One of our survey respondents writes:

“We’re back in the black and plan to continue that way by offering online ordering of custom wall decor, wrapping paper, in addition to our traditional services.”

Which seems like a good theme for this year’s Printing Outlook, as print businesses are indeed “back in the black.” However, new challenges other than the pandemic plagued print businesses in 2022, and while many of them are easing as we head into 2023, new challenges are on the horizon.

Here is a little sneak peak of some survey results.

Business Conditions

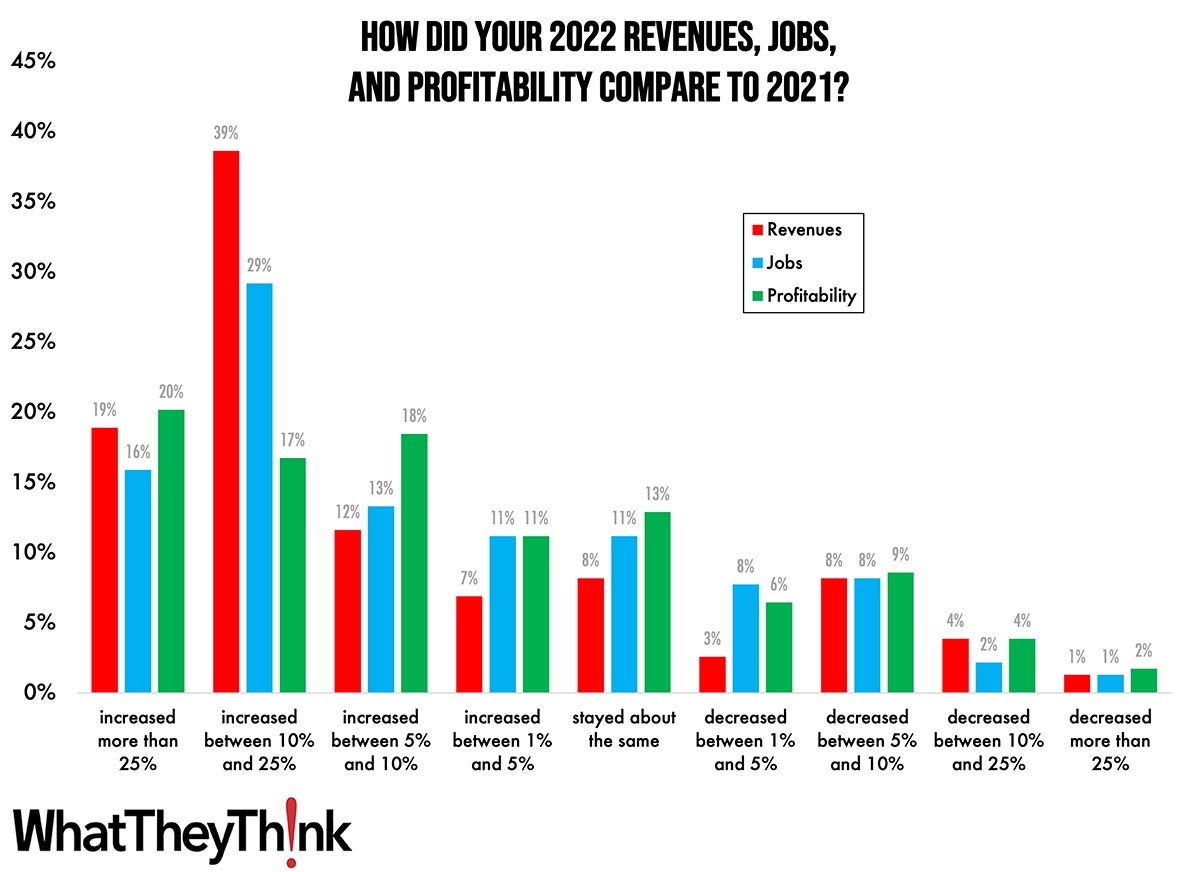

In terms of revenues, 19% of print businesses surveyed said that revenues for 2022 had increased more than 25% compared to 2021, and 39% said that revenues had increased between 10% and 25%. All told, more than three-fourths (77%) of print businesses surveyed reported an increase in revenues in 2022 compared to 2021. Likewise, 69% saw an increase in jobs, and 66% saw an increase in profits compared to 2021.

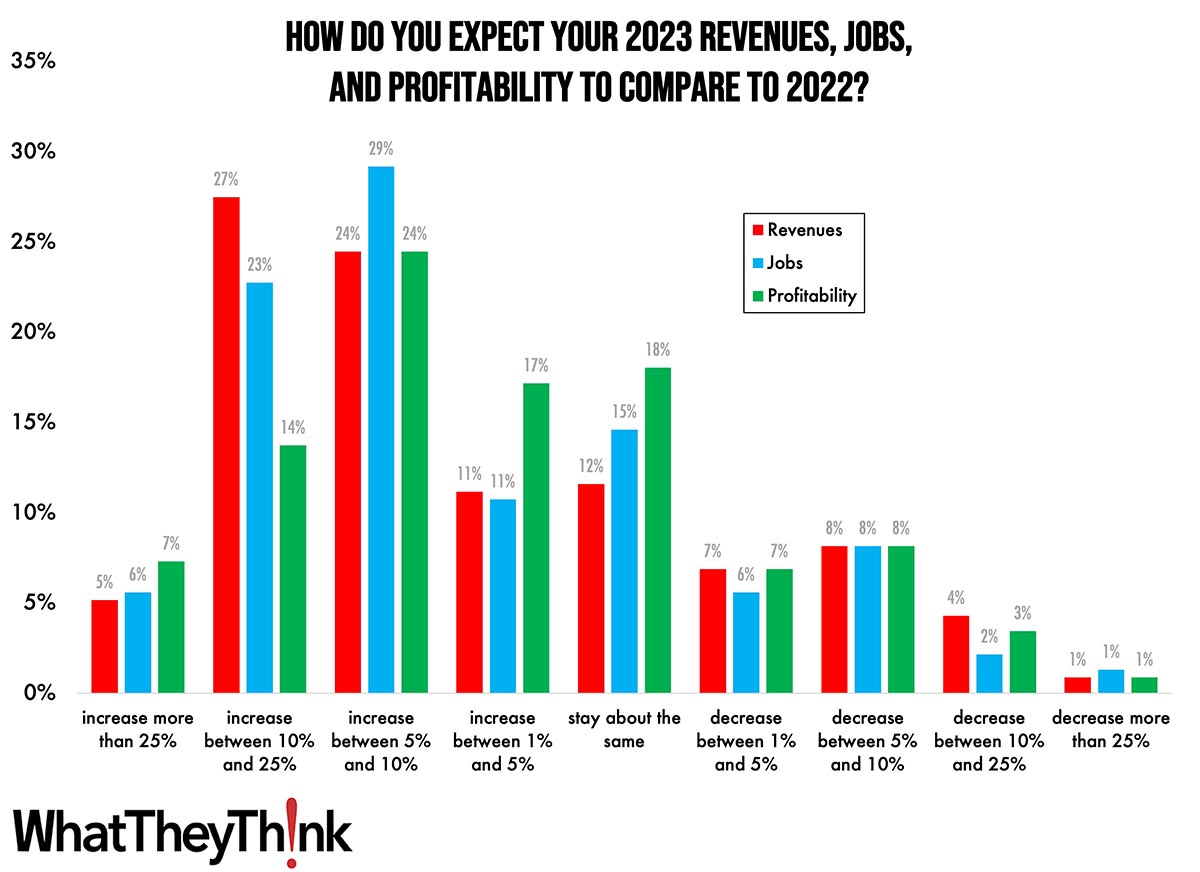

The general expectation is that 2023 will be a bit more muted than 2022, with about the same level of growth in revenues, although it’s easy to see the 2022 revenues as reflecting more new business growth than reclaiming what was lost in 2020.

Business Challenges

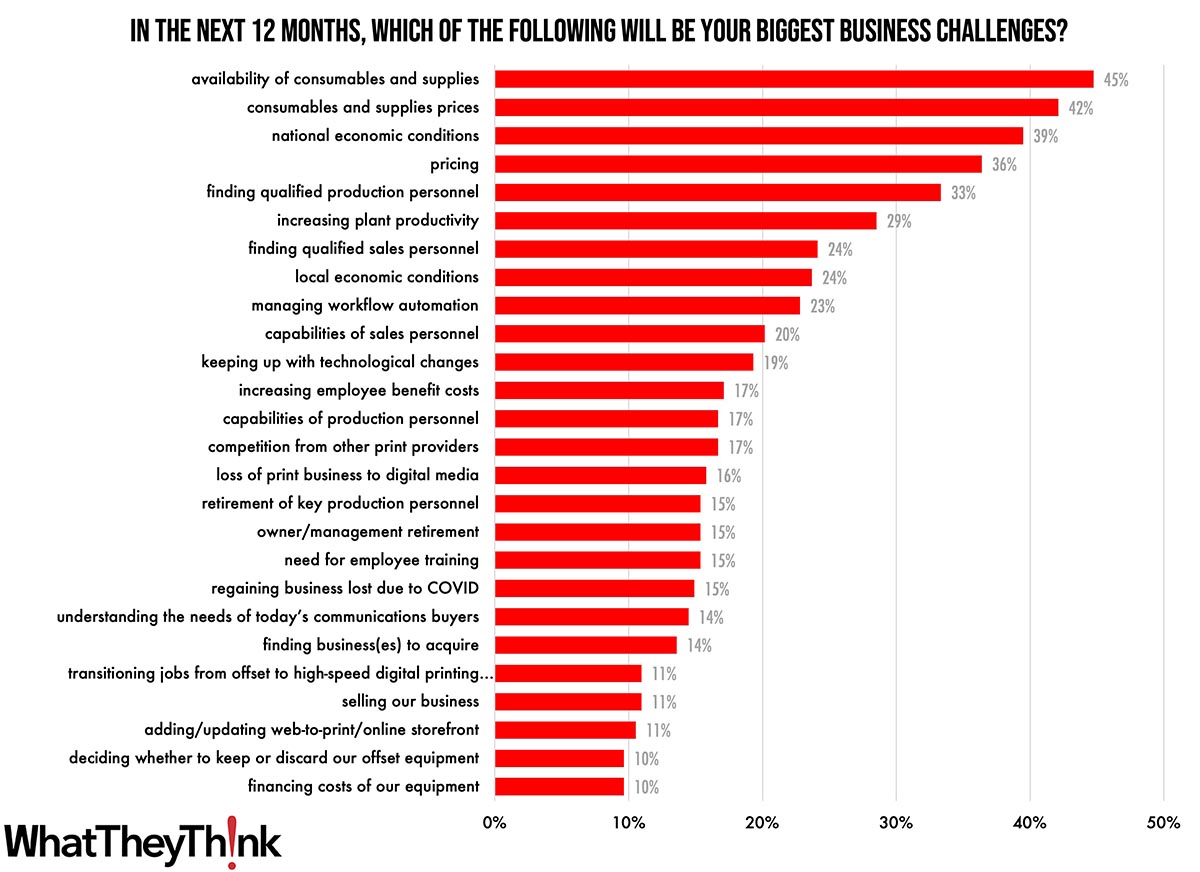

The top challenge this year was “availability of consumables and supplies,” which we had added to this year’s survey and which debuted at 45% of all print businesses. Number two was the related “consumables and supplies pricing,” selected by 42% of respondents. Number three was the perennial favorite “national economic conditions,” selected by 39%. We can interpret “national economic conditions” as equivalent to “inflation” as well as, to a lesser extent, “fear of an impending recession.”

New Business Opportunities

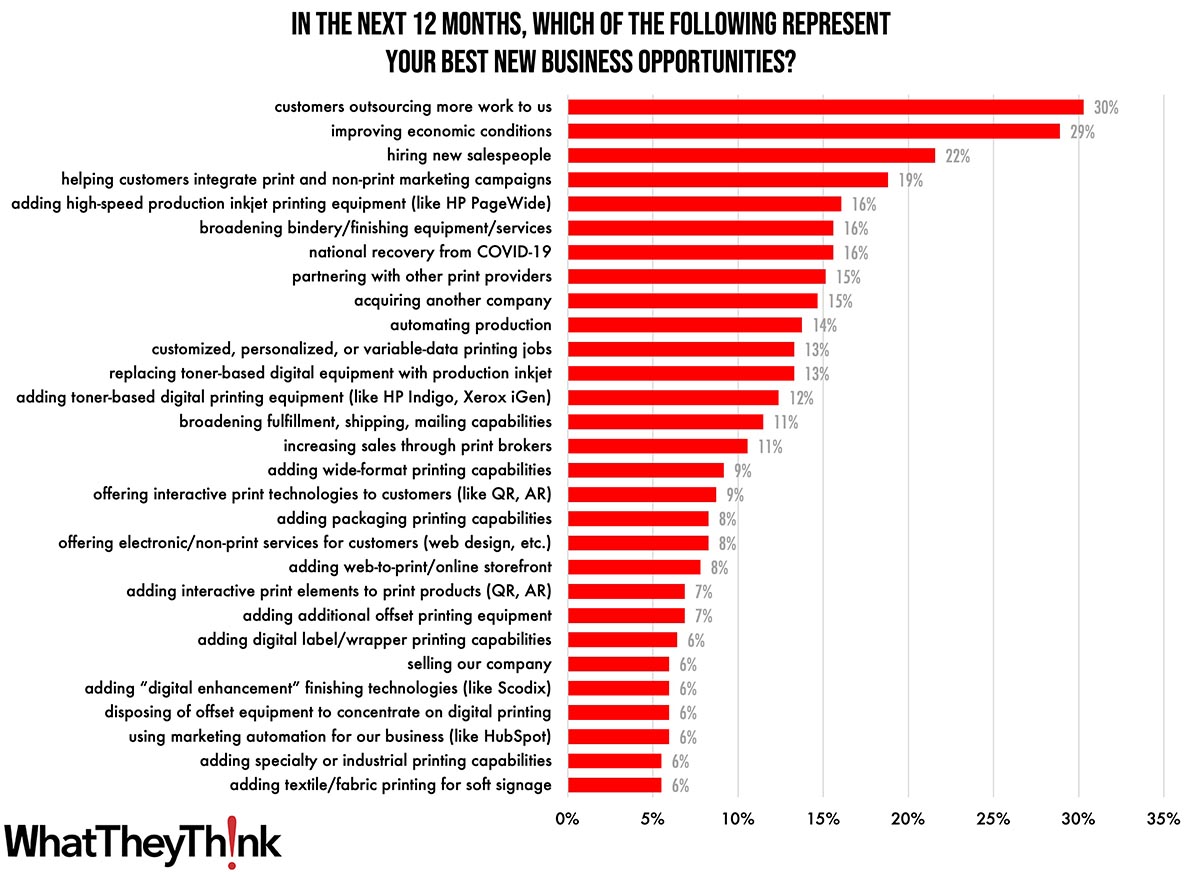

One indication that things are getting back to normal is that the pre-pandemic number one opportunity—“customers outsourcing more work to us”—has squeaked back into the top spot at 30%. Last year’s number one opportunity, “improving economic conditions,” is at number two this year at 29%. Number three is “hiring new salespeople” at 22%—the highest this opportunity has ever hit. This had been a perennial top opportunity back in the day, and although it had been losing favor towards the end of the 2010s, it seems to be coming back.

Planned Investments

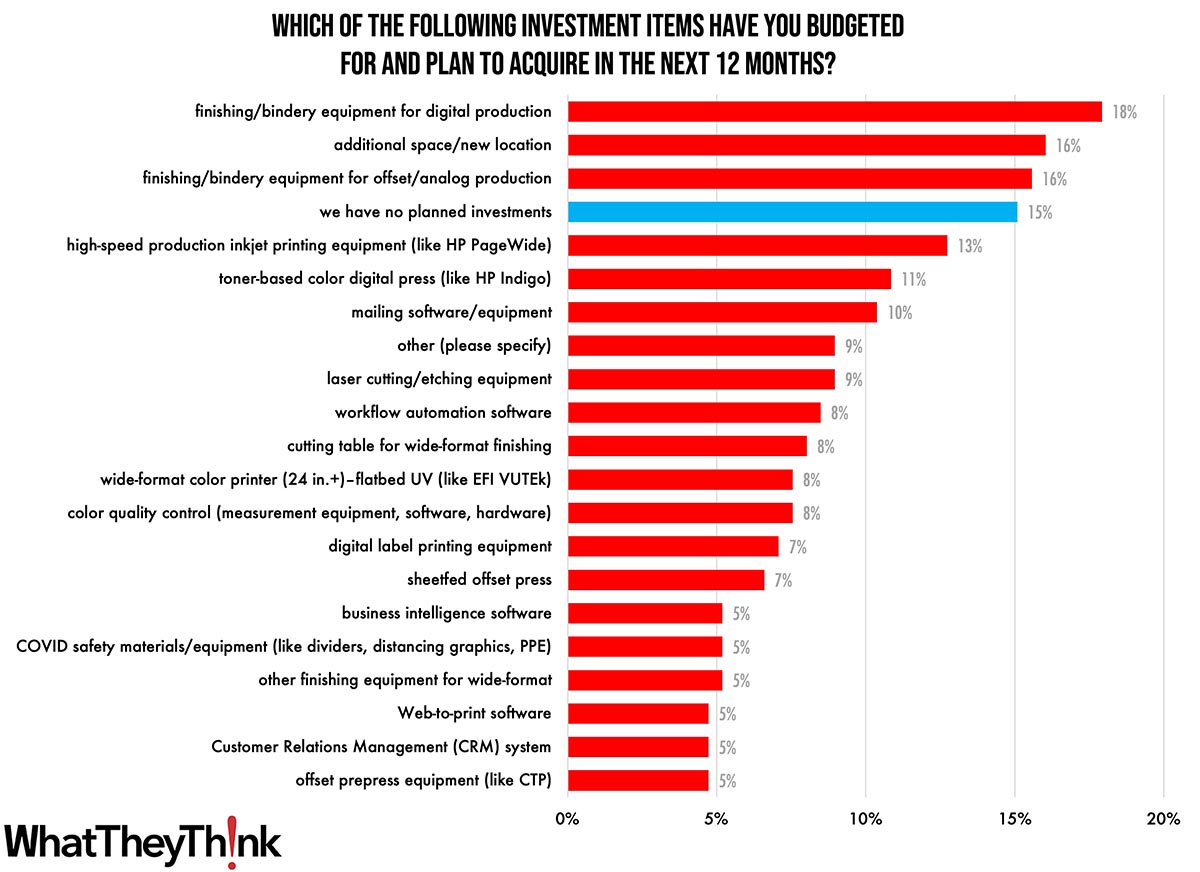

In terms of planned investments, unlike previous years, “we have no planned investments” is not the top item this year—it was selected by 15% of respondents, an all-time low for this selection.

Top of the list of planned investments is the traditional number one item, “finishing/bindery equipment for digital production” at 18%. There is a tie for number two at 16%: “finishing/bindery equipment for offset/analog production” and “additional space/new location.” The number three investment item is “high-speed production inkjet printing equipment (like HP PageWide)” selected by 13%— an all-time high for this item. Lest we think inkjet rules the digital equipment roost here, “toner-based color digital press (like HP Indigo, Xerox iGen)” is the number four investment item at 11%.

“Supply Chain Issues”

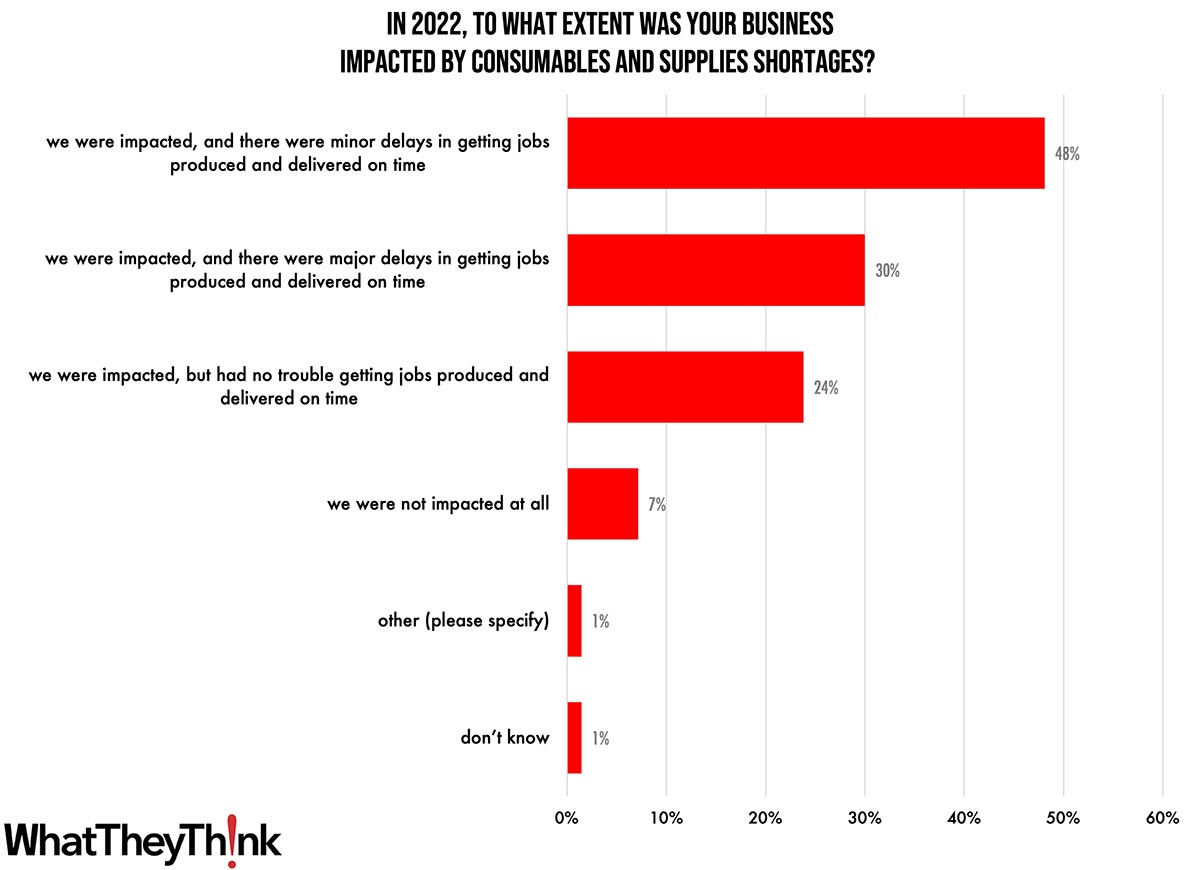

We asked about the extent to which print businesses had been impacted by the consumables “supply chain” issues—a lucky 7% said they were not impacted at all. Still, just about half of all businesses surveyed said that they had been impacted and there were minor delays in getting jobs delivered on time. Three out of 10 said there were major delays getting jobs delivered on time, and one-fourth (24%) said they had been impacted, but ultimately had no trouble getting jobs delivered on time.

Hiring Plans

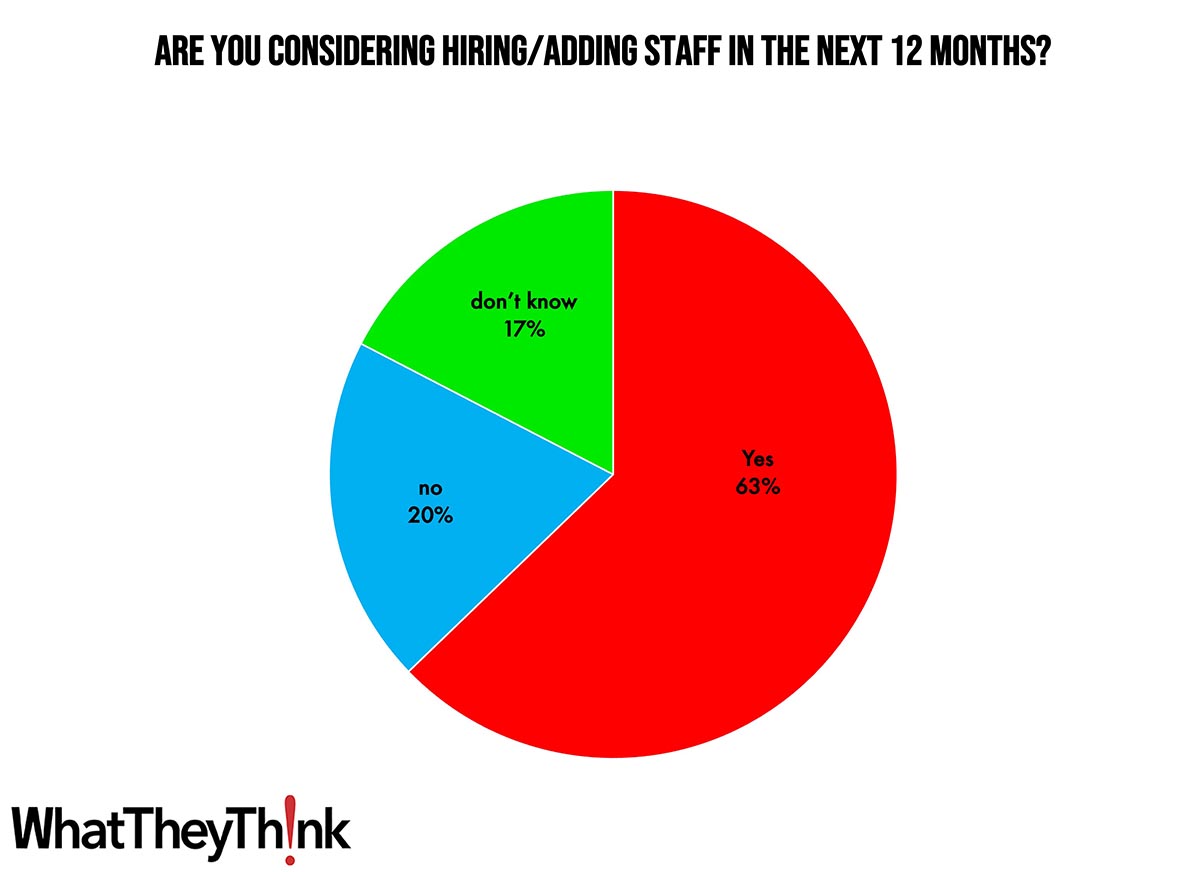

Less than two-thirds of survey respondents (63%) have plans to hire staff in 2023—down from 71% in last year’s survey—with 20% (up slightly from 17%) say they are not planning to hire. A larger than usual cohort (17%) “don’t know” which is in itself telling. Unlike previous years, where [production staff were the most in-demand, this year’s top potential hires are sales reps.

Looking Forward

Ultimately, 2022 had been a good year—challenging in certain ways, but generally good. The year-over-year data can be a little erratic, as we saw business plummet in 2020, rebound strongly in 2021, and now we’re settling into a post-pandemic normalcy. Shops are optimistic about 2023, and for good reason—God willin’ and the COVID don’t rise.

Purchase our Printing Outlook 2022 special report in our Report Store.

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free