Booming global demand will drive expansion in the world packaging market through 2020, according to analysis from Smithers Pira.

In its flagship report, The Future of Global Packaging to 2020, Smithers Pira data charts how a market value forecast at $839 billion in 2015 will undergo healthy year-on-year growth at 3.5%, reaching $998 million in 2020.

Expansion will not be uniform, however. Emerging countries will expand beyond the market average, creating new opportunities for material suppliers and converters. Simultaneously, more established regions are undergoing significant business and demographic changes that will transform value chains in the packaging segment.

In generating its data on global packaging growth Smithers Pira identified and analyzed the differing impacts such trends will have on key packaging segments. The outlook for these across the study period is summarized here.

Rigid Plastics Will Increase Market Share

Rigid plastic will experience the highest annual growth across the study period—4.4% year-on-year. This can primarily be attributed to the popularity of plastics, like polyethylene terephthalate (PET), as substitutes for heavier metal cans and glass bottles formats. As lightweight options, plastics meet the dual goal of reduced material consumption and cost and a reduced CO2 footprint during transit.

This transition is supported by consumers who perceive smaller or more lightweight packaging as being more environmentally friendly, though this does compete with a poor public perception of the environmental profile of plastics at end-of-life.

The push for environmental savings, cost optimization and recyclability driven by technological developments—such as blow molding and PET bottles for markets like UHT (ultra-high-temperature pasteurized) milk, and hot-fill bottles and jars for cooking sauces—is set to continue.

Coca-Cola is one major name looking also to address the negative connotations of packaging in plastic with the development of its 100% bioplastic Plant Bottle 2.0. The soft drinks multinational plans to have complete a global switchover to these by 2020.

Greatest expansion will occur in the next five years in new regions like Africa, the Middle East and Asia. Conversely, in some developed markets like Australia, demand for rigid plastic is reaching a saturation point in certain key applications such as carbonated soft drinks and bottled water. Strong competition between rigid plastic packaging and flexible plastic packaging in particular is a source of growth, as various food and beverage applications could utilize either plastic type.

Growth of Flexibles to Slow Down

Flexible format packaging—paper, plastics and foil laminates—expanded significantly over the last decade as technological changes have transformed the packaging type from a low-cost industrial-use option into consumer-grade containers with a vast variety of applications.

The market for flexibles—and particularly flexible plastics—will continue to boom over the next five years. This will happen at a rate slower than that witnessed in the first half of the decade, but will still exceed the mean market growth.

Smithers Pira’s data shows that Asia will continue to be the most significant regional market for flexible format packaging, and will increase its relative share of sales from 42% to nearly 45% between 2015 and 2020.

Global food will continue to dominate the market for flexible packaging, aligning with the pan-industry demand for lightweight packaging.

Innovation will continue to focus on improving the barrier properties of multilayer plastic and laminate formulations for food applications, or maintaining performance while reducing the thickness of the film. Simultaneously, new high-speed filling equipment that holds containers by their neck fixtures will allow flexible formats to displace rigid PET in the beverage segment where its penetration has hitherto been limited.

Board Packaging Responds to Online Retailing

At $261 billion, board packaging (corrugated formats, folding cartons and liquid cartons) was the material type with the highest value in 2015––a position it will retain in 2020. In 2015, China overtook the U.S. as the largest national market for paperboard packaging and will account for nearly a quarter of global consumption in 2020.

Of the major economies profiled by Smithers Pira, after China, two other Asian countries—India and South Korea—will have the greatest relative annual expansion across the study period.

The rise of online retailing has been one consumer shift that is responsible for much of the recent growth in the board packaging market, an application where it is the dominant format. Emerging markets such as China and India shop online as frequently as more developed countries, and consumers increasingly prefer digital shopping over physical retail experiences. This points to several key aspects of board packaging that are changing. For example, 30% to 40% of online purchases are returned, meaning that their packaging must be easily opened and resealed.

In the future, e-commerce will likely see even further focus on tailoring board packaging to maximize the end-user experience.

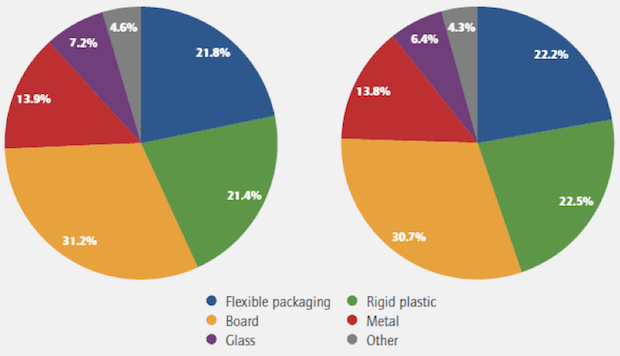

Flexible and rigid plastic packaging will increase market share as the world market approaches a $1 trillion at the end of the decade – Source: Smithers Pira

Stability in Metal Packaging

Metal packaging will mirror the average annual growth in packaging for 2015-2020, according to Smithers Pira’s data.

Demand will come from Asia, again spearheaded by China. In the developed markets of Western Europe and North America, canned foods will suffer from competition from lighter weight, consumer friendly flexible and liquid paperboard materials. This is buttressed by health-conscious consumers in developed regions demonstrating a preference for fresh, rather than canned, fruit and vegetables.

Aerosol cans have seen an overall increase in demand as personal care, cosmetics, household and automotive care industries grow steadily. This growth is primarily centered on the growing consumer class in Asia. There will be scope for innovation too, looking to repeat successes like Unilever’s in cutting its aluminum use by 24 tons per year after moving its deodorants to a 50% smaller “compressed can” format in 2013.

Glass Considers a Luxury Future

The slowest growing packaging type for 2015-2020 is glass. This reflects its longer-term transition from an essential commodity in beverage packaging to a luxury material preferred to create a premium feel and sophisticated impression.

At the top-end of this market, Champagne houses are looking to pioneer isothemal packaging that keeps the product cold for around two hours after being removed from refrigeration.

Brewers, meanwhile. will continue to shift from traditional labels to premium-finish bottles using pressure-sensitive labels (PSL) to achieve a “no label” look. At the same time they will investigate frosted glass, tactile effects, and unique shapes to project a quality perception.