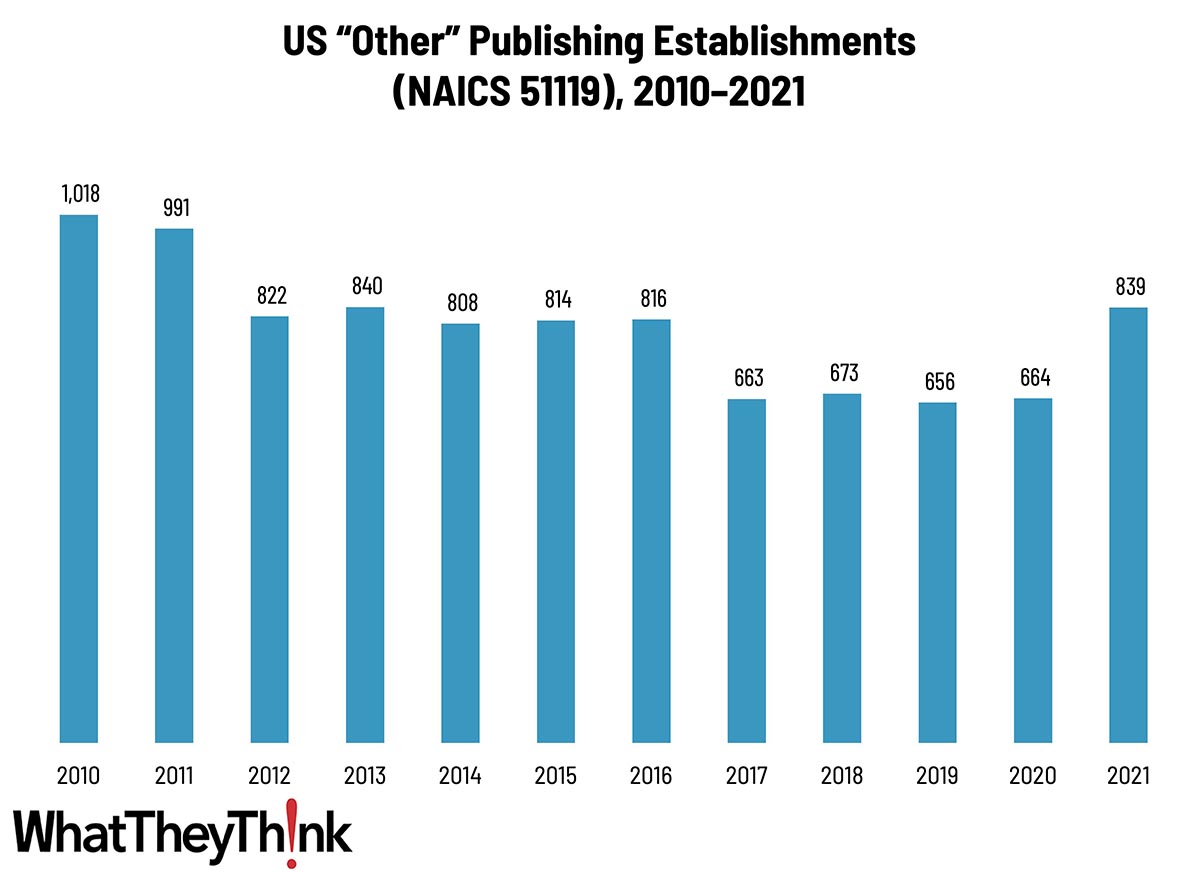

Our Friday data slice’n’dice look at the latest edition of County Business Patterns has been detailing the publishing industries. As 2021 began, there were 839 establishments in NAICS 51119 (Other Publishing), a net decrease of 18% since 2010—but a 26% increase in the past year. Wha?

This category includes—as the name suggests—a mix of assorted types of publishers. The official description of this NAICS from the Census Bureau identifies it thusly:

This industry comprises establishments known as publishers (except newspaper, magazine, book, directory, mailing list, and music publishers). These establishments may publish works in print or electronic form. (This category includes publishers of art prints, greeting cards, calendars, and others.)

Greeting card publishers are given their own sub-NAICS (511191), which we’ll look at separately in our next slice’n’dice installment.

A lot of the applications produced by businesses in this catchall still remain popular print items, even if the method of their production may have changed, which is why establishments have only modestly declined over the past decade, and even increased in the past year. Some general trends that affected these businesses:

- Print postcards have been replaced by posting pictures of trips and events on social media sites.

- Art prints are increasingly produced digitally on inkjet equipment like Epson SureColor units.

- Wall and “page-a-day” calendars are still strong, despite electronic calendars.

- Printed maps are almost entirely replaced by GPS/Google Maps, but there is somewhat of a market for historical maps.

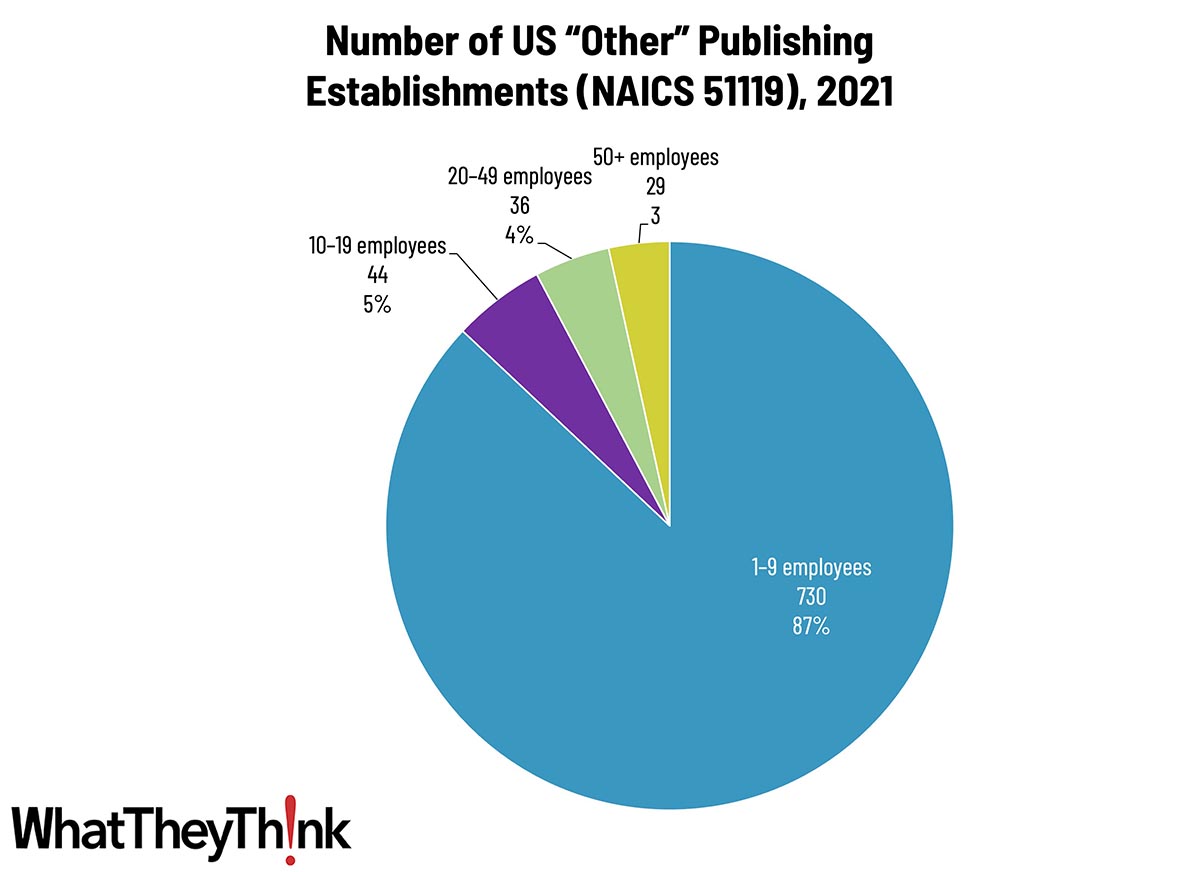

These publishing establishments are concentrated at the lower end of the employee-count spectrum. Small publishers (1 to 9 employees) comprise the bulk of the establishments, accounting for 87% of all establishments, with the other three size classifications just about equal.

These counts are based on data from the Census Bureau’s County Business Patterns. Throughout this year, we will be updating these data series with the latest CBP figures. County Business Patterns includes other data, such as number of employees, payroll, etc. These counts are broken down by commercial printing business classification (based on NAICS, the North American Industrial Classification System). Up next:

- 511191 Greeting Card Publishers

- 511199 All Other Publishers

These data, and the overarching year-to-year trends, like other demographic data, can be used not only for business planning and forecasting, but also sales and marketing resource allocation.

This Macro Moment…

The Bureau of Economic Analysis released its second estimate of Q4 GDP

Real gross domestic product (GDP) increased at an annual rate of 3.2 percent in the fourth quarter of 2023, according to the “second” estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 4.9 percent.

The GDP estimate released today is based on more complete source data than were available for the “advance” estimate issued last month. In the advance estimate, the increase in real GDP was 3.3 percent. The update primarily reflected a downward revision to private inventory investment that was partly offset by upward revisions to state and local government spending and consumer spending.

Source: BEA

As for what Q1 2024 is looking like, Calculated Risk rounds up some forecasts:

- Bank of America: 2.5% q/q saar

- Goldman: 2.2% (qoq ar)

- Atlanta Fed: GDPNow: 2.1%

Our Printing Outlook 2024 report is now available for download! The brand-new report provides detailed analysis of the latest WhatTheyThink Printing Industry Survey, the latest industry economic data and macroeconomic trends, as well as industry and cultural technological trends to look out for in 2024 and beyond. Purchase now!