Big printing companies are writing down assets that don’t match market needs and goodwill from overpriced acquisitions. Writedowns in the first quarter of 2018 for commercial printers with $25 million or more in assets were $157 million, or 1.9% of sales. The assets may be written down, but the borrowing that was created to finance them remains. Interest expense was 4.8% of sales. For the quarter, losses were -1.47% of sales.

That rate of loss made average profits before taxes for the industry a mediocre 3% of sales, which means that printers with less than $25 million in assets must have done well.

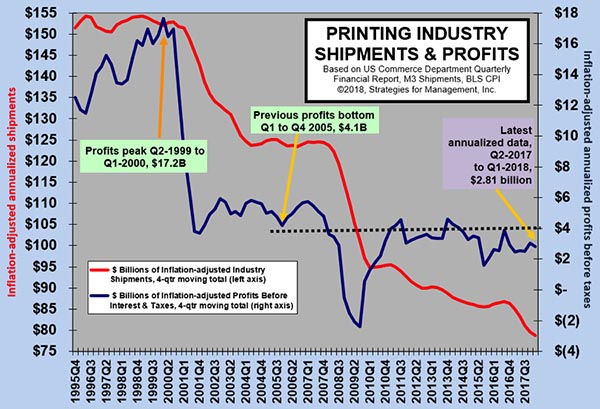

Those printers had strong profits before taxes of 8.25% of revenues. For the last six quarters, these printers have averaged 6.41% of revenues, while their larger brethren have an average of -0.21% for that period of time. If large printers were showing profits at the rate of smaller ones, total industry profits would have no problem breaking the $4 billion barrier. That level has proven to be very difficult to surpass.

Big printing companies were always admired in the industry for their prestigious clients (big publishing companies and big retailers) and their ability to invest in the latest technologies. The communications marketplace turned against them, and they could not adapt to a market with fast-growing new media competitors and new methods of accessing information and entertainment. Profits of smaller printing companies have been increasing because of the shift to digital printing and that successful businesses have absorbed the volume of plants that have closed.