondents this time around was outside sales representative, selected by 25% of respondents who are considering hiring staff in 2019. Postpress/bindery/finishing staff was a somewhat distant number two at 13%. Prepress staff and press operator were each selected by 12%.

If yes, for what positions are you looking to hire? (multiple responses permitted) Respondents considering hiring in 2019, Winter 2018–2019

The complete report provides the full survey results, including breakdowns by establishment size, as well as third-party industry and macroeconomic data; industry, technology, and cultural trends; and our forecast of shipments through 2026.

Discussion

By Pete Basiliere on Mar 11, 2019

Thanks for sharing, Richard. The article refers to percentages of respondents. How many respondents were there? Were all of the respondents from the USA?

Discussion

Only verified members can comment.