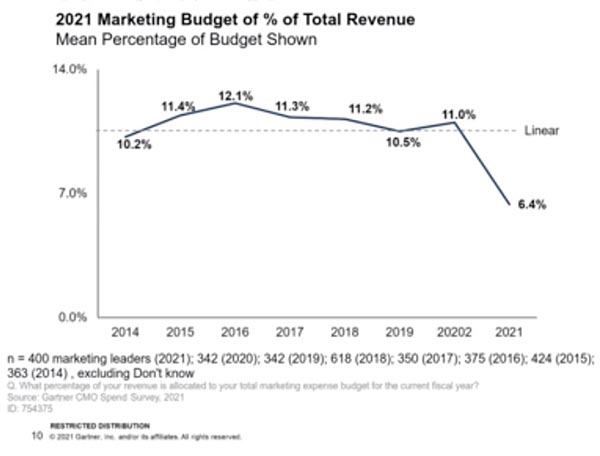

Even as CMOs’ 2020 marketing budgets were being slashed as a result of the COVID-19 pandemic, CMOs were hopeful that those budgets would bounce back in 2021. But Gartner’s just-released “CMO Spend Survey” tells a different story. Not only are budgets not bouncing back, but they have dropped to the lowest level in the history of the survey.

(In my article from August 4, I discussed the top-line results of this survey in light of the differing results from the CMO Council’s survey on the same topic. Here I drill down into the results from the Gartner survey on its own.)

Gartner’s CMO Spend Survey (2021) takes the pulse of 400 CMO and marketing leaders in North America, the UK, France, and Germany. “Despite facing in-year budget cuts in 2020 due to the pandemic, most CMOs expected budgets to bounce back in 2021,” said Ewan McIntyre, co-chief of research and vice president analyst for Gartner for Marketers in Gartner’s webinar announcing the survey. “This budgetary optimism was misplaced, as marketing budgets have fallen to their lowest level in the history of [our] CMO Spend Survey.”

Earlier data (from Gartner’s CMO Strategic Priorities Survey 2020-2021) reported that, in 2020, the majority of CMOs expected budget growth of more than 5% for 2021, even if COVID-19 had negatively impacted their business performance. Instead, marketing spending has been slashed in 2021, with the average budget falling from 11% of company revenues in 2020 to 6.4% in 2021, a cut of 4.6 percentage points.

“Marketing is an area that gets its budget cut first and its budget restored last,” says McIntyre. “This doesn’t mean budgets won’t return to pre-pandemic levels. There is just no guarantee that they will.”

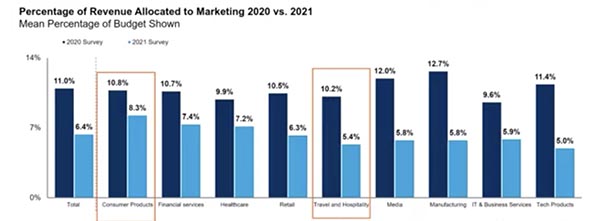

Hardest hit, according to Gartner, were travel and hospitality, manufacturing, and tech companies, as well as larger companies in general. Indeed, companies with revenue of more than $2 billion reported the lowest average allocation to marketing of just 5.7%. On the other hand, companies with revenue of less than $500 million reported the highest allocation to marketing, with an average budget of 8.6% of revenue.

Consumer products and goods (CPG) companies reported the strongest 2021 marketing budgets at 8.3% of company revenue. This is followed by financial services (7.4%) and healthcare (7.2%). Lowest—at 5.4%—is the sector most impacted by the pandemic, travel and leisure. Its marketing budgets have fallen to nearly half what they were last year.

There is little difference between B2B companies and B2C companies when it comes to budgets. The greatest difference was seen, not in business model, but in the size of company. The larger the company, the lower the percentage of revenues allocated to marketing:

- $100M–$500M (8.6% of revenues)

- $500M–$1B (8.2% of revenues)

- $1B–$2B (6.9% of revenues)

- $2B–$20B+ (5.7% of revenues)

The other area of biggest budget variation is in a company’s level of marketing experience. Those who consider themselves “master” marketers report allocating 8.6% of company revenues to marketing vs. those who consider themselves “nascent” marketers, who allocate 5.2%.

- Level 1 (nascent) 5.2%

- Level 2 (developing) 6.0%

- Level 3 (intermediate) 6.3%

- Level 4 (advanced ) 7.1%

- Level 5 (master) 8.6%

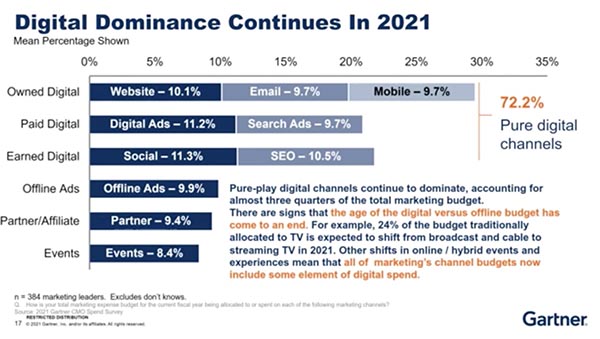

Where are companies spending their money? Nearly three-quarters (72%) of respondents’ market budgets are spent on owned, paid, and earned digital channels, including websites, digital ads, social media, email, search ads, SEO, and mobile. Only 9.9% of their marketing budget is spent on offline media. But MacIntyre points out the extent to which digital and offline are merging into a hybrid model (i.e., traditional offline television ads are migrating to streaming services, and we can assume that this would include print-to-digital cross-channel movement, such as direct mail to digital using augmented reality, as well).

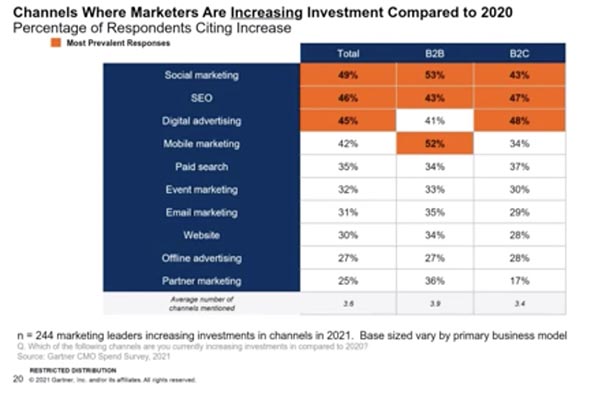

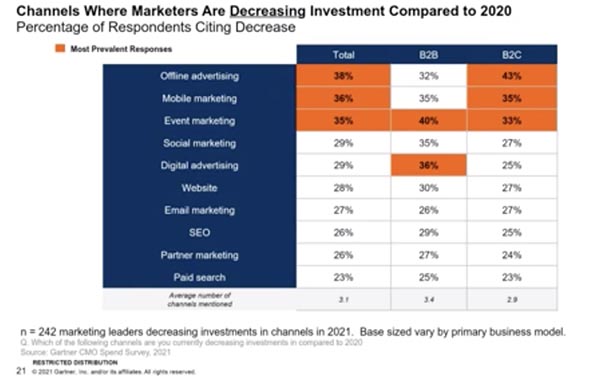

When asked which channels for which they were increasing or decreasing investments, respondents said the following:

“The offline channels are the targets of defunding right now,” says McIntyre.

When asked why they had made the change in allocation, respondents gave the following top three answers:

- To better meet the pace of change brought on by digital technology (47%).

- To improve brand awareness (40%).

- To gather data-driven insights from digital channels (39%).

McIntyre notes that only 24% of respondents ranked “reduce costs” as a “top three reason for changing their channel investment. “As an analyst who took client calls throughout 2020, certainly in the earliest stages of the pandemic, we experienced an uptick in cost optimization inquiries where clients were considering the various channel reallocation efficiencies to reduce cost at a time of significant budget pressure,” he says. “As we go through this period of squeezed budgets, it’s [interesting that reducing costs is] not the foremost thing in CMOs’ minds. They are looking at how they can focus their channel investments, not just to get great spend efficiency but to make sure it’s paying off in different ways, such as in brand awareness and data-driven insights. Changes in the channel mix aren’t a pure cost play.”

For B2B marketing, the greatest increases in budget allocation are in social media and mobile marketing. For B2C, it is in digital advertising and SEO. Areas of greatest decline in allocation? For B2B, it’s event marketing and digital advertising. For B2C, it’s offline advertising and mobile.

When looking at the largest resource allocation—agencies, media, labor, and paid media—agency spend continues to decline. “Albeit a small dip from 23.7% in 2020 to 23% in 2021, this continual change indicates significant in-housing activity, as CMOs reimagine the capabilities that can be supported by their internal teams,” added McIntyre.

This suggests that PSPs trying to win marketing development work may have their work cut out for them. CMOs report that 29% of work previously carried out by agencies has moved in-house in just the last 12-months alone.

The focus on in-housing is changing as well, with brand strategy, innovation and technology, and marketing strategy development making up the top three capabilities areas CMOs are moving to internal teams. Meanwhile, marketing technology [martech, which is typically managed in-house] continues to dominate, taking up 26.6% of the total budget.

For its part, McIntyre notes, while marketing analytics still commands 11% of the total budget, it has continuously dropped in prioritization—now in the fourth position in 2021. “CMOs continue to invest in marketing data and analytics, [although] for many, the results have failed to live-up to expectations,” he says. “Given recent and upcoming regulations, and changes in data collection, we expect this investment area to continue to be a strategically important capability, but also to continue to fluctuate until uncertainties subside.”

For greater details on the results of Gartner’s survey, you can watch the webinar here.