There is a saying that a rising tide lifts all boats. But the opposite is also true. As the skipper of a business, an owner needs to know when a tide comes in and when it recedes in order to plot a course to realize maximum business value. Just as there is a repeating nature to the tides, the economy also runs in cycles. They may not be as predictable as the moon’s gravitational force on our oceans but they are nevertheless still cyclical and their periods can have some predictability, …if you know who to ask, what to look for and what action to take.

The problem with the government’s descriptions of the economy is that they are “after the fact” and useless to most business owners trying to plot a course for the future. Who wants to know that we are in a recession three or four months after it starts? At that point, business owners are interested in the recovery, when it will start and how long it will last.

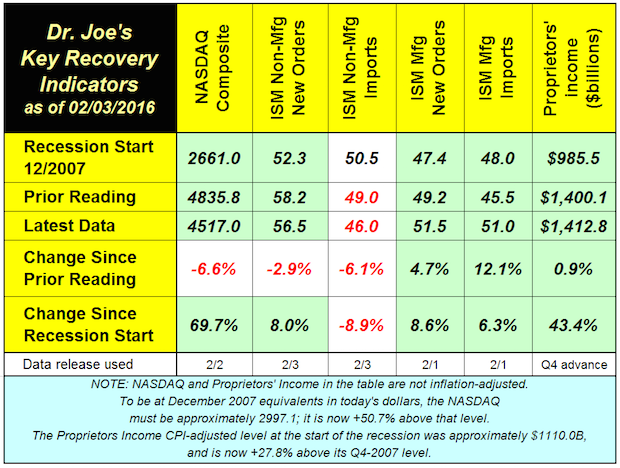

Most economists have their own set of statistical tea-leaves that they use to provide justifications for their economic outlook. In 2009, after the last recession, Dr. Joe Webb developed a model for predicting economic recovery. It utilizes six desperate indicators, which are highly correlated with the future condition of the overall economy. Indicators like employment, new orders, imports, proprietors’ income and the NASDAQ stock index are all considered. Data on these are tracked on a monthly basis and when all are positive from the pervious month, the economy will be strong and vibrant in the coming months. When they all turn negative from the prior month and are below 50 (the midpoint of overall strength and weakness), the model signals a pending economic downturn.

In early February (which reflects the January data) the model reflected 4 of the 6 indicators were negative illustrating that there are a number of reasons to be very cautious of the economic future. The data is illustrated in the table below:

Key Indicators of Future US Economic State

The impact of a negative economic outlook on M&A activity will be to turn the current sellers’ market into a buyers’ market and result in decreased valuations. The situation will cause most owners who might have been considering a sale transaction in the near future to pause and re-examine their strategies. This is not necessarily bad news for owners looking to engage in a sale transaction. It is however, “a call to action”.

Like the uncontrollable tides, the state of the M&A capital markets should influence the timing of a would-be seller and being able to predict the market’s direction is important to developing a presale strategy. But that’s not all. An owner should be aware that two additional components will also influence a more favorable sale when markets recycle. And these componentsareunder the owner’s control. One component focuses on developing a strategy to strengthen the likelihood of business growth and the other is a plan for the next phase of the owner’s life. They both have specific goals and are critical factors that can turn a down market situation into a highly productive and rewarding outcome.

So how does a business owner improve the value of his/her business in a down economy when sales and profits are also likely to be down? Of course an owner could index the company’s history against government reported data such as GDP, proprietors income and Stock Market indicators to show relative performance, all of which would be useful to any buyer. However, the biggest benefit that can be realized in a down market is doing a thorough risk assessment on the company’s ability to sustain growth and implementing a strategy to enhance it. Factors like businesses processes, strength of the management team, succession planning, culture, marketing, etc. can all be barriers and risks to growth. A solid plan to address these factors takes time to develop and implement, but if done properly, the owner could achieve significantly stronger company regardless of the decision to sell or not when the economy recovers.

The second controllable area deals with the owner’s mind-set, and is probably the most critical since it can be a very costly show-stopper in an eventual sale process. If an owner is not psychologically ready to complete a sale transaction, none of the other conditions really matter much at all. This is the reason why so many Investment Bankers put penalties in their engagements if a seller backs out of a deal for no business reason or somehow sabotages the transaction. The problem is that without a thoroughly vetted set of objectives and activities for what a seller is going to do immediately after completing a business transfer, chances are good that the owner will experience seller’s remorse, anxiety, uncertainty, and back out of a deal that contains significant investment of time and money leaving a bad taste in everyone’s mouth that will be hard to overcome in the future.

Properly aligning business risk and readiness of the owner with the economy represents the trifecta in sell-side M&A. This requires development of thoughtful goals, strategies, plans, coordination and implementation. Getting the controllable elements in sync with the market window takes more time and experience than most owners can provide. Fortunately, there are advisors who can assemble the skills necessary, discuss all the options and help the owner avoid uninformed decisions that are likely to have negative outcomes. Experienced transition advisors can predict and help the owner take advantage of economic cycles, de-risk the business and properly prepare the owner for a fulfilling post transaction experience. By doing this, a smart owner can use an economic downturn to strengthen the business, achieve a satisfying sale process and put the next phase of his or her life on cruise control toward a fulfilling destination.