Benchmarking Digital Printing for North American Corrugated Packaging and Displays: Understanding Where and How Value Is Being Created

Press release from the issuing company

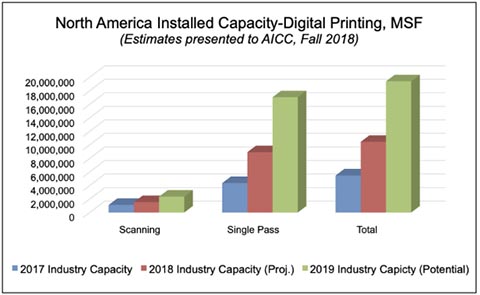

Eden, N.Y. – Globally recognized researchers and industry advisors Karstedt Partners is proud to announce a groundbreaking study, Benchmarking Digital Printing for North American Corrugated Packaging and Displays designed to provide near real-time data and guidance to converters, technology developers and suppliers to assist in future/current strategy development. Digital printing capacity among North American corrugated converters and third-party printers serving converting customers has increased 10-fold over the past four years, reaching approximately 14.1 billion square feet. Single-pass presses, accounting for approximately 82% of current industry capacity, are driving the rapid increase in capacity.

Converters, as well as suppliers, are quick to voice an opinion on digital printing:

- It’s the technology of the future and has unlimited potential

- I may be interested, but I need to see what direction it goes before I act

- I have other higher priorities in my business/it does not align with my business

Opinions tend to change when the following is shared:

- At 14 billion square feet, digital is a small slice of overall market volume.

- However, production threshold digital printing is just entering the market in the form of single pass technology. Initial investment is typically pursued and justified based on current work (low hanging fruit) that can be transferred to a digital press. Depending on assumptions made, the 14 billion square feet of installed capacity can penetrate 50% to 150% of the estimated industry demand for “low hanging fruit”.

- Digital growth beyond the “low hanging fruit” will materialize. The development of this “discreet digital market” requires active selling and will take time to develop.

The base case of how these numbers are generated, as well as the implications to current and prospective participants, will be covered in detail in the benchmarking report series. This scenario is not unique to corrugated packaging and has occurred in virtually all other digital markets. We have identified and are in the process of securing support and participation from a targeted 70+ percent of the installed base of digital capacity participating in corrugated packaging. The surveys are designed to collect critical information based on the lessons learned from other markets, providing more timely information and data.

The survey and research for this ongoing project begins in April with the first semi-annual report disseminated to participating companies and supporting subscribers in May with the second survey and report conducted in September and October. It will provide near real-time data and guidance to converters offering visibility to changing market/technology/product enhancements and developments, and key benchmarking data enabling day-to-day improvement of current operations.

Corrugated converters who have already invested in single-pass or multi-pass production digital printing solutions are encouraged to participate in the survey and receive the full reports by contacting Karstedt Partners directly at +1 716-992-2017 or at [email protected]. Likewise those converters still evaluating digital, suppliers and OEMs involved in, or considering, this market can be enlisted as study sponsors and receive a special report designed for their needs on the same semi-annual basis.

Karstedt Partners have provided an authoritative voice on the industry for many years. For more information on the benchmarking report, contact [email protected] or [email protected], or visit www.Karstedt.com for a report overview and additional details.

- Questions to ask about inkjet for corrugated packaging

- Can Chinese OEMs challenge Western manufacturers?

- The #1 Question When Selling Inkjet

- Integrator perspective on Konica Minolta printheads

- Surfing the Waves of Inkjet

- Kyocera Nixka talks inkjet integration trends

- B2B Customer Tours

- Keeping Inkjet Tickled Pink

© 2024 WhatTheyThink. All Rights Reserved.