Now in its fifth full-year since its introduction, the continuous-feed inkjet printer market shows no signs of maturity. There are few other markets in either the printer segment or consumer electronic segments that continue to show growth after five years. This doesn’t mean that the path forward is lined with rose petals; the challenge of where to continue to find enough pages to fill these highly productive printers is not an easy challenge.

Transaction printing remains the largest application of all pages printed on these devices. While actual pages will double through the forecast period, I.T. Strategies is projecting that by 2017, nearly all toner-based mono continuous-feed pages remaining will have been replaced by continuous-feed inkjet printers. This means that future page volume growth will become more dependent upon a combination of both offset page replacement and new application page volumes.

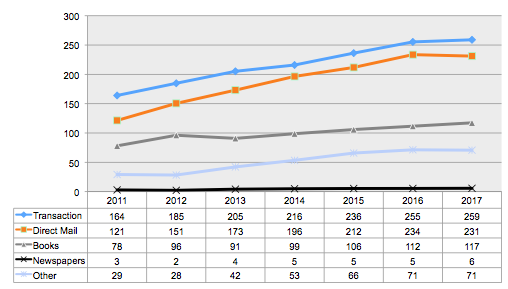

Applications

There remain three core applications for continuous-feed inkjet production printers: transaction, direct mail, and book printing. Transaction printer sales continue to do well, but a significant amount of placement volume was due to large account sales. Some of the sites purchased in excess of six engines in a single deal (all U.S.-based), with one account reportedly acquiring in excess of 15 engines. Units intended for direct mail applications also grew, mainly due to growth in Asia (mitigating decline in Europe).

Engines for book printing applications grew in 2012 as existing accounts added more engines. It should however be growing more, as the technology and print quality are well proven at this stage in the market. The issues may well be related to costs. I.T. Strategies is projecting slower adoption for 2013 among book printers as those that have not yet moved to ink jet printing systems continue to be slow to make the large investments required. When adding inline finishing, the cost of total investment can often be double the system acquisition price.

Engine Unit Sales by Applications

Source: I.T. Strategies, Inc.

“Other” applications include those units that are neither strictly transaction nor direct mail printers. Some are printing variable-data catalog inserts, some wealth management reports with photographic image content, customized travel itineraries/brochures, etc. The common link is the heavy dependency on variable data and color photographic images.

Conclusion

The continuous-feed inkjet production printer market is a great market to invest in, especially in the context of most other printer market segments. Total revenue growth is expected to average 18% annually for the next five years.

It may well grow even faster than projected in our forecast here, providing some of the ink coverage and substrate challenges get solved sooner than expected. The focus on applications will be:

- Short-term: Remains transaction focused.

- Mid-term: Must come from direct mail and books.

- Long-term: General commercial print applications on broad range of substrates and PQ, with a heavy focus on variable-data print value creation.

To outpace the forecast projections, I.T. Strategies believes the equipment suppliers will need to make a large investment in:

- Substrate/ink technology development to open up broader application range beyond transaction, direct mail, books, which are mostly printed on uncoated papers.

- Large-scale development and accessibility of variable-data sources to enable the production of high-value pages.

While the journey to be able to print on inexpensive offset coated papers is underway, and may take more resources and time than we’d all like, these issues will probably be solved. The large-scale development and accessibility of variable data is a more complicated challenge. It involves the many more stakeholders, including the specifier who orders the print, the print provider, regulatory bodies, and ultimately the OEM equipment supplier in whose interest it is to have their customers print more page volumes, page volumes that are valuable. Both of these are good challenges to have, ones that the industry leaders will be working hard on to most efficiently and time effectively resolve.

Discussion

By David L. Zwang on Jul 16, 2013

Marco.. interesting piece..

To what do you attribute the flattening/dip of direct mail in 2017... is it eMedia, the new liquid ink tech, or???

By Marco Boer on Jul 16, 2013

David, With the caveat these projections are based upon assumptions, we're assuming that 1) there will be consolidation among the PSPs, the larger ones ending up with ever faster engines reducing the need for as many engines. We are also factoring in continuing erosion of print to electronic alternatives. Direct mail is an especially difficult one to forecast because errant postage rate changes could have huge and fast impacts upon demand for direct mail production. We don't expect other print technologies to impact existing ink jet during this period - ramp us of new technologies always takes longer than one expects.

By Oscar Dubbeldam on Jul 17, 2013

What is the prediction when the US market will (finally) adopt the direct debit, Internet banking and portals to sent statements? So have a rapid decline of 10% or more on a yearly basis for its statement volumes?

By Marco Boer on Jul 17, 2013

Hi Oscar,

Currently the migration rate from paper transaction to electronic statements is running about 2-3% annually for the US overall. The customers who were apt to switch to electronic statement delivery have mostly done so. The ones who still like a paper record are difficult to switch. Most of the switch to electronic statements now occurs when opening new accounts, where the default is usually electronic statement. Interestingly, as paper statements become rarer they often become more valuable: "If I get something in the regular mail it must be important". That's why many large financial companies like Citibank and others love ink jet production printers - it enables them to directly communicate with 100% attention to their offers/messages, messages relevant to the recipient, printed in color.

Marco Boer

By Greg Imhoff on Jul 17, 2013

Thank you wtt.com and Marco for the great insights in this report. I believe two future critical points IT Strategies notes are:

" 1 - Substrate/ink technology development to open up broader application range beyond transaction, direct mail, books, which are mostly printed on uncoated papers.

and

2 - Large-scale development and accessibility of variable-data sources to enable the production of high-value pages."

Basically once Digital RIPs find the production ability to match Offset in image quality ie: 2540 dpi, the market demand will be pointed higher.

By Andrew Copley on Jul 17, 2013

~~~

Marco, you provided some great insight into this market in your article.

I agree that the continuous-feed inkjet production printer market is a wise one to invest in – when you look at the trillions of pages that will be produced over the next 10 to 15 years, inkjet will certainly be a big piece of the pie and a huge focus in the graphic communications industry. In fact, some say 50 percent of digital pages will be done on inkjet devices by as early as 2017.

A great deal of the inkjet pages currently being produced are generated from legacy mono imprints and offset transfer, but there will also be some crossover between inkjet and electrophotographic production. The key for manufacturers is to provide the industry with solutions and workflow automation that cover their specific needs, whether that is inkjet or electrophotographic.

– Andrew Copley, Senior Vice President/General Manager, Graphics Communications Business Group, Xerox

By David Jimenez on Jul 18, 2013

Hello Marco,

Does your data include inkjet devices sold only by the major vendors (Kodak, Canon/Oce, HP, etc...)? Or does it include the devices developed by companies for internal use only? For instance, the ProteusJet by RR Donnelley. If not, it would be interesting to see the shifts within your data. RRD producing a good percentage of direct mail, marketing and book product via inkjet technology.

-David Jimenez

By Marco Boer on Jul 19, 2013

Hi David,

We did not include in-house development in the article as most of those are imprinting systems. Effectively that is a captive market. Please contact me directly for a perspective on that market which we track separately.

Marco

By Fadel Iskander on Jul 19, 2013

Thank you Marco for the article.

I am assuming that the graph is for worldwide shipments/Installations.

If that is correct, can you share a similar one for just the USA?

Fadel Iskander

By Greg Imhoff on Jul 19, 2013

I agree with Marco's assessment on inplant imaging. This has always been viewed measured and approached separately.

Marco - if as requested by Fadel there are USA charts - I too would find this of interest, all things considered.

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free