During a Document Technology Business Briefing conducted by Xerox Corporation in Rochester, I had the opportunity, along with dozens of analyst colleagues, to hear Chairman & CEO Ursula Burns provide a Xerox transformation update.

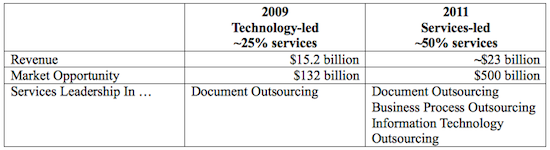

Ms. Burns has often informed the financial community that her goal was to transform the company to 75% of revenues from services. As a result of the integration of the ACS acquisition and other efforts, Burns reported that today, 50% of Xerox revenues are generated by services, significant progress toward that milestone with plenty of market opportunity within which to grow:

The growth opportunity is driven largely by the BPO- and IT-related capabilities Xerox acquired with ACS. Some achievements include this Xerox positions:

- 900 million healthcare claims processed annually

- 50% of all electronic toll co0llection processed in the U.S.

- #1 worldwide rank in transportation services to governments

- 60% of all U.S. child support payments processed annually

At the same time, Xerox continues to hold significant market share relative to equipment revenue worldwide. Declining B&W volumes-30% of equipment revenue 2 years ago now 17% and declining-are being offset by growing color volumes.

The acquisition also offers growth potential for the formerly independent ACS, for whom the majority of its business was domestic within the U.S. As a Xerox company, ACS now has the backing and infrastructure to grow its business globally.

Burns insists, however, "We are by no means abandoning the technology [equipment] business. We must continue to play in the technology business and lead there. The focus on the equipment side is to accelerate the transition of pages to higher value color pages. Burns adds, "In the office, though the number of pages will go up, the value of pages will go down. Office printing is mostly just-in-time pages that do not live long."

She also spoke about Xerox' cloud strategy, saying, "We are minoring in cloud and using it to our benefit. Our managed print services play is cloud-based and has been for a long time. But a hybrid model is appropriate in many cases."

Dr. Sophie Vandebroek, Chief Technology Officer and President of the Xerox Innovation Group, spoke about Xerox' rich history of innovation. She reported that Xerox:

- Invests $1.5 billion in R&D each year, jointly with Fuji-Xerox

- Has brought to market more than 100 new products and services in the past three years

- Has achieved 500 awards in the last three years

- Owns 55,000 global patents and is filing about 30 U.S. patents per week.

- Innovation efforts, according to Dr. Vandebroek, are focused on business agility, knowledge, sustainability and personalization.

During most the balance of the session, the group separated into office and production tracks. We were able to get a closer look at the Xerox entry into the inkjet market, the Production Inkjet System, a waterless inkjet system that was announced earlier this year at Hunkeler Innovation Days. Naming and pricing will be available at Graph Expo 2011. We saw the press in action as well as were able to closely examine a number of sample prints. The product is not yet commercially available; it will be interesting to see how market adoption goes with this very different inkjet technology. Several WhatTheyThink contributors, including myself, have already commented on the press, as a WhatTheyThink search for "Xerox inkjet" will reveal.

The Color 1000 press was also on display, with its Clear Dry Ink option, as well as the IGen4 EXP Press with Matte Dry Ink. Analysts were provided with a sneak peak of some of the new initiatives we will be seeing from Xerox at Graph Expo 2011 and into drupa 2012, and WhatTheyThink will be reporting on those announcements as they become public.

Overall, the presentation was impressive, the strategy cohesive, and Burns' marching orders to the Xerox team very clear. Like most companies whose historical revenues have come from equipment, the transition to a services mentality is not easy. Direction from the top is one thing, but execution in the field is critical. Progress to date against these transformation goals has been quite impressive, largely spurred by the ACS acquisition. The challenge now will be to carry that services transformation "the last mile," while keeping the appropriate focus on and balance in innovation and revenues on the equipment side of the house.

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free