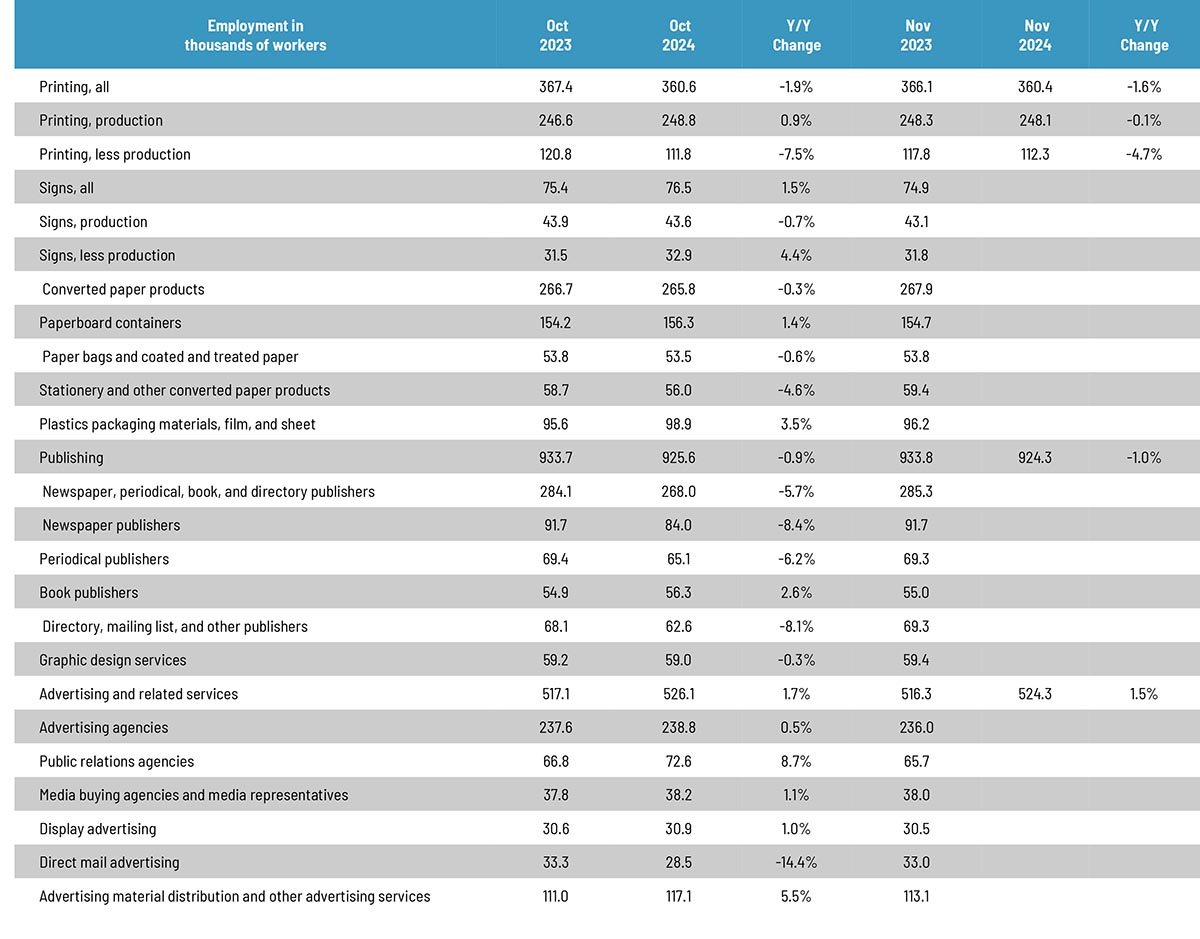

Over the summer, overall printing employment had been generally flat, a situation which continued through the autumn. For the past couple of months, production and non-production employment alternated being up and down, with November seeing production employment down (by 0.3%) and non-production employment up (by 0.4%), the reverse of October.

Overall publishing employment was down 0.1% from October to November, while advertising and related services was down 0.3%.

Looking at other business categories, the reporting of which lags a month:

Overall employment in the signage industry was up 0.3% from September to October, with sign production employment down 2.0% and non-production up 3.5%.

Converted paper products employment was up 0.5% from September to October, with paperboard container employment up 0.5% and paper bags and coated and treated paper employment up 0.4%.

Looking at some specific publishing and creative segments, from September to October, periodical publishing employment was unchanged, while newspaper publishing employment was up down 0.1% and book publishing was down 0.9%. Graphic design employment was up 1.7% from, ad agency employment was up 0.8%, and PR agencies were up 2.1%. Direct mail advertising employment was down 3.1%.

As for November employment in general, the BLS reported on December 6 that total nonfarm payroll employment rose by 227,000, with the unemployment rate creeping up from 4.1% to 4.2%. September and October payrolls were revised up by a combined 56,000.

The U-6 rate (the so-called “real” unemployment rate which includes not just those currently unemployed but also those who are underemployed, marginally attached to the workforce, and have given up looking for work) ticked up 7.7% to 7.8%.

The labor force participation rate dropped from 62.6% to 62.5% and the employment-to-population ratio decreased from 60.0% to 59.8. The labor force participation rate for 24–54-year-olds was unchanged at 83.5%.

The November report was above economists’ expectations. Said Calculated Risk, “This report was boosted by the end of strikes (especially Boeing) and workers returning following the hurricanes.”