The latest edition of County Business Patterns was just released, which includes 2022 data.

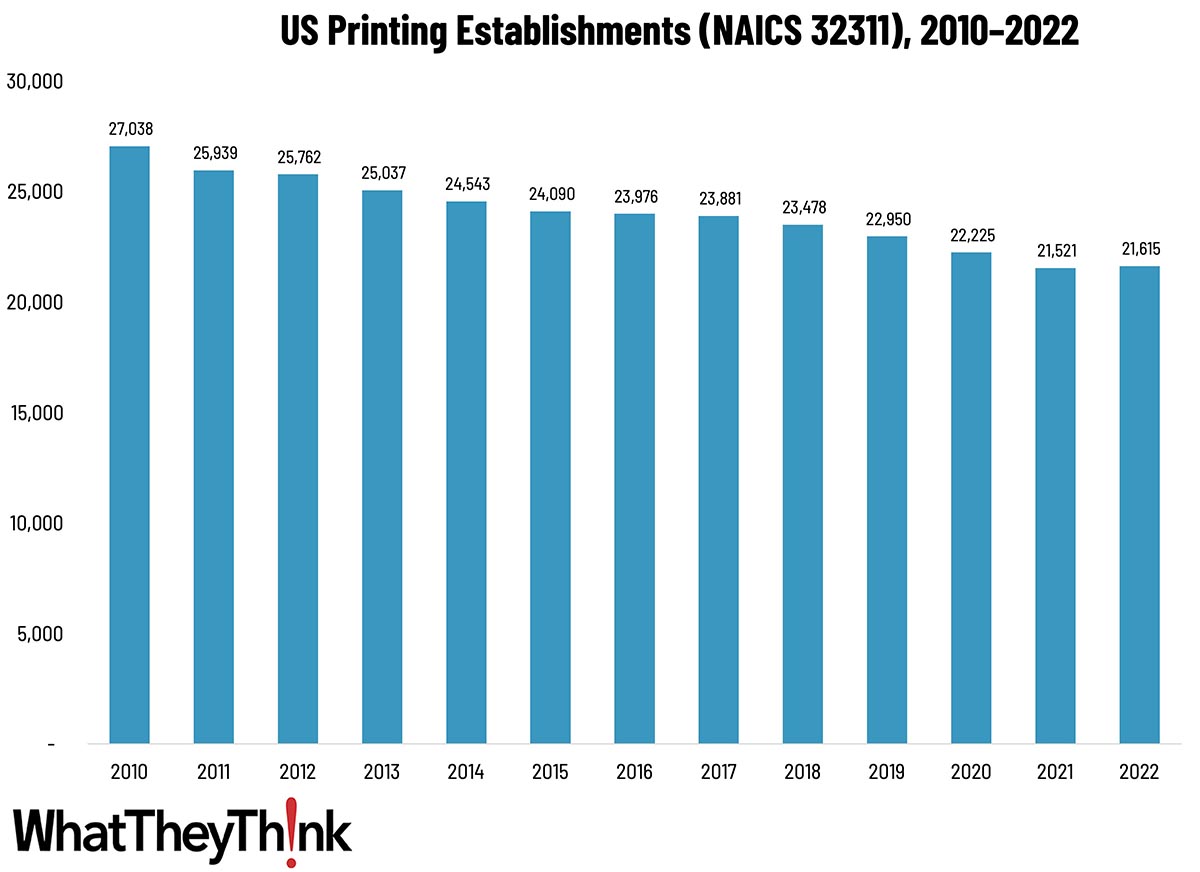

As 2022 began, there were 21,615 establishments in NAICS 32311 (Printing). This represents a decline of 20% since 2010—but an increase of 0.4% from 2021. The biggest declines were in the early years of the decade, thanks to the Great Recession—from 2010 to 2011, establishments declined by 4%; from 2014 to 2015, the decline was only 2%. Consolidation picked up toward the end of the decade, with establishments declining 5% from 2018 to 2020. And then the pandemic hit, although the impact was not as bad as we had been expecting. As we remarked in our Printing Outlook 2023 report, based on our Fall 2022 survey, 2022 was the “back in the black” year for the industry, with print buyers racing to replenish the printed materials they had cut back on during the pandemic year(s). It is not surprising that an increase in demand saw an increase in printing establishments.

NAICS 32311 is defined by the Census as:

This industry comprises establishments primarily engaged in printing on apparel and textile products, paper, metal, glass, plastics, and other materials, except fabric (grey goods). The printing processes employed include, but are not limited to, lithographic, gravure, screen, flexographic, digital, and letterpress. Establishments in this industry do not manufacture the stock that they print, but may perform postprinting activities, such as folding, cutting, or laminating the materials they print, and mailing.

Basically, this NAICS is all “printing” companies, excluding prepress and postpress establishments, which are included in NAICS 323.

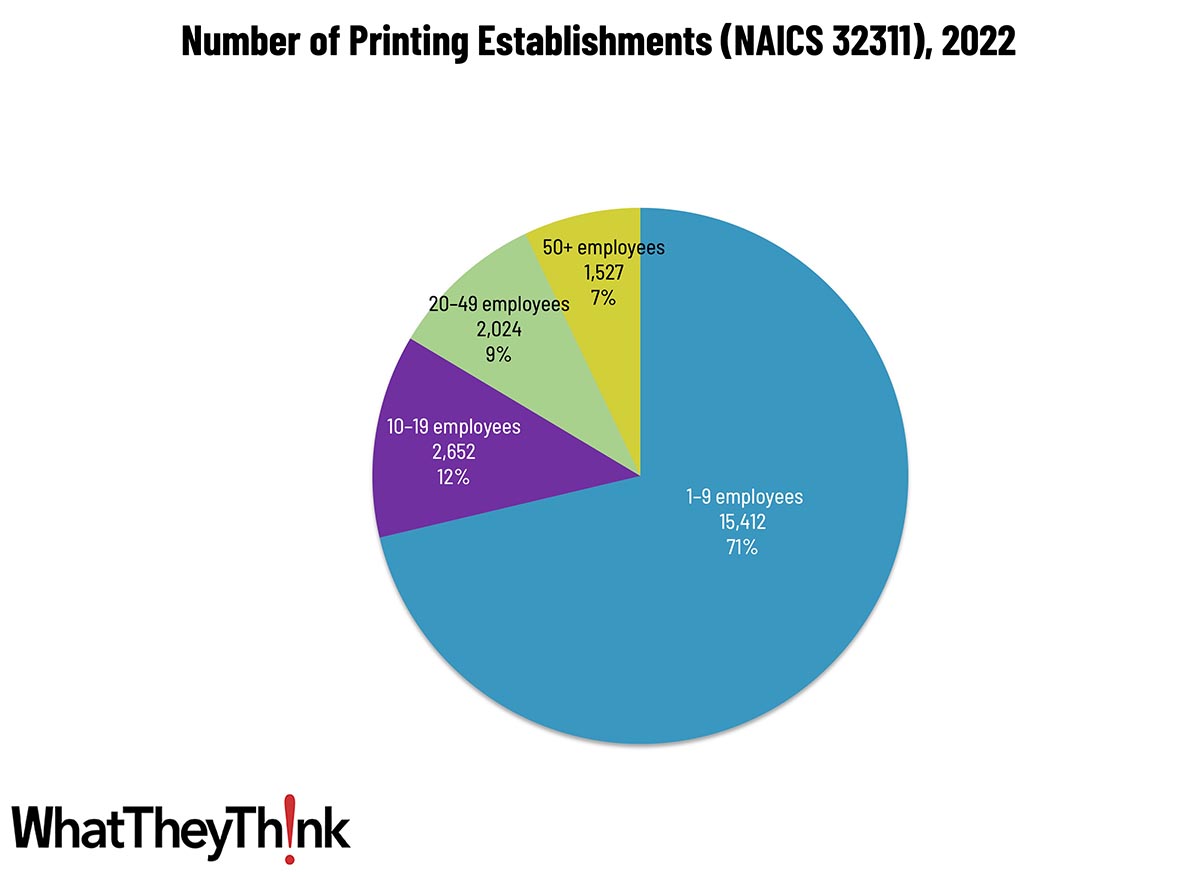

Small shops (1 to 9 employees) still comprise the bulk of the industry, accounting for 71% of all establishments. The largest shops account for only 7% of industry establishments with mid-size shops accounting for about one-fourth of establishments. These percentages have not varied substantially since at least as far back as 2010.

These counts are based on data from the Census Bureau’s County Business Patterns. Throughout this year, we will be updating these data series with the latest CBP figures. County Business Patterns includes other data, such as number of employees, payroll, etc. These counts are broken down by commercial printing business classification (based on NAICS, the North American Industrial Classification System):

- 323111 (Commercial Printing, except Screen and Books)

- 323113 (Commercial Screen Printing)

- 323117 (Books Printing)

- 32312 (Support Activities for Printing—aka prepress and postpress services)

These data, and the overarching year-to-year trends, like other demographic data, can be used not only for business planning and forecasting, but also sales and marketing resource allocation.

This Macro Moment…

This week, the Federal Reserve published its most recent “Beige Book” (aka “Summary of Commentary on Current Economic Conditions”), which is issued eight times a year. The Beige Book compiles more or less anecdotal information on economic conditions in each of the 12 Federal Reserve districts. Not quantitative, it is based on conversations with bank and branch directors and interviews with key business contacts, economists, market experts, and others. It is published as a prelude to Federal Open Market Committee meetings.

Overall Economic Activity

Economic activity rose slightly in most Districts. Three regions exhibited modest or moderate growth that offset flat or slightly declining activity in two others. Though growth in economic activity was generally small, expectations for growth rose moderately across most geographies and sectors. Business contacts expressed optimism that demand will rise in coming months. Consumer spending was generally stable. Many consumer-oriented businesses across Districts noted further increases in price sensitivity among consumers, as well as several reports of increased sensitivity to quality. Spending on home furnishings was down, which contacts attributed to limited household mobility. Demand for mortgages was low overall, though reports on recent changes in home loan demand were mixed due to volatility in rates. Commercial real estate lending was similarly subdued. Still, contacts generally reported financing remained available. Capital spending and purchases of raw materials were flat or declining in most Districts.

… Labor Markets

Employment levels were flat or up only slightly across Districts. Hiring activity was subdued as worker turnover remained low and few firms reported increasing their headcount. The level of layoffs was also reportedly low. Contacts indicated they expected employment to remain steady or rise slightly over the next year, but many were cautious in their optimism about any pickup in hiring activity.

… Prices

Prices rose only at a modest pace across Federal Reserve Districts. Both consumer-oriented and business-oriented contacts reported greater difficulty passing costs on to customers. Input prices were said to be rising faster than selling prices for most businesses, resulting in declining profit margins. Although input prices rose generally, contacts in several Districts noted declines in certain raw materials and non-labor costs. In contrast, rising insurance prices were again reported widely as significant costs pressures for many businesses.

You can read the whole thing here, particularly the reports from your Fed district, but here are some selected comments. Note that it is based on information compiled before November 22, 2024.