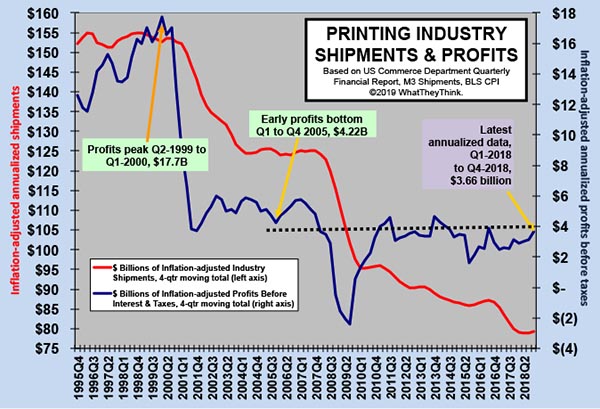

Industry profits data came out earlier this week, and annualized profits for Q4 were up to $3.66 billion, closing in again on that seemingly unbreakable $4 billion threshold.

Digging down into this report, we notice that the “tale of two cities” trend that we have been seeing is—at least temporarily—on hold. Perhaps urban sprawl is bringing these cities closer to each other. (So many metaphors, so little time.)

In Q4 2018, for the industry on average, profits before taxes were 4.47% of revenues, and for the last six quarters, they’ve averaged 3.98% of revenues.

Here’s where things are getting interesting. Remember how, in past profits reports, we have noted a vast disparity between large printers ($25+million in assets) and small printers (<$25 million)? In Q3, for example, for large printers, profits before taxes were 0.37% of revenues, but for smaller printers, Q3 profits before taxes were 7.71% of revenues. In Q4, large printers’ profits before taxes were 4.76% of revenues, while for smaller printers, they were 4.11% of revenues.

So that disparity is closing—both by larger printers seeing greater profitability and, alas, by smaller printers seeing less profitability. So maybe it’s less a “tale of two cities” and more of a “there goes the neighborhood.”