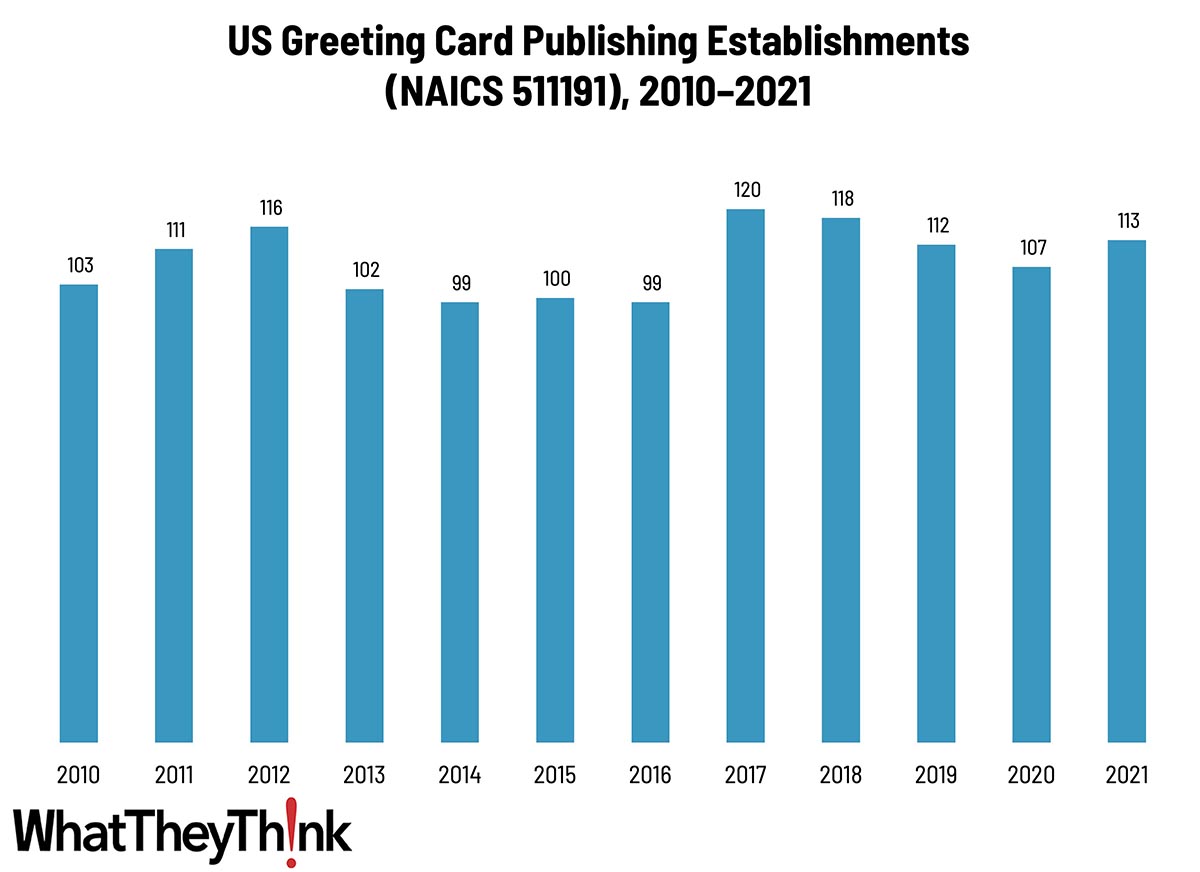

Our Friday data slice’n’dice look at the latest edition of County Business Patterns has been detailing the publishing industries. As 2021 began, there were 113 establishments in NAICS 511191 (Greeting Card Publishing). Although this represents a net increase of 10% since 2010, it has been a category that has ebbed and flowed over the course of the decade, although we’re not talking about a tremendous number of establishments.

The Greeting Card Association doesn’t seem to have the general industry statistics they used to, but as recently as 2018 they had found:

- Americans purchase approximately 6.5 billion greeting cards each year. Annual retail sales of greeting cards are estimated between $7 and $8 billion.

- Nine out of every ten households buy greeting cards each year.

- USPS reported that greeting card mail volume has increased last year, for the fourth year in a row (USPS Household Diary Study).

NDP Analytics had found in 2020 that:

- Unlike the stamped letter category overall, greeting cards experienced growth from FY 2015-18. However, in FY 2019, greeting card volume suddenly declined more than 15%.

They add:

- The timing of the decline in greeting card volume parallels the 10% increase in first-ounce stamp prices. It is the only factor that appears to align with the change in greeting card volume. While other factors, such as electronic diversion, contribute to steady decreases in physical greeting card volume, they cannot explain the sudden decline in FY 2019.

The Greeting Card Association published a 2022 white paper on the subject of greeting card use by small businesses. Some interesting findings from the 2,000 small businesses they surveyed:

- One-third of small businesses send greeting cards during the winter holiday season

- 87% of those cards are physical, not e-

- 91% of greeting cards are sent to current customers

Digital technologies have made greeting card design and production easier than ever—although we note that it has become typical around the holidays to receive custom photocards containing family photos produced via the likes of Shutterfly. We have even run into a few artisans who have picked up a letterpress press and started a boutique card production facility in a garage.

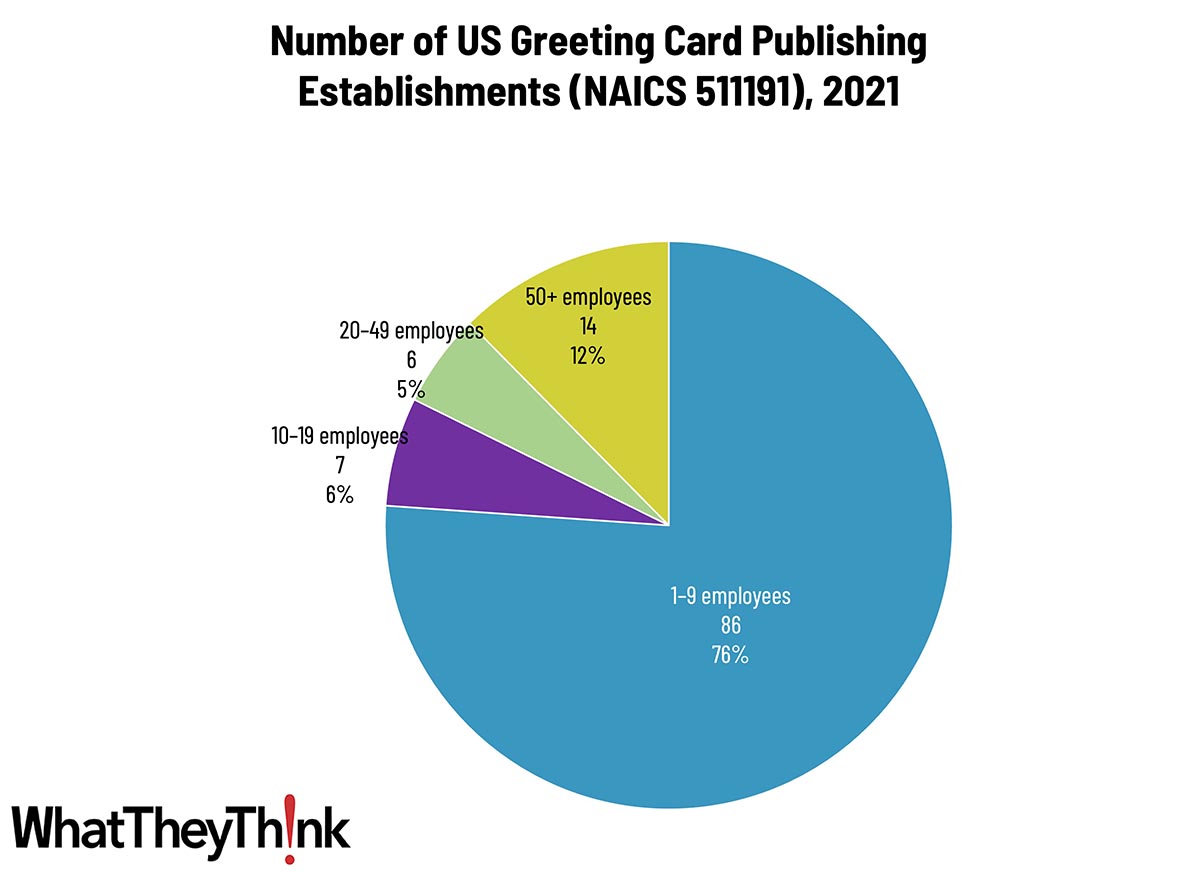

Greeting card publishing establishments are naturally concentrated at the lower end of the employee-count spectrum. Small publishers (1 to 9 employees) comprise the bulk of the establishments, accounting for 85% of all establishments, with the other three size classifications just about equal and under 10%.

These counts are based on data from the Census Bureau’s County Business Patterns. Throughout this year, we will be updating these data series with the latest CBP figures. County Business Patterns includes other data, such as number of employees, payroll, etc. These counts are broken down by commercial printing business classification (based on NAICS, the North American Industrial Classification System). Up next:

- 511199 All Other Publishers

These data, and the overarching year-to-year trends, like other demographic data, can be used not only for business planning and forecasting, but also sales and marketing resource allocation.

This Macro Moment…

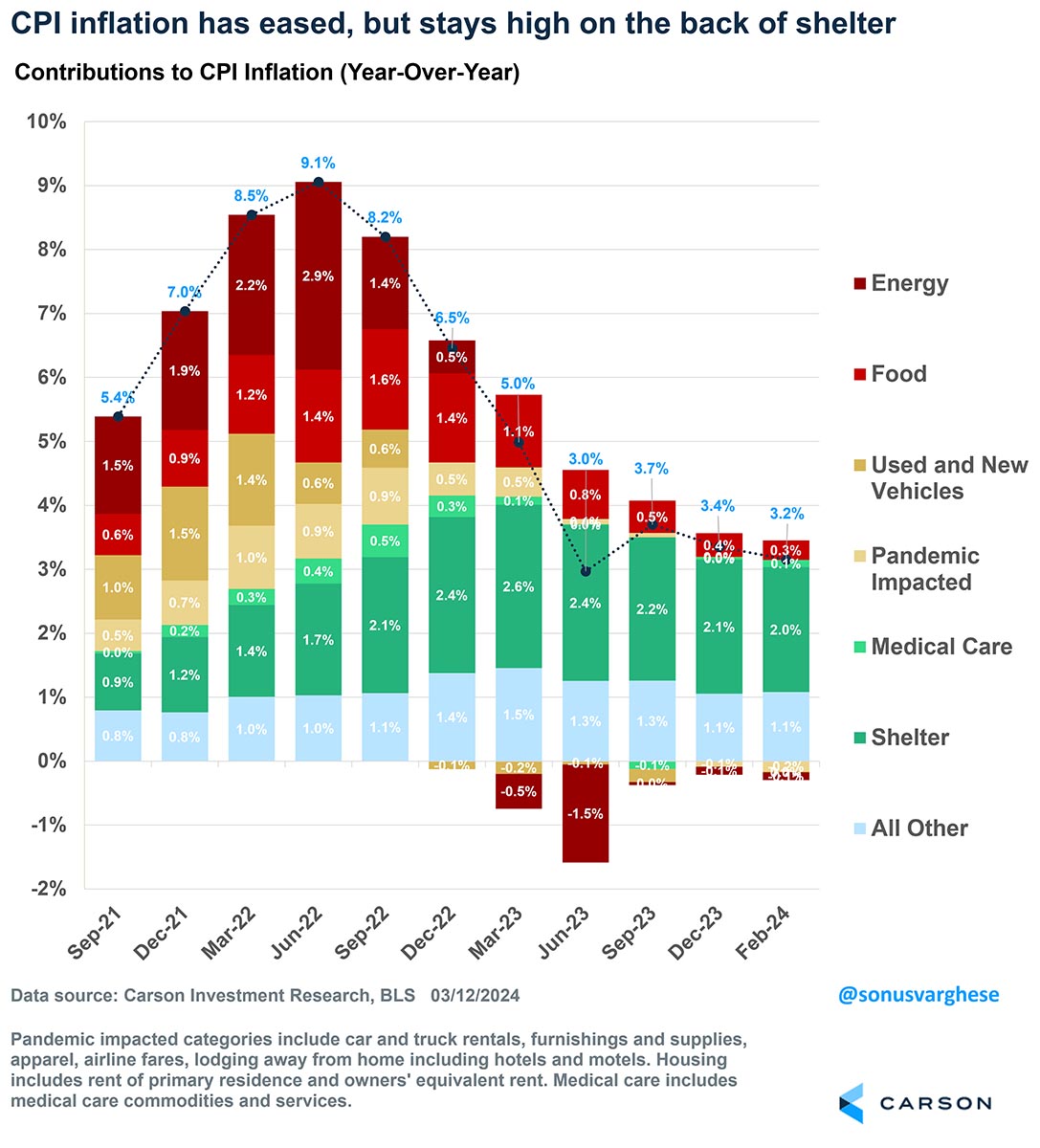

According to the Bureau of Labor Statistics, inflation ticked up in February:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4 percent in February on a seasonally adjusted basis, after rising 0.3 percent in January, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.2 percent before seasonal adjustment.

The increase was mostly due to an increase in gas prices but especially shelter. Food and other commodities prices were unchanged. Says Carson Investment Research (via The Big Picture):

If you exclude shelter, headline inflation is running at a 1.8% annualized pace over the last 6 months, similar to its year-over-year increase.

Source: Carson Investment Research, BLS 03/12/2024

A lot of this is driven by the methodology by which shelter inflation is calculated:

As I’ve explained previously, a big part of shelter is “Owners Equivalent Rent” (OER). It is the implicit price at which homeowners are assumed to rent their homes to themselves. It’s derived from market rents of single-family homes and has nothing to do with home prices, or mortgage rates. It makes up 27% of the CPI basket, which is ironic because a large majority of American households own their homes (66%) and do not experience anything like OER. Meanwhile, regular rents of primary residences make up 7% of the CPI basket. So, you can see how shelter can have an outsized impact on CPI inflation.

In response to the CPI report, on Wednesday, the Federal Reserve issued issued its FOMC statement:

Recent indicators suggest that economic activity has been expanding at a solid pace. Job gains have remained strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals are moving into better balance. The economic outlook is uncertain, and the Committee remains highly attentive to inflation risks.

As a result, there will be no change to interest rates.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.

Our Printing Outlook 2024 report is now available for download! The brand-new report provides detailed analysis of the latest WhatTheyThink Printing Industry Survey, the latest industry economic data and macroeconomic trends, as well as industry and cultural technological trends to look out for in 2024 and beyond. Purchase now!