In the marketing world, customer experience (CX) isn’t just important. It’s everything. But while printers are used thinking about how to help clients improve their CX, they need about their own CX, too. In the eyes of a print buyer, CX is every bit a differentiator between you and your competitors as it is between them and theirs.

What goes into a print buyer’s CX? Everything. From streamlined estimating and job submission to fast, predictable turnarounds, CX is anything that impacts your clients directly or indirectly.

No printer can be everything to every print buyer, so where to start? “Enhancing the Print Customer Connection: Delivering Client Experiences that Build Competitive Advantage” (NAPCO Research/Canon USA, 2021) has some insights. The study surveyed 193 commercial printers, 80 in-plants, and 211 experienced communication buyers and influencers to assess print job submission and production trends across the print supply chain.

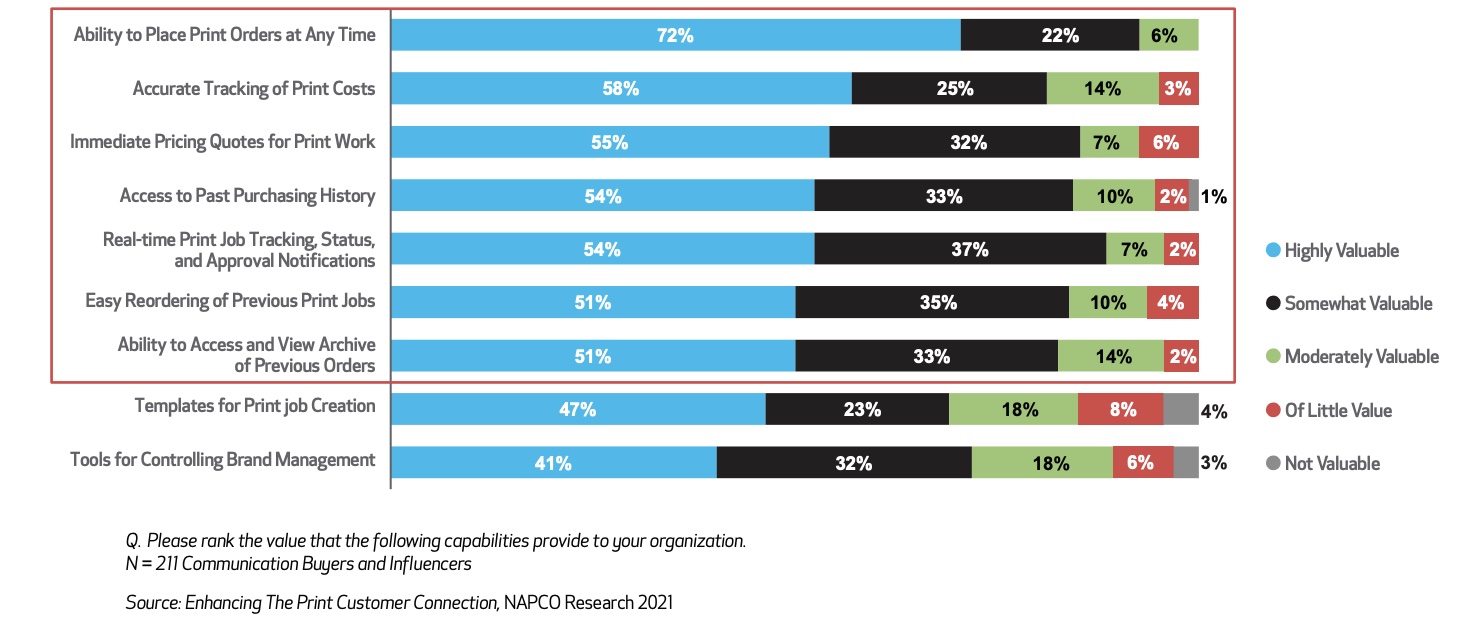

What do print buyers value most? Most pointed to full transparency and access to print ordering, tracking, and management data. In other words, web-to-print. However, this is not the web-to-print of five years ago, where the draw was largely on online ordering and brand management from locked-down templates. In fact, print buyers responding to the survey listed the two things historically most associated with web-to-print—templates for print job creation and tools for brand management—dead last.

Is it true that print buyers really don’t value those things? Not likely. It’s just that those things are now taken for granted. The value (and differentiation among PSPs) is in print management and tracking tools, such as job costing, inventory tracking, instant price quotes, access to previous order history, real-time status update and notifications, and so on.

More and more printers offer these capabilities nowadays, so the differentiator is in the details.

This is all being driven by the pressure to reduce costs and prove ROI. As the report points out, this requires print buyers to take a holistic look at the entire document pricing, production, and management chain:

Today’s communication buyers demand higher levels of management control over their print ordering and spending. Many are under enormous pressure to reduce costs and maximize the return on their communication investments. This presents an opportunity for print providers that offer customers tools and processes to better access, manage, create, and control print production and spending. Offering such services to help manage and track their print projects can help build stronger customer bonds that may not be as easily broken by competitors offering lower prices.

Note the “may” in the last sentence. In other words, “We hope that it lessens price sensitivity, but no guarantees.” But at least it’s a hedge against customer defection. You may not keep your customers based on these capabilities, but at least you’re not giving them an excuse to leave.

What about “outstanding print quality” and “great customer service”? After all, these have always been things on which printers hang their hats. Print buyers aren’t necessarily seeing it. When asked about the five top ways that PSPs can improve, print buyer respondents cited “improving print quality” (51%), “meeting production deadlines” (50%), “sending price quotes in a timely manner” (48%), “improving color consistency” (39%), and “offering better color matching” (39%) as ways PSPs can improve. As my teenager daughters would say, “Big oof.”

With numbers like these, there is clearly a disconnect between the quality and service printers think they offer and the quality and service their customers think they offer. So if you are counting on your awesome print quality and turnarounds to keep your customers loyal, that might be wishful thinking. (In fact, you might want to invest in some customer surveys to see where you stand.) With that much perceived room for improvement, job onboarding, management, and tracking tools become that much more important.

At the same time, investing in a W2P solution if you don’t already have one—or taking it up a notch if you already do—isn’t a slam dunk either. The NAPCO/CUSA survey also found that the very efficiency that provides key benefits to customers can also be seen as too limiting by those same customers. Sure, web-to-print may speed things up and provide the transparency and tracking they want, but customers are also concerned that it reduces flexibility and bargaining power (76%), that it’s too much of a pain to learn each vendor’s system (68%), and the benefits don’t outweigh the work required to integrate these systems and train their staff (84%).

So what’s the answer? Find out where your customers stand. Determine where they think you are doing well and where you could improve. If that area is in job tracking and management, find out what, specifically, they would like you to prioritize so you can find the right solution for your customers and not for someone else’s. Then educate, educate, educate. Customers know what they want, but there is fear and hesitance, too. Create an education program that allows you to communicate their needs [walk] while addressing their concerns [chewing gum] at the same time.

Discussion

By David Spencer on Sep 22, 2021

Need real-time production tracking? Ask [email protected]!

By Kate Dunn on Sep 23, 2021

This is very interesting data. It's hard to tell though if these buyers have access to these services now or if this is what they would value. Was there an earlier question that narrowed these respondents down to people who have web to print solutions now? Or was this what they would value if they could get it?

By Heidi Tolliver-Walker on Sep 24, 2021

@Kate — I don't see one. However, the report indicates that, of the print buyers or influencers surveyed, "most" of their companies employ over 100 people. Based on that, I would assume that the percentage of respondents with W2P is quite high.

By Kate Dunn on Sep 24, 2021

@Heidi - Thanks for the info. This is critical data and I hope printing company owners and print sales reps are paying attention. The sales position within printing companies is going to change from reactive quoting and hoping to a much more strategic role in helping clients achieve their business objectives. Much of what I call the "ins and outs" that take up much of the time for reps today will go away freeing up time to develop a more strategic relationship. When I start a new engagement with a sales team I interview the reps and ask how much of their days are devoted to "job related communication" meaning they have already sold the job and the answer is always 5 - 6 hours per day. Prospecting on the other had gets less than an hour a week in most cases.