Intermediate Bulk Containers (IBC) Market Expected to Reach US$ 10 Billion by 2020

Press release from the issuing company

More than 596,600 units of intermediate bulk containers were sold in 2018, which are likely to witness around 6.3% increase by the end of 2019. According to a new research study presented by Future Market Insights (FMI), the global revenue of intermediate bulk containers (IBC) market is set to cross a US$ 10 billion market by 2020.

“Intermediate bulk containers have emerged as an efficient and relatively economical alternative in bulk packaging applications, over conventional drums. As the packaging industry is accelerating its shift away from plastics and plastic-based composites, the report points to spectacularly increasing demand for paper and paperboard-based intermediate bulk containers,” says the report by FMI.

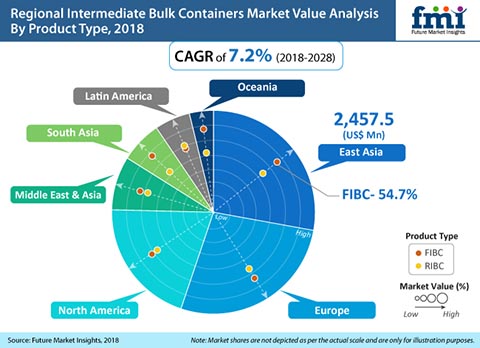

· Strong growth in the preference for flexible packaging solutions over rigid counterparts is driving FIBCs (flexible IBCs) to hold a larger value share over RIBCs (rigid IBCs) in intermediate bulk container market

· Accounting for an approximate value share of 80%, collectively, food & beverages, industrial chemicals, and building & construction industries remain predominant consumers of intermediate bulk container market

· High suitability for transportation and storage of corrosive chemicals is accounting for towering sales of HDPE-bottled RIBCs in intermediate bulk container market

· Environmental stress cracking resistance is emerging a vital QA measure for manufacturers of intermediate bulk containers

Request sample of Report with table of contents and Figures @ https://www.futuremarketinsights.com/reports/sample/rep-gb-2036

Paper Intermediate Bulk Containers Gaining Traction in F&B Industry

A majority of intermediate bulk container demand remains concentrated in food & beverages, industrial chemicals, and building & construction industries, as indicated by the study. IBC adoption in F&B industry is however witnessing a higher annual growth rate, says the report.

Paper and paperboard intermediate bulk containers are recently gathering traction in the food and beverages vertical. In addition to economical handling costs, a significantly less filling and discharging time associated with paper intermediate bulk containers is positioning them as an ideal IBC candidate for the F&B industry.

An additional benefit in terms of transporting and warehousing space consumption is also cited as an important factor pushing adoption of paper intermediate bulk containers among food and beverages industry operators.

A variety of RIBCs remain the preferred standard choice for packaging and transportation of bulk chemicals, and paints & dyes, whereas emerging application opportunities in non-hazardous bulk fluid transportation are projected to provide a strong push to the demand for FIBCs – especially flexitanks. The report spots substantial applicability of flexitanks to be arising in segments such as juices, syrups, & other food-grade liquids, wines, and oils.

Maturity of Western European Market to Prevail

According to the study, a majority of Europe’s intermediate bulk containers demand relies on imports from South Asia. While Western Europe’s demand for intermediate bulk containers is on the brink of maturity, the impressively growing acceptance of non-plastic IBC alternatives is posing a significant impact on the growth of Eastern Europe’s intermediate bulk container market.

Holding a prominent position in the intermediate bulk containers export scene, South Asian countries - especially India, are projected for an impressive growth outlook in global landscape over the course of coming years. Expanding manufacturing industries, rampant growth of the building & construction vertical, and strong presence of major F&B industry operators are favoring the demand growth of industrial bulk containers market within the region.

India, the world’s largest flexible intermediate bulk containers exporter, is poised for over 11% yearly growth in the revenue in 2019. China’s nearly US$ 1.4 billion market for intermediate bulk container also continues to demonstrate robust expansion, pushing prospects of East Asia further.

Intermediate bulk container manufacturers are likely to collaborate with shipping companies over the development of tracking-enabled intermediate bulk containers that update precise status of packaged products directly to customers. A few prominent players currently involved in R&D of RFID enabled IBCs include Metano IBC Services, Inc., CHEP (U.S.A.) Inc., and Hoyer Group.

Driven by rapid growth of small scale manufacturing sector worldwide, economic opportunities residing in renting, reconditioning, and refurbishing of RIBCs are projected to attract leading companies as well as retailers and distributors active in intermediate bulk containers market.

Ask a question to Analyst @ https://www.futuremarketinsights.com/ask-the-analyst/rep-gb-2036

Industry giants such as Mondi Group, BP Polymers, Schoeller Allibert, and others continue to augment investments in IBC material innovations and new product launches in intermediate bulk container market.

Future Market Insights tracks performance of global intermediate bulk container market through 2028. For more insights, write in to the team of analysts at [email protected]

- Inkjet driving insourcing for state in-plants

- Real World AI for the Printing Industry

- Harnessing the Power of Synergy: HP High Speed Inkjet and Indigo Liquid Toner Technologies

- KYOCERA NIXKA INKJET SYSTEMS (KNIS) INTRODUCES BELHARRA, THE NEW WAVE OF PHOTO PRINTERS

- New RISO Printing Unit Offers Easy Integration for Package Printing

- March 2024 Inkjet Installation Roundup

- Inkjet Integrator Profiles: Integrity Industrial Inkjet

- Revisiting the Samba printhead

WhatTheyThink is the official show daily media partner of drupa 2024. More info about drupa programs

© 2024 WhatTheyThink. All Rights Reserved.

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free