CJK Group, the grand master consolidator of formerly distressed assets in the book manufacturing and journal printing segments, adds another chapter to its book of business with the acquisition of Cenveo Publisher Services and Cenveo Learning. The acquired business includes offices in London and four locations in India, creating for the first time a global presence for CJK. The acquired business units will be merged with its existing content services businesses, Sheridan Journal Services and the hosting platform Sheridan PubFactory. The various business units will now all be rolled up together and rebranded as KnowledgeWorks Global.

In addition to going global, the new combined business unit pushes CJK further upstream in the production cycle of bringing books and journals to its customers. Content services offered include project management, content development, editorial services, peer review management, art and design services, rights and permissions management, translation and accessibility services, eLearning, online hosting, and presumably transitioning completed documents to one of CJK’s production facilities for printing, binding, and distribution.

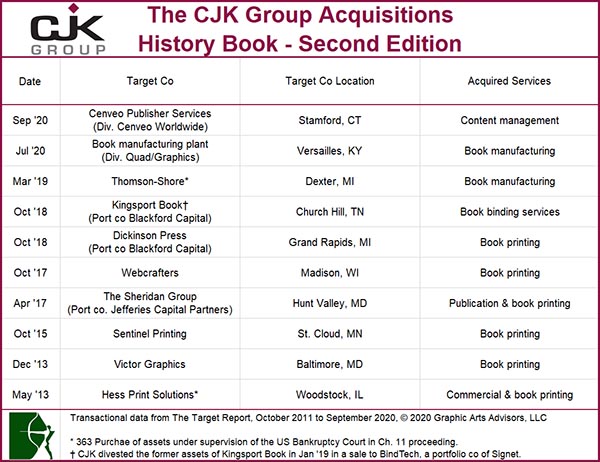

As we have noted in past Target Reports, the CJK Group has stayed laser-focused on acquiring print assets in the book and related print production segments, often swooping in to save, revitalize or absorb ailing companies (most recently Thomson-Shore), stalled roll-ups (Blackford Capital’s Printing Consolidation Company), treading water portfolio companies (Jefferies Capital’s Sheridan Group), corporate orphans (Quad’s book manufacturing plant), and this latest transaction, the product of a formerly bankrupt restricted roll-up in the process of unwinding itself (Cenveo’s aforementioned content services).

CJK was featured in our report as recently as this past July, noted for staying the course on the company’s strategic acquisition track in the midst of what arguably was the point of least visibility forward out of the COVID-19-induced recession (see The Target Report: Buyers are On The Move and On Track – July 2020). With the benefit of hindsight and considering the emerging consensus that there is now a shortage of book manufacturing capacity, CJK’s acquisition of Quad’s one million square foot book printing and binding facility in Versailles, Ky., looks like a smart move. Nonetheless, we suspect it took both a good hard reality check and a big dose of believing in their strategic plan for the CJK team to proceed with the deal back in April, May, and June of this year, announcing the completed transaction on July 1. (And, yes, you read that correctly, there is at least one segment of the printing industry in which demand currently outstrips capacity and that is book manufacturing!)

The company has honed its expertise in acquiring assets that are impaired, or in the case of specialty book printing company Thomson-Shore, bankrupt. CJK executed a textbook strategic acquisition of a distressed company’s assets under the 363 provisions of the US Bankruptcy code by extending loans to Thomson-Shore both before and after the filing of the Chapter 11 bankruptcy (see The Target Report: CJK Group Opens Next Chapter with Loan-to-Own Strategy – March 2019). By taking on the “stalking horse” position, they controlled the process and were in the best position to bid on the assets and ultimately prevail in the purchase.

The latest acquisition, the purchase of Cenveo’s Publisher Services, appears to dovetail nicely into the suite of services offered by CJK’s Sheridan division which assists publishers of scholarly and technical journals, books, magazines, and catalogs. These service offerings, at both the acquiring and acquired entities, sit on top of strong technology platforms, which will now benefit from the combination.

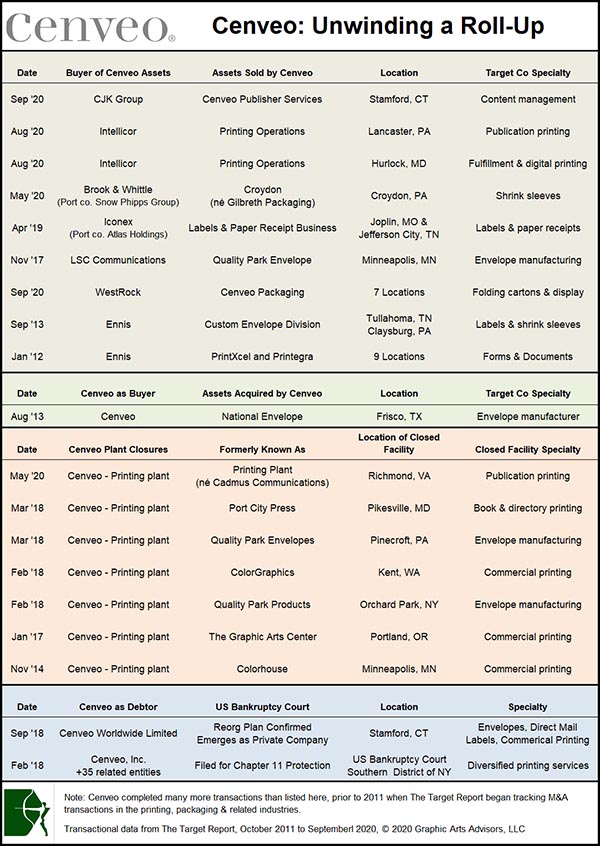

On the other side of the transaction, the seller, Cenveo, continues to unwind the diverse range of print-centric assets that were seemingly pasted together willy-nilly throughout the late 1990s and 2000s. The sale of its technology-based content services is one of a continuing parade of divestitures, both before Cenveo’s bankruptcy and after its emergence from bankruptcy as a private company in September 2018. (see The Target Report: The De-Evolution of Cenveo – April 2019).

Commercial Printing and Diversified Services

BR Printers, based in San Jose, Calif., acquired the on-demand printing company Content Management Corporation located in Fremont, Calif. Both companies offer a wide range of commercial services, including print, direct mail, wide format, promotional items, kitting, and fulfillment services, with online customer storefront portals.

Mainline Printing, located in Topeka, Kan., has acquired the printing assets of Go Modern which was owned by Advisors Excel, a marketing firm focused on assisting financial advisors to build their individual practices. The Go Modern division, which provides marketing and promotional products, decided that its printing production capability was not core to its business, and will now outsource its print related services to Mainline. Selected equipment and print production employees will move to Mainline’s facilities. The promotional products business and related employees will remain with Go Modern. As noted in our report last month, approximately 50% of transactions in the commercial printing segment are similarly structured as a “tuck-in” from one entity to another as the industry continues to consolidate.

Packaging and Labels

Essentra Packaging, a division of Essentra, a UK-based global diversified engineering and parts manufacturer, has acquired 3C! Packaging in Clayton, N.C. The acquired company prints and produces folding cartons, product information inserts, blister packs, flexible packaging, and labels, primarily for the pharmaceutical industry. The company has a differentiating factor with its sterilization technology.

Texas-based Frankston Packaging Company has acquired Paco Label Systems. Frankston has grown from primarily a folding carton company to a producer of a diverse range of products including pressure sensitive labels. Consistent with the majority of acquisitions in the packaging segment, the Paco plant will continue operations as a separate additional facility for Frankston.

Meyers, based in Minneapolis, announced the acquisition of the sheetfed business unit of Insignia Systems. Meyers specializes in printed signage, large format printing, prime labels, retail displays, folding cartons, and corrugated packaging, with a focus on marketing in retail environments. The seller, Insignia Systems, provides a range of marketing services and in-store printed promotional items to grocery and similar consumer products outlets such as right-angle signs that fit easily into standard store shelf channels, and stand-up product displays. The acquired business unit produces cut & stack labels and other in-store products and furthers Meyer’s expansion into the grocery channel.

Update: The Impact of COVID-19

Although there were fewer transactions in September than in August, which is unusual, there was still a steady, albeit reduced, drumbeat of M&A activity, and most of the activity that is occurring appears to be driven by clear-eyed strategic thinking and not by overreactions to the dramatic dips in revenues that many printing companies experienced. We are beginning to hear from some companies that sales are almost back to 100% of pre-COVID-19 revenue levels, and in some instances, at or above last year’s results. The key differentiating factor is clearly what particular industry a printing company serves and how those customers have been impacted by the shut-downs. Theater, museums, and other venue-centric promotions are virtually non-existent, but political work is booming (for now, at least).

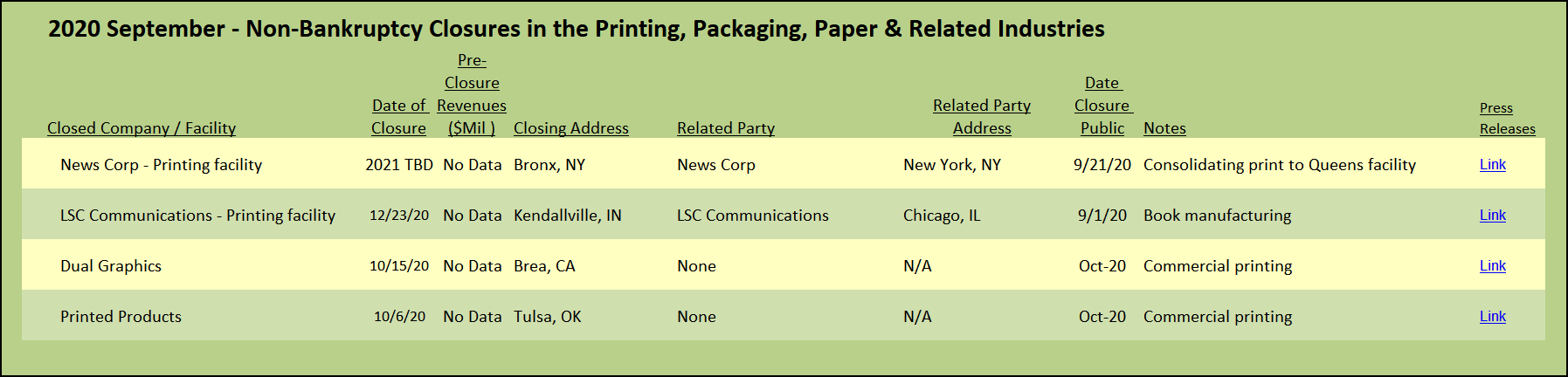

There were a couple smaller commercial printers that closed up shop. News Corporation, the publisher of The Wall Street Journal and The New York Post, among other titles, is consolidating its New York City printing plants, closing up the Bronx location and moving the work to its Queens plant. LSC Communications announced another closing, this one its book manufacturing plant in Kendallville, Ind. (LSC simply cannot seem to get its timing right; as noted above, publishers are bemoaning the shortage of book production capacity! Let’s hope that Atlas Holdings prevails in its stalking horse bid for LSC Communications and the company emerges from bankruptcy well-positioned to stop the hemorrhaging of its post-RRD existence.)

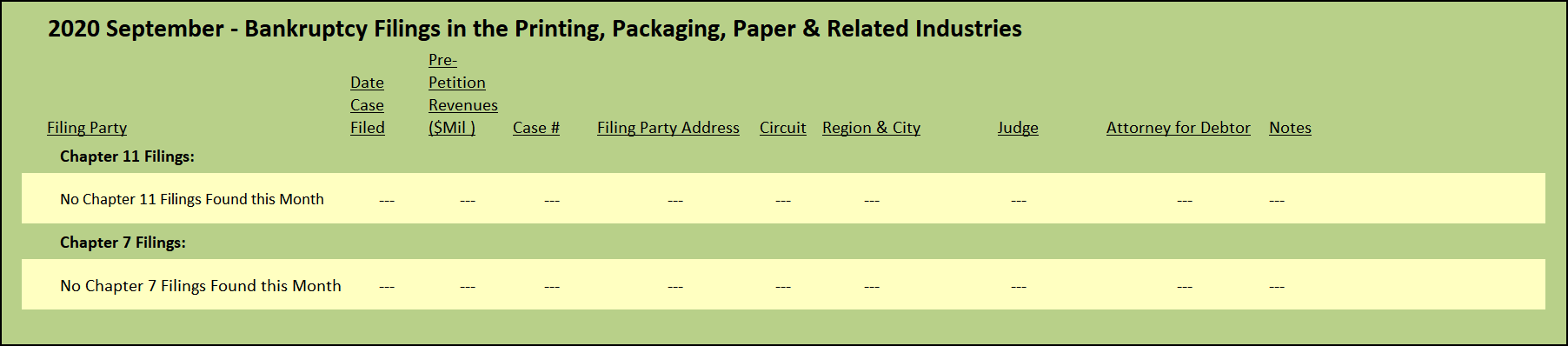

Speaking of bankruptcies, we found no new bankruptcy filings in September in the printing, packaging, or related industries. This has not happened since August 2018 when the economy was still chugging along in growth mode. However, we do expect that there will be, at some not too distant time, a robust consolidation phase in some print segments, driven by the recession, and exacerbated by the forced transition to electronic media which has changed user habits, some probably permanently. Commercial printing and publication printing will be most affected.

View The Target Report online, complete with deal logs and source links for September 2020.