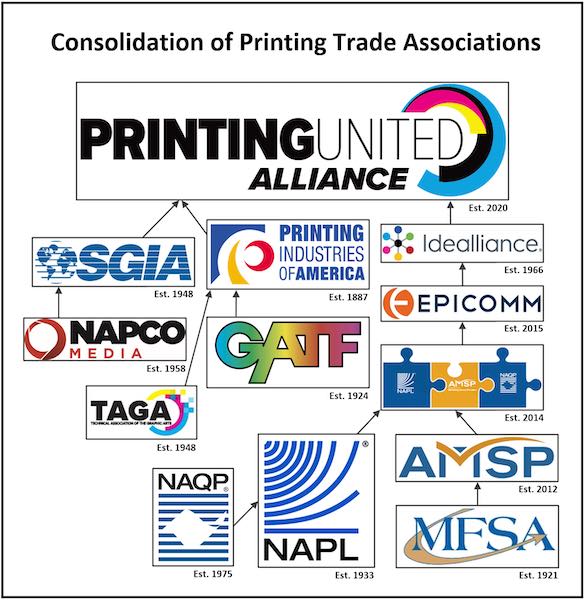

It finally happened. PIA and NAPL have joined forces, or at least the remnants of each will now be together under the umbrella of Printing United Alliance. It has been a long and winding road for the two venerable and influential trade associations that served the commercial offset printing industry for a combined 215 years. Unable to figure out on their own how to combine, it took the SGIA, with its roots firmly planted in the screen printing industry, to bring it all together with the announcement that it was merging with Idealliance. Through a rather convoluted series of mergers and rebranded identities, some of which never gained traction with members, Idealliance contains the last remnants of the NAPL organization. The PIA, which managed to maintain its identity longer than the NAPL, finally folded into the SGIA last Spring, with the new combined organization emerging as Printing United Alliance.

PIA and NAPL had similar missions, both dedicated to serving the fragmented printing industry. Each organization had highly respected economic research services. They both had very successful and well attended annual conferences that catered to the owners of the many independently owned and operated companies that make up the commercial printing industry. Both associations sponsored multiple industry-specific social events that encouraged and enabled relationships throughout the industry and across the country. Many of those relationships endure to this day.

As the commercial printing industry shrank in size and number of establishments, the logic of consolidation between PIA and NAPL was compelling, but there were fundamental differences that made joining together problematic. NAPL was a singular national organization, while PIA was a confederation of local chapters each with its own structure and membership. The two sides tried to put themselves together in 2012, but despite the common sense that the industry did not need two competing associations, the inertia behind each side’s position was too strong and the talks ended without the desired outcome.

I doubt that anyone would have predicted 10 years ago that the eventual consolidator of all these printing industry associations would have emerged out of the humble screen printing segment that lacked the trappings of big presses and highly mechanized production. Something changed; the digital technologies that have rocked the printing industry have nowhere been more transformative than how we apply graphics to wide format and irregularly shaped substrates. The resultant growth and excitement surrounding that transformation, among other factors, propelled the SGIA to the leadership position it now enjoys as the survivor and master consolidator of industry trade associations.

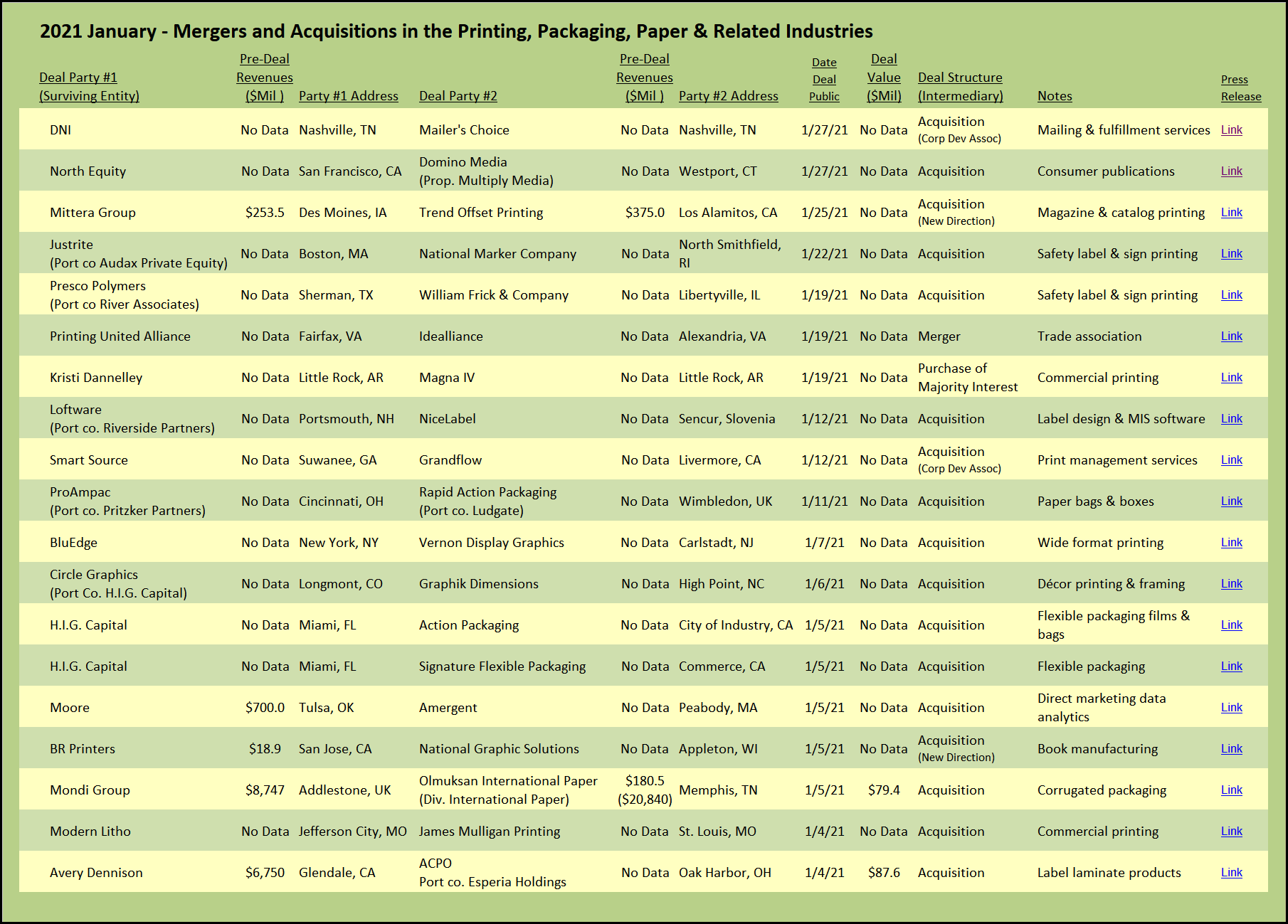

Flexible Packaging & Bags

A new PE-backed platform has entered the fray in the flexible packaging business, arguably the hottest M&A segment in the printing industry, with purchase price multiples reportedly often in the double digits. Private equity powerhouse H.I.G. Capital completed two simultaneous acquisitions with the purchase of Action Packaging and Signature Flexible Packaging, both located in Southern California. The new platform starts out with three manufacturing facilities and serves makers of consumer products, primarily snacks, meats, candies, and baked goods. The clearly articulated growth plan is focused on additional M&A to build out this new platform. H.I.G. Capital is no stranger to the printing industry, with multiple investments in direct mail and marketing (Vision Integrated Graphics), out-of-home and décor graphics (Circle Graphics), and personalized digital printing (Digital Room) (see Commercial Printing: Consolidation or Regional Expansion? – November 2019).

ProAmpac, the flexible packaging roll-up backed by Pritzker Partners, which last month expanded its portfolio into the paper bag manufacturing business, is again adding to the strength of its bag offerings with the acquisition of Rapid Action Packaging. The stage is set for competition to heat up in the specialty bag business which often services similar markets and customers as those catered to in the sizzling flexible packaging segment (see Bags, Pouches, Trays & Bowls – December 2020).

Safety Labels & Signs

Sometimes there are printed products that exist in the shadows of the industry and suddenly there will be a spate of acquisitions that bring focus to the sector. Presco Polymers, a portfolio company of River Associates, manufactures safety marking and damage prevention products, such as printed tapes, flags, and tracer wires for identifying and finding hazardous conditions. Presco announced the acquisition of William Frick & Company, a printer of labels, tags, product identification, and other marking products, often used in harsh and hazardous environments.

Three days later, Justrite, a manufacturer of storage and biohazard cans, spill control and other safety products, acquired National Marker Company. The acquired company is a printer and manufacturer of signs, tags, labels, and other products all geared to identify safety hazards and assist customers with compliance.

Wide-Format Printing

Circle Graphics, a portfolio company of the aforementioned H.I.G. Capital, acquired Graphik Dimensions, a wide-format printing company in High Point, North Carolina. The acquired company is a provider of customized printed and framed wall décor products, sold through online channel partners and other commercial customers. The acquisition fits nicely into Circle Graphics existing business that produces custom in-home décor products, which is in addition to its better known industry-leading position in outdoor billboard graphics.

BluEdge, a multi-location graphics company headquartered in New Jersey, acquired Vernon Display Graphics, a wide format printing company that uses both digital and traditional screen printing to produce signage, retail displays, and vehicle graphics. BluEdge is family-owned and traces its roots back to 1898 when it was known as National Blueprint. Similar to other reprographic companies that produced blueprints, essentially a simple form of wide-format graphics, BluEdge has made the natural transition to digital wide-format technologies.

View The Target Report online, complete with deal logs and source links for January 2021

Discussion

By Jeffrey White on Feb 08, 2021

Let's not forget the Research and Engineering council as well. They became part of NAPL back in 2002 when Greg Van Wert was leading NAPL and Ron Mihils was the Managing Director of the R&E Council. The R&E council was instrumental in the 90's in getting JDF off the ground and sponsored many important conferences on emerging technologies during its existence. It was one of the few places where vendors and printers who were competitors could come together and discuss ideas to improve the operational efficiency of print organizations.