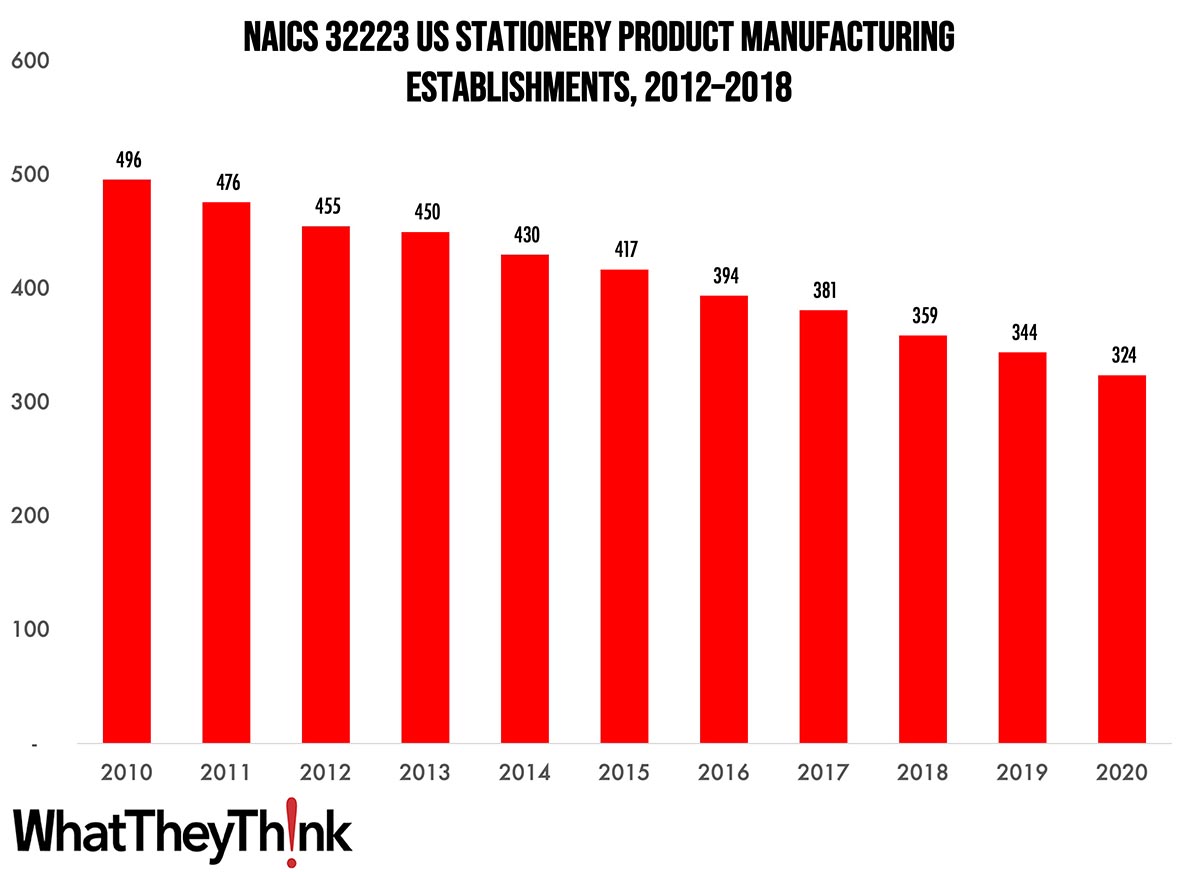

According to County Business Patterns, in 2010, there were 324 establishments in NAICS 32223 (Stationery Product Manufacturing). This NAICS category has declined steadily over the course of the decade.

The Bureau of the Census definition for this business classification:

This industry comprises establishments primarily engaged in converting paper or paperboard into products used for writing, filing, art work, and similar applications.

Think about how much stationery you use these days and you can probably explain much of the decline in this category. Still, it was circa 2016 that industry watchers had been noting a renewed interest in stationery and related products. Said Stationery Trends magazine in 2016: “There is a strong resurgence in consumers’ passion for stationery and specialty paper products. From journals to cards to prints, the written word and personal sentiments are returning stronger than ever—and in new ways.” Traditional print greeting cards remain fairly strong (a common theme of them has been “I got you a real card” although were seeing less of those these days) while LEDs, audio, and other electronic/rich media elements have made their way into printed greeting cards. In 2022, the Greeting Card Association published a study that found that 98% of small businesses send greeting cards of some kind to customers.

Christmas and other holiday cards are increasingly customized/personalized, featuring the sender’s family and printed via digital print services such as Shutterfly. “Hand-crafted,” often using letterpress, is often the operative term in much of this product category, although many of these “makers” may not be reflected in Census data, as they tend to be individual artisans or hobbyists.

Journals with unique uses also stand out, from blank journals, to travel diaries, self-exploration journals, and journals that track family memories have been trending subjects. For fitness buffs, “workout diaries” (“WODBooks”) are also popular items. The classic Moleskine notebook had a resurgence mid-decade and pictures of note-filled Moleskines are shared on social media.

Although these data points are a few years old (as is typical for CBP), it will be interesting to see next year what the pandemic and forced lockdowns have done to demand for these kinds of items.

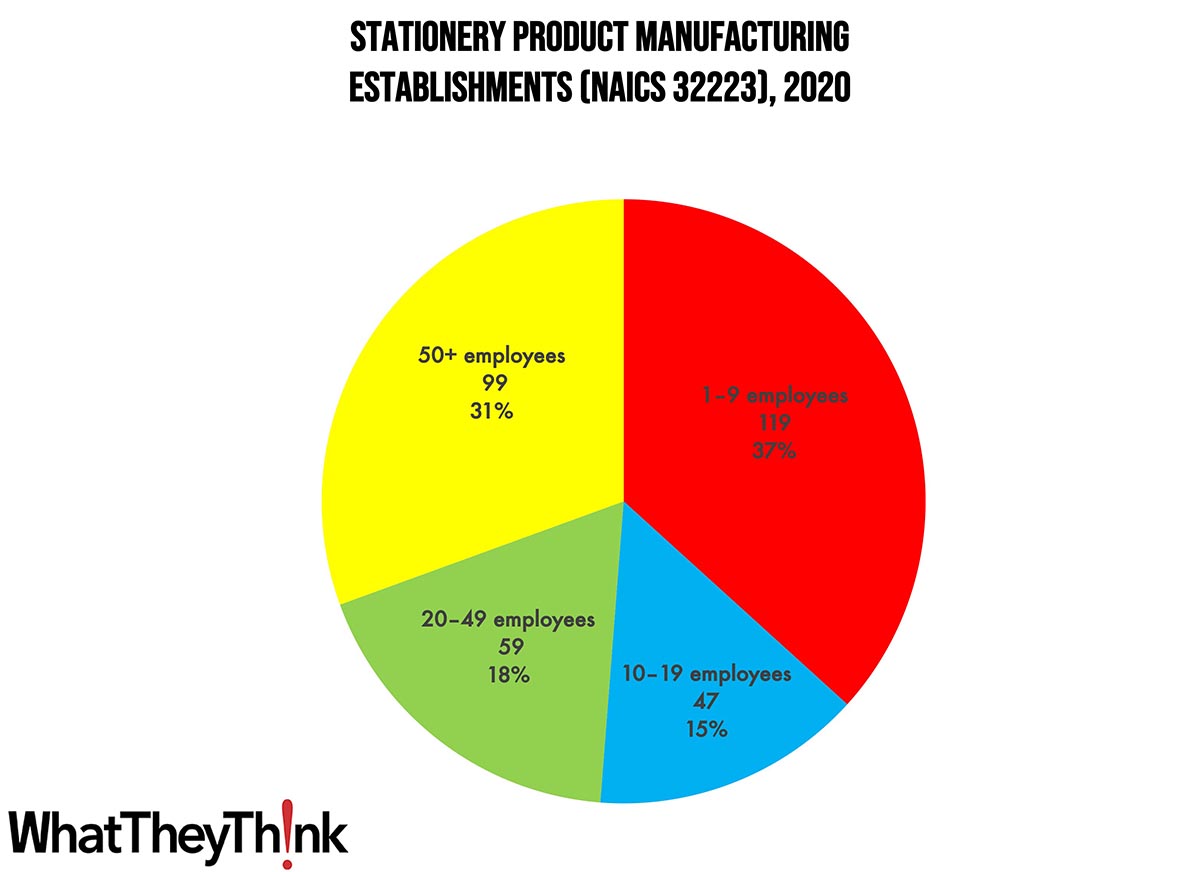

Establishments in this category are pretty evenly distributed. Small stationery product manufacturers (1 to 9 employees) account for 37% of all establishments, large manufacturers (50+ employees) account for 31% of establishments, and mid-size establishments (10–49 employees) account for 33%.

These counts are based on data from the Census Bureau’s County Business Patterns. Every other week, we update these data series with the latest figures. These counts are broken down by printing business classification (based on NAICS, the North American Industrial Classification System).

Next up, we’ll continue through the converting NAICS categories:

- 32229 Other Converted Paper Product Manufacturing

- 322291 Sanitary Paper Product Manufacturing

- 322299 All Other Converted Paper Product Manufacturing

To clarify what is included in the 2020 CBP, establishment counts represent the number of locations with paid employees at any time during the year. If an establishment existed at any point during the year, it would be included in the CBP count of the number of establishments for 2020 CBP. Thus, businesses lost during the COVID pandemic won’t be accounted for until the 2021 CBP.

These data, and the overarching year-to-year trends, like other demographic data, can be used not only for business planning and forecasting, but also sales and marketing resource allocation.

This Macro Moment…

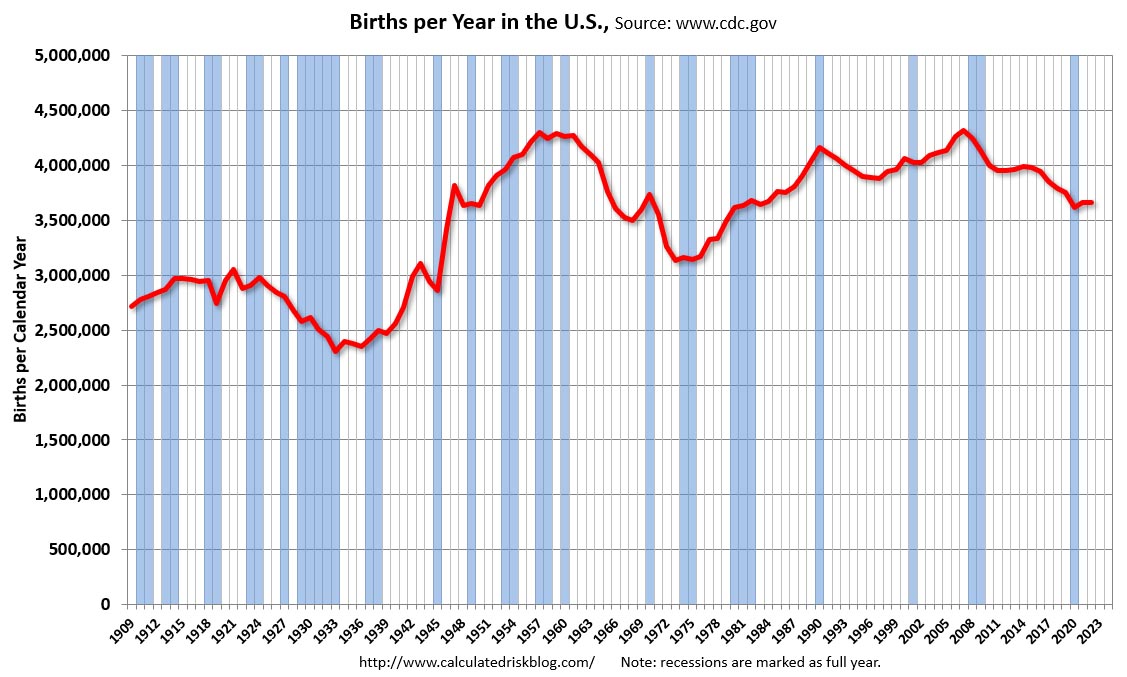

Poking around on Calculated Risk—one of our go-to macroeconomic blogs—we noticed that the National Center for Health Statistics released Births: Provisional Data for 2022.

The provisional number of births for the United States in 2022 was 3,661,220, a nonsignificant decline from 2021.

But if you look at the long-term US birth rate trend, there are some troubling implications.

Source: Calculated Risk

Obviously the birth rate in 1909 is not of particular interest, but look at the period after the Great Recession of 2008. The US birth rate started to drop and has continued through 2020. Marco Boer of IT Strategies has been sounding the alarm on this trend for the past several years, and David Zwang brought it up in his Technology Outlook webinar a couple of weeks ago. Ultimately, what this means is that starting in 2026, substantially fewer people will be entering the workforce and, by extension, the printing industry. Ultimately, we’re looking at 500,000 fewer US workers between 2026 and 2036. Add to that the aging of the current workforce, and if you were expecting the labor shortage problem to sort itself out…well, it’s only going to get worse. On the plus side, the way automation—both hardware and software—is evolving, it may be the cure for the missing worker blues. So if you aren’t hiring robots now, you soon may be.

Which raises an interesting question. If that post-2020 line continues to go up and the birth rate returns to pre-Recession levels by, say, 2036, with all the automation that is going to exist by then, will there be any jobs for the increased number of people entering the workforce after 2056?