What’s the truth about consumers’ attitudes toward sustainable packaging? A study from Trivium, The 2023 Green Buying Report, found that 82% of consumers across age demographics value sustainability enough that they are willing to pay more for it, up 4 points from 2022, and up 8 points since 2021. That’s impressive.

According to the study of 9,000 consumers across Europe, North America, and South America, this rises to 90% of Gen Z consumers.

Young Consumers and High Earners Care the Most

Narrowing in on sustainable packaging specifically, Trivium found that 71% of consumers are actively choosing products due to the sustainability of the product packaging. Interest in purchasing products in sustainable packaging has increased since 2022, especially among younger consumers and high earners. More than half (59%) look for information on the label about recycling and sustainability.

Other consumer attitudes toward sustainability? According to Trivium:

- 80% of consumers said they would be interested in buying products that come in refillable packaging to reduce their environmental impact.

- Two-thirds consider themselves environmentally aware.

- 63% are less likely to buy products with packaging that is harmful to the environment (up six points from last year's survey).

- 71% engage in reusable and refillable activities.

- 80% are interested in buying refillable packaging products to reduce their environmental impact.

- More than half engage in reducing food and packaging waste.

Even Then, They Don’t Care That Much

But do other studies find the same? McKinsey & Co. launched a global survey, as well. In the study, “Sustainability in Packaging,” found environmental issues to be important, but not at the level found by Trivium.

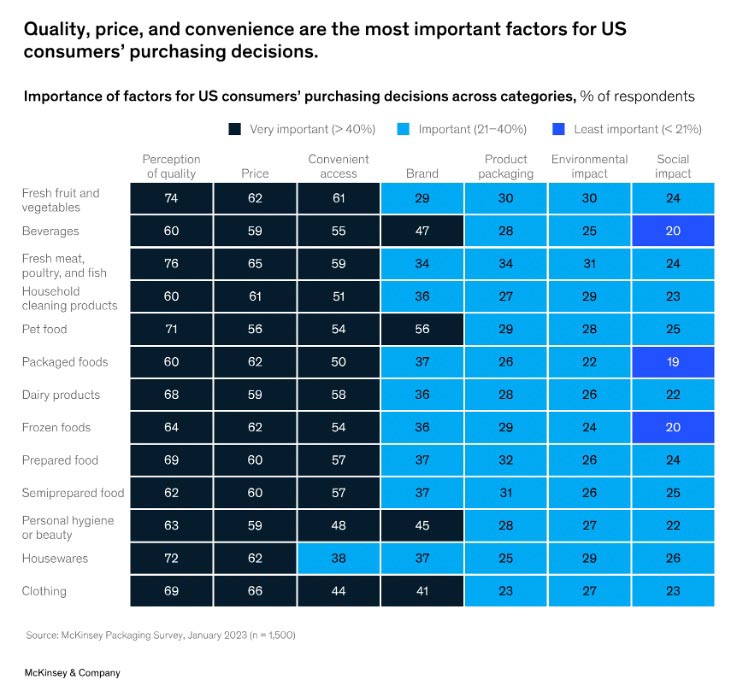

McKinsey found that price, quality, and convenience remain consumers’ top buying criteria for products, while environmental impact continues to be one of the lowest-ranked factors. Hygiene, good safety, and shelf life are cited as the most important characteristics; however, 43% still cited environmental impact as “extremely” or “very important” when making purchase decisions.

(This number varies considerably by generation and geolocation. Only 18% of Baby Boomers and 21% of consumers living in rural areas had the same level of concern about environmental impact.)

Still, McKinsey found that most consumers are willing to pay more for sustainable packaging. In each end-use category surveyed, 4% to 7% of consumers are willing to pay a premium well above 10%.

“About half of U.S. consumers are willing to pay more for sustainable packaging: across different end-use areas, about 50% of consumers are willing to pay 1% to 3% more; 25% are willing to pay 4% to 7% more; and about 12% are willing to pay 7% to 10% more,” notes the report. “In each category, 4% to 7% of surveyed consumers said they are willing to pay a significantly higher premium than 10%. Conversely, 5% to 8% of consumers surveyed across different categories said they were not willing to pay any price premium.”

Time for (More) Education

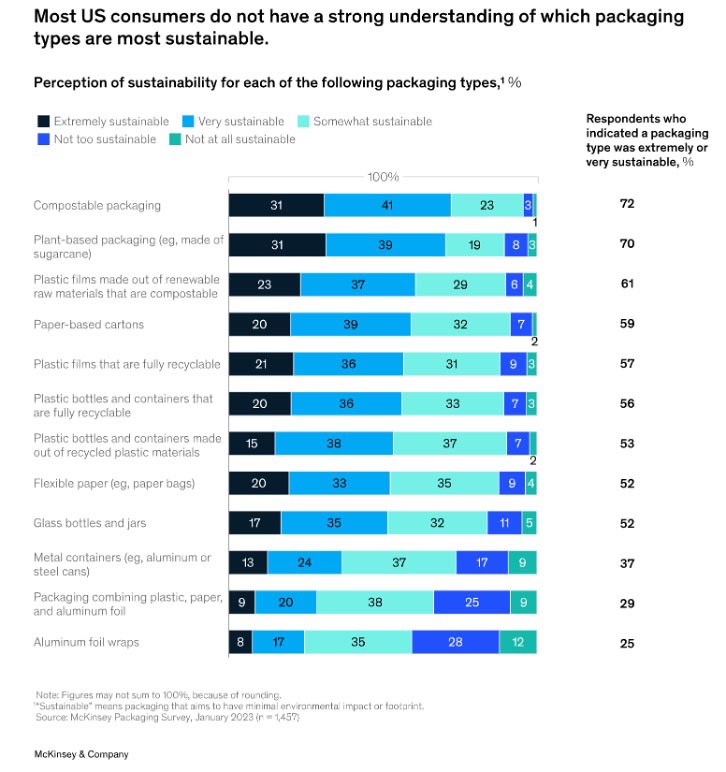

Of course, it’s hard to be enthusiastic about something you don’t understand. Another issue emerging from the McKinsey study is that consumers in the U.S., in particular, really don't know what types of packaging are recyclable and sustainable and what types aren’t.

While consumers see compostable and plant-based products as providing the most sustainable packaging (72% and 70%, respectively), there are several other packaging types that at least half of consumers rank as extremely or very sustainable that aren’t. For example, while consumers overall rank packaging that combines plastic, paper, and aluminum foil as among the least sustainable options, 29% consider this type of packaging to be “extremely” or “very” sustainable. Education, it seems, is very much needed.

In conclusion? In the words of McKinsey (and Trivium would likely concur):

“Our survey results clearly show there is there is not a universal solution for packaging players—consumers today have diverse views on packaging sustainability. In some of our segments, consumers rank fiber packaging as the most sustainable. In others, they rank compostable plastic film as the most sustainable. Hence, a truly granular understanding of end-user segments will be critical to win the sustainable-packaging race. Packaging players need to not only understand how consumers buy and use products, as well as how the packaging is disposed of, but also consider how to improve the pain points (for example, the hassle of recycling by cleaning packaging and bringing it back to the store). Such insights will be the starting point to offering sustainable packaging with a high fit for different end uses. Our recommendation is to apply an incremental approach, and don’t wait to have the perfect solution in place from the start.”

In other words, “Don’t let perfection be the enemy of done.”