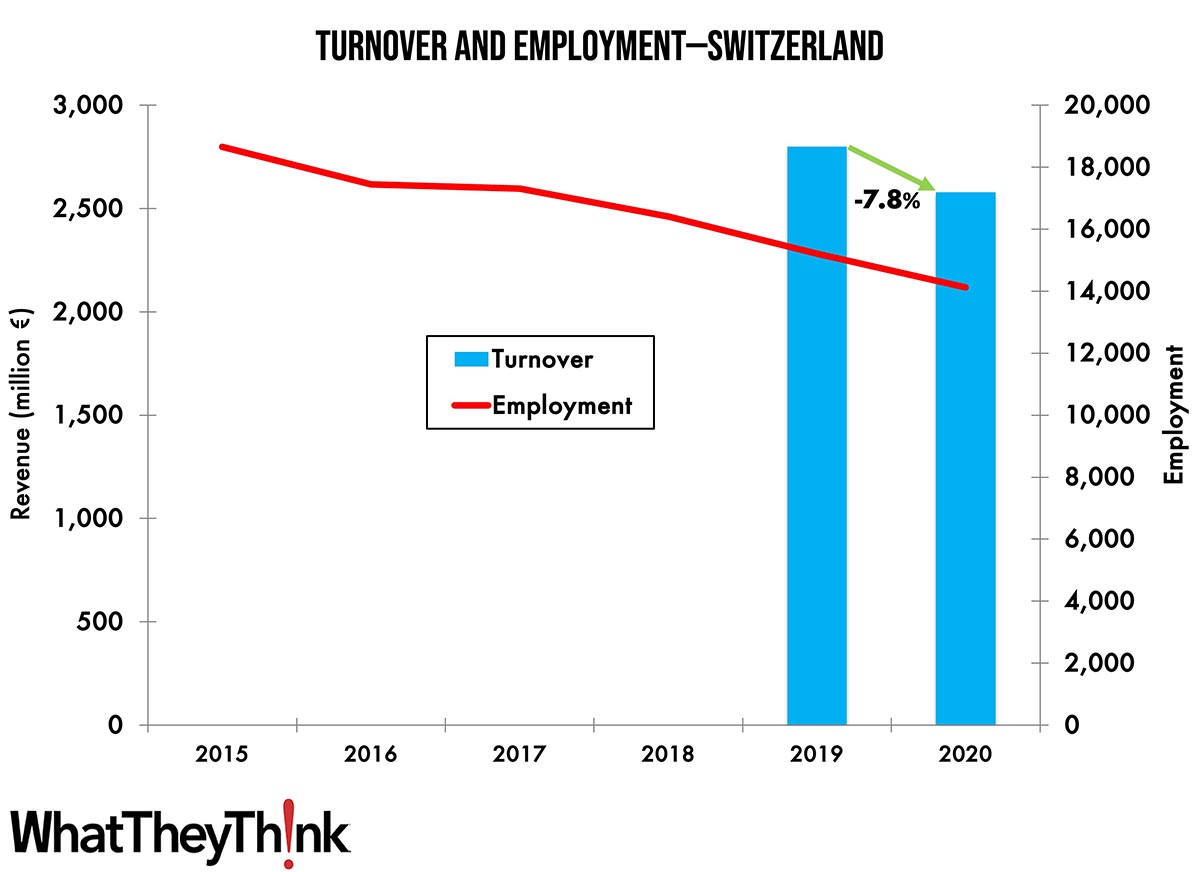

Eurostat only offers limited turnover (revenues) data for commercial printing for Switzerland and only the years of 2019 and 2020 are reported. Fortunately, this allows for a look at the declines at the onset of the pandemic. 2019 turnover stood at €2.8 billion. In 2020, the turnover dropped by 7.8%, or to €2.58 billion, due to the pandemic, a moderate rate compared to other countries in Europe. Keep in mind that Eurostat data is reported in euros, while rates in Swiss francs can have developed slightly differently.

The number of persons employed showed a steady decline from 2015 to 2019 with an average annual decline of 4%, a relatively high rate only seen in the Nordic countries. It is a combination of industry contraction and ongoing productivity improvements. The decline accelerated to 7.1% in 2020 at the onset of the pandemic, close to the rate of the drop in turnover in 2020.

Source: Eurostat 2022 and digitalprintexpert.de

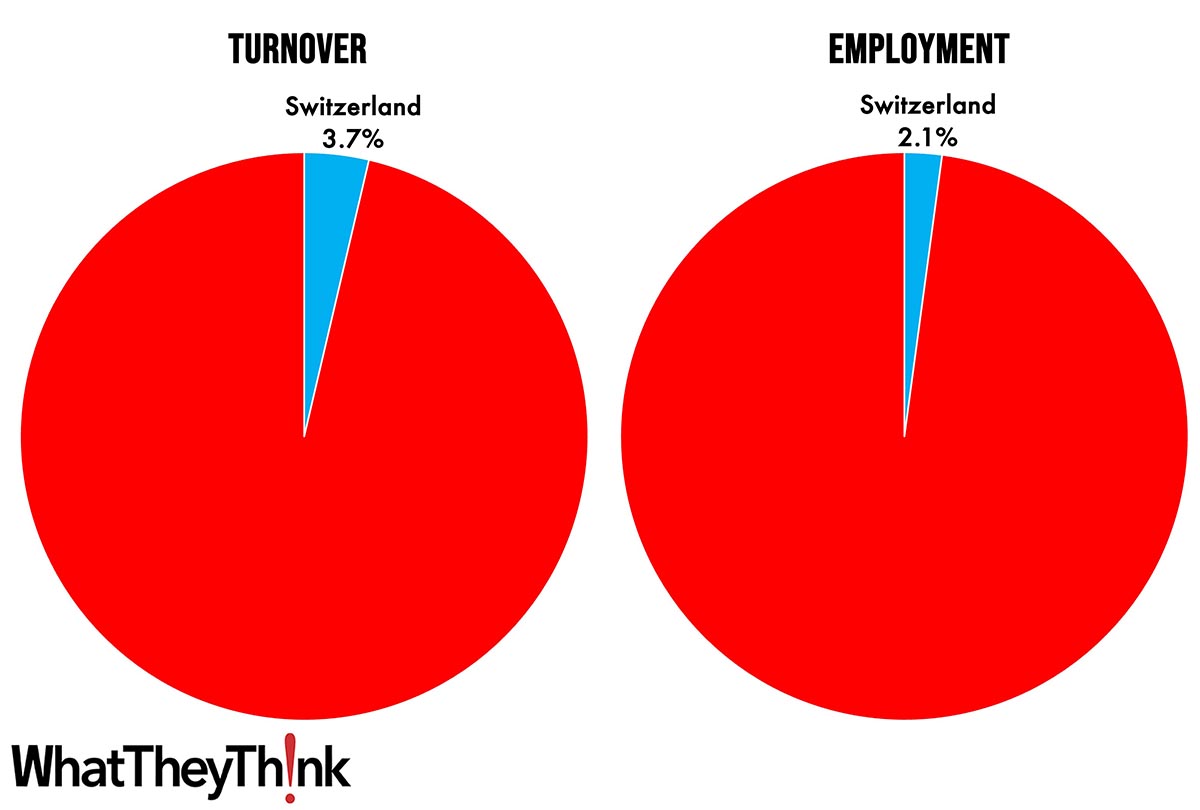

Overall, the printing industry in Switzerland accounted for 3.7% of the total European printing industry in 2020, falling between the Netherlands and Belgium. In terms of the number of employees in print, the European share of Switzerland is markedly lower at 2.1%.

Switzerland—Share of Turnover and Employment in Commercial Print in Europe, 2020

Source: Eurostat 2022 and digitalprintexpert.de

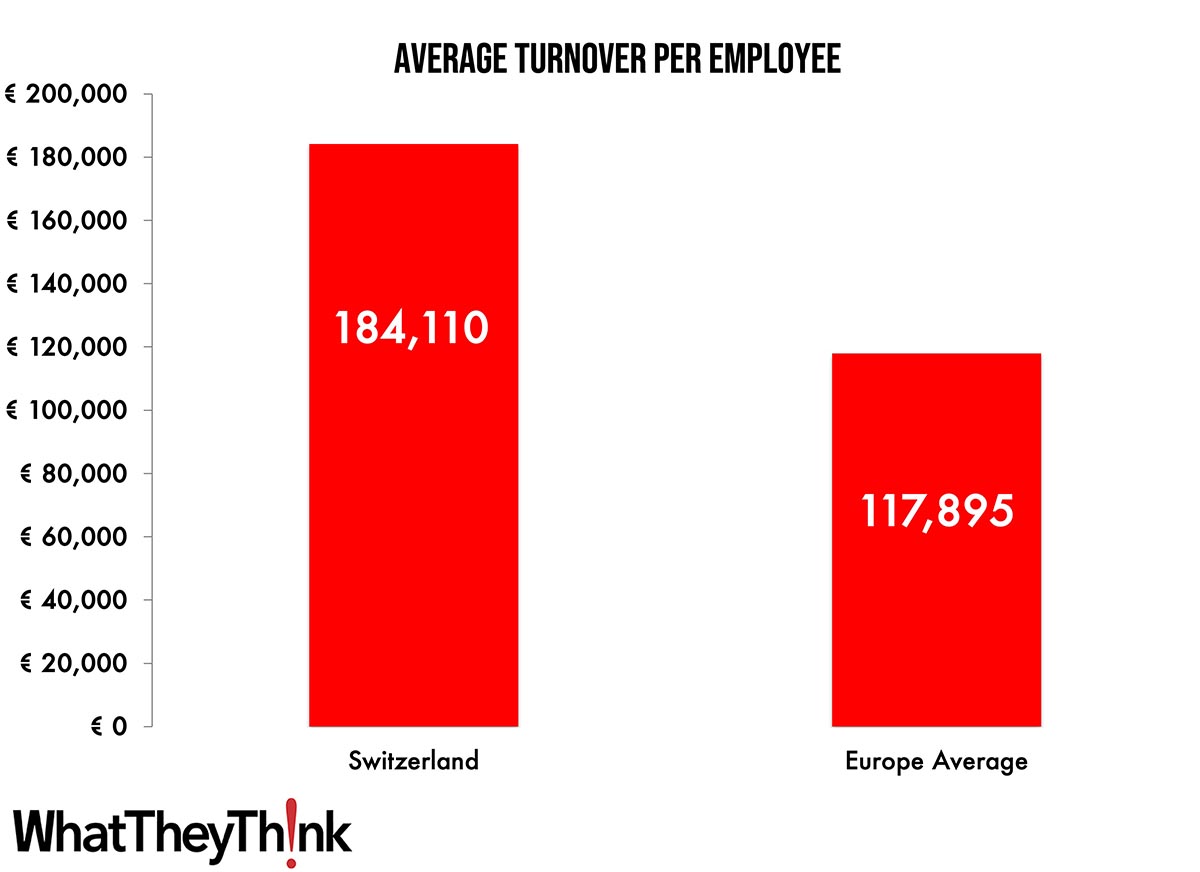

Based on Eurostat numbers for turnover and the number of employees in the printing industry, the average annual turnover per employee can be calculated. Not surprisingly, the €184,110 for 2019 is among the highest in Europe and only Norway, Austria, and Belgium are close. The employment number does include part-time employees and owners with a salary. The year 2019 has been chosen as a basis for the comparison as 2020 could have been impacted by the COVID-19 pandemic and the differing speeds the labour markets reacted.

Source: Eurostat 2022 and digitalprintexpert.de

Please keep in mind that the data is based on Eurostat numbers for printing and related services (complemented by some estimates), which consists mainly of commercial and publishing printing, including prepress and finishing companies. That means that packaging, data center, direct mail print, or quick print/copy shops are not included or only on a limited basis. In-house print/CRD are not included at all. Europe as used in the series of articles includes the EU countries plus Norway, Switzerland, and the UK. If you have questions about sizing the European printing industry or need clarification, please contact me at [email protected].

This series on the turnover and employment development in commercial print in Europe will be continued. Next time we will have a look at the printing industry in Romania.