We may have gone through the first six week recession in history. That's said a bit tongue-in-cheeck, but many of the economic measures seem to have bottomed or are in the process of doing so. Besides that, recessions are measured in quarters, not weeks. The doom of the global economic slowdown and the worldwide currency crises seems to have left with a whimper.

That does not mean that things are rosy. As we have warned, any time that an economy is at this persistent a low growth rate, it can roll over at any time into recession. This one seems to just teeter near the edge, look like it's tipping, and then steps back onto safe ground.

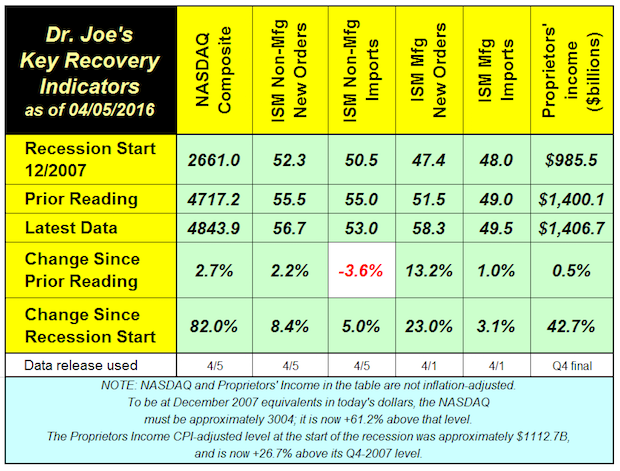

In the recovery indicators, the NASDAQ rebounded, up 2.7% since last month. The ISM manufacturing new orders were on fire last month, up from a sluggish 51.5, close to the breakeven level of 50, to a hot 58.3. New orders for non-manufacturing were up, too. The only item down was non-manufacturing imports, but even that was at a healthy level indicating growth.

Proprietors' income had a very slight downward revision from $1,407.3 billion to $1406.7 billion; less than a rounding error.

The Atlanta Fed's GDPNow is currently estimating that Q1-2016 GDP will be just +0.4%, but these data show that at the end of the quarter the economy was starting to right itself, and head back to the less than mediocre +2% growth rate everyone seems to be accustomed to. All of the indicators are below where they were last year at this time, except proprietor's income which is just a smidge above, +0.3%

Last week's employment report was good. The rate went up to 5.0% because more people entered the workforce than found jobs. This is a reversal, and we're curious if it can last, of the unemployment rate going down because the number of people leaving the workforce exceeded job-finders.

There are still concerns in other data series. The Federal Reserve revised years of manufacturing data down, and the data series has not reached pre-recession levels, despite nearly seven years of claimed economic recovery. Factory orders were unexpectedly down. On a year-to-year basis factory orders are negative for the last 16 months.

Printing industry shipments, on the other hand, are up 21 consecutive months on a current dollar basis.