- Back in May, WhatTheyThink reported that printing shipments in the United States were down to $6.42 billion—representing an even further slide from April’s disappointing results of $6.51 billion.

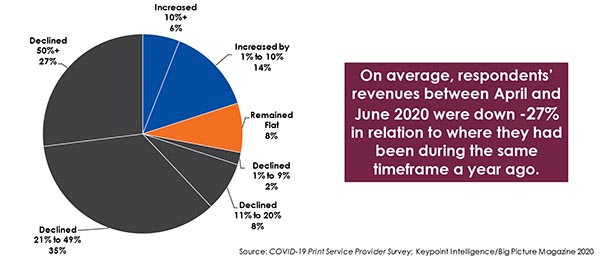

- According to research by Keypoint Intelligence/Big Picture Magazine, the average revenue loss among US production printers of all sizes was about -27% between April 2020 and June 2020.

- Although most PSPs have seen a decline in orders due to COVID, those with an online presence were able to curb the decline to some extent.

By Ryan McAbee

Introduction

In what will come as a surprise to no one, the second quarter of 2020 wasn’t been kind to the printing industry’s economic outlook or print companies’ financials! Back in May, WhatTheyThink reported that printing shipments in the United States were down to $6.42 billion—representing an even further slide from April’s disappointing results of $6.51 billion. There is no denying that the printing industry has suffered during the pandemic, but the good news is that the outlook is expected to improve soon.

Disappointing Results

Some of the larger printing companies have reported their quarterly results, providing us with a better glimpse into the impact of COVID-19 and the subsequent economic downturn. As shown in the Table below, the results haven’t been pretty.

Table 1. Quarterly Financial Results from Major Printing Companies

|

Company |

Net Sales/Revenues |

Year-Over-Year Change |

|

Cimpress plc |

$429 Million |

-36.4% |

|

LSC Communications, Inc. |

$532 Million |

-38.8% |

|

Quad/Graphics, Inc. |

$585 Million |

-38.4% |

According to research conducted by Keypoint Intelligence/Big Picture Magazine, the average revenue loss among US production printers of all sizes was about -27% between April 2020 and June 2020—somewhat better than the printers cited in the previous table. The good news for the overall print market is that the outlook is steadily (albeit slowly) improving across the industry as economies reopen and businesses begin to navigate a path forward.

Figure 1. Change in Year-Over-Year Revenues (April–June 2020)

This same research further showed that average revenue losses improved by 1% between January and April. Furthermore, Cimpress recently announced that its June bookings were up from April, although they were still down by -19% year-over-year.

What About Online Ordering?

During the pandemic, businesses of all types encouraged customers to place orders online for shipment, delivery, or local pickup. Many print service providers (PSPs) also explored this avenue; another recent study by Keypoint Intelligence found that 34% of PSPs encouraged their customers to place online orders during the COVID-19 shutdown. The assumption would be that PSPs with an e-commerce presence might have experience less of an impact to their orders and ultimately their revenues—but did this assumption prove to be accurate? Despite the push, the results of our research found that order volumes still declined for both B2B and B2C print e-commerce. Private storefronts for B2B transactions declined by -22%, whereas open storefronts for consumer transactions declined similarly at -20%.

It should be noted, however, that these declines don’t tell the entire story. Keypoint Intelligence’s research data did show a revenue difference between PSPs that offered a private storefront for their customers and those that did not. Specifically, PSPs that had established an e-commerce presence reported 29% higher revenues. So although most PSPs did see a decline in orders, those with an online presence apparently put themselves in a better revenue position that helped curb the decline to some extent.

The Bottom Line

COVID-19 impacted sales and revenues for all types of businesses, and the printing industry is no exception. Print e-commerce is certainly not a silver bullet that will completely combat the business disruption associated with the pandemic. At the same time, however, the availability of online ordering has given prospects and customers to conduct business amidst government-enforced lockdowns and continued social distancing measures. Even as the economy reopens, things are still not back to normal by any means. Fortunately, offering customers the ability to place, approve, and track orders online does appear to lessen the overall financial hit.

Ryan McAbee is a Director for Keypoint Intelligence's Production Workflow Consulting Service, which focuses on providing technology, business, and market insights to clients in the Digital Marketing & Media and Production Workflow markets. In this role, he is responsible for conducting market research, market analysis and forecasting, content development, industry training, and consulting with print service providers.

Discussion

By Ludovic MARTIN on Sep 11, 2020

Nice article, interesting study. It would have been interesting to get detailed data per market segments, I think the situation differs from packaging, labels or commercial printing. I think also that the gap between reduction of number of orders in eCommerce and the increase of revenue compared to offline printers is the result of an increase of the AOV. In Europe, we see that : less orders, but huge increase of the AOV, and a shift from offline to online, driving to an increase of activity for hybrid PSPs, capable of providing both online and offline experiences, with internal production capabilities.

By RYAN MCABEE on Sep 11, 2020

@Ludovic, yes this particular data focused mostly on commercial printers and sign shops. I agree the availability, adoption, and use varies by printing segment. Interesting observation on the average order value as it could be a way to interpret what's happening in online ordering. I think we can all agree that printers and their customers have had to quickly sort out new ways of interacting in 2020 that may have been overlooked or undervalued in the past.