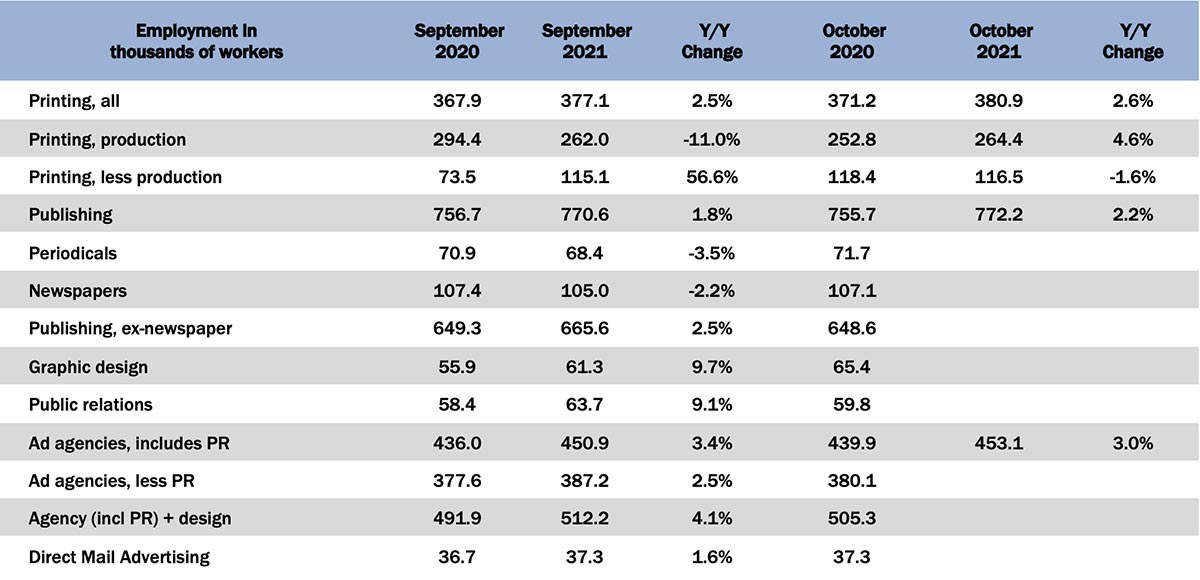

Last month, we remarked that we may be climbing out of the employment holding pattern that persisted through the summer, and that climb continued through October. Overall printing employment was up +1.0% from September, with production employment up +0.9%, and non-production printing employment up +1.2%. If you look at the year-over-year changes, early 2021 saw a return of the workers that had been shed or furloughed during the pandemic, which had started to slow over the summer and continued through the fall. October 2021 production employment was up +4.6% over October 2020, with non-production employment lagging, in this case by being down -1.6% from October 2020.

Publishing employment had been improving slightly, although general publishing employment was only up +0.2% from September. Digging into the specific publishing segments (the reporting of which lags a month), things don’t look quite so good: from August to September, periodical publishing employment declined -0.6% while newspaper publishing employment declined -0.3% (it had been up +0.9% from July to August).

The creative markets continue to be a mixed bag. Graphic design employment was down -0.5% from August to September, but ad agencies (less PR) were unchanged. PR continued to be the star of the show, with September employment up +1.4% from August. In August, direct mail advertising employment took a beating but has rebounded substantially: it’s up +4.8% in September, the highest gain all year.

In the general October employment report, said the BLS:

Total nonfarm payroll employment rose by 531,000 in October, and the unemployment rate edged down by 0.2 percentage point to 4.6 percent… Job growth was widespread, with notable job gains in leisure and hospitality, in professional and business services, in manufacturing, and in transportation and warehousing. Employment in public education declined over the month.

… The change in total nonfarm payroll employment for August was revised up by 117,000, from +366,000 to +483,000, and the change for September was revised up by 118,000, from +194,000 to +312,000. With these revisions, employment in August and September combined is 235,000 higher than previously reported.

Some other quick hits from the October report:

- The labor force participation was unchanged at 61.6%.

- The employment-to-population ratio increased from 58.7% to 58.8%.

- The number of persons working part time for economic reasons was basically unchanged at 4.423 million, close to the pre-pandemic level of 4.4 million.

- The 25 to 54 participation rate increased from 81.6% to 81.7%.

Despite everyone in the mainstream media being laser-focused on inflation, this was a very strong employment report and is good news—although with the Omicron variant now making its way around the globe, and COVID cases on the rise again, we may be in for a rough winter.

Calculated Risk adds, “This report (and the previous reports) show the impact of the pandemic. When COVID cases are rising sharply, the economy slows, and when COVID cases are falling, the economy picks up. There are other factors, but as the FOMC noted this week: ‘The path of the economy continues to depend on the course of the virus.’”