The First Lady details the first changes to the FDA’s nutrition labeling requirements in more than 20 years (photo: LetsMove.gov)

Soon, people who pay attention to what’s printed on the Nutrition Facts Labels carried by virtually every food and beverage package are going to have a thoroughly revamped set of facts to pay attention to.

That much became clear on May 20 when First Lady Michelle Obama and the U.S. Food and Drug Administration (FDA) announced sweeping changes to rules governing what the labels must report and how the data is to be presented. The FDA estimates that the labeling changes, which have a compliance deadline of July 26, 2018, apply to nearly 800,000 packaged products and will cost manufacturers about $2 billion to implement.

For food and beverage producers, however, complying could involve more than just the effort and expense of a simple label update. In some cases, new packages and even product reformulations may be necessary.

This is because stricter requirements for defining serving sizes and disclosing how much sugar has been added lie at the heart of the changes. Other stipulations may bar some products from continuing to make claims like “excellent source of fiber” and “reduced fat.”

Nutritional values will have to be recalculated accordingly, and disclosing the new data could necessitate changes in label layouts and package configurations.

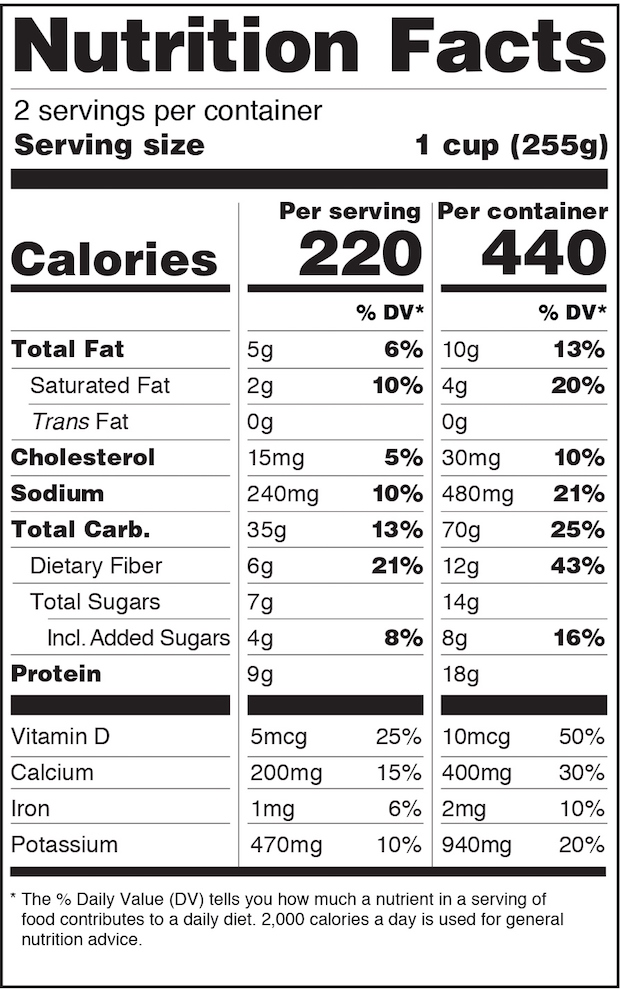

Some labels, for example, will have to go from a one-column format to a more complex two-column version in order to display both “per serving” and “per package” calorie and nutrition information. To protect their brands, manufacturers might opt to change serving counts and package sizes in the hope of putting their products in the best possible light that the new numbers will permit. In the worst cases, products suddenly embarrassed by unflattering nutritional profiles could be pulled from store shelves.

Backstopping all of this and asking themselves how the changes will complicate their day-to-day operations are printers and converters of labels and packages. As service providers, they don’t have to “comply” with anything—their role is to accurately reproduce the data-bearing graphical content their food and beverage customers send them. But, this doesn’t mean that they can hover serenely above the fray while the mandate for compliance takes hold.

“These changes are the most sweeping that the FDA has imposed since the initial Nutrition Labeling and Education Act (NLEA) rules of 1993,” according to Marriott Winchester, president of sgsco Americas, a provider of packaging design, production, and marketing services. “They will impact the entire packaging supply chain.” Winchester believes that the scramble for compliance will create “demand like we have never seen before” for premedia, printing, and converting support.

Other label and package producers are taking stock of the changes, which followed two years of development and survived intense opposition by lobbyists for some segments of the food and beverage industries. The consensus among the producers is that they’ll be able to take compliance in stride and give their customers whatever help they may need to stay on the right side of the new rules.

Although there will be exceptions, most of what label producers will be called upon to do shouldn’t represent much of a departure from the prepress and production routines they are already following.

“Ultimately, the changes to the Nutrition Facts Label is simply a modernized version of the format that has been in use for over 20 years,” says Dan Muenzer, chairman of the Tag and Label Manufacturers Institute (TLMI). What this means, according to Michael Leeds, senior vice president for client engagement at Schawk, is that the mandatory changes typically will be reflected “as a single color change”—not as a broad overhaul of label design.

But that depends on what the revised information requires each brand owner to do. “It’s all in the numbers,” Leeds says. If the new numbers indicate that the product’s brand identity or positioning has changed—as they would in the case of a product that can no longer make a certain nutritional claim—then this could result in the brand’s needing to create a new visual presentation.

A slew of radical design reworks isn’t expected, however. “Most of our labels are going to be fine,” says Marybeth Foss, prepress manager at Fortis Solutions Group. Scott Pillsbury, president of Rose City Label, observes that both before and after compliance, a nutrition label is “still black ink on a white box.” This is why in most cases, says TLMI’s Muenzer, “we do not anticipate any changes to the size or structure of labels already utilizing the existing format.”

And when changes are indicated, they could even be a plus for the brands that have to make them. Catherine Haynes, a sales and customer support specialist at All Printing Resources, notes that when packaged goods producers are obliged to comply with new rules, they often use the occasion to freshen up their graphics and rethink their SKUs.

According to Winchester, getting a recalculated nutritional profile won’t invariably be bad news. “There may be new claims that can be added with the new regulations,” he says.

Pillsbury thinks that some of his customers may even welcome the changes. Producers of organic and craft foods like being transparent about their ingredients, and the more transparency the new rules let them show off, “the better they look.” Foss agrees that compliance could be “very beneficial” for organic brands and for those that don’t add a lot of sugar to their recipes.

In any event, label shops should be able to rely on their current production capacity to handle whatever compliance-related upticks in orders may be on the way.

“The changes can be produced with label printers’ and converters’ existing equipment, so no additional equipment will be required,” says Muenzer. Winchester also believes that existing resources primarily will be used. But, he thinks that “progressive” companies will add whatever machines and staff they need to be sure of getting it all done by the deadline two years from now.

Come what may, John Grunst, sales director at Alpine Packaging, doesn’t see a business bonanza in compliance-related work. “This is not something we expect to make excess profit from,” he says. Customers who buy pressure-sensitive labels from Alpine will be looking at charges for new flexo plates if their layouts have to change. But these charges, Grunst says, are reasonable, and per-thousand running costs shouldn’t be affected.

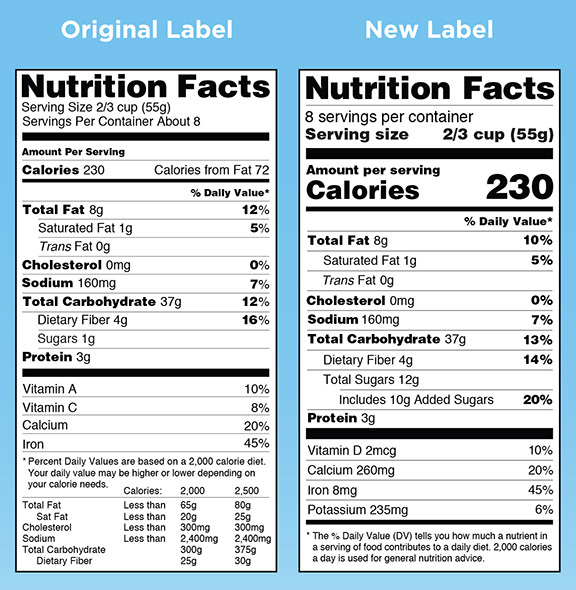

Before and after: new information in bigger, bolder type

Label printers like Alpine will need to update their Nutrition Facts panel templates to align with new graphical requirements brought on by the changes. For example, calorie counts and serving information must now be displayed in fonts that are noticeably larger and bolder than the ones specified by the FDA up to now.

Updates also are in order for printers relying on software that generates panel layouts from nutritional data. Haynes recommends using solutions that dynamically create “smart” label layouts populated with numbers from XML databases. Esko has announced that it will build such change-supporting features into plug-ins and other software it offers for label and packaging workflows.

At this point, the main concern for label producers is understanding how proactive their food and beverage customers are going to be about complying with the new regulations. Two years, after all, is not much time to get ahead of a situation in which “every single SKU is going to have to be changed or touched,” as Winchester puts it. He also thinks that industry capacity could be severely stressed if too many brand owners wait until the last minute.

There are some mitigating factors. Food and beverage manufacturers with sales under $10 million have an additional year to comply. Enforcement won’t begin until after July 26, 2018, and before then, manufacturers and retailers can go on using labels they already have on hand. “Existing inventories should be able to be utilized with proper management,” Muenzer says.

If one possible scenario is an avalanche of late orders as procrastinators scramble to meet the compliance deadline, Dave Hayes isn’t worried about it. He owns Apogee Industries, and his sense is that change-related orders will “start slowly, over time” and proceed until his customers’ submission of updated files “almost becomes seamless.” He acknowledges, though, that a few smaller customers might “come to us in a panic” as realization slowly dawns.

At Schawk, says Leeds, “we expect the full gamut” of responsiveness. The first responders undoubtedly will be Schawk’s largest customers. “Some of our clients, owning the most recognized and valued brands in the world, have been scenario planning since the proposed rules were announced in 2014,” he says. Other clients took a wait-and-see stance and did “minimal planning.”

As in all things, the customers will call the shots with respect to compliance, and the service providers will accommodate them. Grunst believes that Alpine may have to bear with delays “that are intentional in nature” as some customers wait to make all of their plate changes at once. “That’s smart, and I don’t blame them,” he says.

Fortis Solutions Group also will have its share of “outliers” to deal with in what Foss sees as a “mixed bag” of customer attitudes toward getting in step with the new rules.

Historically, she says, “labels are the last things that people think about” as they put manufacturing and marketing considerations first. For some, compliance comes with “a pretty substantial cost,” and these customers naturally will want to spread the expense over as much time as the regulations give them.

Label producers that want their customers to be proactive must take some of the initiative themselves, even though this technically isn’t required of them. TLMI’s recommendation, says Muenzer, is that “label printers and converters act as partners with their food and beverage producing customers to assist in the implementation of the new requirements; however, according to the regulations, the ultimate responsibility for compliance rests with the manufacturer, brand, or importer.”

The new dual-column layout

Taking the advice to heart is sgsco Americas, which has partnered with Prime Label Consultants to produce a series of videos and other educational materials about compliance for brand owners. A few days after the FDA announcement, Prime Label Consultants hosted a conference in Washington, D.C. to review the impact of the changes.

Leeds says that Schawk has been working to educate its clients since the proposed changes were announced in early 2014. Part of that effort is Label-Central, a website where clients can interactively test their preparedness and request expert consultation.

Smaller shops can provide their own kinds of valuable help. Long before the changes were formally announced, Haynes alerted customers of All Printing Resources to them with a detailed blog post on what the new regulations could be expected to bring. Pillsbury refers Rose City Label customers to Oregon State University’s Food Innovation Center, which he calls “awesome resource” for those needing help with nutritional analysis.

Muenzer urges label printers and converters to become subject-matter experts in the revised requirements, especially on behalf of small customers who may need extra assistance. This is the spirit in which Grunst says he is trying to read “everything I can get my hands on” about the changes his food and beverage customers are facing. Hayes says that Apogee Industries’ laggard customers can count on him to “gently remind them” of what they must do, and when.

This is the traditional supporting role of printers and converters, and Pillsbury says that Rose City Label is happy to be playing it in the phasing-in of the new rules for the Nutritional Facts Label. That’s just as well, because the change isn’t the last one of its kind that he and others in the label and packaging industry will be tasked with helping to carry out.

On July 14, the U.S. House of Representatives, following the lead of the U.S. Senate, passed a bill requiring packages of food containing GMO (genetically modified organism) ingredients to be so labeled with text, symbols, or smartphone-scannable QR codes. The Obama administration is expected to sign the bill into law.

The effects won’t be felt immediately, or perhaps even anytime soon. GMO labeling comes under the jurisdiction of the U.S. Department of Agriculture, which first has to define what qualifies as a GMO and which types of food must disclose GMO content.

Those inclined to toast the passage of the bill with a cold beer may be interested to know that the Beer Institute, a brewing industry trade group, has launched a “voluntary disclosure initiative” that would label cans and bottles with information about ingredients, calories, carbohydrates, protein, fat, and alcohol content.

QR codes can be used to deliver the data. The Beer Institute says that brewers producing more than 81% of the volume of beer consumed in the U.S. have agreed to follow the guidelines and are expected to be in full compliance with them by the end of 2020.

Discussion

By Marriott Winchester on Jul 27, 2016

http://sgsco.com/nutrition2016

View the link above for free information on what to expect and to keep updated as we all navigate the nutrition label changes. Keep an eye out for the next PLC/sgsco video, Plan Label Changes. We are working with the FDA daily to clarify the over 900 pages of regulations to ensure 100% compliance.

If you are a packaging printer or design firm lets work together to be the primary source of information for our CPG, Retailers and Food and Beverage Manufacturers.

Contact Marriott Winchester, Zone President sgsco Americas at [email protected] for detailed information.

Warm regards,

Marriott