By John Nelson, Editor, Smithers

Sustainability in printing is an increasing priority across the world, with print buyers paying more attention to the carbon impact of all their business activities. This can provide a demonstrable commercial advantage for those print systems and operations that give a genuine reduction in environmental impact.

As the industry confronts 2023, booming energy prices in Europe are placing a new imperative of energy efficient printing. In this exclusive content for WhatTheyThink, Smithers—the leading consultancy for the paper, print, and packaging industry—shares its latest insights into the short- and medium-term impact of the drive to greener printing.

Low-Carbon Digital Production

Digital (electrophotography and inkjet) OEMs are actively looking to exploiting the demand for lower energy use in print room. In contrast to offset litho or flexo printing, digital means significantly less make-ready, which saves time, energy and ink. For analogue press operators these are typically amortised across a long print run, but following the pandemic run lengths are trending downwards—with shorter more repeat orders with quicker turnarounds. The main rationale for this is tighter cash control by print buyers and the desire to reduce inventory, but such benefits can also be spun as a sustainability gain, especially in reduced waste.

Furthermore, inkjet presses have continued to improve throughput rate and hence their commercial viability at longer print runs, and now HP Indigo’s new V12 press with LEPx configuration is promising similar potential with toner.

Analog OEMs are not blind to this trend and are increasingly fitting new automation and low-energy equipment to their print lines. One option for larger converters is to recycle production line exhausts. Smaller converters may not have that same opportunity, but can take smaller steps to reduce energy use.

A parallel trend is radiation-curing work cutting energy use at curing stations via a new generation of low-energy UV curing lamps.

There are competing claims over which equipment and configurations delivered the greatest reduction in carbon input. Sustainability targets are now a core part of print buyers’ corporate commitments. This is generating more interest in objective, agreed lifecycle analyses that track all factors in delivering print work—energy, consumables, transport/haulage, waste, etc.—to enable customers to select a greener print partner.

Substrates

Within the wider sustainability debate the leading impetus is to replace plastic, especially single-use plastics, with alternative more recyclable materials. For print this is seeing some work transition back to fibre-based substrates. The trend is especially marked in packaging, where packs and labels now form a real-world touchpoint by which shoppers can judge the seriousness of a brand’s commitment to the planet.

For printers the impetus is to manage any transition from plastic to paper, with no loss of print quality. On press, this means the ability to handle heavier media and print effectively on less planar surfaces, which supports the adoption of inkjet. Many of the latest presses are being built to handle heavier materials, including kraft grades now being seen in customer-facing packs.

This is happening as packaging is already a leading growth target for most OEMs. In North America publication volumes are continuing to decline, and the outlook for graphics/advertising is decidedly flat. In contrast, packaging work (excluding labels) in the region will be worth $99.25 billion in 2023, and is forecast to see real growth, +2.1% year-on-year by value, through to 2027 (The Future of Digital vs Offset Printing to 2027).

As recyclability is emerging as the most important metric for brand owners in packaging, it is generating new impetus for effective deinking technology. If inks or other components such as coatings cannot be removed, it can compromise both the physical appearance and material strength of recovered pulp. This is stimulating new R&D spending, as well as a move away from decorative effects that are harder to remove, such as metallic embellishments and glitters. The vision of a circular economy in materials is leading to more scrutiny of conventional publication inks—especially the migration of mineral oil hydrocarbons—as posing a potential health risk if recovered pulp is used in food contact. In Europe, Germany has passed a law specifically safeguarding against this issue. In France, these are now prohibited in packaging, and since January 1, 2023, in consumer-facing advertising materials and catalogs as well.

Aqueous Printing

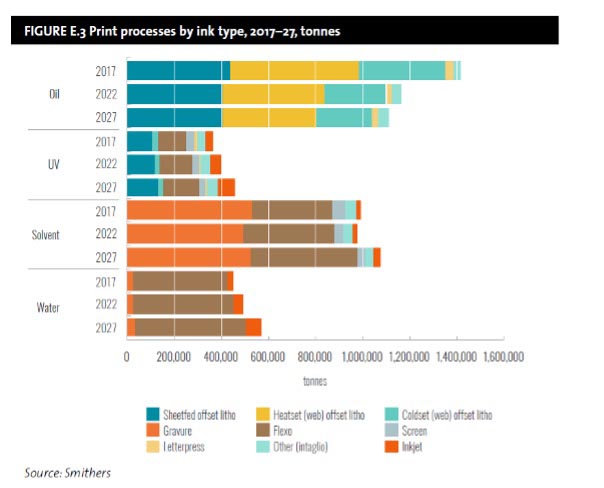

Another contribution ink companies are making is the broadening in range of aqueous (water-based) inks in their portfolios, especially as replacements for solvent-based formulations. The main markets for water-based inks are on flexo and inkjet presses, with a smaller segment in gravure.

Through 2022, a series of aqueous inkjet systems were demonstrated, including Ricoh’s forthcoming proposition for commercial print, the Pro Z75 B2 sheetfed press, and Xaar’s Aquinox printhead, which is targeting ceramics, coding and marking, textiles corrugated board, and other packaging substrates.

In 2022 Smithers projects water-based inks sales just topped $5 billion, according to its report The Future of Water-based vs Solvent Printing to 2027, compared to $7.67 billion for solvent-based inks. The aqueous segment does have the fastest growth forecast, +5.6% year-on-year to 2027 (by value); while solvent inks will grow at just +1.3% year-on-year, trailing the market average.

The main factor retarding the move to aqueous inks is the established market for solvent printing in flexo packaging, and water-based inks’ inferior performance on polymer substrates used for flexible packaging. Some headway is being made for these in developed markets, especially as and when packaging converters transition to more absorbent paper substrates.

Across all ink types rising raw material costs is combining with moves for greater supply chain transparency, and where possible a reshoring of supply. As these post-pandemic supply chains mature, they can help reduce the damage done by ingredient sourcing in less regulated countries and confront other issues, such as exploitation of child workers.

Smithers publishes a complete suite of market reports covering all traditional, digital, and diverse high-growth segments of the print industry. Its most recent study—The Future of Water-based vs Solvent Printing to 2027—is available to purchase now from Smithers.

John Nelson is an award-winning editor and journalist working in the market reports and consultancy business of Smithers. Here he covers market and technology developments across multiple technical and commercial segments; including home and personal care, sustainability, packaging, printing, paper, nonwovens, rubber and tires.

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free