What will consumers be thinking in 2023? How will they behave and what will drive their decisions? Answering these questions was the goal of GWI, an audience targeting company, in its U.S. “Connecting the Dots” report. For the report, GWI analyzed its data of 240 million U.S. Internet users aged 16+ to uncover the most need-to-know trends for the year ahead. In addition to looking at the traditional data points, GWI looked at trends not often covered in consumer studies, including questions around cultural identity, race, and ethnicity.

Note the authors of the report:

We seem to be surrounded by crises right now, each of which can be understood using objective measurements and scales like GDP, CPI, global temperature, and loss of life. But different groups and cultures internalize the world around them in different ways, leading to different outcomes. What we give you here is the subjective side of things: how do consumers feel about these crises? What’s the deeper impact on people’s worldviews and priorities? What are they doing differently as a result?

The results can be summarized in 20 over-arching trends as follows:

1. Belt-tightening. Consumers will still spend, but they are downsizing their expectations. More than half (51%) expect the economy to get worse in the next six months, and their confidence in their own financial security is waning. Since Q2 2021, the use of apps to track spending has increased by 9%. “Budgeting,” according to the report, “is back on the menu.”

2. Focusing family-ward. In the immediate aftermath of the COVID-19 lockdowns, American consumers let loose, indulging in all kinds of luxuries and experiences. Now, GWI finds, 34% say that being present for family and friends is their most important goal in life, up 7% from last year. “At the same time, the kind of YOLO (you only live once) attitude we saw when lockdowns were lifted is disappearing,” the report continues. “Having a goal of ‘challenging myself’ is down 8%, while ‘trying new things’ is down even more—11%.”

3. Work-life balance is coming back. U.S. workers are some of the most burned out workers around—and they are aiming to change that. Salaries, benefits, and paid time off represent three out of consumers’ top four priorities in a job, while “work-life balance” comes in at number two, with 54% of respondents giving this answer. Part of the way American workers are handling work-life balance is by combining the two. The percentage of people who work while on the road or traveling has increased by 38% since Q3 2021. There is a reason that one of the most popular series on TV right now is “The Van Life.”

4. Showing off is out. Luxury brands listen up: American consumers are souring on showing off brand names for the sake of brand names. A brand-name logo won’t be enough anymore. If you sell luxury, the product’s quality needs to live up to its high-end name. Look at the changes in how consumers describe themselves today:

- “I have sophisticated tastes” -10%

- “I am influenced by what is cool and trendy” -11%

- “I want my lifestyle to impress others” -9%

- “I like to be the center of attention” -13%

American consumers are going basic.

5. Social media addiction is waning. Wait, what? That’s what the data say! GWI finds that Americans of all ages are less likely to agree that social media is good for society, and the number of Gen Zs who say that following influencers is a top reason for using social media has dropped 22% since Q2 2021. As an example, GWI points to the rise of the social media platform BeReal, which is social media without filters. (Yep, you really look like that.) The report finds that American consumers still show interest in influencers. They just want them to be inspirational (“hey, I can do that!”) rather than aspirational (“I want to be like that”). In fact, the percentage of American consumers who notice what their favorite influencer is wearing has dropped 7% since Q2 2021.

6. 2023’s hot brand is Goodwill. Thrifting is hot, baby! Consumers’ comfort level with buying pre-owned items is up 12% year over year.

7. Offline activities are trending. American consumers are increasingly moving their leisure activities offline. Interest in gaming, television, technology, and computers are all down among 16-25-year-olds, while some of the fastest-growing personal interests for Gen Zs year-on-year are handicrafts (+16%) and (printed) books/ literature (+15%).

8. Taking it slow. While there are still plenty of young consumers who want Ferraris or Lamborghinis, the overall trend toward simplicity extends to vehicles, as well. The percentage of consumers who see their vehicles as a way to express their personality and status has dropped 9% and 14%, respectively, since Q2 2021. Buyers are more interested in having a vehicle that is cheap and easy to maintain (+7%).

9. Looking to the stars. How are consumers handling the stress of modern society? When they aren’t crafting, they are looking to modern spirituality. Interest in astrology (+11%), meditation (+10%), and “spirituality” (+8%) are up, while interest in traditional faiths is down (-6%).

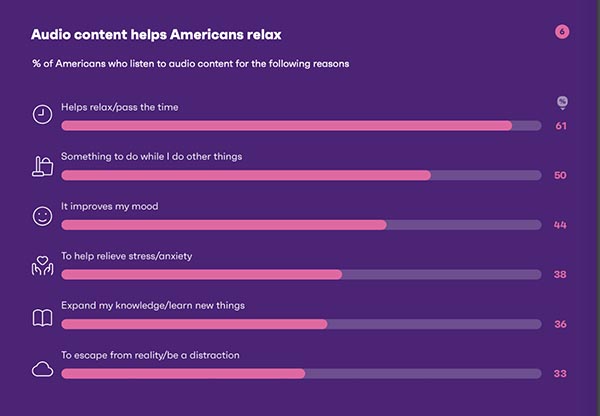

10. You mad, bro? Even as interest in non-traditional spirituality is up, unhappiness and discontent are rising, too. Fifteen percent of consumers say they are “never happy with life,” up 6% from Q1 2021. American consumers are seeking way to release their frustrations, which perhaps is why “True Crime” is one of America’s favorite podcast genres. The series saw a 21% growth in listeners from Q2 2020.

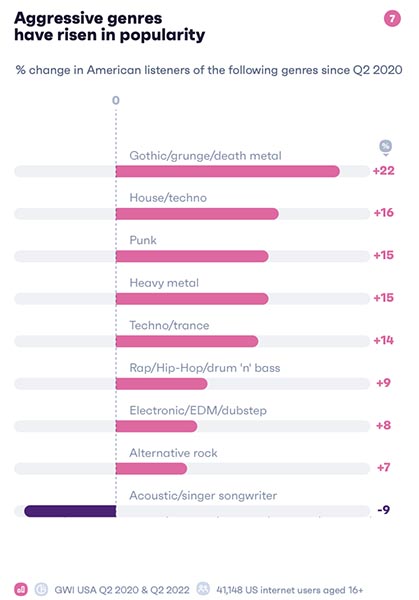

11. Turn it up! Another way American consumers are coping with stress is turning to music, especially “aggressive” genres like heavy metal and punk. They are also looking to action/superhero movies a form of catharsis. Marvel accounts for four of the seven most watched shows on Disney+.

12. Be a lover, not a fighter. Even as Americans look to action for catharsis, romance and romantic comedies as a genre are up 9% in popularity in the last two years. We’ve all got a little bit of a softie in us, it seems. Besides, these stories almost always leave us with a happy ending. They are formulaic, but we can count on those formulas to leave us feeling good.

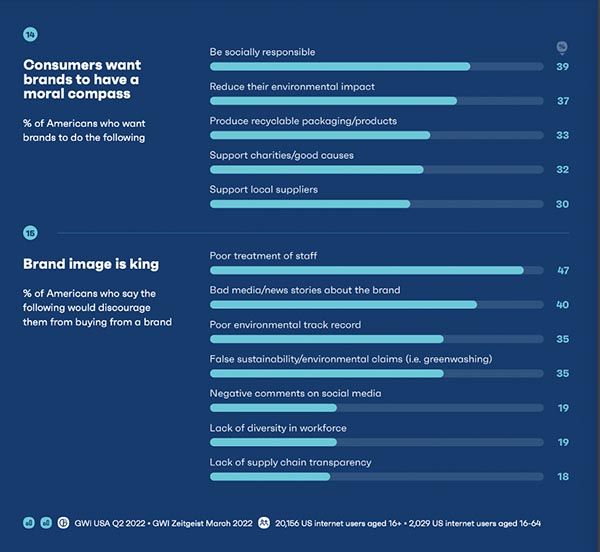

13. Be a good human. Concern about social justice and environmental issues continue to be a large and growing concern for younger consumers. They not only want to do the right thing, but they want their brands to do the right thing, too.

However, brands can’t just give this lip service. Notes the report, “Since 2020, the key theme has been ‘we need to do better.’ But as other priorities weigh on consumers’ minds in 2023, they will be increasingly tired of hearing that message from brands. They will want evidence that brands have actually created change for America.” For example, instead of merely posting supportive messages on social media, consumers want to see companies take active steps, such as offering paid leave for women’s health issues or, in the area of racial and gender injustice, reviewing hiring policies.

14. Bring humanity to the workplace. Consumers want concern about equality, social justice, and work-life balance to be a real in the workplace, too. For example, 47% say poor treatment of staff would discourage them from buying from a brand; and 29% of Gen Z and millennials want a working environment that makes them feel like they’re contributing to society. Workers also want to see more environmental responsibility at the workplace—more than two-thirds are concerned about the global impact of climate change.

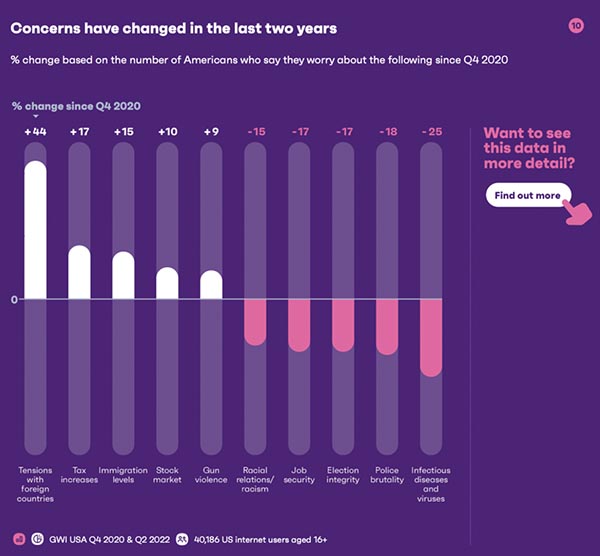

15. Crisis fatigue is real. Despite all of these concerns, American consumers are tired of hearing all the doom and gloom. GWI’s data shows an increase in what is called “crisis fatigue.” Beliefs that issues will continue to get worse are up, but concern or worry about those things is down. The percentage of Americans regularly watching and following the news is down, too. If you can’t fix it, turn it off. Positive messages welcome!

16. Make environmental friendliness economical. GWI points out that brands really win when they tie sustainable issues to cost savings. For example, H&M is creating drop-boxes of used clothing where shoppers can donate in exchange for a coupon for discounts on their next purchase. This way, consumers don’t have to choose between being environmentally conscious and being price conscious. They can do both.

17. Don’t greenwash. Consumers care about the environment, but they want brands to be truthful, too. More than one-third of U.S. consumers say they would be discouraged from buying from a brand if they made false sustainability or environmental claims.

18. Metaverse has a trust issue. Consumers love the convenience of being online, but when it comes down to it, they don’t really trust it. There is a growing desire to avoid being tracked and monitored. Interest in being anonymous online is growing.

19. If I’m in, I’m in. But for those who do trust the metaverse, they are all in: “Compared to the average American, those interested in the metaverse are over 3x more likely to buy products/ services to access the community built around them, and over 4x more likely to buy tech products as soon as they’re available. They’re a confident, affluent, and risk-taking group who want to be the first to try new things.”

20. I want it my way. Nearly two-thirds (62%) of potential metaverse users are interested in using the space to browse or shop for products (especially clothing). However, they want to be able to customize them to exactly what they want. They are interested in experimenting, not just with clothes, but with their identities (via avatars), including creating custom versions that allow a level of experimentation and risk they might take in physical space. They also expect the metaverse to be as diverse as in the real world, but with more respect and inclusivity.

If some of these trends sound familiar, they are. We’ve heard them before. But 240 million data points is a compelling reason to pay attention to them more closely. Just as the world we live in, consumers are changing, and marketers need to understand those changes in order to reach them.