Drawing on six years’ worth of Print Business Outlook surveys, our “Tales from the Database” series looks at historical data to see if we can spot any particular hardware, software, or business trends. This issue, we turn our attention to specialty printing—or any printing beyond traditional offset or digital commercial work.

These surveys form the basis of our annual Printing Outlook reports, the most recent of which (2024) is available here. In every survey, we ask a broad cross-section of print businesses about business conditions, business challenges, new business opportunities, and planned investments. In our Business Outlook reports, we tend to focus (obviously) on the most recent survey data, occasionally looking back a survey or two to see how these items have changed in the short-term. Plumbing the depths of our survey database can give us a better sense of how these trends have changed since the mid-2010s.

This issue, we rounded up a few opportunities and investments related to not only display graphics, but also textile printing, packaging, other types of specialty printing, and even traditional signage. Let’s see what history can tell us.

New Business Opportunities

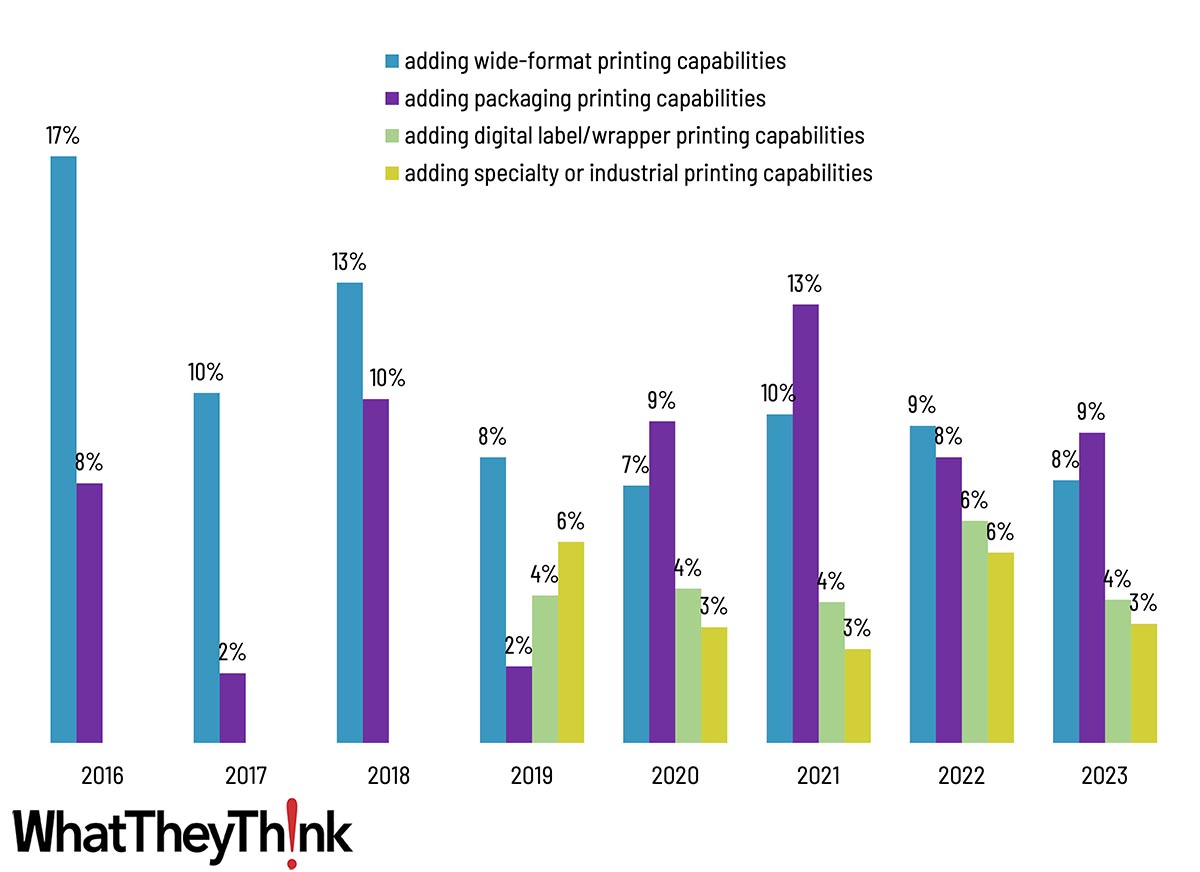

As we have chronicled in many other places, if we had been conducting these surveys between 2010 and 2015, it’s likely that “adding wide-format printing capabilities” would have been higher than 20% for at least some of that period, as that was the “golden age” of expansion by commercial printers (and other businesses such as photo labs and service bureaus) into display graphics. The mid-2010s is when we started to see all the print businesses that were likely to expand into wide format already having done so, which is why the wide-format opportunity has not exceeded 10% since 2018. In our most recent survey (Fall 2023), it is at 8% of respondents.

What then do print businesses see as the hot new area to expand into? It doesn’t appear to be any one thing; the choppiness of “adding packaging printing capabilities” suggests some ambivalence, although in 2021 it did chart the highest in the history of your survey, and in 2023 is at 9%. We added “adding digital label/wrapper printing capabilities” in 2019 and it had been slowly climbing, but dropped from a high of 6% in 2022 to 4% in 2023. “Adding specialty/industrial printing capabilities” has also hovered in the single digits for much of this period, so not much excitement there. (See Figure 1.)

Figure 1: Wide format, packaging, labels, and specialty printing-related business opportunities.

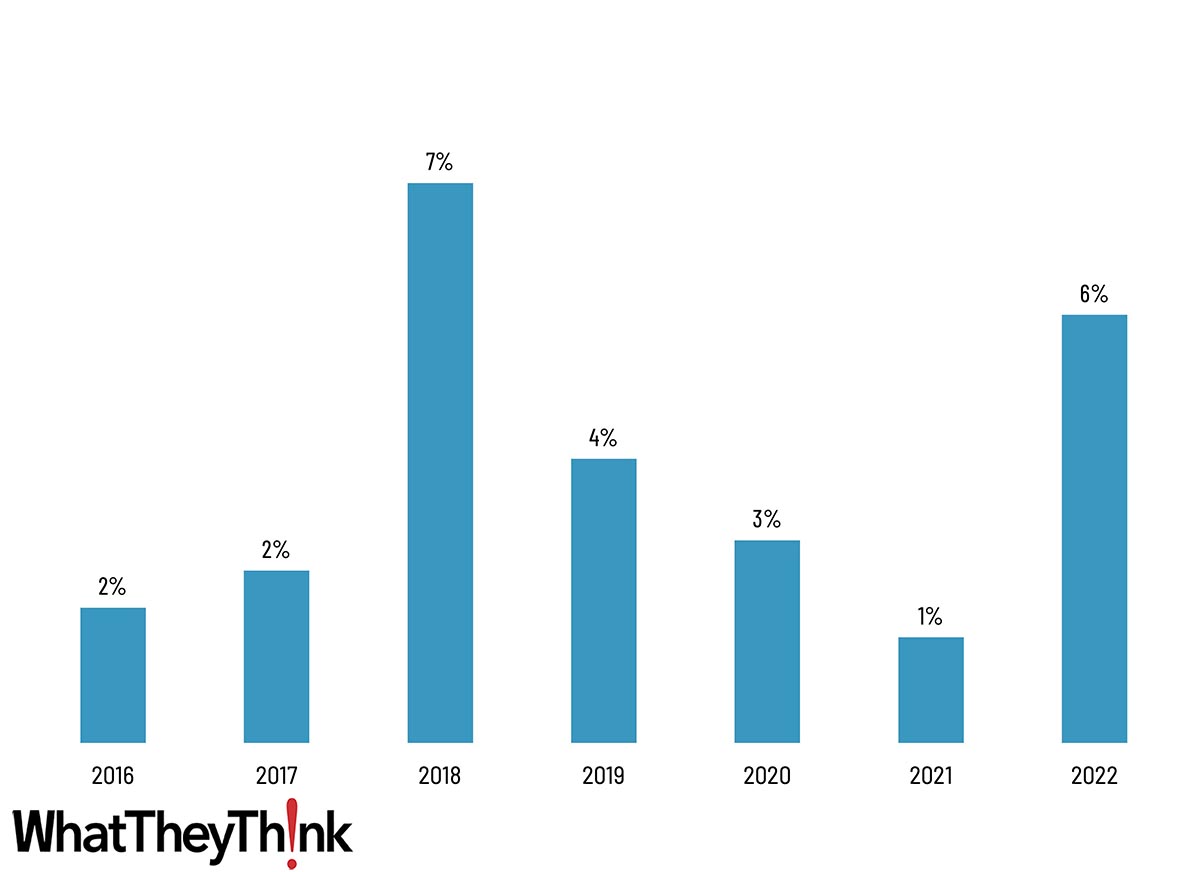

We had “adding textile/fabric printing capabilities” as a new business opportunity from 2016 to 2022, which was cited as a business opportunity by 7% of survey respondents in 2018 and 6% in 2022. (See Figure 2.)

Figure 2: Adding textile/fabric printing capabilities as a business opportunity.

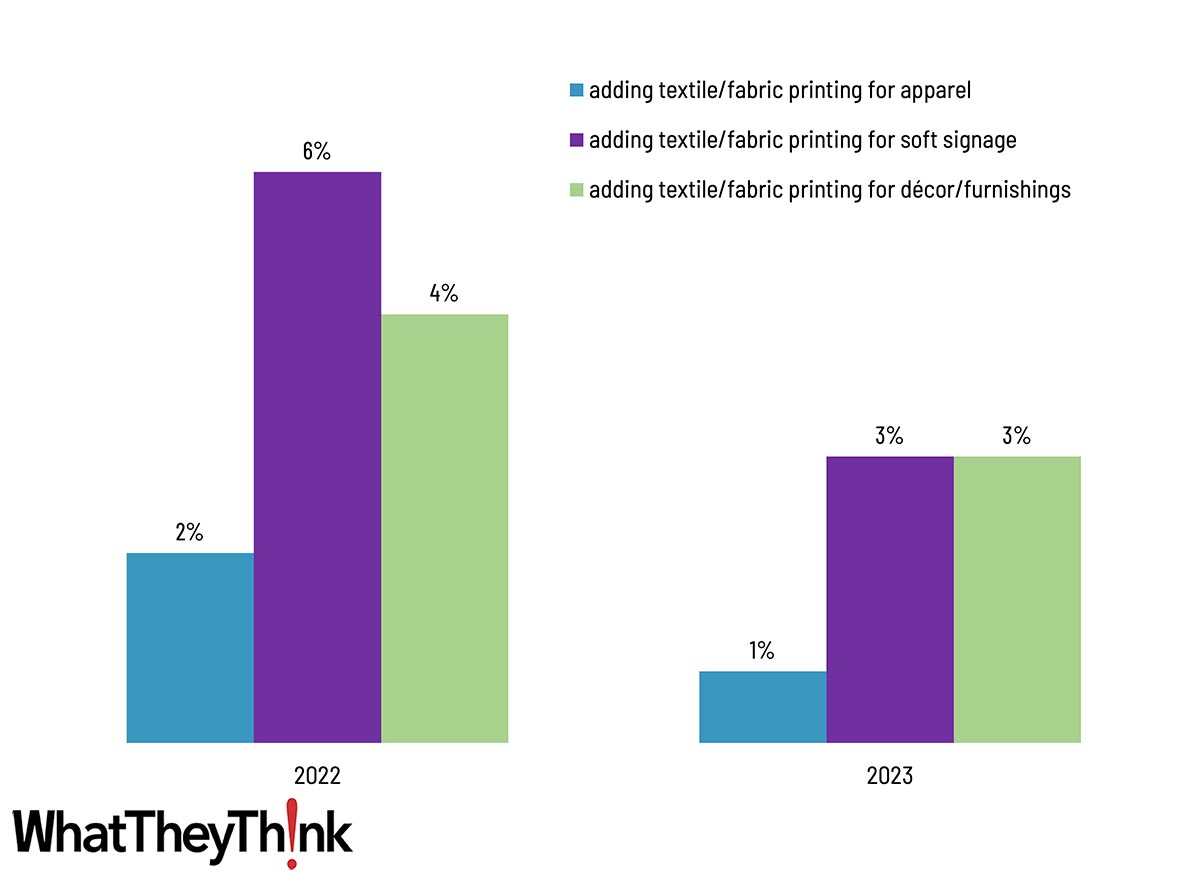

In 2022, we broke out catchall “adding textile/fabric printing” into “adding textile/fabric printing for apparel,” “adding textile/fabric printing for soft signage,” and “adding textile/fabric printing for décor/furnishings”—none of which have tracked very high. (See Figure 3.)

Figure 3: Detailed textile/fabric printing capabilities as business opportunities.

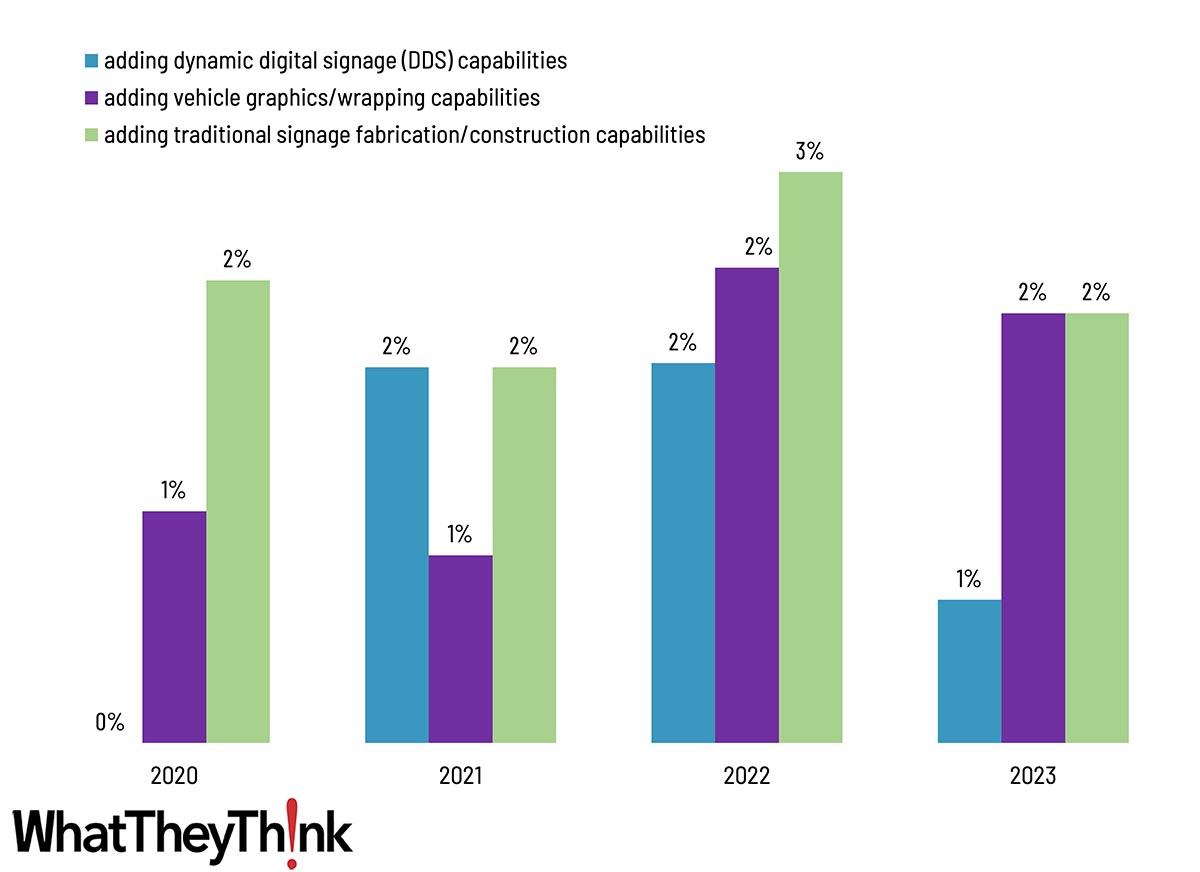

In 2020 and 2021, we added some other signage and wrapping-related opportunities to the list of potential new business opportunities, which are still in the lower reaches. (See Figure 4.)

Figure 4: Adding new signage and wrapping business opportunities.

Interestingly, in the 2023 survey overall, “diversifying print product/application offerings” was a top five opportunity—but these data (and other findings in the most recent survey) indicate that these are not the products/applications they are looking at. We suspect some variations of commercial print are where they see the opportunities, rather than in commercial-adjacent specialty printing. Which I think is a bit of a lost opportunity.

Planned Investments

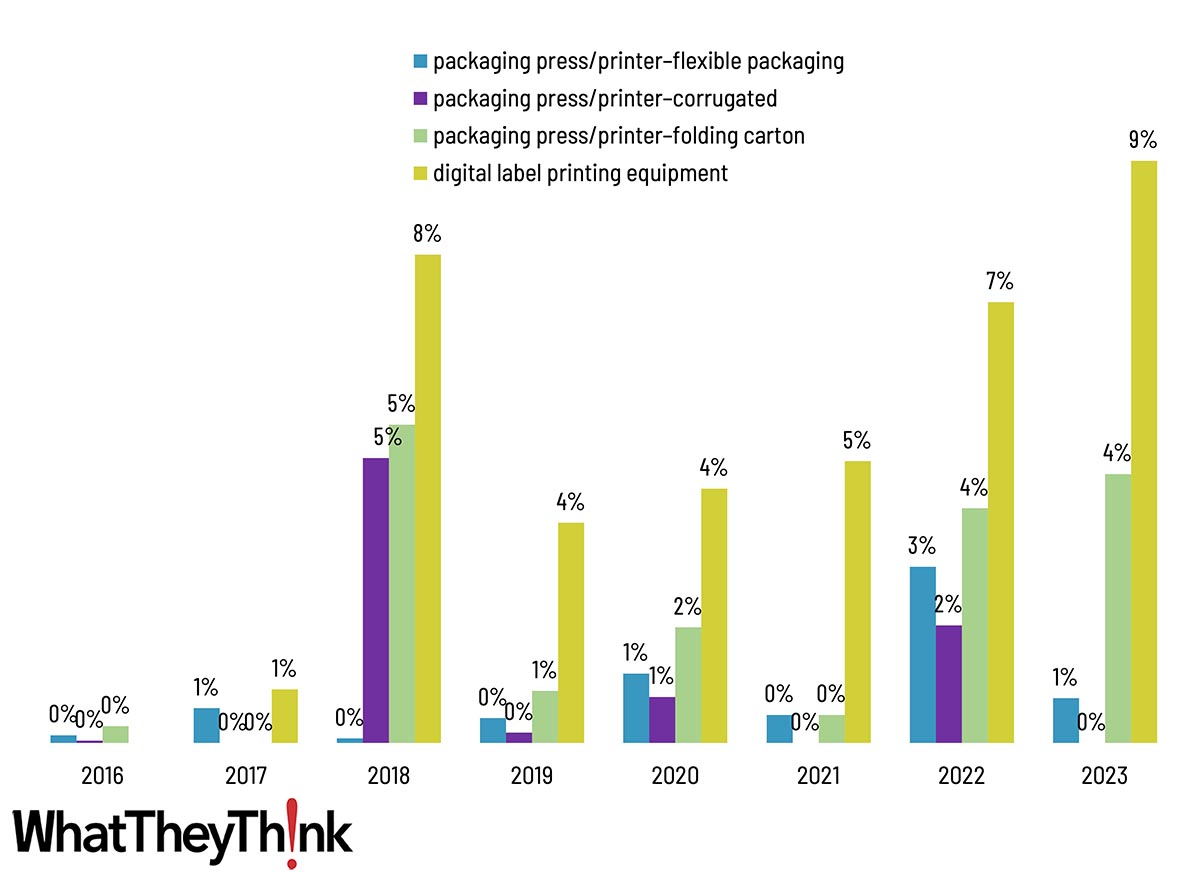

As for planned investments, digital label equipment seems to be where it’s at, relatively speaking, with only folding carton printing equipment ticking up (less than 1 percentage point) in 2023. (See Figure 5.)

Figure 5: Label and packaging printing-related investments.

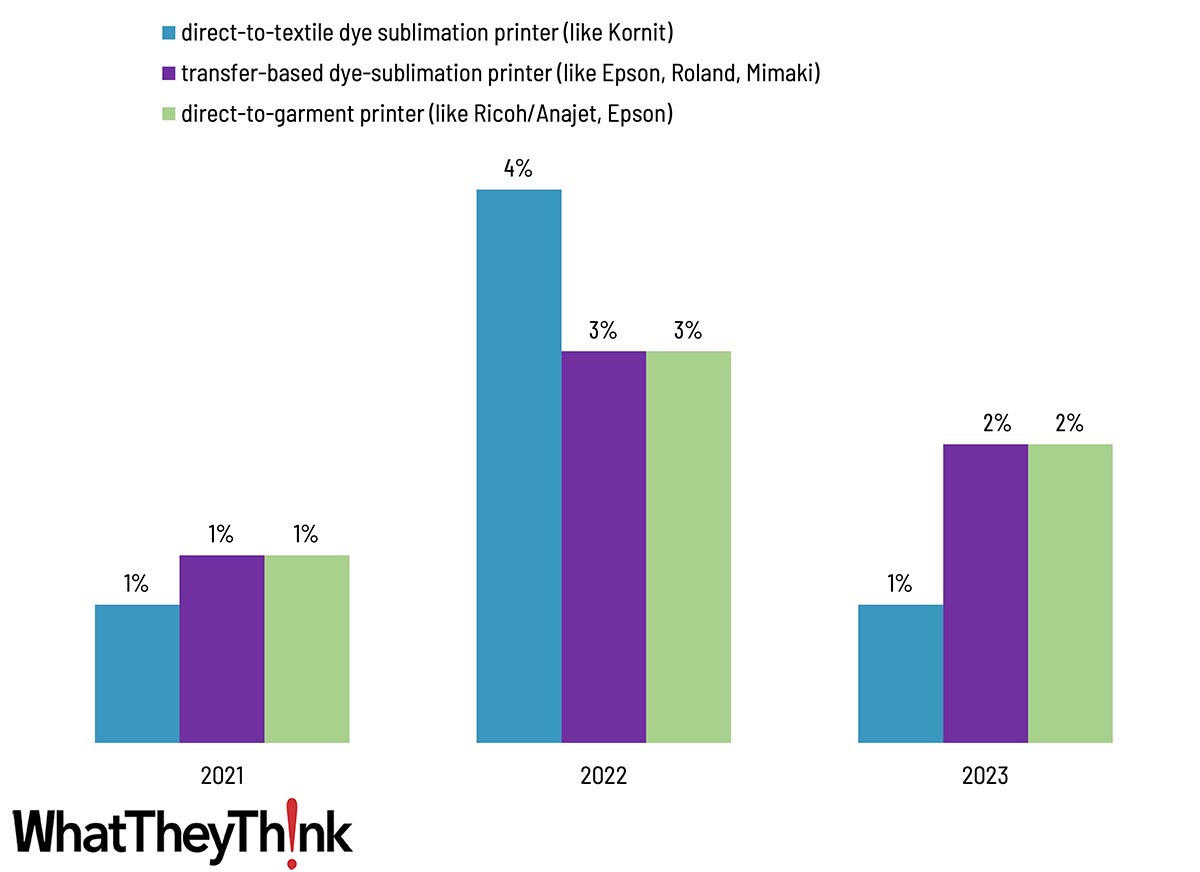

As for textile printing equipment, they are even less sanguine. (See Figure 6.)

Figure 6: Textile printing-related investments.

We also added a new item to the 2023 survey: direct-to-film printer (like Mimaki, Epson), which came in at 2%.

It also bears mentioning that 2023 was a lousy year for capital investment across the board, largely because interest rates have been elevated (ostensibly to conquer inflation), and we did indeed see “financing costs of our equipment” as a business challenge at a record high in 2023.

Printers continue to look for new products to offer, but not in these specialty areas. Some are exploring packaging, fewer are exploring textiles, but digital label printing looks the most promising at the moment.