It is often accepted as a given article of business truth that a highly fragmented industry is destined to consolidate and that the result will be positive due to synergies and elimination of redundant overhead. Sometimes, that turns out to be false.

It is often accepted as a given article of business truth that a highly fragmented industry is destined to consolidate and that the result will be positive due to synergies and elimination of redundant overhead. Sometimes, that turns out to be false.

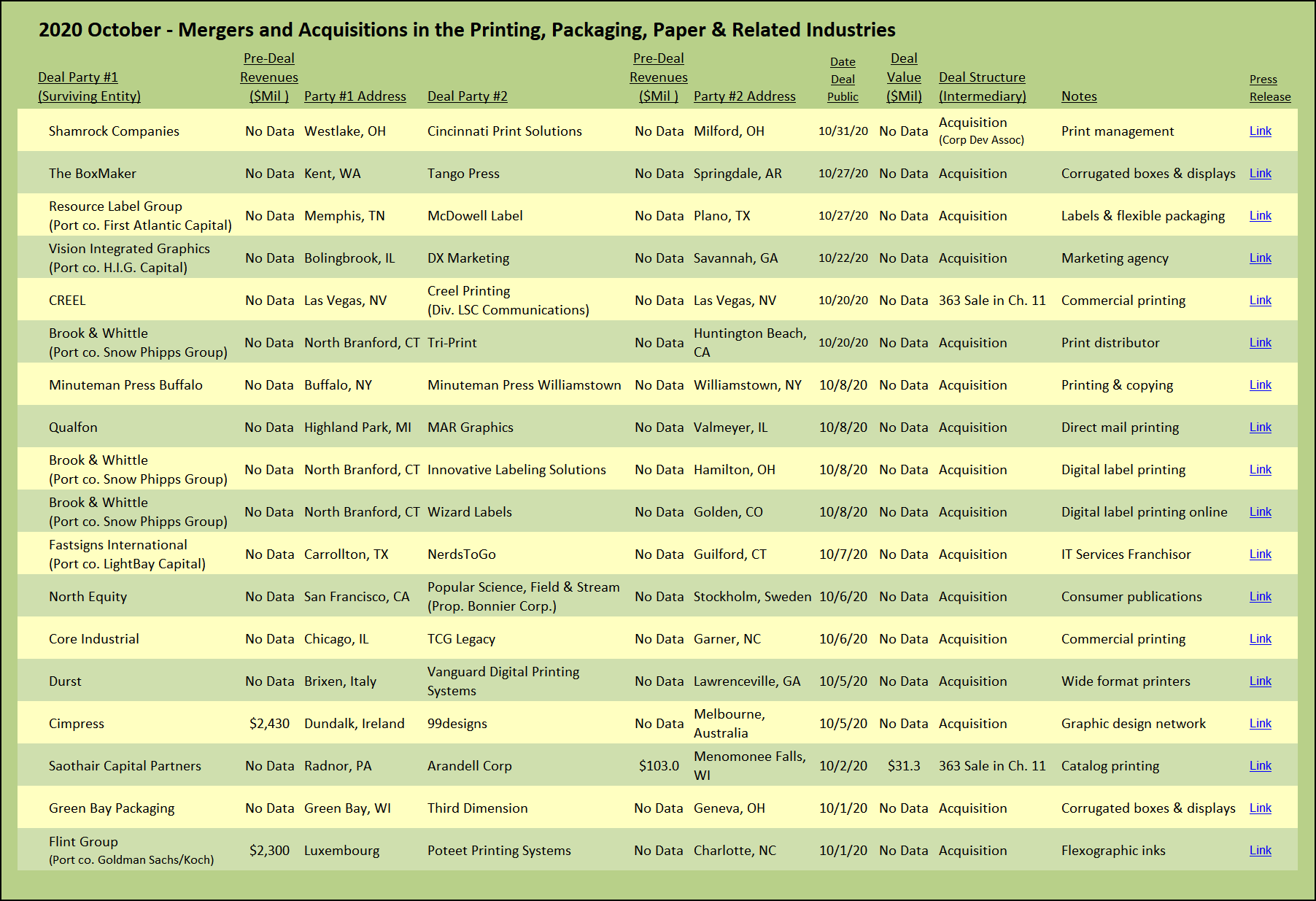

As LSC Communications prepares to emerge from bankruptcy in a section 363 bankruptcy asset sale to private equity firm Atlas Holdings, the news broke that Alan Creel was back in the game, buying back the piece of LSC that was the backbone of the company he sold to LSC in 2017. It’s no small piece; the acquired Las Vegas printing plant includes five heatset web presses including a massive 55” wide press recently relocated there by LSC as it struggled to rationalize itself back to profitability. However, the re-purchase does not include Creel’s two acquisitions in the digital print space, Digital Lizard and GlobalSoft Digital Solutions, arguably the Creel assets that most represent the future of the printing industry. The newly reconstituted and independent Creel, with all that heavy iron, will be competing in the highly competitive segment of the commercial print industry littered with bankruptcies and plant closures as the demand for medium and long-run publications and catalogs has plummeted.

LSC Communications was born in 2016 as R.R. Donnelley (“RRD”) deconsolidated into three businesses. It was a hopeful beginning for LSC, freed from the constraints of the unwieldly behemoth that RRD had become. At the time of the split, RRD had held the top spot for decades as the largest US-based printing company. While the announcements pertaining to LSC’s strategic direction at the time were all but indecipherable, it was buried somewhere in the hoopla about supply chain management, e-services and office products, that the new company would be focused on printing catalogs, publications and books.

As soon as LSC was free from RRD, now a newly pared-down and independent corporate entity, the company began a consolidation play of its own, beginning with the acquisition of Creel Printing. The purchase of Creel included six facilities across the US and began a spree of acquisitions by LSC that seemed at first in some ways designed to recreate a new RRD. Having apparently missed the opportunity to acquire sufficient logistics capability in the spinoff from RRD, LSC shortly thereafter acquired Fairrington Transportation, a logistics company with expertise in co-mailing and co-palletization, critical capabilities needed to compete in the business of printing publications. Not wasting any time, LSC shortly thereafter purchased Publishers Press, a smaller, but still significant, player in the publication printing segment. All this within the first year of independence. LSC kept up the pace in year two, with the acquisition of three more logistic companies, including, incredibly, the print logistics business of its former brethren RRD which somehow seemed to have ended up in the wrong place in the divestiture. More acquisitions and some divestitures followed, but the bloom was off the rose as debt weighed down the company. Acquisition ceased. LSC then offered itself for sale to Quad/Graphics. Inexplicably, the US Department of Justice killed that deal, and with its options now limited, LSC entered Chapter 11 bankruptcy in April 2020. With approval of the US Bankruptcy Court, LSC will soon become a privately held portfolio company of Atlas Holdings, sans the Creel Las Vegas plant.

LSC Communications is not the only consolidator to run into trouble. We wrote last month about the unwinding and bankruptcy of Cenveo, the rebranded MailWell, one of the two more “successful” consolidators of the printing industry in the 1990’s. The other big consolidator of the ‘90s, Consolidated Graphics, was itself acquired by none other than RRD before it split itself into three. Many of those plants continue to operate within the RRD family, while others have been shuttered, including the recent closing of The Hennegan Company.

Clearly, consolidation of the printing industry will continue; some consolidators will succeed, and others, for reasons of misplaced strategy, or simply bad timing in a tumultuous market, will need to deconsolidate whether via a trip through bankruptcy court or divestitures. The question remains for printing companies in the commercial segment, how big is too big for an industry that looks like a manufacturing business but is effectively really all about service?

Packaging—Labels

In the packaging segments, consolidation appears to be more successful as roll-ups continue to march along at a steady pace. Resource Label Group added McDowell Label, located in Plano, Texas, to its stable of acquired label and flexible packaging companies. McDowell is Resource Label’s second acquisition this year, and the sixteenth overall. Atlantic Capital, the owner and financial sponsor of Resource Label since 2011, seems headed to keep on building Resource Label, already well past the five-year average hold time for private equity platforms.

Brook & Whittle, a portfolio company of Snow Phipps Group, its second private equity sponsor, is on a tear, racking up three acquisitions announced in October. The first two companies, Innovative Label Solutions and Wizard Labels, both represent investments in digital printing of pressure sensitive labels, shrink sleeves, and flexible packaging. Innovative Label serves the craft beverage, nutraceutical, food, and personal care markets, where digital technologies are especially well-suited to the quick turn times and shorter run lengths required for niche products and multiple brand line extensions. Wizard Labels, co-founded by the owner of Innovative, takes digital technology one step further as an online-only custom product label printing company. Brook & Whittle wrapped up the month with one more acquisition, the purchase of specialty label print distributor Tri-Print in California. Snow Phipps is clearly committed to building out the Brook & Whittle platform, having completed two other acquisitions earlier in 2020 in the midst of the Covid-19 lockdown, buying shrink sleeve manufacturer Croydon in May, followed up shortly thereafter with the purchase of west coast Label Impressions in June. For those of us who wondered this past Spring if the M&A market for print-centric companies would go into a Covid-19 induced deep freeze, Snow Phipps proved otherwise and kept the heat on and has not let up all year.

Packaging—Corrugated

Consolidation continues apace in the corrugated box market. Green Bay Packaging, a company that appears regularly as the buyer of companies in The Target Report, expanded its footprint into the Ohio, Virginia and Kentucky markets with the acquisition of Third Dimension. The acquired company produces molded foam inserts along with custom corrugated packaging. Green Bay Packaging is deeply invested in the packaging industry and is vertically integrated with its own forest lands, sawmill, and linerboard papermaking mills.

The BoxMaker company, headquartered in Kent, Washington, acquired Tango Press in Springdale, Arkansas. Tango Press is an all-digital printer and manufacturer of corrugated packaging and displays. With flexo and digital printing capacities, The BoxMaker produces corrugated cartons and retail displays primarily serving the Pacific Northwest market. The addition of Tango represents not only a further commitment to the digital printing of corrugated products, but also a first geographic expansion far from its home base.

Direct Mail

Vision Integrated Graphics, now a portfolio company of H.I.G. Capital, added to the depth of its data-driven marketing expertise with the purchase of DX Marketing in Savannah, Georgia. This latest acquisition builds on the prior purchase last November of SourceLink, a company that brought data analytics and digital marketing capabilities to the Vision portfolio of services. As noted previously in The Target Report, H.I.G. Capital is no stranger to the printing and related industries, with investments in direct mail, grand format out-of-home graphics, promotional items, folding cartons, and production of fine papers (see The Target Report: Commercial Printing: Consolidation or Regional Expansion? – November 2019).

Qualfon, a provider of call center and business process outsourcing services, added to its investment in the printing industry with the acquisition of MAR Graphics, a printer of direct mail forms, plus lettershop and other direct mail services. Qualfon has announced that the MAR Graphic services will be integrated with its existing Dialog Direct brand of direct marketing services.

Update: The Impact of COVID-19

The financial stress caused by the outbreak of COVID-19 has clearly been mitigated by the government PPP loan and other programs. Within the print-centric segments we follow, the negative impact has been mostly limited to commercial printing companies, with many companies reporting revenue declines north of 20%, some telling us that sales were off 50% or more. Some have closed up shop, while others are just now facing the reality that they will have to shut their doors permanently. As we have noted previously, the key differentiating factor separating the survivors from the walking dead is clearly what particular industry a printing company serves and how those customers have in turn been impacted by the shut-downs. Geography also plays a part, as the shift to working remotely has removed the convenience factor offered by printing shops operating in an urban location. Other segments, in particular packaging, appear to be weathering the COVID-19 storm with minimal impact; acquisitions abound, but do not appear to be in reaction to the outbreak of the coronavirus.

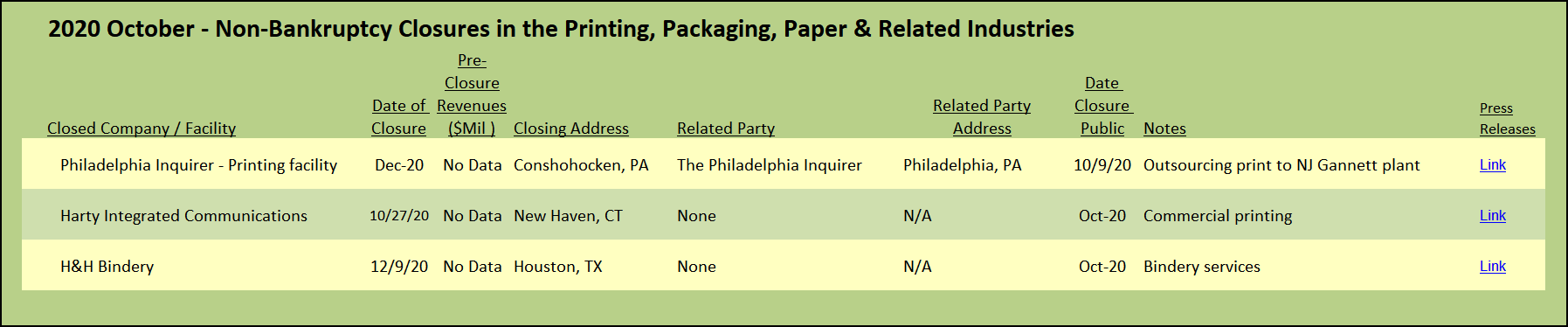

The expected wave of opportunistic M&A activity, as would be indicated by bankruptcy filings, non-bankruptcy closures, and tuck-ins, has not materialized, at least not in any overwhelming sense. Nonetheless, there has begun a slow trickle of activity indicating that the impact of Covid-19 is culling out some of the weaker players in the market. The equipment of Harty Integrated Communications, a general commercial printer in New Haven, Connecticut that dates its founding back to 1900, was auctioned off in a complete plant closure by order of the company’s secured creditor.

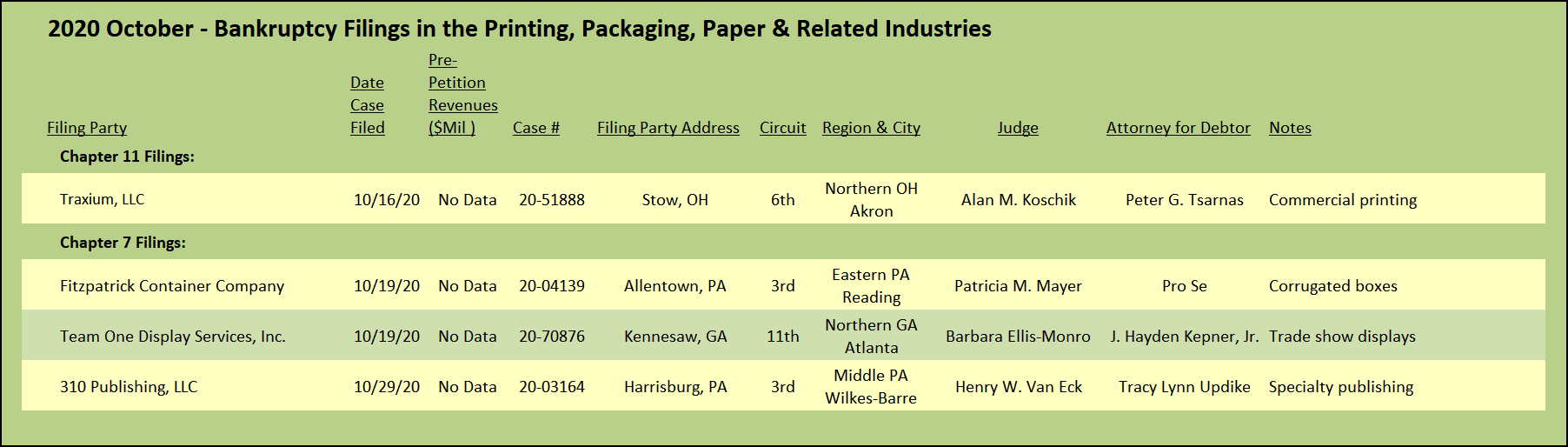

Traxium, the erstwhile commercial printing consolidator based in Ohio, filed for Chapter 11 bankruptcy protection. In court filings, the debtor stated that its reason for filing, among others, was that the companies it acquired were extremely inefficient, and losses incurred led to missing payments to the senior secured lender. Accusations of tortious interference by one of the acquired company’s former owner, with lawsuits flying in both directions, were noted as additional causes of the bankruptcy, with the coronavirus pandemic added in as the final coup de grace. (Every company in trouble for the past six months has cited the virus as instrumental in its demise, why not?)

Notable to me was the inclusion of Great Lakes Integrated in the Traxium portfolio. Great Lakes was at one time a recognized leader in the commercial printing industry and an early adopter and proselytizer of adding fulfillment and mailing services to a printing company’s core services. Jim Schultz, the former owner of Great Lakes Integrated, was a regular speaker at the Top Management Conferences I attended some twenty years ago, sponsored by the now defunct NAPL (National Association of Printing Leadership). Jim championed his vision of Great Lakes as a marketing execution company with “value-added” services that supported the company’s printing capabilities. It would not be an exaggeration to say that through his leadership and enthusiasm, Jim changed the commercial printing industry, likely leading many others to add those services and eventually become his competition.

View The Target Report online, complete with deal logs and source links for October 2020