- As we move into the future, the flat trajectory of print spending means that it will be vital for print service providers to sell the value of print at a higher price.

- The vast majority of print buyers surveyed by Keypoint Intelligence were customizing at least some of their marketing materials.

- 93% of print buyers were buying at least some of their print online.

By German Sacristan

Introduction

Like so many other markets, the printing industry is evolving. These shifts only accelerated during the COVID-19 pandemic, and print’s role will continue to change as it co-exists with other technologies in our increasingly digital world. Today’s marketers have more options than ever for reaching their customers and prospects, and print is often playing a secondary role to digital marketing. The good news is that printed communications can still be highly effective, particularly when they are customized/ personalized or used in conjunction with digital communications.

Keypoint Intelligence has just completed a survey of over 200 print buyers to assess how these businesses are using print within their overall marketing strategies. This article offers a high-level overview of our survey results to illuminate print’s changing role in the overall ecosystem.

Survey Overview

Earlier this month, Keypoint Intelligence published the findings from its in-depth survey of 201 print buyers in the United States. Here are some general findings about our survey participants:

- To qualify for participation in the survey, respondents were required to have at least 250 employees and some involvement in their company’s marketing communication strategy.

- Roughly two-thirds of respondents were marketers, while the rest were line-of-business managers.

- Respondents reported an overall average of 850 employees.

- The most common vertical industries that are respondents worked in were retail, healthcare, and finance/insurance.

Strategies for Selling the Value of Print

When total respondents were asked to specify the share of their budget that was attributable to printed marketing materials, the overall average was 26%. It is interesting to note that this share was 31% among firms with 500–999 employees. Over the next two years, respondents expect their budgets for print to remain largely flat. It is encouraging that print buyers as a whole do not expect their budgets for print to decline dramatically in the near term.

As we move into the future, the flat trajectory of print spending means that it will be vital for print service providers (PSPs) to sell the value of print at a higher price. This is easier said than done, but our survey findings reveal some areas of opportunity. For example, certain print applications (e.g., direct mail, catalogs, and training materials) are expected to see a modest growth in volume over the next two years.

Outside of specific applications, the results from our survey point to some other strategies for selling the value of print in a digital world. These include incorporating customized printing as well as e-connectivity options like QR codes, augmented reality, or NFC tags.

Increase the Use of Customization/Personalization

Today’s consumers understand that businesses have access to a great deal of their personal information, and they actually expect any communications to reflect this level of knowledge with customization and/or personalization. Ongoing research from Keypoint Intelligence’s Customer Communications consulting service has consistently shown that personalization attracts attention. In fact, over half of consumers reported spending much more time with communications that were personalized and relevant. This was true for printed direct mail as well as digital marketing messages.

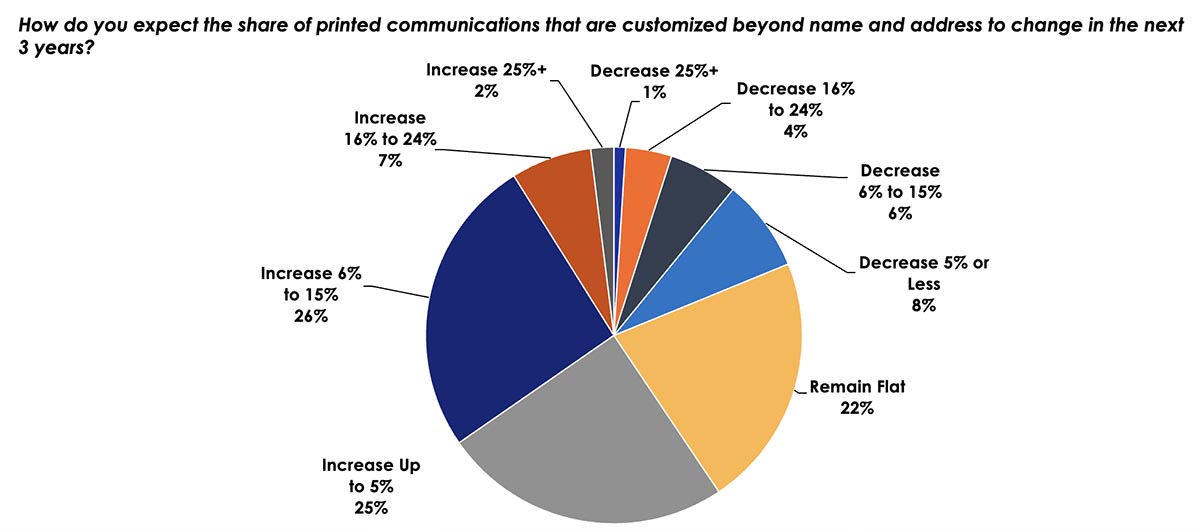

According to Keypoint Intelligence’s survey of print buyers, less than a quarter (24%) of total printed communications were currently customized beyond name and address. That said, the vast majority of total respondents (97%) were customizing at least some of their marketing materials. Among those respondents that were using customization, 60% expected the share of communications that were personalized beyond name and address to increase over the next 3 years.

Figure 1. Expected Change in Customization/Personalization

N = 194 Print Buyer Respondents in the US that customize some of their printed communications beyond name and address

Source: US Print Buyer Marketing Survey; Keypoint Intelligence 2022

This anticipated increase in personalized communications is unsurprising; print buyers clearly recognize that printed communications that are customized to the recipient are more likely to get noticed.

Use Specialty Printing Techniques

Thanks to ongoing technological innovations, today’s devices are now capable of faster printing speeds, longer run capabilities, larger formats, wider color gamuts, and the ability to create eye-catching effects that enable pieces to attract attention, encourage action, and drive business results. Some of today’s commercially available digital printing solutions have added CMYK+[1] units to enable specialty effects that can further enhance digital prints.

In the past decade, CMYK+ capability has expanded to a much wider range of digital print devices, which most frequently offer a fifth color for effects like clear coatings and special colors. These extra colors/effects, which are sometimes known as print enhancements, are applied in-line with CMYK. In addition, there is also a relatively new class of offline devices that use digital print techniques to add special effects like spot coatings, fluorescent/neon colors, white/clear ink, dimensional effects, raised textures, and metallic foils.

According to our print buyer survey, the vast majority of respondents are interested in purchasing specialty printing products that would enhance their printing capabilities. Print buyers were most interested in acquiring devices that enable customized printing or the creation of QR codes/ augmented reality/NFC tags. Only 5% of print buyers had no interest in purchasing specialty printing products in the next two years.

Don’t Overlook the Online Platform

Although print is a physical medium, most print buyers have fully embraced the online world. In fact, 93% of the print buyers that responded to our survey were buying at least some of their print online. Among these respondents, the printing products that were most commonly ordered online included business cards, general office print, and posters/banners/signage.

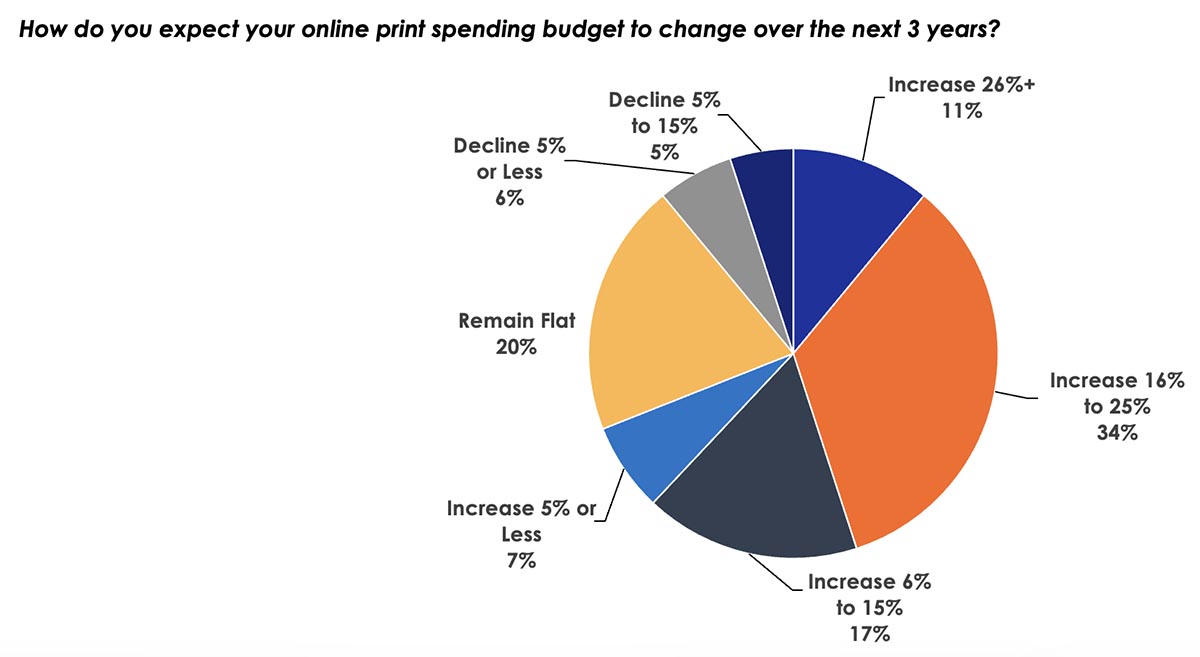

At this time, about 84% of respondents that purchase at least some of their print online say that at least half of their print purchasing funds are spent online. In addition, nearly 70% of print buyers who purchase print both online and offline expect their online spending budgets to increase over the next three years. Only 11% expected their online budgets to decline.

Figure 2. Online Purchasing is Expected to Increase

N = 122 Print Buyer Respondents in the US that purchase print both online and offline

Source: US Print Buyer Marketing Survey; Keypoint Intelligence 2022

Given that print buyers recognize the importance of the online channel and expect their spending on this platform to increase, it is more important than ever for print service providers to support their customers in their online endeavors.

The Bottom Line

Today’s print buyers have been forced to reinvent themselves in a digital first world. Even so, the industry is still experiencing some pockets of growth in certain applications, including direct mail, catalogs, and training materials. In addition, print that is personalized beyond name and address is in higher demand as consumers want to receive relevant correspondence. Specialty printing techniques like foils, metallics, and raised textures can also create an effective printed communication that stands apart from the digital clutter. There is no question that print’s role is changing, but it remains an important channel that won’t be going away anytime soon.

This article provides only a top-level overview of the findings from our recent print buyer survey. If you are interested in becoming part of our survey panel, we will send you a more in-depth executive summary that covers application trends, run lengths, and print buyers’ purchasing criteria. Click here to learn more!

German Sacristan is the Director of Keypoint Intelligence’s Production Print & Media group. In this role, he supports customers with strategic go-to-market advice related to production printing in graphic arts and similar industry segments. German’s responsibilities include conducting market research, industry and technology forecasts, custom consulting and development of analyses, editorial content on technology, as well as support to clients in the areas of production digital printing.

[1] The primary colors used in the printing process consist of four colors—cyan, magenta, yellow, and key (black). Moving beyond CMYK (also called CMYK+) involves using special effects beyond the four primary colors.

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free