By John Nelson

E-commerce is a dynamic, fast-growing segment of the packaging market. As it requires greater personalization and responsiveness from print services, it is seen by many as perfect fit for the next generation for inkjet presses. And its easy integration with web-to-print platforms and variable data requirements means in many ways, like e-commerce itself, it can be seen as a digitally native technology perfect of an online world.

North America

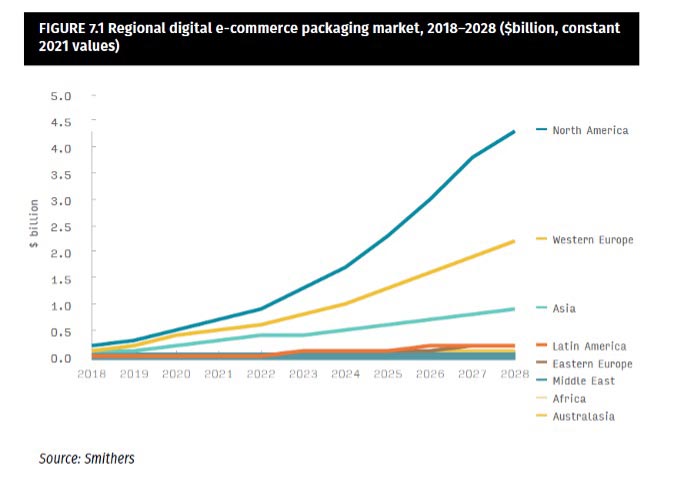

Digital print e-commerce delivery pack jobs in North America will be worth $1.26 billion in 2023, according to the latest exclusive data from Smithers—the leading consultancy for the paper, print, and packaging industries. Its new study, The Future of Digital Print for E-commerce to 2028, forecasts future value growth in the region at 27.8% year-on-year driving value to $4.32 billion in 2028, at constant pricing.

North America is the leading regional market, accounting for 42.7% of value globally in 2023, and 57.0% of volume. This is reinvigorating the US print segment as the industry increasingly looks to secure new revenue streams, and is providing the impetus to invest in new digital print lines, for e-commerce brands.

The majority of e-commerce packaging still carries analog print (72.0%), and a significant share (20.3%) is used unprinted. The overall e-commerce boom means these too will grow over the next five years; but their rate of increase will be under half that of inkjet, as it progressively captures more of the market with brand owners embracing the potential of hybrid and full digital printing.

In e-commerce, packaging provides an essential touchpoint for relay brand values, meaning more online businesses are investing in high-quality graphics and embellishments. Furthermore, e-commerce sellers prefer lower stockholdings, and experience greater fluctuation in order and hence packaging demand. This inclines packaging buyers towards service providers who can rapidly turnaround orders and print-on-demand at short notice; both of which is easiest on inkjet. This responsiveness commands a price premium, with some print service providers now offering refill orders within a week or days.

Corrugated Focus

Over 80% of packaging used in e-commerce shipments is corrugated board, although other formats, such as padded envelopes and mailers are popular for less fragile goods, like clothing. This is reflected in the focus of investment in digital production—in the US and Canada, corrugated work represents 99.4% of value and 99.7% of volume in the contemporary market.

There are multiple installations in the region of single-pass inkjet machines that can produce quality printed e-commerce boxes at volume. This includes Georgia-Pacific’s dedicated Hummingbird business unit. It makes various e-commerce options, alongside bespoke shelf-ready designs, food trays, and large format boxes.

St Louis-based Boxes Inc operates a pair of EFI Nozomi C18000 presses with up to 40% of the work double-sided, reflecting growing demand for e-commerce subscription boxes.

CompanyBox in Charlotte has two HP PageWide C500 presses also configured for double-sided print. The second C500 installed in 2021 is equipped with a stacker that can run small jobs in tandem with larger runs without slowing up the press.

Besides specific installations, specialist integrations are increasingly common, including as end-of-line fitments in e-commerce fulfilment centers. Converters are also adding inkjet printheads to existing analog print lines for mailers, bags, and boxes.

The dominance of corrugated in the segment accounts for the very limited penetration of toner-based systems. While popular in digitally printed labels, contemporary electrophotography systems have difficulty handling thicker corrugated grades, and printing accurately on the less planar substrates. Instead, toner systems are confined to flexible e-commerce formats, such as polyethylene mailers. Volume will increase from their very low base, but any wider changeover is further restricted by electrophotography being by far the most expensive solution per square foot of packaging printed, costing round 70% more than inkjet, Smithers data show.

Market Evolution

E-commerce production is poised to leverage many of the emergent technology improvement in inkjet across the next five years. There will be more installations of high-performance inkjet corrugated preprint units, such as HP’s PageWide T400S and T1190 machines. BHS meanwhile is working with Agfa on a seven-color, full-width print engine and inkjet coater. This will also be offered as a retro-fit on existing BHS corrugators, inline or operated offline in a roll-to-roll configuration.

As the installed base increases it becomes more plausible to mass print individual QR codes on delivery boxes—speeding logistics and reducing the needs for discrete adhesive labels. The same codes can also be used to protect against counterfeiting and losses in e-commerce distribution chains; as well as providing a portal for connecting to the final recipient.

Greater automation will improve handling and order turnaround on e-commerce packaging work, including allowing for printing on the exterior and interior of a box, simultaneously, to improve brand impact at the point of delivery. This can include personalized messages to the recipient to encourage up-selling and cross-selling; or advertising unrelated products and services on the outside of an otherwise blank e-commerce shipper.

Integration with smart finishing equipment is also advancing, allowing printed box designs to be die-cut to present specific products in an aesthetically pleasing design, while reducing the need for loose secondary protective elements.

Across 2023–2028, inkjet will become increasingly more attractive for short-to-medium run flexible packaging jobs, including those encompassing high-quality brand graphics or versioned packaging designs. As kraft and other flexible papers become more popular, wide-web inkjet machines will become increasingly common in bag print lines.

For padded envelopes (protective mailers) inkjet modules will be added into mailer gluing equipment to give customization options. There will also be greater sales of short-run sheets pre-printed with toner or inkjet, which will be converted into final delivery packs by smaller start-ups and craft producers.

The market opportunities, latest technology, and commercial outlook for this sector are all examined in forensic detail in the new Smithers study – The Future of Digital Print for E-Commerce to 2028. This includes an exclusive dataset with over 130 tables and figures segmenting the market by print process, packaging format, and geographic region.

John Nelson is an award-winning editor and journalist working in the market reports and consultancy business of Smithers. Here he covers market and technology developments across multiple technical and commercial segments; including home and personal care, sustainability, packaging, printing, paper, nonwovens, rubber and tires.