(Watch the first installment of our “Road to drupa” video series here.)

Inkjet technology driving cut-sheet production inkjet printers is well-proven, serving general commercial (marketing collateral, brochures, flyers, business cards, etc.), direct mail, book manufacturing, and transaction statement printing applications. One of the highlights of drupa 2024 will be the range of new products that are introduced at this year’s exhibition to expand the range of products available to commercial printers, from lower hardware cost entries to the highest productivity technology the market has ever seen.

The outlook for cut-sheet inkjet printer growth continue to look quite positive in years ahead, for three core reasons:

- Convenience and cost savings as run lengths continue to come down as paper and postage cost continue to rise, making these runs fit better on inkjet than offset.

- Every time an offset press operator retires, so does the offset press. Production inkjet is much simpler to operate, and can be run with lower-skilled, lower-paid and more readily available operators.

- Value-add; the ability to make last-minute changes and allow an increase or decrease of a print run at no extra-cost, the ability to offer versioning, and even personalization.

With the high image quality of inkjet technology, many of the inkjet pages will replace short-run print jobs that are no longer economical to be produced on offset presses. Much of the growth of production cut-sheet page volume is counter-intuitive, sometimes at the expense of offset print. For example, direct mail volume overall is in decline, as the increasing cost of postage and paper reduce the number of pages that can be printed within print existing budgets. The pages that remain have to be more relevant, valuable, and have to show a demonstrable return-on-investment. Many of those will be printed on inkjet printers, especially postcards and other specialty stocks that a well suited to be printed on cut-sheet inkjet production printers.

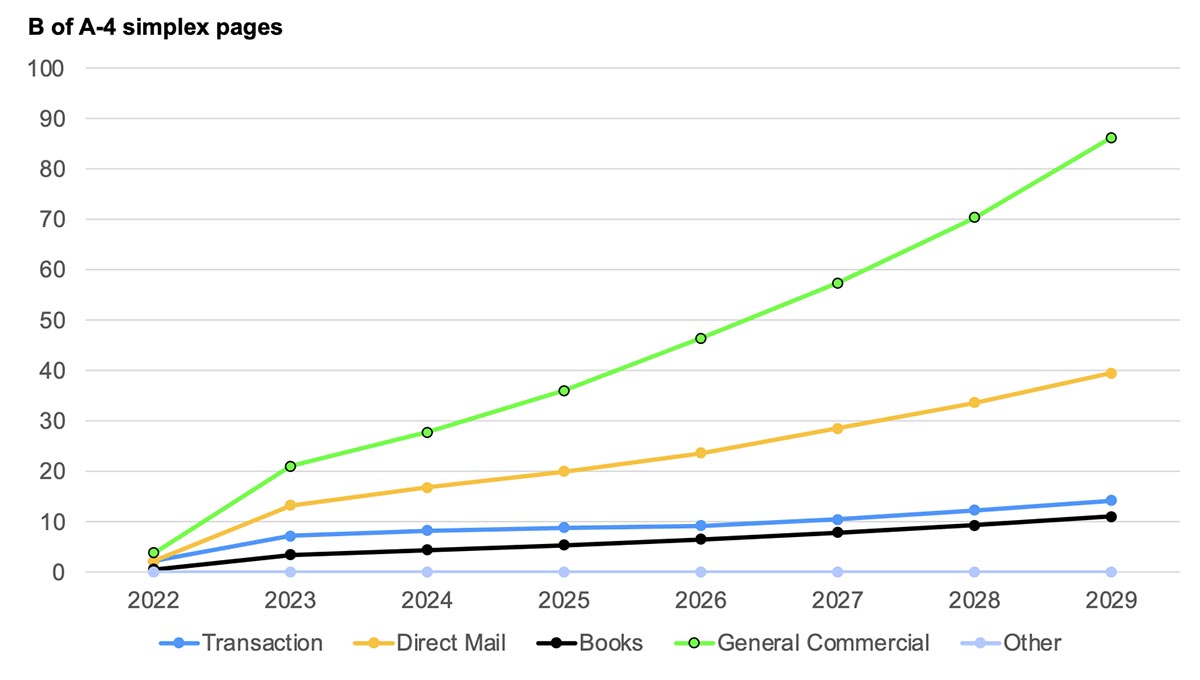

Cut-Sheet Production Inkjet Page Volume by Application, Billions of Simplex Letter-Size Pages 2022–2029, WW

Source: IT Strategies

For transaction pages, IT Strategies is projecting modest cut-sheet inkjet growth for volume of transaction pages declines overall, with the assumption that some of remaining transaction pages will shift from legacy monochrome cut-sheet toner presses and continuous feed inkjet production printers as statement providers continue to reduce the volume of printed statements.

Book pages are mainly color covers, as well as some specialty color book applications like medical device operating instruction manuals. The majority of trade and educational book pages however will be printed on continuous feed inkjet printers.

IT Strategies may be under representing the “other” category, which includes applications such as folding cartons occasionally produced by commercial printers. As the next generation of cut-sheet inkjet presses is designed to print up to 24-point or 400gsm board, we expect to see application expansion into folding cartons produced on these cut-sheet inkjet production printers.

drupa 2024 will have the widest range of choice of production cut-sheet printers the market has ever seen, enabling commercial printers to grow revenues and profits.

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free