Have you noticed the many new types of packaging that you are seeing in your last visit to the supermarket? While it may be difficult to differentiate the packaging that is digitally printed from conventional methods, with breakthroughs in material science, there are increasingly new types of packaging making to the shelves that are much easier to distinguish. For example, according to the Smithers Pira report, The Future of High Barrier Pouches to 2020, global high-barrier pouch packaging totals approximately 49 billion units and consumed 319,000 tons of polymer materials in 2015. Global high-barrier pouch consumption is forecast to grow at a compound annual growth rate (CAGR) of 6.1% to 2020, reaching 69 billion units and a market value of almost $3.0 billion.

All flexible packaging films have some level of permeability to oxygen, carbon dioxide, and water vapor. It is rarely economical to use a single film as a barrier because of the large wall thickness and higher cost that would be required. Where a barrier is required, multilayer film structures are commonly used. They typically incorporate a base film—which itself could provide some barrier protection—and either a higher barrier polymer or a barrier coating.

There is rapidly increasing demand for packaging materials that give even greater protection to their contents. This is especially noticeable in the food, beverage and pharmaceutical industries. As plastics have become more and more common, concerns have arisen about their ability to allow the exchange of gases and vapours that can compromise the quality and safety of packaged products.

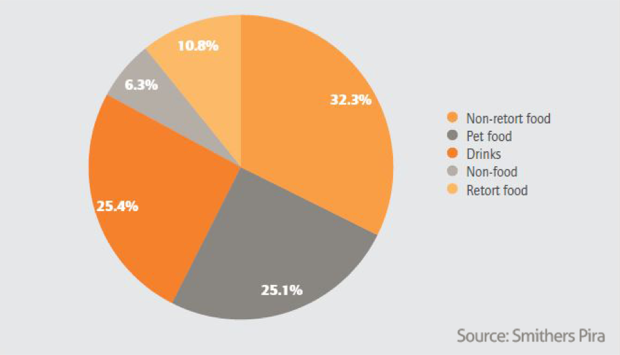

Food applications dominated global use of high-barrier pouches in 2014

High-barrier pouch demand is being driven by several factors including the ability to incorporate value-added features such as resealable zippers and sliders, spouts and handles. Technology improvements such as faster machinery speeds and reduced heating times in retort applications are also playing a role. Finally, there are ongoing improvements in materials such as higher barrier film substrates and coatings with increased heat tolerance and strength.

Food packaging opportunities

Food markets (retort and non-retort) are forecast to show the highest growth rates during the period 2015–20 for high-barrier pouches. Retort pouches undergo a sterilization process that gives their contents an extended shelf life. Non-retort pouches are for food items that do not require sterilization. Non-food markets are expected to develop from a low base level, with drinks and pet food markets growing at the slowest pace.

Non-retort food pouch applications includes fresh and processed meat, dried food, breakfast cereals, snack food and confectionery, dairy products, baby food, powdered instant drinks, hot drinks, fruit compote, ketchup and mayonnaise. Non-retort food markets for high-barrier pouches have been established for a longer period of time than retort high-barrier pouches. Non-retort high-barrier pouches are nevertheless predicted to grow during the forecast period at a rate above the high-barrier pouches market average rate. Fresh and processed meat, snack food and confectionery and dairy products offer good growth potential for non-retort high-barrier pouches.

New applications

Juice drinks is the largest area of application for high-barrier pouches in the beverages category, followed by wine. The highest growth has been in fruit compotes and frozen alcoholic cocktails. There has been a slower than expected uptake in flexible pouches by soft drinks producers over the five-year period to 2014. Beverage producers believe it is difficult to convey a premium image with a pouch container that is becoming ubiquitous across many different product categories.

Wine is now available in flexible pouches often employing a barrier coating and bag-in-box packs. Single-serve wine demand is growing and pouches offer a light, portable and convenient solution, quality, ease of use and environmentally friendly packaging.

Stand-up pouches

Stand-up pouches also possess advantages that enable them to replace conventional packaging such as glass bottles and metal tins.

The advantages that are often claimed for barrier pouch packaging solutions over traditional packaging include reduced retort and sterilization time; energy savings; better preservation of taste and nutrition; lightweight packaging material; economical transport; strength and durability; and better shelf appeal.

In addition, stand-up pouches generally have a superior carbon footprint compared with rigid plastics when the complete supply chain is taken into account. Stand-up pouches also provide all-round graphics and consist of only one packaging component.

Growth in Asia-Pacific

North America is the largest regional market for high-barrier pouch packaging with a 2014 volume share of 31.9%, followed by Asia Pacific with 27.1%. The high share of the Asia Pacific region is mainly attributable to the well-established Japanese high-barrier pouch packaging market. Compared to Japan, the rest of Asia Pacific is less advanced in terms of high-barrier pouch packaging demand, but is growing at a faster rate.

The North American and European retort packaging markets have been slower to develop than in Japan due to competition from the well-established frozen and canned product industries. In Japan, where these industries were smaller, the development of the retort pouches has been stronger. Furthermore, the widespread adoption of the microwave oven and ever-increasing time pressure on consumers are stimulating demand for convenient microwavable ready meals in pouches.

While there is overall growth expected in the high-barrier pouches market in 2015-20, the more mature markets of Western Europe, North America and Japan are forecast to grow sales at less than global market average rates during the forecast period.

Asia Pacific countries such as China and India, as well as South and Central America and Turkey, are forecast to grow sales at higher than market average rates. Eastern European demand for high-barrier pouches, on the other hand, is likely to be restrained by a sharp slowdown in the Russian economy.

These and other key trends are covered in more detail in Smithers Pira’s The Future of High Barrier Pouches to 2020 report.