By John Nelson

COVID-19 delivered a sudden, unwelcome shock to the entire print industry. As the industry now looks to achieve a degree of normalcy in the post- COVID world, print orders will become smaller and more frequent. This means print service providers (PSPs) must be more agile and responsive, while for OEMs it is creating a new emphasis on digital print technology and customer support services.

As a factor that will define the print landscape across the next 10 years, this is a subject of the brand new report—Impact of Changing Run Lengths on the Printing Market—from Smithers. In this exclusive insight for WhatTheyThink, Smithers profiles the following for evolutionary trends for major print segments linked to run lengths in the 2020s:

Packaging SKUs

Pre-pandemic, there was a trend for increasing variety via a proliferation of stock keeping units (SKUs) in printed packaging. Brands have been eager to extend their offerings for different customer groups—in the food sector, the same brand product may be used in many recipe variants and packs. There are also now more private labels, challenger brands, and artisan craft offerings, many sold via e-commerce, which can demand alternative packaging and label designs.

The growth in SKUs leads to disaggregation of demand for packaging and labels, reducing run lengths overall. In 2020, this trend reversed slightly as brands focused on their core offerings—Mondelez and Coca-Cola stated they would reduce SKUs to position them better to meet rapidly changing patterns of demand.

As the disruption of the pandemic recedes, SKU proliferation will again increase, driven by changing consumer preferences for more personalisation, convenience, affordability, healthy lifestyle options, and catering for more diverse tastes and lifestyles. This will again push print commissions length downwards. This will lead to an increased focus on flexibility and agility in print rooms, benefitting digital technologies and solutions that can support faster product development and shorten order turnarounds, such as integrated web-to-print design platforms.

E-commerce Shopping and Sales

The use of e-commerce in segments like grocery shopping where penetration pre-2020 was limited will remain. Brand owners have already pivoted to develop their own direct-to-consumer businesses, with memberships, exclusive content and offers. As this sales channel grows there will be an opportunity to target small segments of consumers and personalise packaging and promotional print; which favours digital production.

This will incline the market again towards shorter print runs, and on occasion print-on-demand models. In e-commerce, speed in delivery can be a major factor influencing purchases, as browsing shoppers move towards a more impulse-driven consumption model. For print buyers, this will also make order turnarounds shorter and a more important factor in selecting a PSP.

This will help the latest digital presses to take work from analogue presses. Increasing productivity on inkjet will raise the ceiling on the job lengths at which digital is competitive; although developments like automated plate preparation and changeover will also improve the responsiveness of analogue print lines too.

In some instances, larger e-commerce sellers will also invest in their own digital in-house print equipment.

Publications

Circulation figures for magazines, catalog, and newspapers fell significantly across 2015–2019—combined, the volume of these fell from 23.8 trillion A4 prints to 21.1 trillion.

This trend with consumers moving on to online news, lifestyle, and shopping channels has only accelerated as lockdown orders have closed physical retail and curtailed business and leisure travel. A further 4.2 trillion A4 sheet equivalents was wiped from global print volumes in these three applications in 2020.

No major recovery is forecast; run lengths will fall further in line with circulation. In response publishers will close many titles, moving them exclusively online; or combining them, and publishing fewer editions each year.

Advertising

Simultaneously, advertising budgets are switching toward online channels. While spending on electronic advertising will increase as markets recover, advertising print revenues and volume will remain essentially static at around 2020 levels over the next decade.

Marketing commissions have shifted to a multi-platform approach, which has involved wide use of QR codes and even trialling augmented reality print features to provide a connection between the physical and virtual worlds. A problem is that marketers often struggle to calculate ROI for print-based campaigns compared to online advertising, where a customer’s engagement is readily tracked and conversion rates are measured easily through dedicated landing pages and browser analytics.

As it evolves, this emphasis will reward PSPs that can make their offerings more relevant, personalized, and imaginative. For direct print advertising, marketers will concentrate on content tailored or personalized to the intended recipients or groups, and this will increase demand for shorter run printing—with inkjet systems again being the main beneficiary.

The market evolution of these and other trends for print runs ordering across the next ten years is examined expertly and in detail in the new Smithers report, Impact of Changing Run Lengths on the Printing Market, which is available to purchase now.

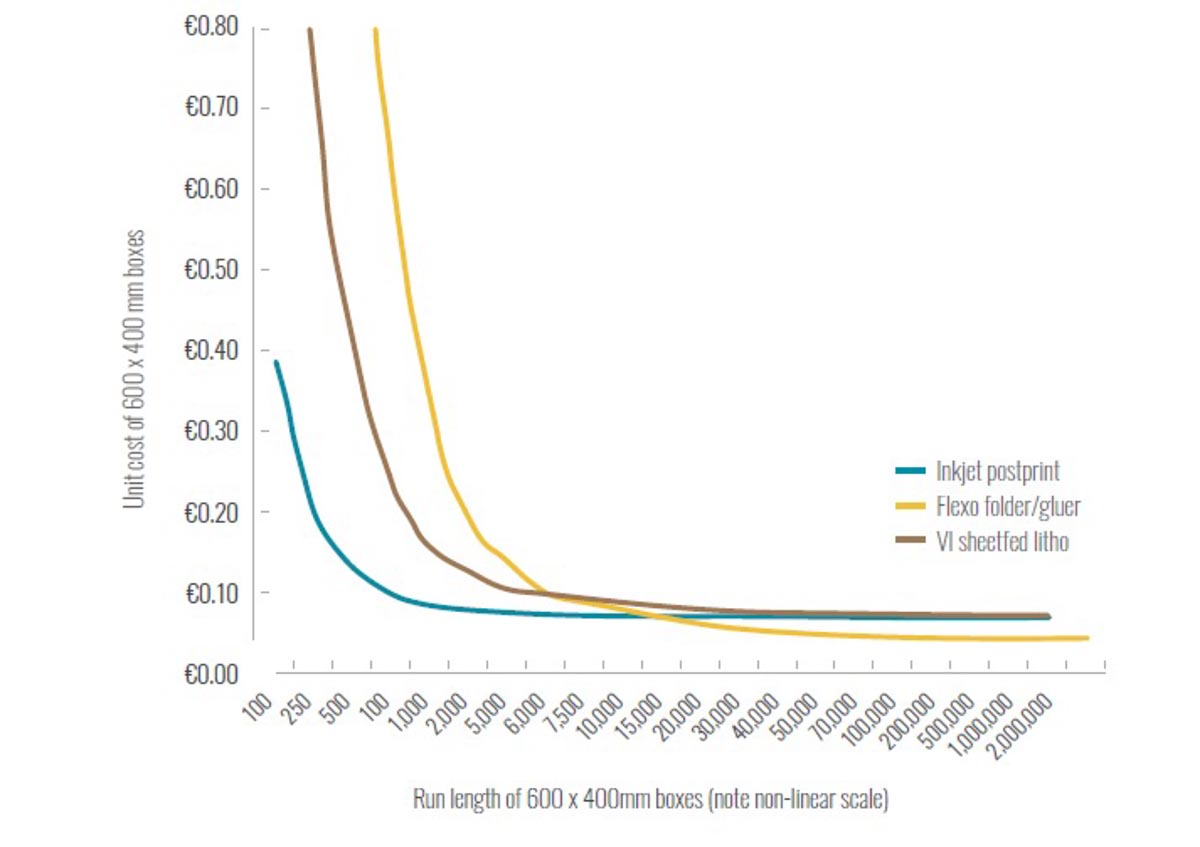

Cost per print vs. run length comparison for inkjet postprint, flexo folder/gluer, and litho-lam processes for 600mm x 400mm boxes

Source: Smithers

John Nelson is an award-winning editor and journalist working in the market reports and consultancy business of Smithers. Here he covers market and technology developments across multiple technical and commercial segments; including home and personal care, sustainability, packaging, printing, paper, nonwovens, rubber, and tires.