Soon you will be hearing about pending investor disclosure legislation that could negatively impact anyone producing or reselling financial documents. It’s called the Improving Disclosure for Investment Act, S3815, and it allows financial companies to default investors into e-delivery, even if they previously selected for print delivery in the past.

(Investors can still get print delivery, but they have to go back to their communication preferences and re-select it.) This bill has already passed the House and is pending in the Senate.

What’s the big deal? Isn’t the move to e-documents a shift that has been happening for a long time? Why shouldn’t investor disclosure documents be any different? Why should the print industry do anything but shrug and say, “There goes another one?”

There Is a Reason Documents Are Mandatory

There is a reason that investor documents are mandatory communications. They are intended to keep regular people in the know about their investments, including those that nearly all of us have—retirement accounts. The whole idea of mandatory communications is that this is information that I, as an investor (or even consumer), need to know.

Think about it this way. If the bank holding my credit card decides to increase my credit limit, am I more likely to read this notification if it comes in the mail or by email? If it comes in the mail, I’ll likely recognize that it’s not one of my usual bank communications and read it. If it comes by email, I will likely miss it because I get a high volume of promotional emails from my bank. The chances of me seeing this information is low, and if the bank is going to increase my interest rate, I certainly would want to know! The same issue exists with investor information—information about changes in fees, market performance, the regulatory environment, and so on.

This is why there is such concern about the Improving Disclosure for Investment Act. Not only does it take away revenue from printers and print resellers whose customers produce these documents (or, in the future, produced—past tense), but there are millions of people who would likely miss out on critical information that could impact their financial decision-making.

Internet Use Is Not Ubiquitous

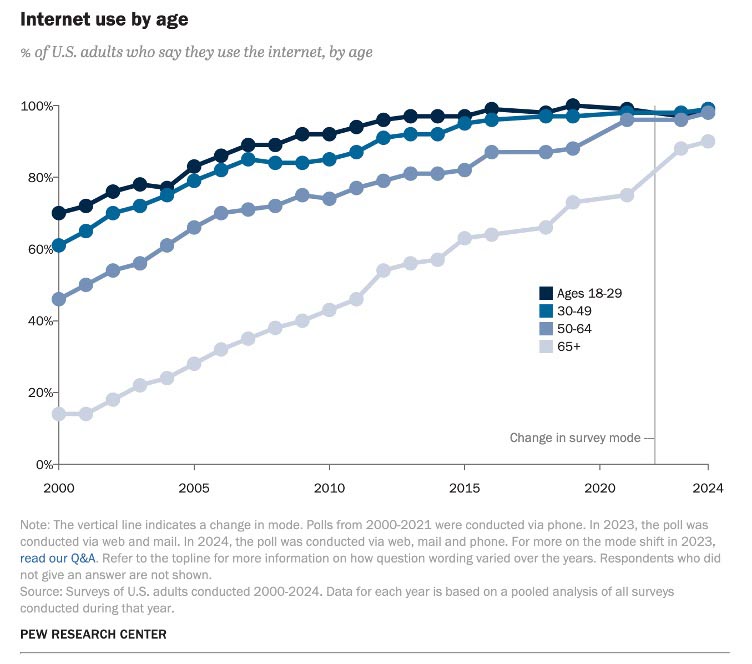

While we think of Internet use as being ubiquitous, it isn’t. According to the latest Pew Research (November 2024), there are entire categories of people who either say they don’t access the Internet or who only access it through their smartphones. Ever tried to read an investment disclosure document on a mobile phone screen?

So who are these people who don’t access the Internet?

- Those aged 65+: 10%

- Those with less than a high school education: 29%

- Those earning $30,000 per year or less: 9%

- Brown and Black Americans: 4% and 6%, respectively

Is it really possible that all of these people don’t access the Internet at all? Is it possible that some could be accessing it in ways they don’t realize, such as through apps on their phones? Yes, but accessing apps on your phone, including financial apps like Rocket Money, is very different from reading a dense, complex financial disclosure document that way. It would be extremely difficult to locate and understand key information in that kind of document on a mobile phone screen.

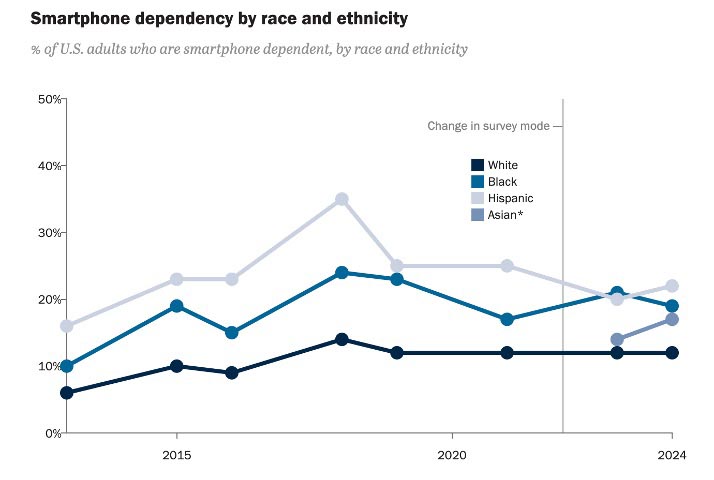

Smartphone Dependence Doesn’t Make It Better

The percentage of Americans who are smartphone-dependent is quite high. This puts them at a serious disadvantage when it comes to reading and understanding financial documents, too. As just a few examples of those who are smartphone-dependent:

- Those aged 65+: 17%

- Black Americans (19%) and Hispanic Americans (22%)

- Those aged 18–19: (21%)

- Those making less than $30,000 per year (31%)

- Those making $30,000 - $70,000 per year (17%)

- Those with a high school education or less (24%)

Online access may be nearly ubiquitous, but that doesn’t mean equal access to information. If investors are defaulted into e-delivery, then it puts the burden back on millions to contact their investment companies to change their preferences or remain with a communications delivery method that puts them at a financial disadvantage.

The combination of loss of income for printers and resellers and the negative impact on millions of Americans makes this bill something that printers should care about. Got a minute? Write your Senator!

WhatTheyThink has permanently disabled comments thanks to spambots. You are welcome to write me at [email protected].