IDC Says Inkjet Technology Will Continue to Dominate the Worldwide Continuous-Feed Printer Market Beyond 2014

Press release from the issuing company

The worldwide continuous-feed, digital production print market is experiencing significant opportunity thanks to a major technology shift. According to new research from International Data Corporation (IDC), the much anticipated shift from electrophotography (EP) to high-speed inkjet (HSIJ) came to fruition in 2013, and will continue through the 2014-2018 forecast period. Placements of both monochrome and color EP equipment declined in the past year, while HSIJ installations continue on their growth path. IDC expect HSIJ to reach $1 billion in equipment sales by 2018 with a compound annual growth rate (CAGR) of 10.8%.

By technology segment, IDC research finds the following worldwide engine unit placement changes from 2012 to 2013:

Technology

|

Color EP |

-51.1% |

|

Monochrome EP |

-32.1% |

|

HSIJ |

+15%% |

|

Total Market |

-22.1% |

Source: IDC Worldwide and U.S. Continuous Feed 2014–2018 Forecast and Analysis

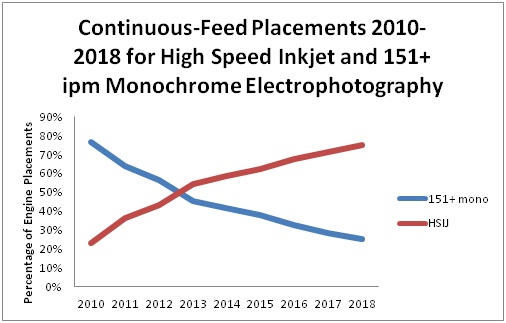

Not only was HSIJ the only growth technology segment in the continuous feed production print market, but for the closely watched high-volume segments of 150+ ipm monochrome and HSIJ, HSIJ became the overall market share leader, achieving 54% of the placements. While the cross over in placements occurred in 2013, HSIJ will grow to 75% of placements by 2018. HSIJ providers have appropriately focused on the high-volume segments of the continuous feed market where print volumes and corresponding supplies and service revenue are significant.

"A dramatic technology shift occurred in 2013 as high-speed inkjet maintained its momentum, while incumbent technologies declined," said Andrew Gordon, research director, Production Output Solutions. "There will continue to be opportunity for color laser, which will hold a quality advantage for a while. However, high-speed inkjet vendors will make great strides toward improving print quality and substrate flexibility."

Figure 1

Figure 1

Source: IDC Worldwide and U.S. Continuous Feed 2014–2018 Forecast and Analysis

IDC's Worldwide and U.S. Continuous Feed 2014-2018 Forecast and Analysis (IDC #248239) presents data and analysis to support planning, development and go-to-market strategies for technology vendors participating in the continuous-feed production print market. The report includes over 30 tables and figures for each segment of the continuous-feed market, detailed vendor market share, system as well as engine placements, and equipment revenues for both worldwide and U.S. markets. Included in the report are IDC's perspectives on:

- Forecast – Following the dramatic technology shift that occurred between 2012 and 2013, IDC predicts that the continuous feed equipment market will grow modestly at a CAGR of 2.4% through 2018. This will be fueled almost entirely by HSIJ, which will grow at a 12.2% CAGR.

- Traditional applications opportunity – The traditional installed base of continuous feed devices is producing customer communications (bills, statements, notices, checks), direct mail, as well as bound documents such as manuals and books. Each application category offers unique opportunities for HSIJ, from eliminating pre-printed forms, rightsizing equipment fleets, and accelerating outsourcing for customer communications, to reducing waste in the publishing supply chain by digitally printing smaller run lengths closely aligned to customer demand.

- Application diversification opportunity – While the majority of HSIJ placements are going to the traditional markets, technology vendors are opening up new opportunities in publishing and commercial print. Considering the immense print volumes produced in these segments, aspirations to convert these volumes to digital print are driving business development activities. This application diversification will accelerate as vendors find the right balance of operating costs, productivity, and print quality. The commercial print customers who may embrace HSIJ technologies are accustomed to acquiring printing presses that stay in operation 10 or more years. HSIJ vendor success may be impacted by their ability to protect a customer’s investment, with technology that is both scalable and extensible. These vendors will need to deliver robust services and cultivate a long-term relationship with their customers. This has historically been the success model for analog equipment vendors and should be embraced by HSIJ vendors.

- Technology shift – It's clear that a technology shift is well underway and HSIJ will become the dominant technology for traditional applications produced by the existing installed base of continuous feed printers. There will continue to be opportunities for EP color technologies where print quality and substrate flexibility is paramount.

- Vendor Shakeout – Today, a gold rush is occurring as many new entrants are vying for the new HSIJ opportunity. While both the digital print and analog press vendors will seek to defend their base, each will seek to grow through capturing print volume. The competitive pressures will intensify and raise the question of when, or if, a technology shift will occur between higher volume analog print and digital. For this reason, most vendors feel compelled to have an HSIJ offering. Based on IDC's historical data for continuous feed printers as well as current adoption projections, IDC believes there are too many offerings in the market. In IDC's Worldwide Production and Large Format Printing 2014 – Top 10 Predictions (IDC #247120), IDC analysts predict that a looming vendor shakeout is on the horizon as the market begins picking inkjet winners.

This report is delivered as part of IDC’s Production and Large Format Print Markets service. Additionally, IDC tracks global and regional shipments of continuous-feed equipment as part of theWorldwide Quarterly Production Printer Tracker. This offering enables clients to leverage IDC's industry-leading data query and visualization tools to evaluate regional and global shipment activities at both the vendor and product level.

To order this research, please contact your IDC Sales representative, or IDC Sales at 508-988-7988 or [email protected]

- Questions to ask about inkjet for corrugated packaging

- Can Chinese OEMs challenge Western manufacturers?

- The #1 Question When Selling Inkjet

- Integrator perspective on Konica Minolta printheads

- Surfing the Waves of Inkjet

- Kyocera Nixka talks inkjet integration trends

- B2B Customer Tours

- Keeping Inkjet Tickled Pink

© 2024 WhatTheyThink. All Rights Reserved.

Discussion

By Dustin Graupman on May 30, 2014

The results of this IDC report are quite encouraging and confirm that high speed inkjet continues to emerge as a gamechanging technology in print. For the right set of applications inkjet can deliver superior value in terms of productivity, cost and transforming business models for printers and their customers. Printers are often investing here aiming to reduce costs for the same applications currently being produced on other technologies. However some research suggests that many of the pages being run are net new to the printer as they have now added capabilities which allow them to compete for new business and new applications where they couldn't before. Cost or capability - or both - it is clear that many making the investment in inkjet are finding it having a very positive impact on their business. – Dustin Graupman, Vice President, Xerox Inkjet Business