What, exactly, are NFTs? Do they matter to us in the printing industry? Yes, they matter. Maybe not in your clients’ everyday business and marketing—yet—but they will.

NFTs are big business. Nonfungible.com reports that trading in NFTs hit $17.6 billion last year, up 21,000% from 2020. According to the site’s analysis, NFTs also generated $5.4 billion in profits in 2021. As eyebrow-raising as this is, it is actually lower than some estimates, including one from Chainalysis, which put its number at more than $40 billion.

Like digital wallets and social media communities that also took time to find their places, NFTs will eventually move out of the novelty phase and find their place in the business and marketing worlds, too. When they do, their relevance to our industry will become clearer. Until then, the first step is simply understanding what they are.

Defining NFTs

NFT stands for “nonfungible token.” Google “NFT” and you’ll find a host of slightly varying definitions. According to Investopedia, for example, NFTs are defined as “unique cryptographic tokens that exist on a blockchain and cannot be replicated.”

What in the world does this mean? Here’s a simplified breakdown:

1. NFTs are unique, authenticatable, trackable assets in the digital realm.

NFTs are tokens, or digital assets (music, artwork, collectibles), that exist in the digital realm and that can be bought, sold, and traded like physical assets. Some NFTs are as inexpensive as a few dollars. Others have been traded for hundreds of millions.

How can digital assets be assigned that kind of value? Can’t any digital creation be duplicated by pretty much anyone? As many times as they want? When it comes to a regular digital asset, yes. An NFT, however, which has been minted with a smart contract and uploaded to a blockchain, no. That’s why NFTs are more than just cool digital “stuff.”

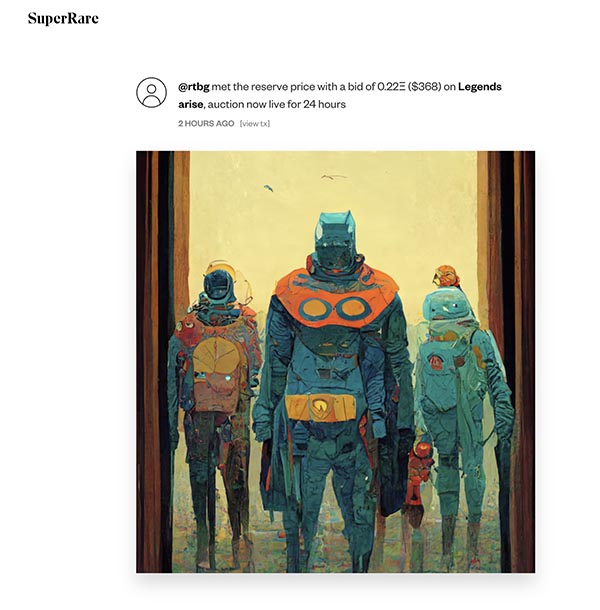

Source: SuperRare.com

Integral to the concept of NFTs are blockchains and smart contracts.

Blockchains are digital ledgers of transactions. Every time a cyber transaction is made, it is recorded on a blockchain. Each blockchain is shared among all the participants in the chain, and because the ledger is distributed, this makes assets on the blockchain extremely difficult or impossible to change, hack, or counterfeit. Once an NFT is uploaded, it now has a unique, trackable, and verifiable identity just like a physical asset.

Think about it (loosely) as being like a car. One car is interchangeable with another car of the same make, model, and year. But once you assign that car a vehicle identification number (VIN), it is no longer interchangeable. It is now unique. It is Make-Model-Year-VIN, and there is no other car just like it. Over the years, the history of that car—repairs, accidents, services, changes of ownership, mileage—are associated with that VIN. When you go to purchase a used car, you get the car, with its unique VIN, and its entire service, accident, and ownership history that comes with it. That’s why, when you select just any car from Carvana, they can’t just send you a car that fits the description of the car you bought. They have to deliver that same vehicle, authenticated by its VIN.

This is the value of NFTs. Once NFTs are uploaded to a blockchain, along with the smart contract that identifies all of the details of what the NFT entails, they can be bought, sold, and traded just like a physical asset.

This is a much simplified definition, and NFTs can include far more than ownership of a singular digital asset. NFTs include “smart contracts” that define the details of the NFT. For example, an NFT for a digital concert ticket might indicate the location of the venue, the date, and which seats have been purchased. It might also include exclusive access to the artist, rights to merch, and any other details the NFT creator decides to include.

Digital contracts can also automatically assign royalties to NFT creators every time the NFT changes hands.

2. Each NFT is unique.

This is why, while we think of digital products as being easily duplicated and shared, this is not the case with NFTs. Once an NFT is minted and uploaded to the block chain, it has its own unique identity that cannot be duplicated. Because of the complexity and interdependence of the blocks in a blockchain, any duplicate would be easily identifiable as a pirated copy and would therefore be worthless.

This is the “NF” in NFT —“nonfungible.” Something that is “fungible” is interchangeable with something of the same type. A New York City subway token, for example, is fungible. It doesn’t matter which token you use. Every NYC subway token carries the same value. “Nonfungible” means that the asset is non-interchangeable. We’ve used the car example, but artwork is an even better parallel. Van Gogh’s famous painting “Sunflowers,” for example, sold for $40 million in 1987. Using the most sophisticated art replication techniques, you could replicate this painting so that even an art expert could hardly tell the difference. But the replica would not carry even a fraction of the value of the original. “Sunflowers” is nonfungible.

Once NFTs are uploaded to a blockchain, along with their smart contract, they become nonfungible just like collectibles or pieces of artwork in the physical world. A digital copy might look and sound identical to the original, but it isn’t.

3. NFTs have a chain of custody.

Because NFTs exist on a blockchain, they have provenance, or a chain of custody. Not only can the owner be assured that his or her NFT is authentic, but that proof of authenticity travels with that NFT for its lifetime. It also enables the owner to look back and see the history of ownership. Think CarFAX for digital assets.

Fundamentally Changing the Market

This, ultimately, is what makes NFTs so exciting. As explained in the Harvard Business Review:

NFTs have fundamentally changed the market for digital assets. Historically there was no way to separate the “owner” of a digital artwork from someone who just saved a copy to their desktop. Markets can’t operate without clear property rights: Before someone can buy a good, it has to be clear who has the right to sell it, and once someone does buy, you need to be able to transfer ownership from the seller to the buyer. NFTs solve this problem by giving parties something they can agree represents ownership. In doing so, they make it possible to build markets around new types of transactions

What’s This Look Like on the Ground?

What does this look like in real life? To take a simplified example, let’s say a designer creates a super cool avatar in the metaverse. The designer turns that avatar into an NFT and sells it to you for $100. You post it as your online avatar, and the compliments start rolling in. Suddenly, all your friends and family want one. Well, they can’t have that avatar (or even one just like it) because it’s an original piece of artwork. But they can buy their own custom avatar from the same artist, and that avatar will be uniquely theirs.

Thanks to the popularity of your avatar, this artist is now swamped with orders, and demand drives the prices up. Now, instead of the artist’s avatars being worth $100, they are worth $1000. Meanwhile, you’ve started to get bored of yours, and with prices on the rise, you see an opportunity to flip it for a profit. You sell your avatar to someone else for $1000. Now the lucky owner has your avatar (and the proof of authenticity that comes it), and you have made a $900 profit—just as if you’d flipped a collectible in the physical world.

Couldn’t someone just right-click your avatar and download it? Or take a screen shot and use it as their own? Yes, but because each NFT is uploaded to a blockchain, if you or someone else makes a copy, it’s just that—a copy. As with any knockoff or pirated digital item, unauthorized use is theft, and if you make your own copies and try to sell them, those copies have no value.

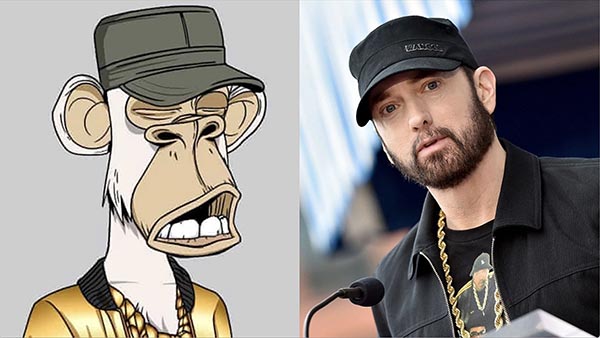

A good example of this model is the Bored Ape Yacht Club. According to the Bored Ape website, there are 10,000 Bored Ape NFTs for sale, and each has its own value. When you purchase a Bored Ape, you also gain access to the Bored Ape Yacht Club, an exclusive online community of Bored Ape owners. Bored Ape owners can continue to purchase more apes, gaining access to higher tiers in the club, sell their apes, or trade their apes as they would any other asset. How much is a Bored Ape worth? The cost varies based on the “rarity” of their features (as determined by their creators). Rapper Eminem recently purchased an ape that looks like him for $450,000.

Source: www.sportskeeda.com

Bored Apes are kind of ridiculous, and even the Bored Ape Club creators acknowledge it (although not as ridiculous as Mark Cuban selling an NFT of one of his tweets for $1,000). But that’s not the point. It’s the model of buying and selling digital assets in the metaverse that has the potential to grow legs and impact marketers in a larger way.

Most Common NFT Types

What are the most common types of NFTs today? According to Business Today, artwork tops the list, but there are many others. Here is the publication’s Top 13 NFTs list:

- Artwork

- Collectibles

- Sports memorabilia

- Video game assets

- Virtual lands

- Memes

- Domain names

- Music

- Event tickets

- Real-world assets

- Fashion

- Identity

- Miscellaneous

Many of these types of NFTs have real-world and lasting implications. Others maybe not so much.

Where Do NFTs Go Next?

The concept of NFTs is still very much in its infancy. Where the true and lasting value will lie, and what business models will end up being a flash in the pan and which will end up surviving the test of time, we’ll have to see. Especially since NFTs can be crafted in ways that enable ownership and access to both digital and physical items (such as giving NFT owners access to real-world meetups, concerts, and other events), as well as creating entirely new types of communities.

So while we to see where NFTs ultimately take us, poke around. Maybe buy an NFT or two—just to see what they do and spark some ideas for how they can be used in a business context. Because, while we cannot be completely sure what the future with NFTs looks like, we can be sure that NFTs, in themselves, are here to stay.