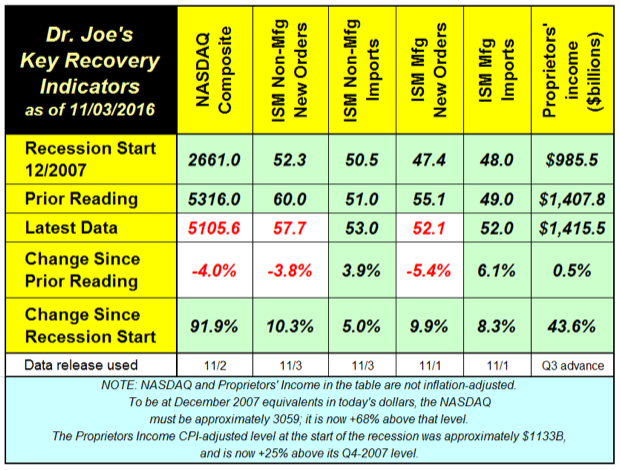

Last month's recovery indicators bounced back big from a dreadful report, but this month's have moderated.

The ISM manufacturing and non-manufacturing new orders decreased, but they are still above the 50 breakeven level, showing growth. The non-manufacturing side is still strongly on the growth side of the line.

The NASDAQ was spooked a variety of things, including speculation that Apple's high growth in recent years has slowed and may not return. Presidential election jitters also play a role, as recent news disrupt the certainty that the stock market experts like. Whether the certainty is for a good outcome or bad outcome, the experts don't particularly care: they just prefer high predictability. And then there's the usual fretting about whether or not the Fed will raise rates by a mighty quarter of a percentage point in December. The idea of paying 25 cents for borrowing $100 just seems to frighten the markets into the realization the that cheap interest rates punch bowl might be taken away.

Compared to last year, four of the six indicators have declined. The NASDAQ is down -0.8%, ISM new orders are down -1.5% for manufacturing and -6.9% for non-manufacturing. Imports are up +10.6% for manufacturing but down -2.8% for non-manufacturing.

Proprietors' income, a measure of small business activity, is up +1% compared to last year, unadjusted for inflation, which means it has actually had a small decline.

* * *

Total manufacturing shipments for September was released by the Commerce Department. That data series showed for 22 consecutive months a decline in current dollar shipments compared to the prior year. This has been one of the reasons why GDP growth has been so tepid.

* * *

Printing shipments for September were virtually the same as last year on a current dollar basis, with a slight decline after inflation adjustment.