Snap-On Closures Market: Personal Care & Cosmetics Industry is Estimated to Dominate in the Global Industry

Press release from the issuing company

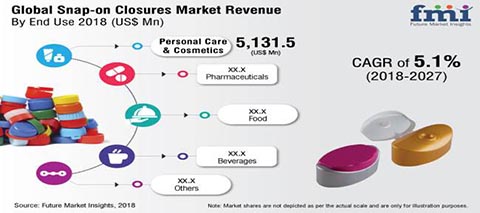

Global data depicting the snap-on closures consumption by F&B and personal care products manufacturers underscores the impressive rate of revenue growth of the snap-on closures market. In a new market research study presented by Future Market Insights, the global snap-on closures landscape is analyzed in depth to deliver a set of actionable insights for businesses operating across the snap-on closures market value chain.

“Forecast to surpass the valuation of US$ 12 billion in 2019, the global revenue through sales of snap-on closures will witness a promising 4.8% year over year growth. While this yearly growth is projected to be over 5% consistently over the near future, the report estimates total volume consumption of snap-on closures to reach beyond 215,000 units in 2019,” says a senior research analyst at FMI.

Key Insights Drawn from the Global Snap-on Closures Market Report

· Diameter-wise, the top selling segment is 34-44 mm snap-on closures that currently hold more than 40% share in the total market value.

· Based on the material of snap-on closures, PP (polypropylene) remains the most favored, following LDPE (low density polyethylene).

· By the end use industry analysis, maximum consumption of snap-on closures is registered in by personal care and cosmetics manufacturers, followed by food and beverage manufacturing companies.

Personal Care & Cosmetics Support Maximum Sales of Snap-on Closures

Snap-on closures are the most prominently used types of closures by personal care and cosmetics industry players. In addition to hassle-free opening and closing, improved product security to prevent potential product wastage continues to play a vital role in compelling manufacturers to employ snap-on closures across maximum product lines.

With a collective value share of more than 60% in the global personal care and cosmetics industry, North America and Asia Pacific secure the top performing market positions in snap-on closures landscape.

In the personal care and cosmetics industry, Unilever, L’Oreal, Procter & Gamble, Shiseido, Coty, and Estée Lauder have been identified to be the major trendsetters in snap-on closures landscape.

Moreover, an expanding space of luxury cosmetics market is also creating impressive growth opportunities for suppliers of snap-on closures for expansion in coming years. FMI thus estimates promising growth prospects for high-end snap-on closures.

Asia Pacific Holds a Lion’s Share in the Global Snap-on Closures Market

· Asia Pacific accounts for around 37% of the global cosmetics industry.

· Around 25% revenue of the global pharma packaging market belongs to Asia Pacific.

While the demand for snap-on closures from F&B, cosmetics, personal care products, and pharmaceuticals packaging manufacturers is consistently surging, the report projects that Asia Pacific will remain the largest regional market for snap-on closures in coming years. Rampant industrial developments, coupled with the elevating spending power of consumers in the region, are pushing the revenue growth outlook for snap-on closures across APAC’s industries. According to the report, ASEAN countries, China, and India are the major growth contributors in Asian market.

Snap-on Closures for Highly Profitable Skincare & Hair Care Products Projected for Innovations

The trending snap-on closures features with flip-top dispensing nozzle are tamper-evident and thus offer multiple additional benefits to personal care products manufacturers such as prevention of the product loss in form of clogging, leakage, or dripping. Snap-on closures manufacturers are especially focusing on innovating the range for high-viscosity liquid products that are suited for smaller, controlled doses. FMI indicates highest innovation potential for snap-on closures used in case of hair care and skincare products that make up for an approximate revenue share of 60% in the personal care and cosmetics industry, at present.

For More Information Request a Brochure of the Report: https://www.futuremarketinsights.com/reports/sample/REP-GB-7774.

© 2025 WhatTheyThink. All Rights Reserved.