Printing and printed packaging is a collection of many operations serving companies and individuals across the world. Today printing has become just one of a group of ever-broadening channels of communication, transaction, and information. It competes with other media as the preferences of end users change and new technologies come on stream.

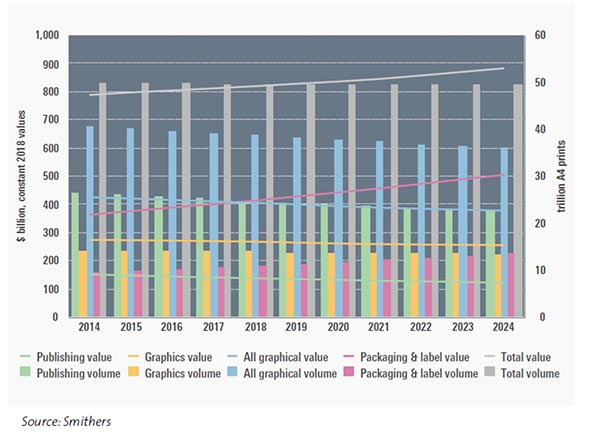

Printing and printed packaging remains an important industry sector in 2019, with a value of more than $826 billion in sales supporting paper and substrate suppliers, ink makers, plate and cylinder suppliers, and high-tech printing equipment manufacturers. In 2019, the global market for all print and printed packaging output is $826.5 billion, printing the equivalent of just under 49.5 trillion A4 prints, according to Smithers’ new report The Future of Global Print to 2024. This results in the printing of just over 2 trillion square meters of substrates, as some is printed both sides, which equates to 281 million tons of paper, board, and other print substrates.

Print and packaging companies paid some $39 billion for 3.5 million tons of printing inks, toner, coatings, and varnish. New pre-sensitized litho plate volume totaled 668 million square meters of metal plates with 6.1 million square meters of photopolymer flexo plates. The capital spent on new printing equipment is $17.4 billion, with additional expenditure on second-hand equipment, as well as on IT, communications equipment, and various software.

The value of global print market is 4.9% higher than 2014, but the total print volume is falling from nearly 50.0 trillion A4 prints to under 49.4 trillion A4s in 2024. In the five years to 2024, print and increasingly printed packaging value will grow by an average CAGR of 1.3% through changes in product mix to higher-value products with more relevance and value to the final consumer. The figure below shows the development of the global market from 2014 to 2024.

Global publication, commercial graphics, and printed packaging markets, 2014–2024 ($ billion, constant 2018 prices and exchange rates; trillion A4 prints)

Regional Trends

Graphics and publishing will fall, particularly in the more developed print markets of North America, Western Europe, Australasia, and some Asian countries, notably Japan. Packaging and labels are growing across the world, in both volume and value.

Despite many positives on a global basis (including printed packaging), the headlines in the printing trade press in Europe and North America are generally gloomy. They report plant closures and declining demand patterns with price increases of ink and paper. At the macro level, there are winners and losers, clearly demonstrated when the CAGRs of print categories and different regions are compared.

The growth in packaging, digital printing, and in less developed printing countries and regions is in stark contrast to struggling mature markets: in North America and Western Europe, some analog printing, and in graphical applications.

Innovative companies are proving there are still major opportunities to succeed in printing in 2019, with many investing in new color inkjet presses as the technology is proven to be capable of competing in mainstream markets with analog alternatives, or in hybrid configurations.

Print Industry Restructuring

There has been painful industry restructuring across the world as the millions of print-for-profit shops adjust to meet their customers’ changing requirements and explore new opportunities and routes to market. There has been growth in the online print sector, where companies use sophisticated web-to-print (and increasingly web-to-packaging/labels) portals to simplify ordering. This has helped printers broadened the range of products and services they provide to customers.

Many print suppliers are partnering with other service providers to solve customer pain points and to reduce the time between order and delivery, which is an increasingly important metric.

Evolving Print Technology

Printing technology continues to develop for digital and analog presses, and for print finishing equipment, which is starting to digitize. Automation is minimizing makeready time and waste with fast set-ups speeding delivery times and allowing print suppliers to become increasingly agile.

Digital printing is disrupting established print and printed packaging supply chains with workflow software that is smoothing administration and prepress and better control routines that are reducing non-productive time.

Changing Purchasing Patterns

Another driver that is reducing print volume is changing purchasing patterns that eliminate supply-chain waste. Publishers are using demand forecasting to determine the optimal order quantity to eliminate unsold copies, while some book printers will link to a publisher’s website and print and fulfill individual orders on-demand, eliminating waste.

In flexible packaging, the fast-growing ePac product offering is disrupting analog producers by using digital printing technology with thermal laminating to offer fast turnaround of small-to-medium runs. This new service is being adopted by small artisan brands to improve their product offering and by larger users to change ordering patterns from one big order to several smaller orders, allowing for change in pack design. ePac is pioneering the adoption of digital printing in flexible packaging as it opens new plants across North America and moves into Europe.

Digital vs. Print Output Trends

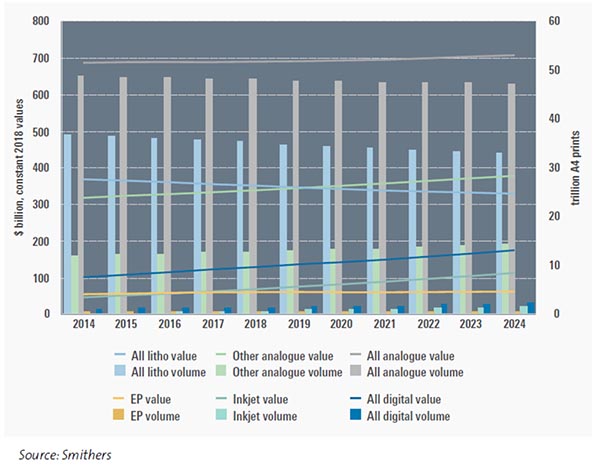

Across the world, digital print methods are generally faring much better than analog alternatives. In 2019 digital print methods account for just 3.1% of all print and printed packaging volume, but 16.2% of the market value, which will rise to 19.5% by 2024 as new applications show strong growth predicted in packaging.

New equipment and improved workflows will help to boost this digital transformation. The higher value is attractive to print service providers and to equipment and consumable manufacturers who are investing billions in improving digital print, especially with the new inkjet technologies coming to market. The growing importance of digital printing in the overall print and printed packaging markets is shown in the figure below.

Global trends in analog and digital printing output, 2014–2024 ($ billion, constant 2018 prices and exchange rates; trillion A4 prints)

Increasingly printers are using both digital and analog print methods to satisfy customer requirements efficiently, and leverage their established relationship to offer new services.

For more information on The Future of Global Print to 2024, download the brochure at https://www.smithers.com/services/market-reports/printing/the-future-of-global-printing-to-2024.