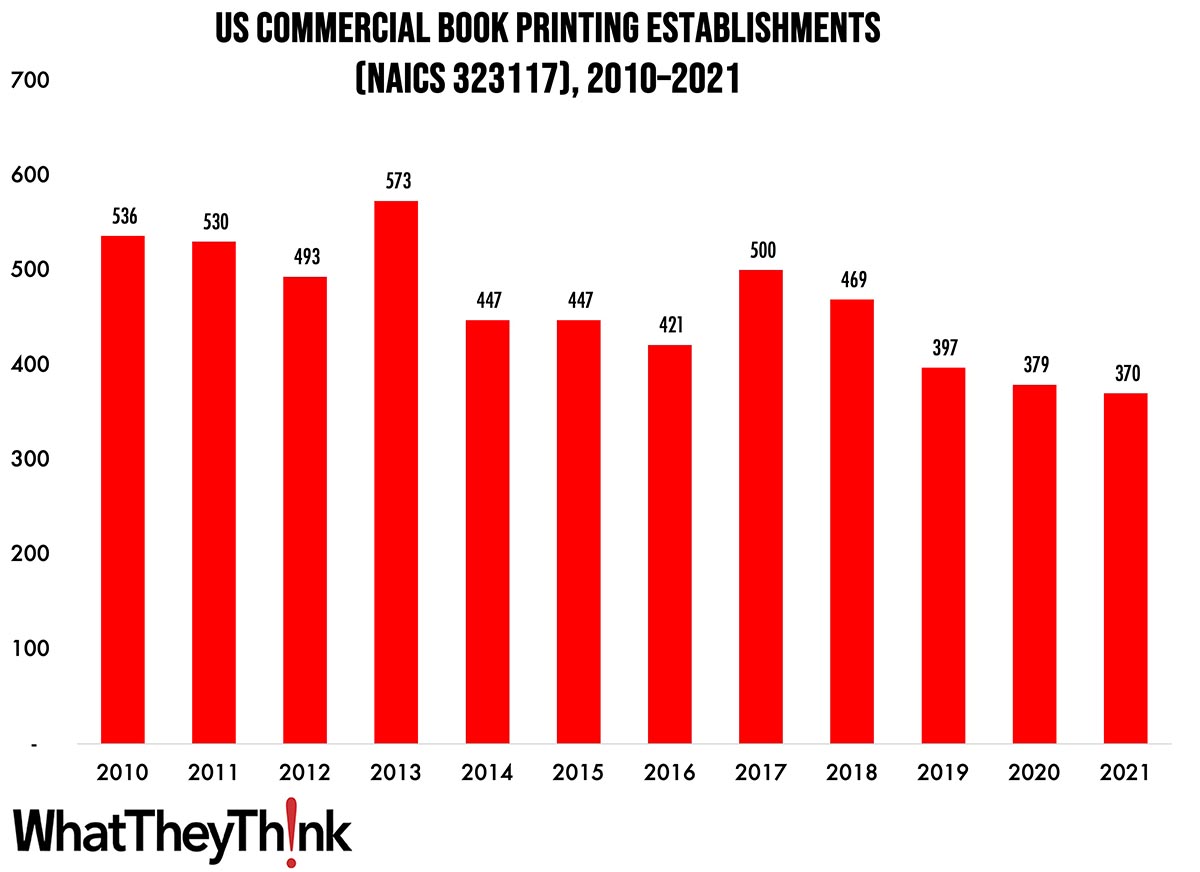

The latest edition of County Business Patterns was recently released, which includes 2021 data—meaning it reflects the businesses that were lost due to COVID.

As 2021 began, there were 370 establishments in NAICS 323117 (Book Printing). This represents a decrease of 31% since 2010 and a decrease -2.4% from 2020 to 2021.

You can see that book printing establishments were up and down throughout the decade, the ebbing and flowing in this business category reflecting the old story of consolidation as well as the results of both shop diversification and specialization. Today’s equipment (production inkjet in particular) can produce a variety of print products, so shops don’t have to stick to any one particular niche the way they used to. So some quantity of “book printers” may not consider themselves just book printers, and thus they classify themselves as general commercial printers or some other business category that better describes what they do. It also goes in the other direction: books have remained a perennially popular print product—especially during the pandemic lockdown—and as more book production moves to the digital on-demand variety, it can be a significant niche to pursue all on its own. Books also lend themselves to more dedicated workflows (highly integrated text printing, cover printing, binding, shipping) so it often makes sense to dedicate production solely to books, especially if the volume is there.

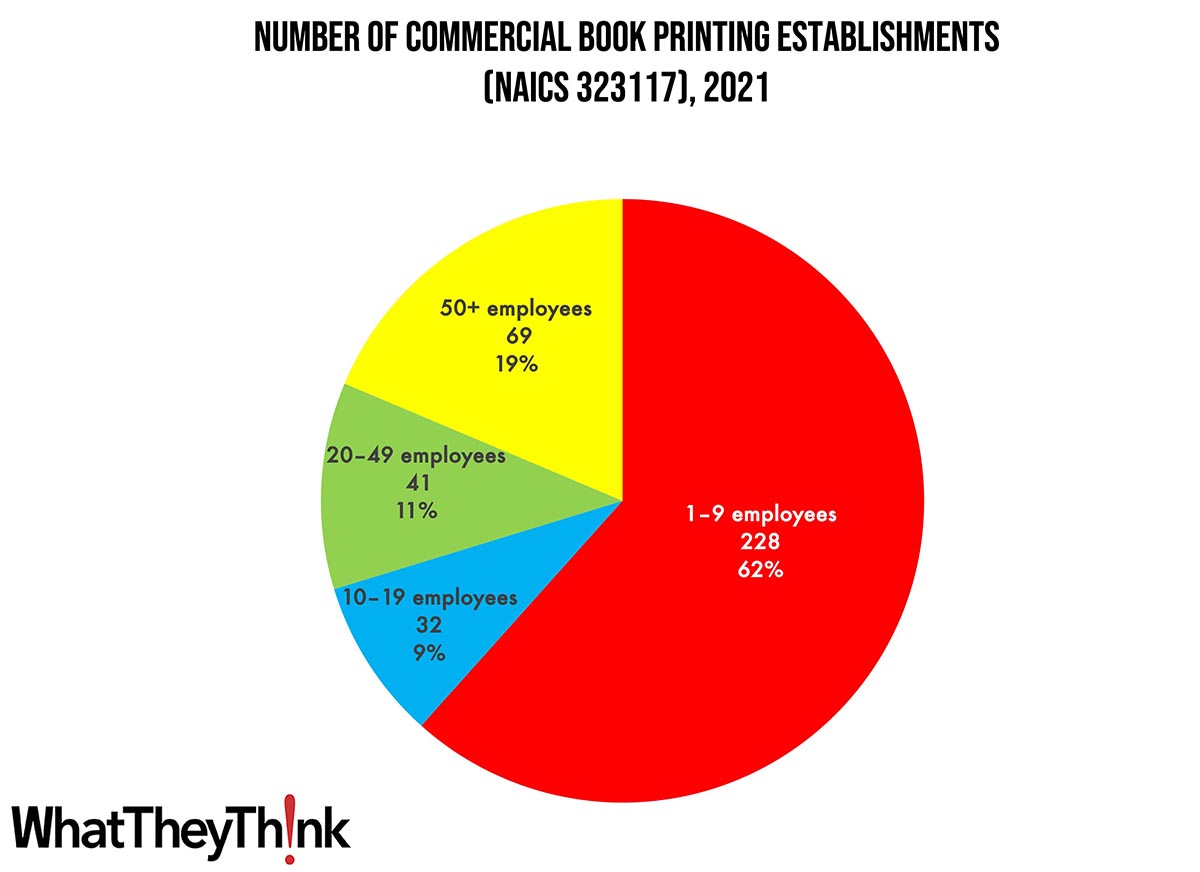

Unlike other printing categories, book printing establishments are not as concentrated at the lower end of the employee-count spectrum. Small shops (1 to 9 employees) still comprise the bulk of the book printing industry, but only account for 62% of all establishments. The largest shops account for almost one-fifth (19%) of industry establishments with mid-size shops also accounting for 20% of establishments.

These counts are based on data from the Census Bureau’s County Business Patterns. Throughout this year, we will be updating these data series with the latest CBP figures. County Business Patterns includes other data, such as number of employees, payroll, etc. These counts are broken down by commercial printing business classification (based on NAICS, the North American Industrial Classification System). Up next:

- 32312 (Support Activities for Printing—aka prepress and postpress services)

These data, and the overarching year-to-year trends, like other demographic data, can be used not only for business planning and forecasting, but also sales and marketing resource allocation.

This Macro Moment…

Every now and then, we like to check in with the American Institute of Architects (AIA) Architecture Billings Index (ABI), which is a leading indicator for new commercial real estate investment and thus potential new signage projects. According to the AIA, in September, demand for design services declined:

The score of 44.8 for September is the lowest score reported since December 2020 during the height of the pandemic. Any score below 50.0 indicates decreasing business conditions and this score indicates a significant increase in firms reporting declining billings.

“The September ABI score reflects a marked downturn in business conditions at architecture firms, with the sharpest decline observed since the peak of the pandemic,” said Kermit Baker, PhD, AIA Chief Economist. “While more firms are reporting a decrease in billings, the report also shows the hesitance among clients to commit to new projects with a slump in newly signed design contracts. As a result, backlogs at architecture firms fell to 6.5 months on average in the third quarter, their lowest level since the fourth quarter of 2021.”

The rule of thumb is that this index leads actual commercial real estate investment by about 9–12 months, which in turn is a leading indicator for potential new sign projects. So this does not bode especially well for sign businesses, at least in terms of landing signage projects related to new commercial construction.

Tell us what you think! Our Fall 2023 Print Business Outlook Survey is now in the field. This short survey will only take 8–10 minutes to complete, and will ask about this year’s business conditions and your expectations for next year, both your biggest business challenges and your biggest opportunities, and your planned investments for 2024. Additional questions will look at what additional products and services you are looking to add, your hiring and employment plans, the extent to which you have implemented automation, and—everyone’s favorite buzzphrase—“artificial intelligence.”

To take the survey, click here. Thanks!