Quarterly Services Survey, US Bureau of the Census

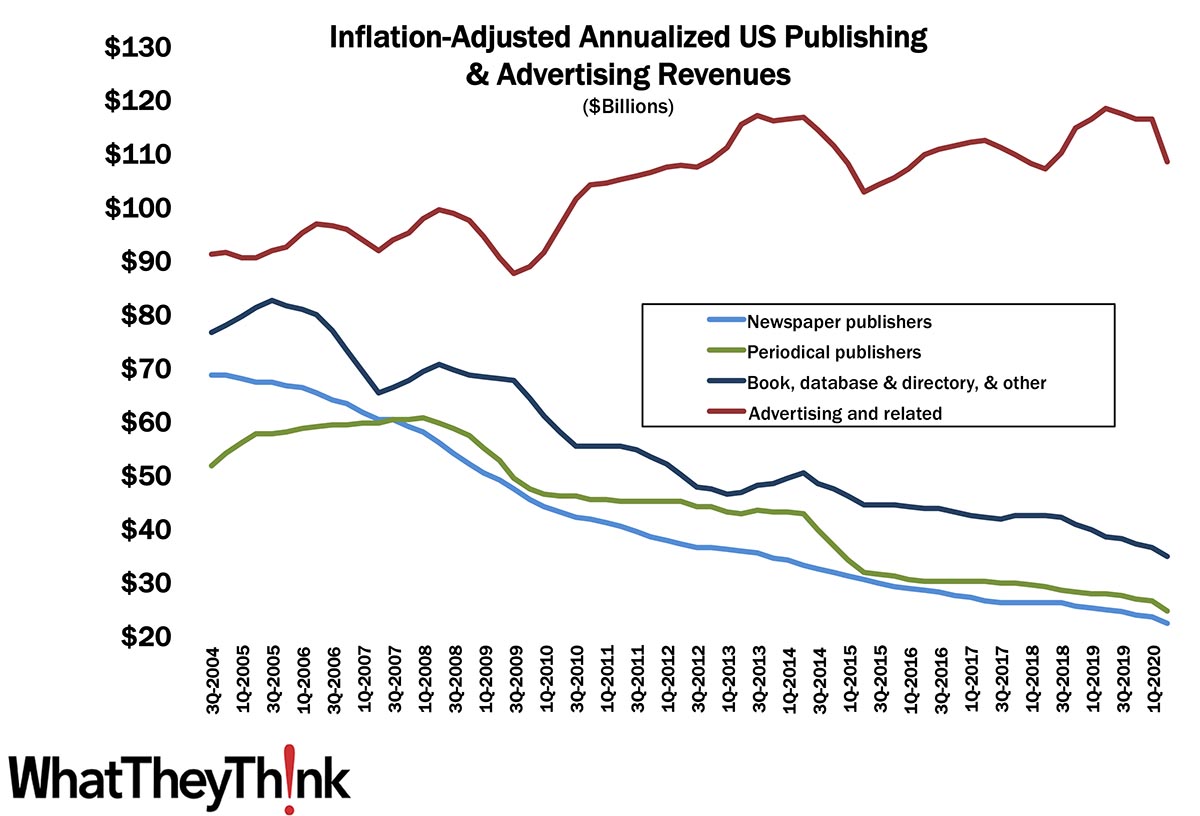

As well all know, Q2 2020 had been a bad one for the economy in general and as we see from publishing and advertising revenues (via the Quarterly Services Survey), it was not great for the creative markets we track either. In the case of publishers, it was just a quickening of a trend that started almost 20 years ago. In the case of advertising, that was an abrupt fall off a cliff. Specifically:

- Newspaper publishers’ revenues dropped from $23.2 billion in Q1 to $22.1 billion in Q2. That was a bit more drastic than the drop from $23.6 billion in Q4 2019 to Q1’s $23.2 billion. Still, that’s just about half of what newspaper publishers’ revenues had been a decade ago. The story this year for newspapers has been a drying up of local advertisers as businesses have been closed, or tentatively opening, or going out of business, or are in danger of going out of business.

- Periodical publishers have been in pretty much the same (sinking) boat, although the fall was a lot more abrupt from Q1 to Q2: from $26.2 billion to $24.4 billion. As you can see, periodical publishers’ revenues have been less of a steady decline and more of a pattern of sharp decline, plateau, sharp drop, plateau, and now, slight sharp drop. Will that drop continue? If history is any guide, yes. BoSacks had a good article earlier this week in which he identified two publishers whose proactive leaders are going all Admiral Farragut and declaring “Damn the torpedoes! Full speed ahead!”* As Dr. Joe Webb used to often comment after various economic downturns, the businesses that hunker down and try to wait out a storm are usually the ones that don’t recover, or don’t receiver as strongly as more active businesses.

- Book publishers’ revenues look like a mashup of both newspaper and periodical publishers: less of a steady decline, but also less of a longish steady plateau. The revenue drop from Q4 2019 to Q1 2020 was $37.0 billion to $36.3 billion and then down to $34.5 billion in Q2. We expect Q3 to look a little better, as book sales have been healthy during the lockdown period.

- As for advertising, they’ve been on a bit of a rollercoaster ride over the past two decades. The $14.6 billion drop from Q2 2014 to Q2 2015 was pretty dramatic, and reflected, following the Great Recession, that marketers had learned what they could do with social media and didn’t need (or didn’t think they needed) traditional advertising. (This tends to be a consequence of economic downturns.) Advertising revenues only surpassed Q2 2014 once again (in Q2 2019 at $18.1 billion), and things had been relatively stable until the sharp drop from $116.1 billion to $108.1 billion. Advertising may pick up a bit in Q3, but it will depend on the health of individual sectors of the economy—hospitality is struggling, retail is hit or miss (big box stores a hit, mom and pops a miss), for example. Advertising and marketing are great ways to communicate with customers and attempt to lure the leery, either by actively promoting the safety measures they have in place, curbside/contactless pickup options, or even special deals. Of course, if there is a stark choice between keeping the lights on or advertising, well, the ad budget is going to get slashed.

For some of these markets (or, to be specific, some companies within these markets, because every industry has leaders as well as laggards), the COVID pandemic is pushing them faster down the road they have been on, and for others, it has opened up a yawning chasm in the highway, and for yet others sent them off on a detour that will hopefully get them back on the main road.

*We acknowledge that this is most likely an apocryphal quote. But still.