Biodegradability of Alpha Olefin Sulfonates: Key to Future Adoption

Press release from the issuing company

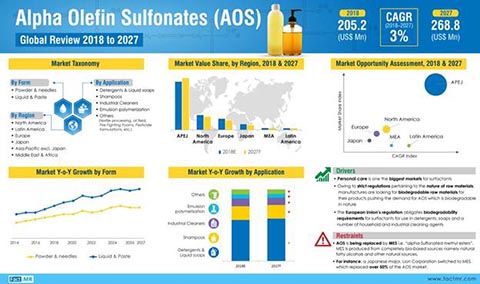

Alpha olefin sulfonates (AOS) market witnessed 2.4% year-on-year volume growth in 2018 over 2017, according to Fact.MR’s latest research. The study remains bullish on the potential rise in adoption of alpha olefin sulfonates as surfactants, owing to its eco-friendly and biodegradable nature. However, volatility in supply and price may hinder its adoption across various industries.

Supply and Prices Fluctuations Drive Customers towards Bio-based Alternatives

Demand for alpha olefin sulfonate is witnessing a decline owing to volatility in supply and price. As alpha olefin sulfonates are petroleum-based anionic surfactants, their prices and supplies are highly dependent on those of petroleum compounds, which is restricting their adoption in various industrial applications. Consumers are preferring bio-based anionic surfactants in industrial cleaners and detergents as they are more cost-effective than alpha olefin sulfonates, which is impeding growth of the alpha olefin sulfonates market. Furthermore, end-user industries are shifting away from alpha olefin sulfonates.

The ‘hydrophilic head and a hydrophobic tail’ structure of alpha olefin sulfonates make it difficult for end-users to maintain a high percentage of perfume oil in shampoos and shower gels without compromising their physical properties such as foaming properties and viscosity.

Technical challenges associated with maintaining target viscosity and clarity in various personal care products with the use of alpha olefin sulfonates are making a negative impact on the growth of the alpha olefin sulfonates market.

Alpha Olefin Sulfonates Witness over 63% Volume Sales in the Asia Pacific Region excluding Japan (APEJ)

The alpha olefin sulfonates market in the APEJ region is likely to outperform other regional markets with the ever-growing consumption of anionic surfactants in developing countries, such as China and India. The Fact.MR study predicts a 3% rise in sales of alpha olefin sulfonates in the APEJ region, in 2018 over 2017. The market in APEJ is likely to account for over 63% sales in 2018, creating more lucrative opportunities for market players in the upcoming years.

The study finds that the recent economic growth and ever-increasing trend of industrialization is triggering growth of surfactant-consuming applications, such as industrial cleaners and personal care products. The dominance of APEJ region in the alpha olefin sulfonates market is mainly attributed to a majority of market players investing heavily in the local markets to expand their surfactant facilities in the region. Growing applications of alpha olefin sulfonates in innovative personal care products and cleaners in the region are spurring the trend of innovations in the market.

Alpha olefin sulfonates market players in the region are adopting technologies and advanced manufacturing processes to gain an edge in the most lucrative regional market for alpha olefin sulfonates, in the upcoming years.

Detergents and Liquid Soaps Industry Creates Maximum Demand for Alpha Olefin Sulfonates

The study report opines that the detergents and liquid soaps segment will account for more than half the sales of alpha olefin sulfonates across the world, by 2018. A majority of liquid detergent and liquid soap manufacturing companies are adopting alpha olefin sulfonates as a third generation surfactant owing to its excellent emulsification and foaming properties.

Another factor contributing to the higher demand for alpha olefin sulfonates in detergents over conventional surfactants is its biodegradability. A majority of governmental organizations have declared that alpha olefin sulfonates pose low risks to the human health as well as the environment. Thereby, most detergent manufacturers are inclined towards alpha olefin sulfonates to minimize the carbon footprint of their products and attract a larger consumer base worldwide.

According to the Fact.MR study, the ever-growing market for detergents and soaps in Asia Pacific is likely to contribute heavily to the consumption of alpha olefin sulfonates. Furthermore, in November 2018, the Indian government slashed the goods and service tax (GST) levied of detergents and soaps from 28% down to 18%. Thereby, anticipating a stronger demand for detergents and soaps, leading players in the alpha olefin sulfonates market are modifying their business strategies and shifting their focus on the detergents & soaps market in the Asia Pacific region.

The insights presented here are from a research study on Alpha Olefin Sulfonates (AOS) Market by Fact.MR

https://www.factmr.com/report/591/alpha-olefin-sulfonate-market.

- Questions to ask about inkjet for corrugated packaging

- Can Chinese OEMs challenge Western manufacturers?

- The #1 Question When Selling Inkjet

- Integrator perspective on Konica Minolta printheads

- Surfing the Waves of Inkjet

- Kyocera Nixka talks inkjet integration trends

- B2B Customer Tours

- Keeping Inkjet Tickled Pink

© 2024 WhatTheyThink. All Rights Reserved.