IT Strategies has just completed its 19th wide-format graphics inkjet forecast, wrapping up nearly two decades’ worth of experience into a single large Excel spreadsheet. The trends year-over-year aren’t surprising. Growth continues, a rarity in markets for print that in general are suffering attrition. What is surprising is the slow down in equipment sales.

Aqueous wide-format printers are now mainly a replacement market; one where life cycles are extending and unit sales are actually in slight decline. Eco-solvent/latex printer unit sales continue to grow, with some brands significantly faster than other, but in aggregate equipment placement growth is projected also at less than 5% annually. Even the UV-curable printing equipment projected growth is now in the single digits.

These slowing growth numbers are not an indicator of a market in trouble; rather. it signifies a shift to higher utilization and higher productivity. The life of the typical wide-format inkjet printer in the installed base is extending. What once might have been an average 4–5 year life has now become a 7–8 year life, and in some cases even longer. Print shop owners are delaying next-generation equipment purchases and squeezing more volume out of existing devices. Compounding the slowdown in equipment growth is the greater productivity offered by the new printers now available on the market. Simply put: with faster printers fewer are needed.

In some instances the composition of a manufacturer’s product line can dramatically affect the number of units sold. For example, one manufacturer moved its product line from one that was weighted towards lower cost units to one that was weighted towards higher cost units. Unit shipments declined, but overall revenues for the vendor increased both on the hardware and on the ink side.

Better indicators of the health of the industry are substrate and ink consumption rates. In both cases, they greatly exceed the growth projection rates of unit installations. IT Strategies is projecting substrate volumes to grow in excess of 7% and ink liters in excess of 8% annually through 2017. Note this doesn’t mean that ink costs are increasing; in fact, the opposite is happening. Ink revenues are projected to grow at 4% during the same period. Effectively, this causes ink prices to decrease about 3% annually across all wide-format graphics technologies. Note that this doesn’t mean print providers should expect a 3% decrease in ink price annually. Rather, what it implies is that total market expenditures are decreasing 3% annually. This decrease is in part the result of a shift from higher cost per liter aqueous inks to lower cost per liter eco-solvent and latex inks, as well as even lower-cost UV-curable inks at the high-end of the market.

While the industry has seen remarkable improvement breakthroughs in print quality, productivity, and even equipment costs, we haven’t seen similar breakthroughs in ink pricing. One reason for this is that the economies of scale continue to work against wide-format inkjet inks. Unlike offset inks, which are manufactured in the billions of liters annually, there are only 4 million liters of aqueous, 2.3 million of UV-curable, and 7 million liters of eco-solvent/latex (excluding the Chinese aggressive solvent printers) wide-format ink manufactured worldwide in 2012. At those levels, it is just too difficult to gain any buying power in dispersions and additives given that those components are far more refined and sophisticated than the ones found in offset inks.

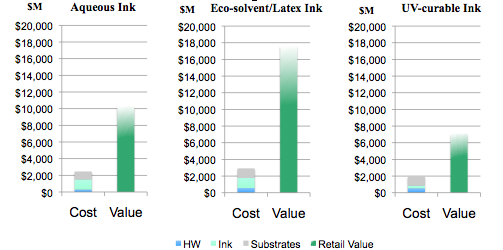

The good news is that while the ink cost is a perpetual topic of conversation, the value of output that those inks enable is many times the value that offset ink is able to create. The average retail-selling price across all wide format inkjet technologies ranges from $2.75 for UV-curable-printed output to $4.40 for aqueous ink-printed output per square foot. The profit margin (the balance left after paying for hardware, ink, substrates) ranges anywhere between 2.7X to 6.0X for wide-format output. There are very few offset document (or even digital document) applications where this type of margin is still enabled.

Figure 3: Wide-Format Inkjet Printer Cost vs. Retail Value of Output, 2012 Worldwide

Worldwide, the retail value of output created by all wide-format printers exceeded $39 billion in 2012. While a small portion of the $600+ billion is generated from other graphics/document print applications, its profits may well be as large as, if not larger than, all the profits of other production print applications. Now that’s worth continuing to invest in.

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free