Drawing on six years’ worth of Print Business Outlook surveys, our “Tales from the Database” series looks at historical data to see if we can spot any particular hardware, software or business trends. This issue, we turn our attention to various aspects of finishing, including mailing and embellishments.

These surveys form the basis of our annual Printing Outlook reports, the most recent of which (2024) is available at whattheythink.com. [INSERT QR] In every survey, we ask a broad cross-section of print businesses about business conditions, business challenges, new business opportunities and planned investments. In our Business Outlook reports, we tend to focus (obviously) on the most recent survey data, occasionally looking back a survey or two to see how these items have changed in the short-term. Plumbing the depths of our survey database can give us a better sense of how these trends have changed since the mid-2010s.

This issue, I rounded up a few opportunities and investments related to various aspects of finishing. Let’s see what history can tell us.

First Class Mailing

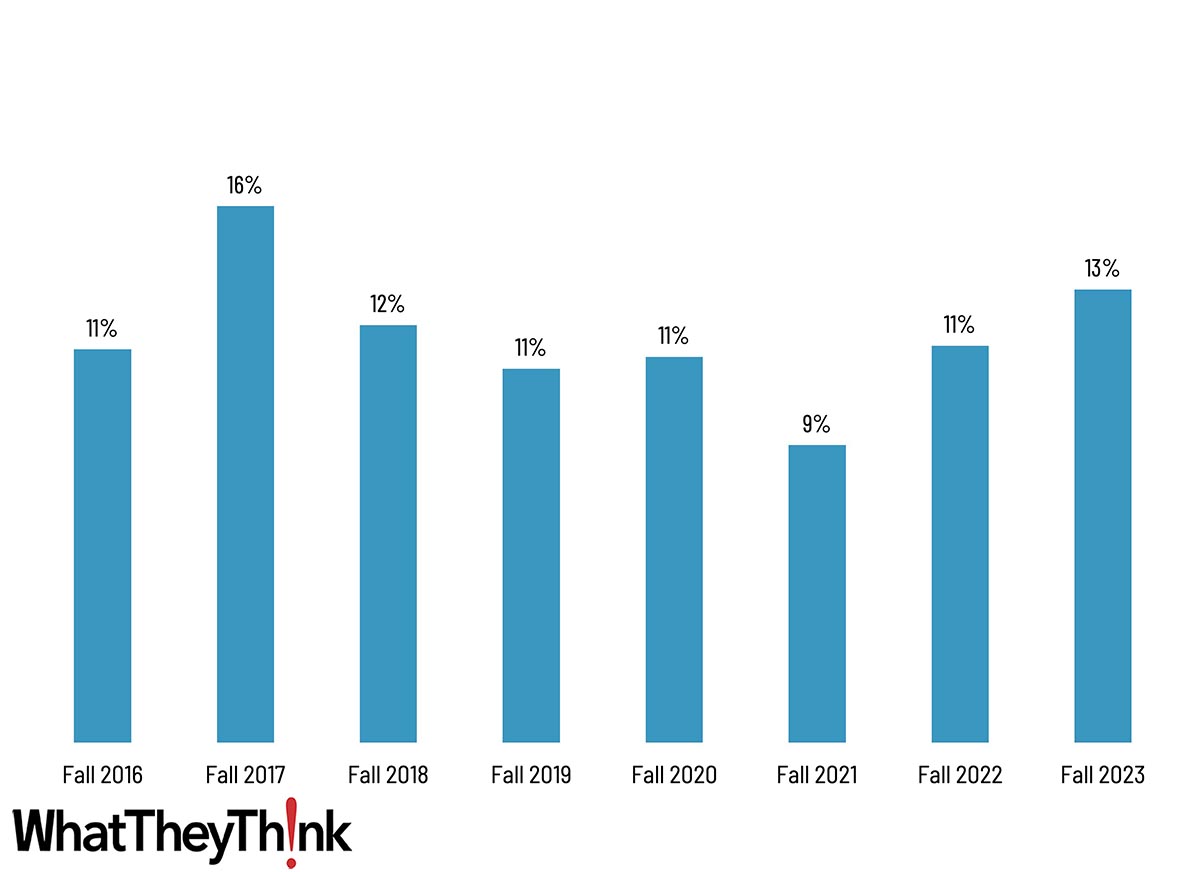

Are print businesses interested in mailing? Yes, to a certain extent: “broadening fulfillment, shipping, mailing capabilities” as a new business opportunity has almost always been a double-digit opportunity, falling under 10% only once (Fall 2021). It has climbed back up to 13% in the two years since (see Figure 1).

Figure 1: “Broadening fulfillment, shipping, mailing capabilities” as a sales opportunity. Source: WhatTheyThink Fall Business Outlook Survey.

As for planned investments, in 2022, after starting to see significant write-in responses, we added “mailing software/equipment” to our Planned Investments list and it debuted at 10%, climbing two percentage points last year.

- Fall 2022: 10%

- Fall 2023: 12%

The opportunities in mailing are not necessarily technological, but being able to navigate often byzantine postal regulations and rates. If you become enough of a postal authority that you can get the best possible postage rate for clients, that is a very powerful added value.

Some print businesses have also become experts in the USPS’s Every Door Direct Mail (EDDM), a way of targeting specific addresses and ZIP codes. It is a vastly underused but very powerful service for marketers. (We have also seen case studies whereby marketers have used the USPS’s Informed Delivery as a marketing tool, but it has not taken the industry by storm.) Says the USPS:

If you’re having a sale, opening a new location, or offering coupons, EDDM can help you send postcards, menus, and flyers to the right customers. Use the EDDM Online Tool to map ZIP Code(s) and neighborhoods—even filter by age, income, or household size using U.S. Census data.

And Now for Something Completely Different

If you are creating materials intended to be mailed, what’s important is standing out from whatever else may be in recipients’ mailboxes. Certainly print mail is a better way to get attention than email, which we are constantly barraged by and is so easily deleted sight unseen. Print can still catch the eye if done right—and that can involve finishing techniques.

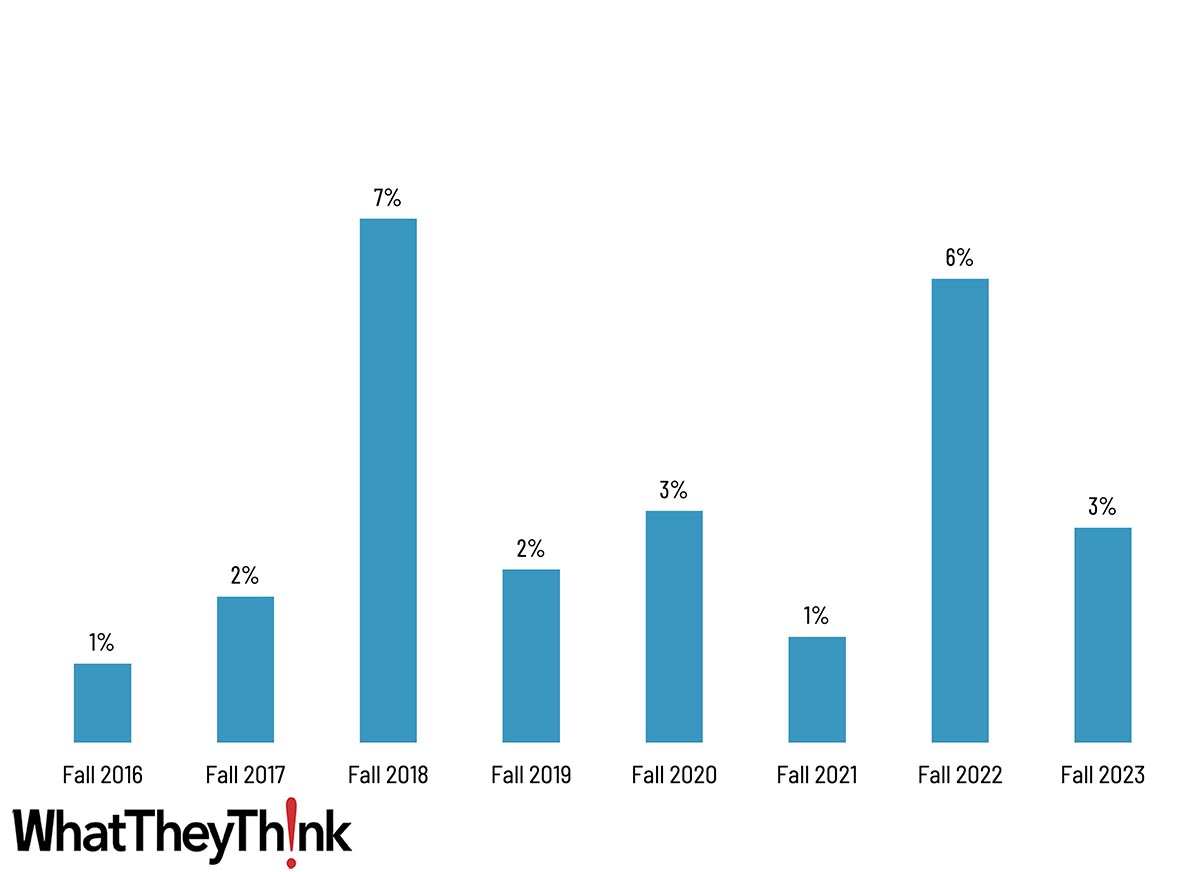

Which brings us to the fact that there are times when a survey is highly disappointing. Case in point: embellishments. There are so many opportunities for printers and marketers to use embellishments—be they digital or not—to create higher-value print products. We are really keen on embellishments, and as our joint 2023 Specialty Digital Ink and Toner Embellishment Study with Taktiful found, companies that have invested in specialty toner capabilities (a subset of the overall embellishment market) are reaping the rewards. And yet, in our own surveys, we get very little interest in these technologies (see Figure 2). “Adding digital enhancement technologies” as a business opportunity has only ever been as high as 7% (back in 2018), peaked again at 6% in 2022, but dropped down to 3%. If I were ever inclined to use emoji, a sad face emoji would be appropriate here.

Figure 2: “Adding ‘digital enhancement’ finishing technologies (like Scodix, Highcon, MGI)” as a sales opportunity. Source: WhatTheyThink Fall Business Outlook Survey.

One potential roadblock to greater interest in the technology is that, very often, the print samples that customers see—at trade shows, etc.—are just “too good.” That is, they are elaborately designed and produced high-end items and many printers just find them too exotic for more prosaic print jobs. And yet that doesn’t need to be the case. The trick—for vendors of this equipment—may be to “dumb down” some of the print samples so that printers can see how they can be applied to something not quite as high-end as BMW or Rolex marketing brochures or the like.

(By the way, we just realized, much to our chagrin, that we never added “‘digital enhancement’ finishing technologies” to our Planned Investments. That is an oversight we shall rectify this fall. Add another sad face emoji here.)

In at the Finish

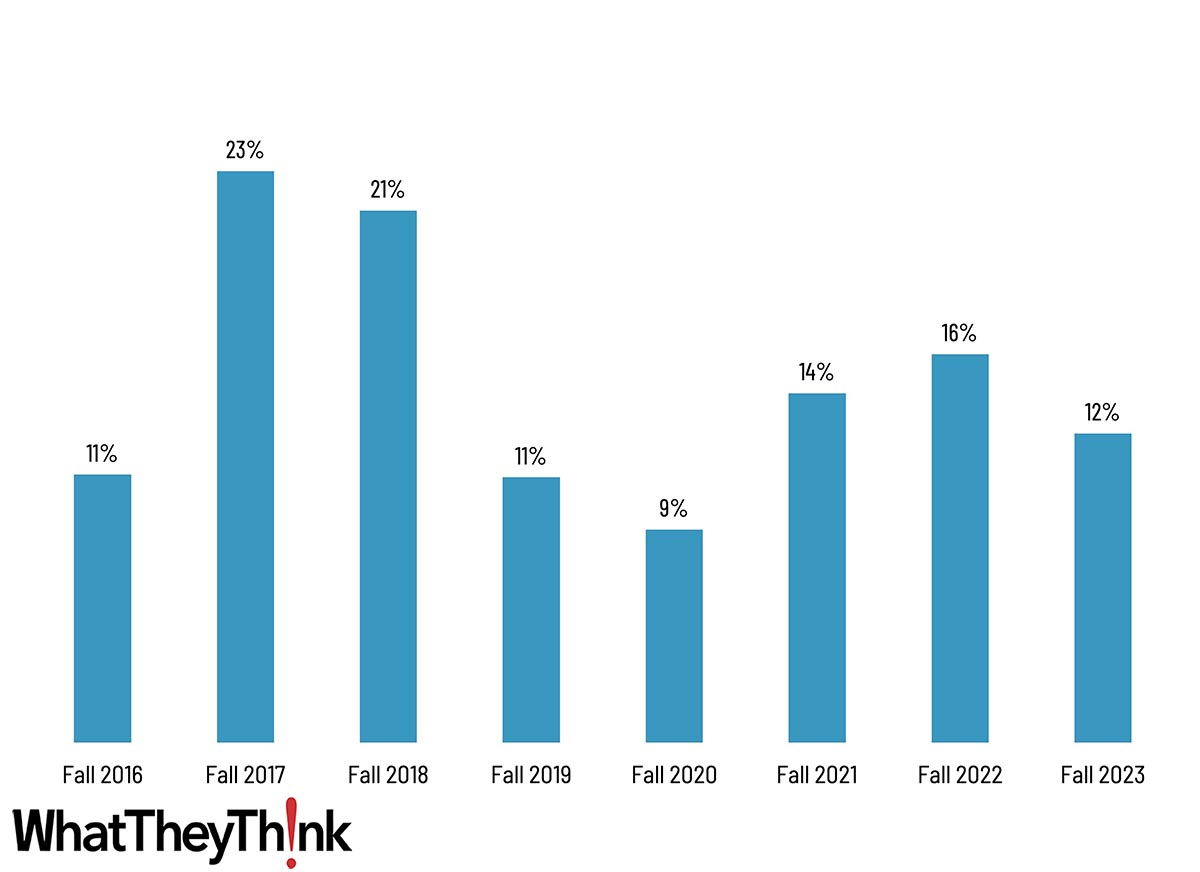

As far as finishing in general is concerned, “broadening binding and finishing services” has always been a modest business opportunity, although dropped off after 2018. (see Figure 3).

Figure 3: “Broadening bindery/finishing equipment/services” as a sales opportunity. Source: WhatTheyThink Fall Business Outlook Survey.

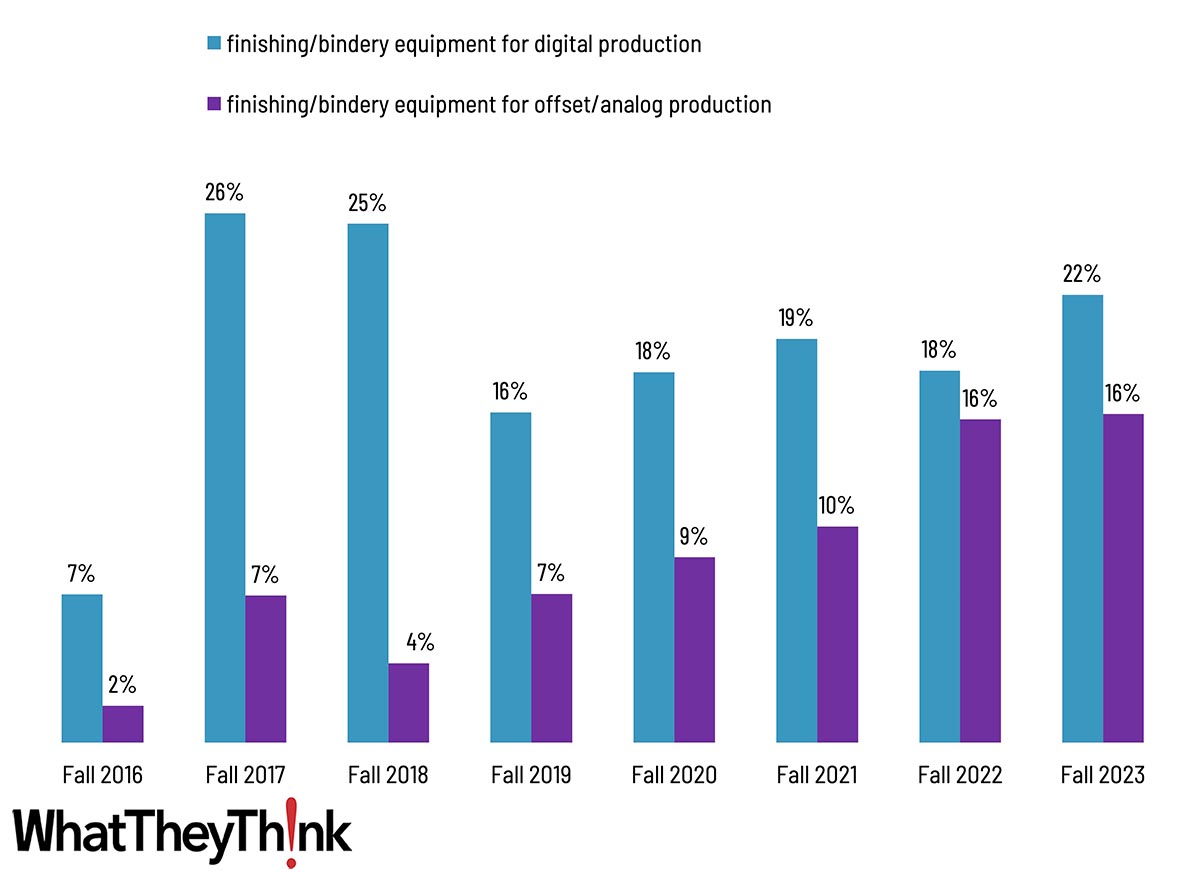

Which is interesting, as binding/finishing equipment has been a perennial top planned investment (see Figure 4).

Figure 4: “Bindery/finishing equipment” as a planned investment. Source: WhatTheyThink Fall Business Outlook Survey.

So the sense one gets is not that they are adding binding/finishing, but adding capacity or upgrading to new equipment to take advantage of new automation features, or to run in- or near-line with a digital press. But don’t discount the fact that planned investment in binding and finishing for offset (or other analog) production has been on the rise.

Time was a barrier, companies would outsource binding/finishing to a trade bindery, but today’s turnaround times preclude outsourcing most jobs.

Binding and finishing equipment has become ever more sophisticated, with automation becoming de rigueuras the challenge remains finding bindery employees.