I’ve looked at clouds from both sides now

From up and down and still somehow

It’s cloud illusions I recall

I really don't know clouds at all

—Joni Mitchell

Drawing on eight years’ worth of Print Business Outlook surveys, our “Tales from the Database” series looks at historical data to see if we can glean any particular hardware, software, or business trends. This issue, we turn our attention to software—specifically, migration to the cloud.

These surveys form the basis of our annual Printing Outlook reports, the most recent of which (2024) was just published in January. In every survey, we ask a broad cross-section of print businesses about business conditions, business challenges, new business opportunities, and planned investments. In our Printing Outlook reports, we tend to focus (obviously) on the most recent survey data, occasionally looking back a survey or two to see how these items have changed in the short-term. Plumbing the depths of our survey database can give us a better sense of how these trends have changed since the mid-2010s.

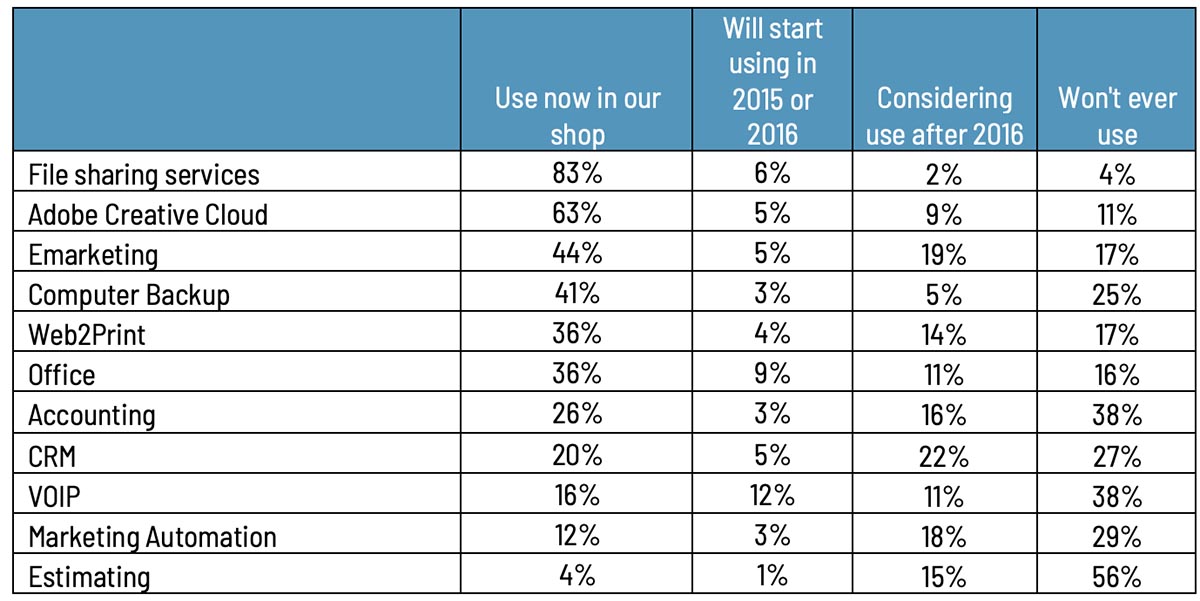

It was about 10 years ago that we all first started hearing about “the cloud,” but even then it was not totally new concept. In the 1990s, various companies attempted to launch graphic design suites that were “cloud-based,” but failed to gain traction. It was an idea ahead of its time, and it wasn’t really until Adobe launched its subscription- and SaaS-based Creative Cloud in July 2013 that the graphic arts markets were ready for it—not necessarily eager, but at least ready. Back in Fall 2015, we had asked about current and anticipated use of cloud computing for various plant functions, and Table 1 is of historical interest in that so many functions fell reasonably high on the “won’t ever use” list. Never say never.

Table 1: “Use of Cloud Services”

Source: WhatTheyThink Printing Outlook Survey, Fall 2015

Our conclusion at the time was:

It’s really about not seeing the value proposition of cloud services, combined with a reluctance—certainly when it comes to sensitive things like accounting—to not have files and other resources stored locally. A lot of it is just force of habit and one of those “if it ain’t broke don’t fix it” situations. And, of course, it’s a question of education.

Attitudes have changed a bit in the past nine years—but it was also a case of being forced into cloud migration simply because of declining support for on-premises solutions.

Cloud Challenges

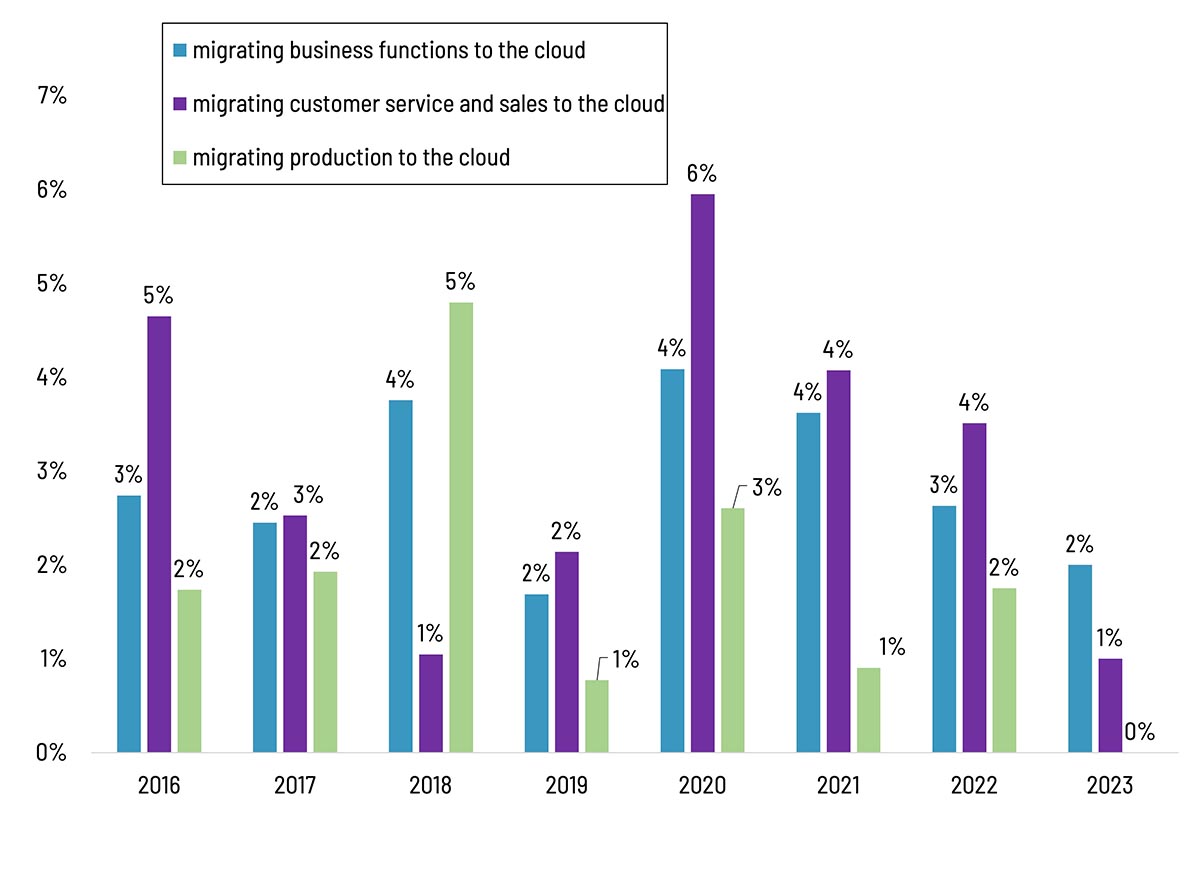

Let’s turn now to some decidedly more recent data. Are print businesses challenged by cloud migration? As Figure 1 shows, not too much. “Migrating production to the cloud” has been at 1–2% of respondents throughout the 2016–2022 period, and in the results of the latest survey it has dropped to 0%. “Migrating customer service and sales to the cloud” has been a little noisy, being a challenge for 5% in 2018, peaking at 6% in 2020 (likely the result of the abrupt need to support “work from home” during the pandemic), and then dropping in the three years since. “Migrating business functions” has stayed in the 2–4% range fairly consistently.

Figure 1: “Migrating to the cloud” as a business challenge

Source: WhatTheyThink Printing Outlook Surveys, 2016–2023

Business Opportunities

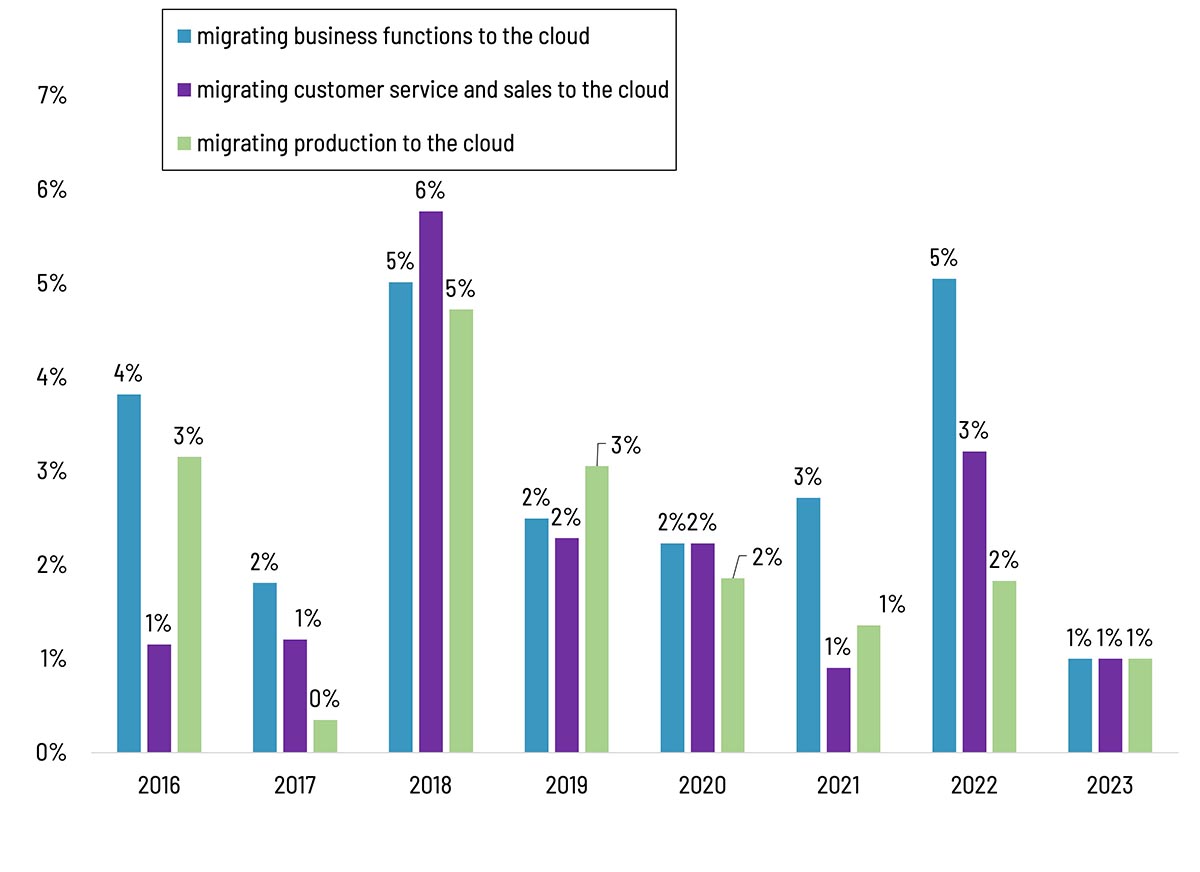

What about the perception of cloud migration as a business opportunity? As Figure 2 shows, print businesses are not too hot on it. “Migrating production” never exceeded 3%, “migrating business functions” never exceeded 5%, and “migrating customer sales and service” was in the 1–3% range, except for a spike in 2018. That the latter didn’t spike in 2020 along with the corresponding challenge suggests that, when it comes to cloud migration, it’s just one of those things that “you gotta do” because there is little alternative. There is no real perception of—as we said in 2015—any overwhelming value proposition, it’s just “the way things are.” For example, it’s likely that no one is particularly excited by Adobe Creative Cloud vs. the original Creative Suite; there just is no really viable on-premises alternative.

Figure 2: “Migrating to the cloud” as a business opportunity

Source: WhatTheyThink Printing Outlook Surveys, 2016–2023

Planned Investments

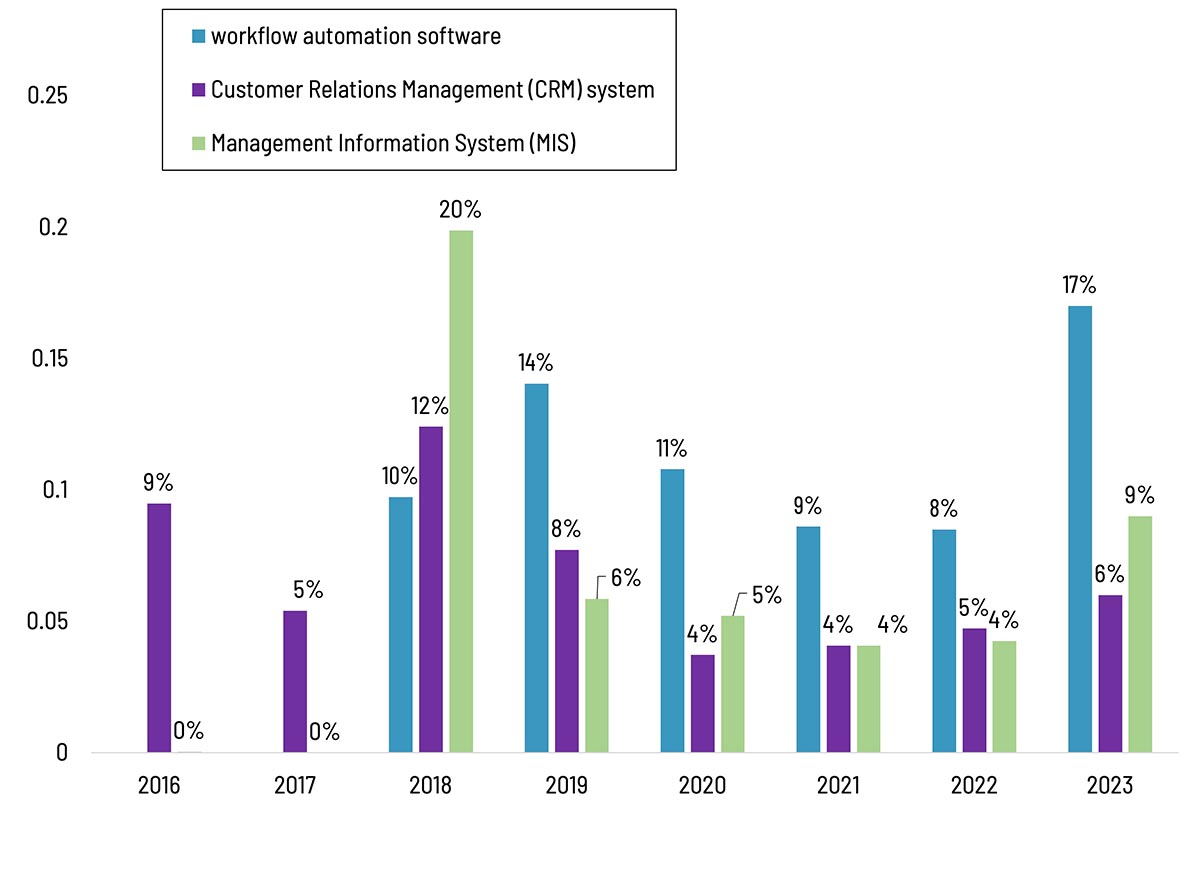

As per Figure 3, 2019 was the year when investment in MIS software spiked (in Fall 2018, 20% said they planned to invest in an MIS in the next 12 months) and it looks as if 2024 is going to be the year for investment in automation software.

Figure 3: Selected software investments

Source: WhatTheyThink Printing Outlook Surveys, 2016–2023

For the printing industry, software has never been as sexy as equipment; you rarely see press releases in which shop owners pose proudly in front of a software interface the way they stand in front of a newly installed press. But more shops are starting to twig to the fact that software is becoming an essential backbone for the business, especially where automation and streamlining of functions are concerned. The cloud is a kind of “meh” issue, insofar as it is becoming the dominant way that software is acquired these days, although not everyone is a fan of the SaaS model. Twenty-five years ago, they probably would have been as excited over 3.5-inch diskettes.